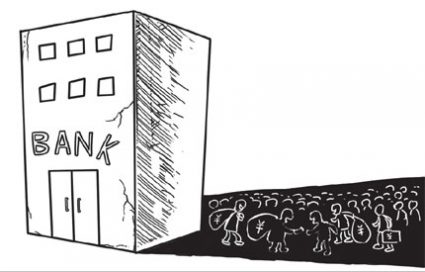

“Shadow Banks” pose a serious risk to the market and your assets because they are non-banks that lend like banks, but with far less oversight or accountability.

April 25, 2019

At the heart of the last U.S. financial crisis in 2008 was a $52 trillion “non-banking” industry that lent unqualified borrowers money for mortgages and refinancing.

You might think U.S. officials would learn a lesson from the Great Recession, and make this form of “non-banking” illegal. Alas, this industry thrives in 2019, and it appears a similar “script” is being followed … one that may lead right to another crash.

At CNBC, we get their take on this developing crisis

Nonbank lending, an industry that played a central role in the financial crisis, has been expanding rapidly and is still posing risks should credit conditions deteriorate.

Often called “shadow banking” — a term the industry does not embrace — these institutions helped fuel the crisis by providing lending to underqualified borrowers and by financing some of the exotic investment instruments that collapsed when subprime mortgages fell apart.

Not all of these “shadow banking” companies do business in the U.S., but most (29%) do. China is a close second.

If history repeats itself, and the “exotic” investments cause another market recession, your assets may be put in serious jeopardy. The resulting market panic can affect your portfolio even if you aren’t directly invested in them.

And the biggest danger to your portfolio may come from the fastest-growing part of the “shadow banking” sector.

$36.7 Trillion in “Significant Risk” Assets

The biggest risk to the economy from the “shadow banking” industry seems to come from a category called collective investment vehicles.

Over at PYMNTS.com, they summarize an incredibly dangerous growth trend in high-risk assets:

Data has also shown that shadow banking share of “collective investment vehicles,” which includes bond funds, hedge funds, money markets and mixed funds, have increased by 130 percent to reach $36.7 trillion. In addition, non-bank financials have grown 61 percent to $185 trillion. By comparison, traditional bank assets had a 35 percent boost to reach $148 trillion during that same period.

Bond ratings agency DBRS highlights the increasing danger from this sector of the “shadow banking” industry in a report titled “Out of the Shadows”:

DBRS sees significant risks stemming from continued growth in shadow banking globally. Assets are now at $52 trillion globally, up from $30 trillion in 2010 according to the FSB. Weaknesses in these nonbank FIs arising in their maturity intermediation, liquidity, leverage and credit transformation could result in runs that would exacerbate financial market stress.

This massive rise in risk within the growing “shadow banking” industry comes on top of unprecedented risks posed by a giant wealth bubble about to burst in the U.S.

Even JP Morgan Chase CEO Jamie Dimon is concerned. He issued a stern warning to investors:

“The growth in non-bank mortgage lending, student lending, leveraged lending, and some consumer lending is accelerating and needs to be assiduously monitored,” said Dimon.

Bottom line: Banks are at risk. The stock market is at risk. The housing market is at risk. Doesn’t matter if you’re in cash, stocks, or real estate… you need to diversify now so you don’t lose your shirt when the next financial crisis hits.

How to Keep Your Options (and Exits) Open

Today, it’s more important than ever to have an offshore bank account and be able to leave the U.S., and set up shop in a foreign country. It’s also critical that you protect and grow your wealth.

So I’d like to show you how to do both.

As you probably know, I’ve been living the life of a “digital nomad” since 2001. And during that time, I’ve learned dozens of extremely valuable lessons about how to keep your options open and maximize your freedom.

I created GWP Insiders to share those lessons.

In fact, I recently updated the entire membership area and I’m relaunching it as GWP Insiders 3.0. And, for a limited time, you can save 70% on membership.

Why should you seriously consider this?

GWP Insiders is a complete roadmap of internationalization strategies for location independent entrepreneurs and investors looking for answers to tax, residency, wealth, and lifestyle questions.

Bottom line, we believe in REAL freedom. Freedom to keep the money you earned. Freedom to travel where you want, when you want…

Freedom to be private and secure in your business affairs and day to day life.

When you become a member of GWP Insiders, you’ll have access to some of the most valuable and closely guarded secrets the wealthy use to protect and grow their wealth. For example, you’ll discover:

- The biggest tax haven in the world (most NEVER get this right).

- How to create offshore bank and brokerage accounts to store, protect, and grow your wealth.

- How to structure your business to minimize or eliminate taxes.

- How to obtain citizenship and a second passport in less than one year.

- The best opportunities for investing in foreign real estate.

- The best places around the world for living as an expat or nomad.

And much, much more.

Right now, you can save 70% on your GWP Insiders 3.0 membership. But please hurry because this offer won’t last much longer.

To living privately,

Bobby Casey

Location Independent Entrepreneur

P.S. You can’t rely on officials to make sure the U.S. economy doesn’t crash like a house of cards. So you have to develop self-reliance and take back your independence. Become a GWP Insiders member today and learn the strategies for keeping your options (and exits) open…