Moving assets abroad is no longer just for the wealthy elite. It’s a strategy to protect your finances from risks like economic instability, currency fluctuations, and legal challenges. With the U.S. dollar depreciating over 10% in early 2025 and lawsuits on the rise, diversifying internationally has become a practical move for many Americans. But how do you ensure compliance and choose the right method? Here’s a quick breakdown:

- Why move assets abroad? Safeguard wealth from currency drops, lawsuits, and political risks.

- Key benefits: Asset protection, currency diversification, privacy, and access to global investments.

- What to know: U.S. citizens must report foreign accounts exceeding $10,000 (FBAR) and comply with strict tax rules.

- Methods: Open offshore bank accounts, invest in foreign real estate, or set up offshore trusts for asset protection and corporations.

- Timing matters: Plan early to avoid legal complications and maximize tax advantages.

When to Consider Moving Assets Abroad

Timing is everything when it comes to moving assets internationally. It’s not just about knowing how to do it – it’s about recognizing when the circumstances make it a smart move. From economic shifts to tax strategies and privacy concerns, certain events and conditions often signal the need to protect and diversify your wealth globally. Let’s dive into the most common situations where U.S.-based investors and entrepreneurs consider this step.

Economic and Political Instability

Economic turbulence and political uncertainty can erode wealth faster than you might think. For example, when the U.S. Dollar Index dropped roughly 10% against major foreign currencies in early 2025, investors who held only dollar-based assets saw their global buying power take a significant hit. This kind of currency volatility highlights the risks of keeping all your financial eggs in one basket.

The banking sector has also shown cracks. The collapse of Silicon Valley Bank, Signature Bank, and First Republic in 2023 shattered the illusion of absolute stability in the U.S. banking system. These failures prompted many high-net-worth individuals to shift their funds to foreign banks in places like Switzerland and Singapore, where regulations and capitalization requirements often provide a stronger safety net. When your local banking system falters, diversifying into more stable international institutions becomes a practical safeguard – not an overreaction.

Political instability adds another layer of risk. Concerns about government overreach, such as potential account freezes or restrictions on moving capital, have grown among affluent individuals. As immigration attorney David Lesperance explains:

"Having money means that they have more tools in the toolbox… It also means they’re at a greater risk of being a target and they’ve got more pain points".

By holding assets in multiple jurisdictions, you reduce the risk of any single government having full control over your financial future. If you spend a significant amount of time – say, 40% or more – in a foreign country, aligning your currency exposure with your spending habits can also help you avoid costly exchange rate losses. Beyond these immediate risks, tax planning often adds another compelling reason to move assets abroad.

Tax Reduction Goals

Tax considerations are a major factor for those looking to internationalize their wealth. Strategic planning can help reduce your tax burden while staying fully compliant with U.S. reporting rules.

Some jurisdictions offer tax advantages on certain income types, such as interest, dividends, or capital gains. These locations can be attractive for holding investment portfolios. However, there’s a catch: foreign mutual funds or ETFs can trigger the Passive Foreign Investment Company (PFIC) rules, leading to punitive tax rates and complex reporting requirements. To minimize complications, many individuals establish residency in no-income-tax states like Florida, Texas, or Nevada. This move can simplify your tax obligations and prevent high-tax states from claiming you owe them taxes after you’ve relocated.

Wealth Protection and Privacy Concerns

Protecting your wealth and maintaining privacy are other key motivators for moving assets abroad. In 2023 alone, the U.S. saw about 5 million new lawsuits filed. Professionals in high-risk industries are often prime targets for litigation. By moving assets to jurisdictions like the Cook Islands or Nevis – where U.S. court judgments aren’t automatically recognized – creditors are forced to restart legal proceedings in those countries, which can be both expensive and time-consuming.

