Protecting your wealth doesn’t require being ultra-rich or hiding your money overseas. You can use simple, legal tools like LLCs, trusts, and insurance to safeguard your assets from lawsuits, creditors, or unexpected financial setbacks. The key is acting early, keeping costs low, and tailoring strategies to your needs.

Key Takeaways:

- Why it matters: The U.S. sees millions of lawsuits annually, and economic risks like dollar devaluation or financial institution failures make asset protection critical.

- Common myths: You don’t need millions to start. Affordable options like umbrella insurance, state homestead exemptions, and Wyoming LLCs are accessible.

- Core strategies:

- Separate personal and business assets using LLCs or trusts.

- Diversify across jurisdictions and currencies for added security.

- Use tax-friendly locations like Nevis or Belize for offshore protection.

- Costs:

- Offshore trusts: $15,000–$30,000 to set up, $4,000–$8,000 annually.

- International LLCs: $1,000–$3,000 setup, $100–$1,200 yearly maintenance.

Start with simple steps like liability insurance and legal structures. For larger assets, consider offshore options. Timing is crucial – set up protections before any legal claims arise.

Core Principles of Affordable Asset Protection

Creating a strong yet cost-effective asset protection plan doesn’t have to be overly complicated. The foundation lies in three key principles: spreading your assets across multiple legal jurisdictions, employing simple legal structures that separate your wealth from personal liability, and choosing jurisdictions that balance strong asset protection laws with reasonable costs. These principles pave the way for exploring offshore protection strategies that won’t break the bank.

How Diversification Protects Your Assets

Think of geographic diversification as a safety net for your wealth. By holding assets in different countries, you reduce the risk of a single legal ruling wiping out everything. For example, if a creditor secures a judgment in the U.S., they would need to initiate a separate lawsuit in another country to access assets there. This process is often both costly and time-consuming, especially given the complexities of U.S. litigation and cross-border collections.

Currency diversification adds another layer of protection. Since early 2025, the U.S. dollar has lost over 10% of its value against major global currencies. To hedge against such risks, you can hold part of your wealth in stable currencies like the Swiss franc or invest in tangible assets like physical gold. This approach not only spreads risk but also helps preserve your purchasing power, even if one currency takes a hit.

Affordable Legal Structures That Work

The right legal structures can act as a shield between your personal assets and potential creditors. For instance, transferring property into an LLC or trust means that the assets now legally belong to that entity, making it far more challenging for creditors to claim them.

A Wyoming LLC is one cost-effective option, limiting creditor claims to distributions rather than the assets themselves. If you’re looking for international protection, a Nevis LLC offers similar benefits and remains affordable.

Another popular strategy is the "LLC-inside-trust" approach. Here, assets are placed into an international LLC, which is then owned by an offshore trust. This setup allows you to retain control over the assets while still enjoying the protective benefits.

For those with high-risk assets like rental properties, family LLCs can be a practical solution. By placing each property in a separate LLC, you compartmentalize risk – ensuring that an issue with one property doesn’t threaten your entire portfolio.

Beyond structuring, choosing the right jurisdiction is key to keeping costs down while maximizing protection.

Using Tax-Friendly Jurisdictions to Your Advantage

Selecting the right jurisdiction can significantly reduce your legal risks and ongoing expenses. Places like Nevis, Belize, the Cayman Islands, and the Bahamas are known for their strong asset protection frameworks, low maintenance costs, and minimal tax obligations.

Jennifer A. Davis, CEO of the Cook Islands Financial Services Development Authority, puts it best: these structures provide "a layer of insurance for something that cannot be insured – the unforeseeable".

Timing is everything when it comes to asset protection. These structures need to be in place before any legal challenges arise. If assets are transferred after litigation begins, they could be clawed back under fraudulent transfer laws. Planning ahead ensures your protection remains intact.

sbb-itb-39d39a6

Low-Cost Offshore Protection Methods

You don’t need to be a millionaire to move your assets offshore. By choosing the right jurisdictions and avoiding unnecessary complications, you can set up structures that offer solid protection without breaking the bank. Below, we’ll explore affordable options for offshore trusts and LLCs that can help safeguard your wealth.

