Currency fluctuations affect your savings, investments, and international transactions more than you might think. Whether you’re saving for retirement, investing abroad, or running a global business, exchange rate changes can either enhance or reduce your wealth. Here’s a quick breakdown:

- Savings: A weaker dollar reduces your purchasing power, while a stronger dollar makes imports cheaper.

- Investments: Currency shifts can amplify or erode returns, especially for international holdings.

- Business Operations: Exchange rate changes impact costs, revenues, and profit margins for companies involved in global trade.

- Risk Management: Tools like forward contracts, currency options, and hedged ETFs can help minimize exposure.

How Currency Changes Impact Your Wealth

Currency fluctuations don’t just affect traders and large corporations – they touch nearly every aspect of personal and business finances. Whether you’re saving for retirement, investing internationally, or running a business with overseas suppliers, shifts in currency values can either enhance or diminish your wealth. Recognizing these impacts can help you make smarter financial choices and manage risks effectively.

Savings and Purchasing Power

A weaker dollar directly impacts your wallet by reducing your savings’ buying power, both domestically and abroad. For U.S. consumers, this often means higher prices for imported goods, from electronics to clothing, as the cost of foreign products rises. On the flip side, a stronger dollar lowers import costs but can reduce the value of dollar-denominated wealth internationally.

Take mid-2025 as an example: the dollar saw a significant decline against major currencies due to slowing economic growth and new tariffs announced on April 2, 2025. When a currency faces heavy selling pressure, all assets and wealth tied to it simultaneously lose value.

Investments and Portfolio Performance

For investors, currency movements can make or break returns, especially for those with international holdings. Your total return on a foreign investment combines the asset’s price change with the foreign currency’s performance against the dollar. A strong dollar can dampen these returns, while a weaker dollar amplifies them.

The first half of 2025 illustrates this perfectly. The MSCI EAFE Index, which tracks developed markets outside the U.S., delivered an 18.1% return in local currency terms. However, with the U.S. Dollar Index dropping 10.7%, U.S.-based investors saw their returns jump to 28.1% after converting gains into the weaker dollar. Rob Haworth, Senior Investment Strategy Director at U.S. Bank Asset Management Group, explains:

"Relative currency values reflect the global flow of funds. When the dollar strengthens, it means more foreign money is flowing into the U.S. than the other way around."

Bonds, often yielding lower returns than stocks, are particularly vulnerable. Currency fluctuations can either double a bond’s return or completely erase its interest gains. Even U.S.-only stock portfolios aren’t immune, as companies with international operations face currency risks when converting foreign-earned revenue back into dollars.

International Transactions and Business Operations

For U.S. businesses operating globally, currency shifts introduce transaction risks that can quickly turn profitable deals into losses. A weaker dollar raises the cost of importing raw materials or finished goods. Conversely, a strong dollar can make U.S. products more expensive for international buyers, potentially hurting competitiveness and sales.

Currency volatility also complicates profit calculations. Companies with overseas operations must constantly adjust for changing exchange rates when converting foreign revenue back into dollars. Managing this complexity often requires hedging strategies to stabilize exchange rates for future transactions. Additionally, U.S. taxpayers dealing with foreign income must comply with tax rules that require translating all foreign earnings and expenses into dollars using the exchange rate at the time of each transaction.

sbb-itb-39d39a6

How to Reduce Currency Risks

When it comes to navigating the ups and downs of currency markets, understanding the risks is just the first step. The real challenge lies in taking action to protect your wealth. The good news? You don’t need to be a seasoned trader to safeguard your finances from exchange rate swings. Here are some practical strategies to minimize your exposure and even take advantage of global opportunities.

Diversify Currency Holdings

Relying solely on the dollar can leave your finances vulnerable. If the dollar weakens, your entire portfolio could take a hit. By spreading your wealth across multiple currencies, you create a natural safety net since currencies rarely move in perfect sync.

One way to do this is by using multi-currency accounts. These accounts let you hold money in different currencies – like euros, Swiss francs, or Singapore dollars – without constant conversions. This approach not only cuts down on transaction fees but also gives you the flexibility to spend or invest in the currency that matches your future needs. For instance, holding euros might make sense if you plan to retire in Europe, while Swiss francs could be ideal for covering education costs in Switzerland.