Privacy is another driving factor. Public records in the U.S. can make wealthy individuals easy targets for predatory lawsuits. Offshore structures can shield your name from public databases, lowering your visibility as a potential target. Timing, however, is critical. Asset protection measures must be put in place before any legal trouble arises. Courts can otherwise reverse these transfers entirely. If you’re in a high-risk profession or foresee potential claims, acting early to secure these protections is crucial.

sbb-itb-39d39a6

How to Take Assets Abroad: Practical Methods

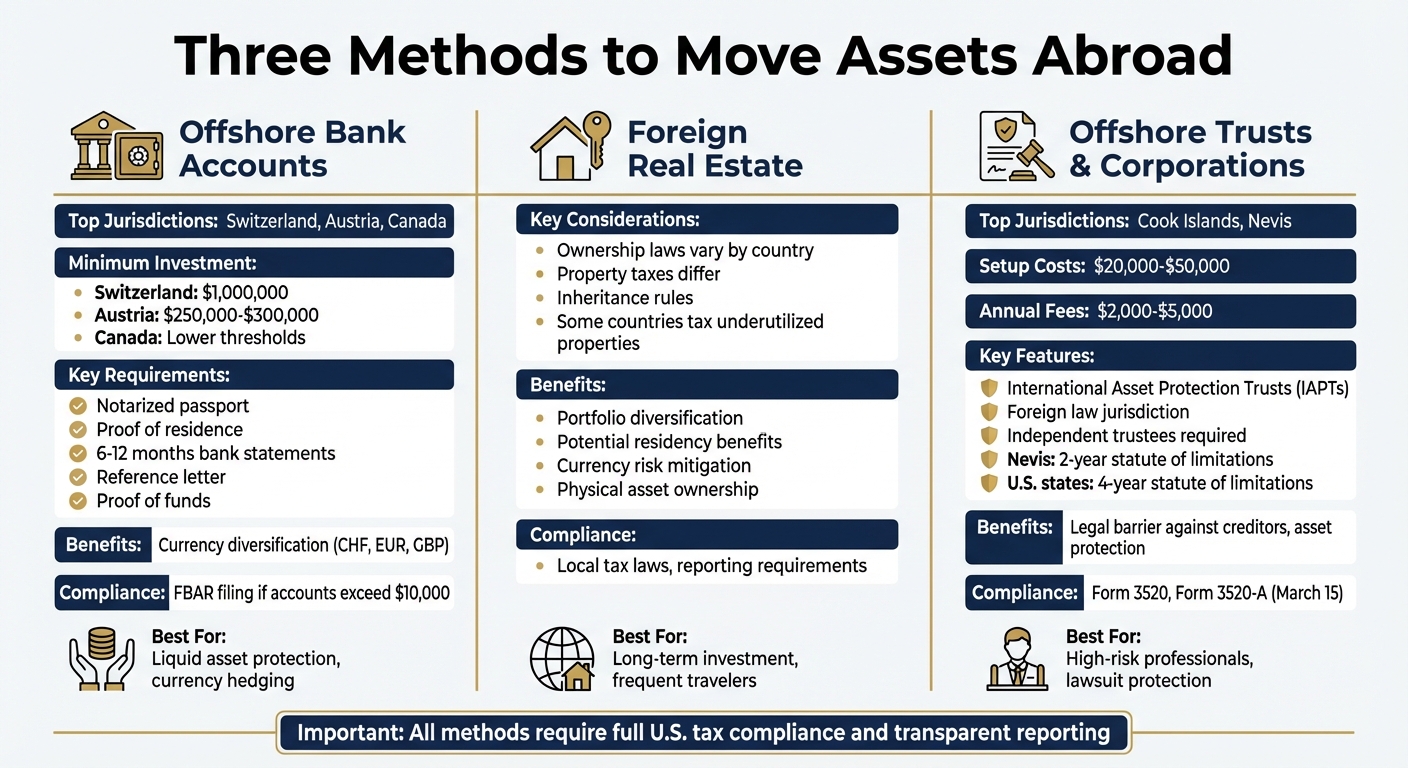

Economic instability and increasing tax pressures can prompt individuals to consider moving assets internationally. But once you’ve made the decision to safeguard your wealth abroad, how do you actually go about it? The most common methods include offshore bank accounts, foreign real estate, and offshore trusts or corporations. Each option serves a distinct purpose and comes with its own set of requirements. Here’s a closer look at how each works.