Setting Up Offshore Trusts on a Budget

An Offshore Asset Protection Trust (OAPT) can cost between $15,000 and $30,000 to establish, with annual maintenance fees ranging from $4,000 to $8,000. While these costs may seem high compared to domestic trusts, their ability to shield assets from creditors makes them worth considering.

Nevis stands out as an economical choice. The government charges only $300 for registration and $300 annually for renewal. Additionally, creditors must post a $25,000 bond before filing a lawsuit against your trust, and they face a short statute of limitations – just one to two years from the date of transfer to challenge fraudulent conveyance claims.

Belize offers another affordable option. It does not recognize foreign judgments and exempts all income earned outside the country from taxes. Meanwhile, the Cook Islands, though sometimes involving slightly higher professional fees, has a stellar reputation. No properly established Cook Islands trust has ever been breached by a creditor. It also has a short statute of limitations and strong legal protections.

"If a U.S. judge orders an offshore trustee to release funds, the trustee is legally required to refuse that order. This creates a ‘firewall’ around your wealth." – Alper Law

For liquid assets exceeding $500,000, the benefits of these structures often outweigh the costs. For smaller asset amounts, however, the annual fees may not make sense. A cost-effective alternative is to pair an offshore LLC with a trust. This setup allows you to retain control as the LLC manager while the trust, which owns the LLC, provides legal protection.

International LLCs That Won’t Drain Your Wallet

International LLCs are another affordable way to protect your assets. The setup costs for these entities typically range from $1,000 to $2,000, with annual maintenance fees between $100 and $500. A Nevis LLC, for example, costs $1,500 to $3,000 to establish, with annual fees of $300 to $1,200.

One major advantage of an international LLC is charging order protection. In Nevis, creditors can only obtain a charging order, which entitles them to distributions (if any) but doesn’t give them control over the LLC. Creditors must also post a $100,000 bond to file a lawsuit and prove fraudulent intent beyond a reasonable doubt – significantly higher than the U.S. standard of "preponderance of evidence".

The registration process is quick, often completed within 24–48 hours. However, U.S. individuals should account for additional costs, such as $3,000 to $5,000 annually for cross-border tax compliance. Failing to file Form 5471 can result in penalties of $10,000 or more per year.

One challenge to keep in mind: securing banking for Caribbean entities has become more difficult due to "de-risking" by international banks. It’s wise to arrange your banking relationships before finalizing incorporation or work with a specialist introducer.