UBS wealth management highlights the complexity of managing currency exposures:

"Managing currency exposures is a dynamic, multi‐step process blending quantitative analysis with qualitative judgment".

A good starting point? Try a "depreciation stress test." Imagine your largest currency holding losing 20% of its value overnight. If that scenario would seriously disrupt your finances, you’re likely too dependent on that single currency.

Use Hedging Tools to Lock in Exchange Rates

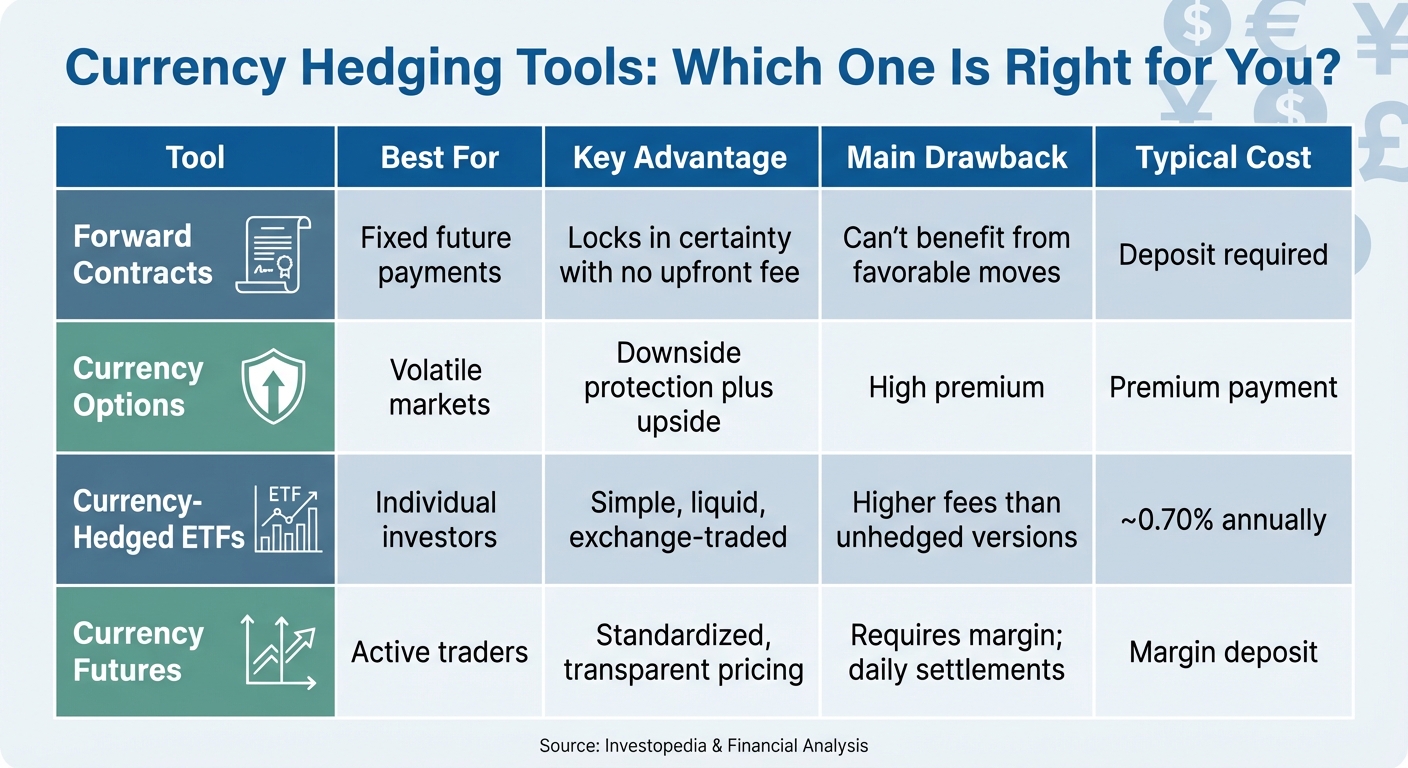

For situations where you need certainty about future exchange rates – like an upcoming property purchase abroad or regular international payments – hedging tools can be a lifesaver. Each tool has its own strengths and trade-offs.

- Forward Contracts: These allow you to lock in an exchange rate for a future date. For example, if you’ll need €100,000 in six months for a property purchase, a forward contract secures today’s rate. The downside? You won’t benefit if rates move in your favor. These contracts typically require a deposit but no upfront premium.