Opening Offshore Bank Accounts

When choosing an offshore bank, jurisdictions like Switzerland, Austria, or Canada are popular options due to their stability and accessibility. Switzerland, long regarded as the pinnacle of banking expertise, often requires a minimum deposit of $1,000,000 to open an account. Austrian private banks typically have lower thresholds, usually between $250,000 and $300,000. For U.S. citizens, Canadian banks may be more accessible, especially if you have business or property ties within the country.

To meet anti-money laundering (AML) and know-your-customer (KYC) requirements, you’ll need to provide notarized or apostilled documents, including your passport, proof of residence, bank statements (6-12 months), a reference letter, and proof of funds, such as wage slips or sales contracts. Tax attorney Korey Waggoner emphasizes the importance of transparency in these transactions:

"Stay away from cash-heavy or anonymous transactions, as those almost always immediately trigger IRS audits and violate banking laws. Always document the source and path of your funds".

Once your account is established, consider holding funds in multiple currencies – such as Swiss francs (CHF), euros (EUR), or British pounds (GBP) – to reduce exposure to U.S. dollar fluctuations. Transfers are typically completed through international systems like SWIFT or IBAN. Keep in mind that U.S. citizens must file an FBAR (Foreign Bank Account Report) if the total value of their foreign accounts exceeds $10,000.

Buying Foreign Real Estate

Investing in foreign real estate not only diversifies your portfolio but may also come with residency benefits. However, navigating the rules and taxes in each country requires local expertise. Ownership laws, property taxes, and inheritance rules vary widely. For instance, some nations impose taxes on underutilized properties, such as Canada’s underutilized housing tax.

If you frequently spend time in a particular country, owning property there can help mitigate currency exchange risks and provide a stable base. Additionally, some countries offer residency or even citizenship through real estate investments, adding another layer of benefit to this approach. While real estate offers physical diversification, offshore trusts and corporations provide legal and structural protection for your assets.

Using Offshore Trusts and Corporations

Offshore trusts and corporations are designed to protect assets from local legal risks while staying compliant with international laws. International Asset Protection Trusts (IAPTs) are particularly effective, as they place assets under the jurisdiction of foreign laws that often do not recognize U.S. court judgments.

The Cook Islands is a top choice for asset protection trusts due to its robust legal framework, while Nevis offers similar protections at potentially lower costs. These structures work by transferring asset ownership to foreign entities, managed by independent trustees. This creates a legal barrier, requiring creditors to pursue claims in the offshore jurisdiction instead of the U.S.. Nevis, for instance, has a two-year statute of limitations for challenging asset transfers, compared to four years in U.S. states like Alaska or Delaware.

Timing is key when setting up these structures to avoid complications with asset transfer reversals. It’s important to note that offshore trusts are not a tax avoidance strategy – they are strictly for legal compliance and asset protection. Setting up an offshore trust typically costs between $20,000 and $50,000, with ongoing administration fees ranging from $2,000 to $5,000 annually. Many professionals recommend combining an offshore trust with an LLC, such as a Nevis LLC owned by a Cook Islands Trust, to hold specific assets like investment portfolios or real estate for additional protection.

To ensure your intentions are upheld, appoint independent fiduciaries, including a professional trustee and a trust protector based outside the U.S.. As attorney James G. Bohm explains:

"You can’t hide money offshore anymore – it has to be transparent and legal".

Modern offshore asset planning is all about compliance and diversification. By taking these steps, you can safeguard your wealth while adhering to legal and regulatory standards.

Legal and Financial Requirements to Understand

When it comes to safeguarding wealth internationally, understanding legal and financial obligations is crucial. Moving assets abroad isn’t just about opening accounts; it involves strict compliance with U.S. laws. The IRS has specific reporting rules, and failing to meet them can lead to severe penalties. Knowing these requirements, selecting the right jurisdictions, and steering clear of common mistakes can make all the difference between successful asset protection and expensive legal troubles.

US Tax Reporting Requirements

U.S. citizens with foreign assets must navigate several reporting requirements. For instance, FBAR (FinCEN Form 114) is mandatory if the combined balance of your foreign accounts exceeds $10,000 at any point in the year. This form is filed directly with the Treasury Department, separate from your tax return, and is due by April 15, with an automatic extension to October 15.