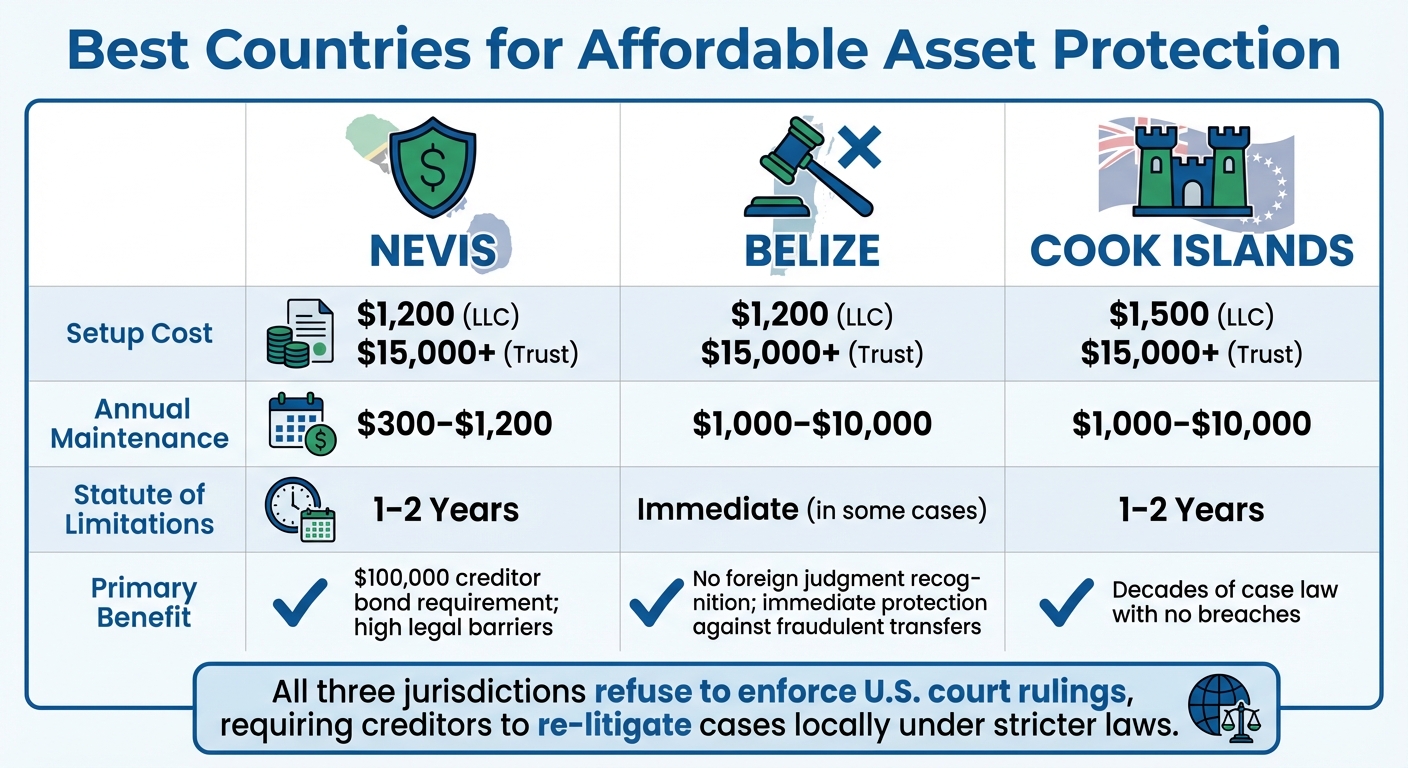

Best Countries for Affordable Asset Protection

When choosing a jurisdiction for your offshore structure, focus on three key factors: non-recognition of foreign judgments, short statutes of limitations, and reasonable costs. Below is a comparison of top jurisdictions that balance affordability and strong asset protection:

| Jurisdiction | Setup Cost | Annual Maintenance | Statute of Limitations | Primary Benefit |

|---|---|---|---|---|

| Nevis | $1,200 (LLC) / $15,000+ (Trust) | $300–$1,200 | 1–2 Years | $100,000 creditor bond requirement; high legal barriers |

| Belize | Similar to Nevis | $1,000–$10,000 | Immediate (in some cases) | No foreign judgment recognition; immediate protection against fraudulent transfers |

| Cook Islands | $1,500 (LLC) / $15,000+ (Trust) | $1,000–$10,000 | 1–2 Years | Decades of case law with no breaches |

All three jurisdictions refuse to enforce U.S. court rulings, requiring creditors to re-litigate cases locally under stricter laws. This creates a powerful deterrent, as the cost and complexity of pursuing offshore assets often outweigh potential recoveries.

"The cost of [litigation] is prohibitive, and the success rates are generally low, serving as a strong incentive against legal action and the perfect defense against predatory litigation." – Nomad Capitalist

Timing is everything. These structures must be in place before any legal threats arise. Transfers made after litigation begins can be reversed, regardless of the jurisdiction. To ensure your strategy remains effective, keep protected accounts separate from personal funds and comply fully with U.S. reporting requirements. Proper planning is key to maintaining the integrity of your offshore asset protection.

How to Set Up Your Wealth Protection Plan

Building a wealth protection plan doesn’t have to drain your wallet. The key is to align your specific risks with the right tools, avoiding unnecessary complexity. Here’s how to create a plan tailored to your needs and budget.

Evaluating Your Protection Requirements

Start by identifying your unique risks – whether they stem from your profession, marital situation, or the type of assets you own. For example, surgeons often face malpractice lawsuits, while real estate developers deal with project-specific liabilities. With litigation risks being high in the U.S., understanding your exposure is crucial.

Next, take stock of your assets and prioritize them. Which ones are most critical to protect? Liquid cash, real estate, or business interests all require different strategies. For liquid assets under $250,000, offshore asset protection trusts may not be cost-effective. In such cases, focus on domestic options like umbrella insurance, retirement accounts, and your state’s homestead exemptions.