- Currency Options: These offer more flexibility. By paying a premium, you gain the right – but not the obligation – to exchange currency at a set rate. If the market improves, you can skip the option and take the better rate. However, the premium can be pricey, and it only pays off if the currency moves enough to cover that cost.

- Currency-Hedged ETFs: For individual investors, these funds simplify the process. They use derivatives to offset currency fluctuations, letting you invest in foreign markets without taking on currency risk. For example, the iShares MSCI EAFE ETF (EFA) charges 0.32%, while its currency-hedged version costs about 0.70% annually.

| Tool | Best For | Key Advantage | Main Drawback | Typical Cost |

|---|---|---|---|---|

| Forward Contracts | Fixed future payments | Locks in certainty with no upfront fee | Can’t benefit from favorable moves | Deposit required |

| Currency Options | Volatile markets | Downside protection plus upside | High premium | Premium payment |

| Currency-Hedged ETFs | Individual investors | Simple, liquid, exchange-traded | Higher fees than unhedged versions | ~0.70% annually |

| Currency Futures | Active traders | Standardized, transparent pricing | Requires margin; daily settlements | Margin deposit |

As Investopedia explains:

"The rule‐of‐thumb, with regard to foreign investments, is to leave the exchange rate risk unhedged when the local currency is depreciating against the foreign‐investment currency but to hedge this risk when the local currency is appreciating".

Invest in Stable Foreign Currencies and Assets

Certain currencies have a long history of stability, thanks to sound economic policies and strong fundamentals. These currencies can act as a financial safe haven during uncertain times.

The Swiss franc (CHF) is often seen as the gold standard of stability. Switzerland’s political neutrality, advanced banking system, and independent monetary policies make the franc a preferred safe-haven currency. For context, Switzerland’s average annual inflation rate is typically between 0.5% and 0.6%. Compare that to the U.S. dollar, which has lost over 40% of its purchasing power since 2000. According to the LFA Team, Swiss Wealth Management:

"The Swiss Franc (CHF) has long been considered a hard currency… backed by decades of prudent policy, independent monetary governance, and fiscal balance".

The Singapore dollar (SGD) is another strong contender, offering stability in the Asia-Pacific region. The Monetary Authority of Singapore actively manages its exchange rate, providing a level of predictability that free-floating currencies often lack. Holding SGD can also help diversify away from European or North American currencies.

In October 2025, the T. Rowe Price Asset Allocation Committee, led by Timothy C. Murray, adjusted portfolios to overweight positions in non-U.S. investment-grade bonds and emerging market local currency bonds. This shift came after the DXY index dropped 10% earlier that year, signaling potential U.S. dollar weakness. Murray noted:

"Relative returns on non-U.S. investment-grade (IG) bonds with unhedged foreign currency exposure show a stronger historical relationship with the DXY… because there are relatively few external factors that could impact returns".

For U.S. citizens, Swiss accounts now offer a fully compliant way to hold foreign currencies under FATCA regulations. This option allows diversification into stable currencies while adhering to U.S. tax reporting requirements. By combining the reliability of Swiss financial institutions with full transparency, you can protect your wealth without compromising on compliance.

These strategies provide practical ways to safeguard your finances in an unpredictable currency landscape.

Offshore Asset Protection as a Hedge Against Currency Volatility

Offshore Companies and Trusts

Using offshore structures like companies or trusts can be a smart way to protect assets while managing currency volatility. Setting up an offshore company or trust in jurisdictions such as Anguilla allows you to hold assets in multiple currencies. This not only provides flexibility but also creates a legal shield between your wealth and potential creditors.

One strategy, known as currency matching, helps you align your assets and liabilities in the same currency. For example, if you plan to retire in Europe, holding euros makes sense. Similarly, Swiss francs are ideal for covering expenses in Switzerland. As Creative Planning International puts it:

"The key to successful management of currency risk is to focus on matching what we call ‘life assets’ and ‘life liabilities.’"

Offshore trusts in places like Nevis, the Cook Islands, or the Cayman Islands offer another layer of protection. These jurisdictions are known for being debtor-friendly, as their laws often make it difficult and expensive for creditors to pursue claims. For instance, foreign trustees in these regions are not required to comply with U.S. court orders. Additionally, many of these jurisdictions enforce shorter statutes of limitation, narrowing the time creditors have to file claims.