FATCA (Form 8938) covers a broader range of foreign assets, such as stocks, securities, and interests in foreign entities, with higher thresholds. If you’re a U.S. resident filing jointly, you must report if your foreign assets exceed $100,000 on the last day of the tax year or $150,000 at any time during the year. For those living abroad and filing jointly, the thresholds rise to $400,000 and $600,000, respectively. Failure to file can result in a $10,000 penalty, which could escalate to $50,000, along with potential 40% underpayment fines.

Additionally, if you’re involved with a foreign trust – whether creating one, transferring assets, or receiving distributions – you must file Form 3520 with your tax return. Foreign trusts also need to submit Form 3520-A by March 15. As Alex Lyden, Chief Fiduciary Officer at Evercore Trust Company, notes:

"The days of sending assets out of the country in the hope of getting away from the clutches of the IRS are long gone".

When calculating FBAR thresholds, make sure to track peak account values and use the U.S. Treasury Bureau of the Fiscal Service‘s exchange rates for currency conversions. If you’ve missed filings in the past, the IRS offers streamlined compliance procedures to help you catch up without facing standard penalties.

Once you’ve grasped reporting requirements, the next step is selecting jurisdictions that align with your asset protection goals.

Selecting the Right Jurisdictions

Offshore jurisdictions vary significantly in their legal systems, regulatory environments, and asset protection laws. Many operate under either Common Law (e.g., the Cook Islands and Nevis) or Civil Law (e.g., Switzerland and Liechtenstein). Common law jurisdictions often provide better recognition for trusts and asset titling structures.

Before settling on a jurisdiction, consult the Financial Action Task Force (FATF) lists. FATF identifies "high-risk jurisdictions" (Black List) and those under increased monitoring (Grey List) for anti-money laundering and counter-terrorist financing deficiencies. As FATF emphasizes:

"Global safeguards to combat money laundering and terrorist financing (AML/CFT) are only as strong as the jurisdiction with the weakest measures".

Jurisdictions like Nevis, for instance, have a two-year statute of limitations for fraudulent conveyance claims, which makes it harder for creditors to challenge asset transfers. In contrast, some U.S. states have a four-year limit. Choose jurisdictions with established courts that don’t automatically recognize foreign judgments. However, bear in mind that privacy isn’t absolute anymore – many jurisdictions participate in international information-sharing agreements and impose stricter customer due diligence requirements than U.S. institutions.

Additionally, check whether a jurisdiction recognizes trust structures and how it handles forced heirship rules that could override your estate plans. Practical considerations, such as physical security, business hours, and compliance with U.S. reporting requirements, should also influence your decision.

While choosing the right jurisdiction is essential, avoiding common mistakes is just as important.

Common Mistakes to Avoid

Failing to file FBAR or Form 8938 can lead to hefty penalties. Non-willful FBAR violations can result in civil penalties of up to $10,000 per return, while willful violations can cost the greater of $100,000 or 50% of the account balance. Additionally, failing to report more than $5,000 of gross income from foreign assets extends the IRS audit window from three to six years.

Another common error is assuming that foreign jurisdictions treat U.S. legal structures the same way. Many civil law countries, like Switzerland, don’t recognize trusts or joint tenancy with survivorship rights. Similarly, U.S. powers of attorney often aren’t valid overseas, which can leave your assets inaccessible if you become incapacitated. Suzanne L. Shier highlights the complexity of foreign asset compliance:

"U.S. persons with foreign assets face extensive reporting obligations… The complexity and penalties for non-compliance are substantial".

Investing in foreign mutual funds without understanding the Passive Foreign Investment Company (PFIC) rules can also be costly. PFICs are taxed unfavorably in the U.S., potentially erasing any investment gains. Additionally, transferring assets to offshore trusts without realizing that the U.S. may still consider you the owner for tax purposes – especially if there’s a U.S. beneficiary – can undermine your asset protection strategy.

To avoid these pitfalls, work with U.S. advisors experienced in international matters as well as local professionals in your chosen jurisdiction. Ensure proper account titling to align with U.S. tax and estate planning objectives, review intergovernmental agreements to prevent double taxation, and establish local legal documents like a power of attorney to manage assets in case of incapacity. If you’ve previously failed to disclose foreign assets, take advantage of the IRS streamlined filing compliance procedures to minimize penalties and achieve compliance.