"The amount of protection you need is going to be customized to your exact situation." – Asset Protection Planners

Timing matters. Set up your protection plan before any claims arise to avoid allegations of fraudulent conveyance. Think of it like car insurance – you can’t buy it after an accident.

Your location also plays a big role. Some states, like Florida and Texas, offer full homestead protection for primary residences, while others, like California, offer far less. Your state’s laws will shape your strategy, so evaluate local benefits before considering complex offshore structures.

Once you’ve assessed your risks and inventoried your assets, the next step is organizing them into separate entities for better protection.

Organizing Your Assets for Better Protection

To shield your assets effectively, separate them into distinct legal entities. Asset segregation acts as your first defense. For instance, if you own multiple rental properties, placing each one in its own LLC ensures that a lawsuit involving one property doesn’t jeopardize the others.

Consider using a trust-owned LLC for added protection while retaining control. This setup reduces trustee fees unless a legal issue arises, giving you security without sacrificing management authority.

Another layer of defense is charging order protection. In states like Nevis or Wyoming, creditors can only obtain a charging order. This allows them to claim distributions but not control the LLC. As the manager, you can often withhold distributions, limiting their access.

Privacy is another powerful tool. Land or title-holding trusts can keep your ownership private, discouraging potential lawsuits from attorneys conducting asset searches.

Don’t overlook free protections like state homestead exemptions and federally protected retirement accounts. Some states shield the full equity of your primary residence. Federally, 401(k) plans have unlimited protection, and as of 2022, traditional and Roth IRAs are protected up to $1,512,800 per person in bankruptcy. These strategies cost nothing yet offer substantial security.

Once your assets are organized, the work isn’t over. Regular reviews and updates are critical to keeping your protection plan effective.

Keeping Your Protection Strategy Current

Wealth protection isn’t a one-and-done task. Whether you’ve opted for domestic or offshore structures, ongoing maintenance is essential. This includes annual filings, trustee oversight, and proper documentation to keep your plan intact. Neglecting these formalities can undermine your entire strategy.

Laws and regulations are constantly evolving. Jurisdictions may update transparency rules, tax agreements, or ownership registries. A structure that was private five years ago might now require full disclosure. Conduct annual reviews to ensure your trustees, service providers, and banks meet current standards.

Stay compliant with tax filings, such as FBAR (FinCEN Form 114) for foreign accounts exceeding $10,000, and IRS Form 8938 (FATCA), among others. Penalties for non-compliance can be severe, sometimes exceeding the account’s value.

"In my 15+ years advising clients on asset protection, the most durable plans combine domestic protection (insurance, estate planning, entity structure) with limited, carefully documented offshore elements only after full legal and tax review." – finhelp.io

Document every asset transfer to defend against fraudulent transfer claims. While keeping records may feel tedious, they are your best defense if your structure is ever challenged in court.

For maximum security, combine domestic measures like umbrella insurance, retirement accounts, and LLCs with selective offshore elements. A layered approach creates a stronger defense, often referred to as a "fortress" effect. Review your plan annually, adjust it as your circumstances evolve, and stay ahead of regulatory changes to protect your wealth effectively.

Conclusion: Making Wealth Protection Accessible

Key Takeaways

Protecting your wealth doesn’t have to be reserved for the ultra-rich. The right strategies, implemented at the right time, can safeguard your assets effectively. Timing is everything – put your plan in place before any legal troubles arise to steer clear of fraudulent transfer claims. Being proactive can make all the difference.

Diversification is a powerful shield. Spread your assets across different jurisdictions to create legal roadblocks for creditors. Pair this with currency diversification – such as holding assets in strong currencies like the Swiss Franc or even gold – and you’ll add an extra layer of security. This approach not only helps protect against lawsuits but also guards against risks like dollar devaluation, which, as mentioned earlier, has been a growing concern.

Your wealth protection strategy should align with your financial situation and needs. Domestic tools like Wyoming LLCs, umbrella insurance, and retirement accounts are affordable and effective for many scenarios. For those with more substantial liquid assets (over $250,000), offshore options like Nevis LLCs (starting at $850 to $5,000) or Cook Islands trusts offer enhanced protection. The key is to tailor your approach based on your profession and risk profile.

"Proper offshore protection is never about hiding assets from Uncle Sam – it’s about legally structuring them to be protected from private creditors."