Conclusion: Protecting Your Financial Future Through International Assets

Moving wealth abroad isn’t about secrecy – it’s about smart diversification. By spreading your assets across borders, you can shield your financial future from risks like currency fluctuations, political instability, and over-reliance on a single economy. In fact, global offshore wealth was estimated at around $10 trillion in 2020, highlighting the importance of this strategy.

Timing, structure, and compliance are critical. Offshore planning takes time, so acting before a crisis hits is key. Using your own name for offshore holdings can be a misstep – structures like LLCs, International Business Companies, or trusts offer enhanced privacy, smoother inheritance processes, and legal safeguards. Compliance is non-negotiable, with reporting requirements such as FBAR and FATCA serving as cornerstones of legitimate offshore strategies.

Tailor your approach to fit your lifestyle and spending habits. For example, if you spend a significant portion of your time in Europe, consider holding part of your liquid assets in euros to offset currency risks. The benefits of diversification are clear: in the first half of 2025, non-U.S. equities outpaced U.S. equities by 12.1%, illustrating the potential of geographic asset allocation.

Finally, don’t go it alone. Cross-border planning is complex, involving everything from navigating diverse legal systems (Common Law vs. Civil Law) to managing intricate tax rules like PFIC regulations and exit taxes. Partner with professionals who specialize in both U.S. tax law and the legal systems of your target jurisdictions for a well-rounded strategy.

FAQs

What do I need to know about the legal requirements for moving assets abroad?

To move assets abroad legally, you need to follow U.S. laws as well as the rules of the destination country. For U.S. citizens and residents, this means reporting foreign financial accounts and assets through filings like the Foreign Bank and Financial Accounts Report (FBAR) and the Foreign Account Tax Compliance Act (FATCA). These filings are essential for maintaining transparency with the IRS and avoiding penalties.

If you’re planning to establish entities such as offshore trusts, LLCs, or foundations, you’ll need to have the right documentation in place – like trust deeds or operating agreements – to clearly outline ownership and control. It’s also critical to ensure all transactions are lawful and that thorough records are kept for compliance. Working with knowledgeable legal and tax professionals is strongly advised to help you meet all requirements in both the U.S. and the country where the assets are being moved.

How can I safeguard my wealth from economic and political uncertainty?

If you’re looking to safeguard your wealth against economic or political turbulence, diversifying your assets internationally is a smart move. This might include setting up offshore trusts, LLCs, or foundations in jurisdictions like Nevis or Panama. These locations are known for their strong legal protections, which can help shield your assets from risks like lawsuits or economic downturns.

Another key approach is to deposit funds in offshore banks based in countries with stable and reliable banking systems, such as Switzerland. By doing so, you can reduce exposure to currency devaluation or potential banking crises. Spreading your banking relationships across multiple jurisdictions can further enhance your financial security.

Just as important is ensuring that all your strategies comply with U.S. reporting laws, including FBAR and FATCA. Staying within legal boundaries keeps your wealth management strategies transparent and above board. By combining these methods, you can better protect your assets from the uncertainties of a shifting global landscape.

What should U.S. taxpayers know about the tax implications of owning foreign assets?

Owning foreign assets comes with important responsibilities for U.S. taxpayers, especially when it comes to taxes. If you have foreign financial accounts or assets, you’re required to report them to the IRS using forms like the FBAR (Foreign Bank and Financial Accounts Report) and FATCA (Foreign Account Tax Compliance Act) disclosures. These forms are mandatory if your foreign accounts exceed certain thresholds, and failing to file them can lead to hefty penalties.

On top of that, U.S. taxpayers are obligated to report income earned from foreign assets on their tax returns. While this income is subject to U.S. taxes, there are ways to ease the burden. Options like the foreign earned income exclusion or the foreign tax credit can help reduce or even eliminate double taxation. The tax treatment of your assets will depend on factors like the type of asset, where it’s located, and whether any treaties apply. Staying informed about these requirements and potential benefits is key to avoiding penalties and managing your tax obligations effectively.