– The Nestmann Group

Modern wealth protection isn’t about secrecy – it’s about compliance and creating legal barriers. Reporting requirements like FBAR and FATCA filings ensure full transparency. These measures make pursuing your assets too costly and time-consuming for most creditors. With roughly 5 million new lawsuits filed in the U.S. in 2023 alone, the risk of litigation is something you can’t afford to ignore.

Turning Insights into Action

The first step to protecting your assets is simple: take inventory. List everything you own – real estate, financial accounts, cryptocurrency, business interests – and identify which are most vulnerable. This step costs nothing but lays the groundwork for your entire strategy.

If your budget is tight, focus on domestic solutions first. Maximize contributions to your retirement accounts, secure umbrella insurance, and leverage your state’s homestead exemptions. These low-cost options provide immediate protection while you work toward more advanced strategies.

When it comes to more complex structures, consult a professional. Online advice can provide general tips, but tailored guidance is essential. Mistakes in wealth protection can be costly, so working with an expert who understands both U.S. tax laws and international regulations is worth the investment.

"Effective offshore protection is never one-size-fits-all. A doctor with licensing risk, a real estate investor managing liability exposure, and an entrepreneur planning an exit all need fundamentally different structures."

– The Nestmann Group

Finally, make wealth protection an ongoing effort. Review your plan annually, stay updated on legal changes, and keep detailed records. Asset protection isn’t a one-and-done process – it evolves as your financial situation and the legal landscape change. The work you put in today will safeguard your future for years to come.

FAQs

What are some affordable ways to start protecting my assets?

Protecting your assets doesn’t have to break the bank. By focusing on affordable strategies, you can safeguard your wealth effectively. One smart move? Setting up a domestic limited liability company (LLC). An LLC helps shield your personal assets from business-related risks, offering a layer of security. In many U.S. states, it can even provide protection against creditors. The best part? Establishing an LLC is relatively inexpensive, with filing fees typically running just a few hundred dollars. Add a straightforward operating agreement, and you’ve got a clear plan for ownership and management.

Another budget-friendly option is leveraging state homestead exemptions and an umbrella liability insurance policy. Many states allow you to protect a portion of your primary residence’s equity from creditors through homestead exemptions, often requiring little to no cost to file. Combine this with an umbrella liability policy, which can extend coverage beyond what your homeowners or auto insurance offers. These policies are surprisingly affordable, usually costing between $200 and $400 annually.

If you’re looking to add privacy and diversify your protection, consider a low-cost offshore LLC in places like Belize or Nevis. These entities are affordable to set up and maintain, often for under $1,000 per year. Just make sure to stay compliant with U.S. reporting requirements like FBAR and FATCA. By keeping thorough records, you can enjoy the benefits of offshore protection without overspending.

What are the advantages of using an offshore LLC for protecting your assets?

An offshore limited liability company (LLC) creates a solid barrier between your personal assets and those owned by the LLC. This separation ensures that if creditors or legal claims come after you, they can only reach the assets held within the LLC, leaving your personal wealth untouched. On top of that, many offshore jurisdictions enforce strict privacy laws, keeping ownership details and financial holdings confidential.

What makes an offshore LLC particularly appealing is how it blends the flexibility of a partnership with the protection typically associated with corporations. You retain control over decision-making while benefiting from limited liability. By selecting a jurisdiction with strong laws against creditor claims or one that doesn’t recognize U.S. court judgments, you can further minimize legal risks and diversify your protection strategies.

With its mix of privacy, control, and legal protection, an offshore LLC offers a practical and cost-efficient way to shield both personal and business assets.

Why is it important to set up asset protection strategies early?

Timing is everything when it comes to protecting your assets. The effectiveness of tools like trusts or LLCs hinges greatly on when they’re put in place. If you transfer assets after a lawsuit has already been filed or when a creditor’s claim is looming, courts might label those transfers as fraudulent, which could completely undermine your protections.

Establishing asset protection strategies long before any potential legal or financial issues arise gives you a significant advantage. Early action ensures your structures are properly funded, thoroughly documented, and fully compliant with U.S. reporting requirements like FATCA and FBAR. This proactive approach not only strengthens your safeguards but also minimizes the chances of legal disputes, offering more reliable and enduring protection for your assets.