For U.S. entrepreneurs, offshore entities offer the added benefit of aligning revenue and expenses in a single currency. This eliminates the need for frequent currency conversions, helping to protect profit margins from the impact of exchange rate fluctuations. When combined with other risk management techniques like diversification and hedging, offshore strategies can be a powerful tool.

Private Consultations and Tailored Plans

To make the most of these offshore strategies, expert guidance is crucial. Managing currency risks effectively requires personalized solutions, whether you’re an entrepreneur, a retiree living abroad, or a global investor.

Firms like Global Wealth Protection offer private consultations to help you design offshore strategies that match your financial goals and risk tolerance. These sessions can guide you through critical decisions, such as choosing the right jurisdiction, structuring multi-currency holdings, and understanding the tax implications of your plan. For U.S. citizens, avoiding complex rules like those governing Passive Foreign Investment Companies (PFICs) often requires specialized expertise.

Timing is another key factor. Offshore structures need to be established and funded well before any potential legal disputes arise. This helps avoid complications like fraudulent transfer claims, which can undermine your asset protection efforts.

Conclusion: Protecting Your Wealth in a Volatile Global Economy

Currency fluctuations are an unavoidable part of today’s interconnected financial landscape. Even if you don’t invest in foreign markets or travel internationally, shifts in exchange rates can still impact your wealth – whether through global supply chains or competition from overseas companies. The good news? You can take steps to manage this risk effectively.

There are several strategies to help safeguard your wealth. Diversification reduces risk by spreading investments across currencies and regions. Hedging tools allow you to lock in exchange rates while keeping some flexibility for potential gains. And offshore accounts can align your assets with your spending needs while offering legal protections.

As UBS explains:

"Managing currency exposures is a dynamic, multi-step process blending quantitative analysis with qualitative judgment. A structured framework can potentially reduce risk, preserve purchasing power, and provide greater peace of mind."

This isn’t a one-and-done task. Managing currency exposure requires consistent attention as your personal circumstances and the global economy evolve. Staying proactive is essential in navigating these changes.

The stakes are high. With the global foreign exchange market projected to reach $861 billion in 2024, even small shifts in currency values can have a big impact. Whether you’re safeguarding your retirement funds, running an international business, or planning for future generations, actively managing currency risks is crucial for long-term financial security.

FAQs

How can I safeguard my savings from currency fluctuations?

Protecting your savings from currency fluctuations requires a thoughtful approach. One popular strategy is currency hedging, which involves using tools like forward contracts or currency options. These financial instruments allow you to lock in exchange rates, minimizing the risk of unfavorable shifts – especially helpful if you hold investments or assets in foreign currencies.

Another smart move is spreading your holdings across multiple currencies or stable foreign assets. By diversifying, you reduce the impact of any single currency’s volatility. If you frequently handle international transactions, using multi-currency accounts can also be a game-changer. These accounts let you manage your exposure more efficiently and adapt to global market changes.

It’s also important to regularly revisit your financial goals. Adjust your currency exposure as needed to ensure it aligns with your spending habits and investment plans. By staying proactive, you can better safeguard your savings against the uncertainties of the global economy.

What are the most effective tools for protecting your investments from currency fluctuations?

To shield your investments from the ups and downs of currency fluctuations, there are a few key strategies to consider: forward contracts, currency futures, and currency options.

- Forward contracts let you lock in an exchange rate for a future date. This approach ensures predictability and protects your assets from unfavorable rate shifts.

- Currency futures, traded on exchanges, work similarly but come with added benefits like greater liquidity and transparency.

- Currency options offer even more flexibility, giving you the choice – not the obligation – to exchange currency at a specific rate before a set deadline.

For those investing internationally, currency-hedged ETFs are another practical option. These funds use tools like forward contracts to help offset the effects of exchange rate changes, making returns more stable while cutting down on currency risk.

Ultimately, the best choice depends on your financial goals, how much risk you’re comfortable with, and your investment timeline. But incorporating these strategies can help protect your portfolio in today’s unpredictable global economy.

Why should I diversify my currency holdings to protect my wealth?

Diversifying your currency holdings is a practical way to guard against the uncertainties of exchange rate shifts. Currency values can change without warning, which might affect your savings, investments, or international transactions. By spreading your holdings across multiple currencies, you can offset potential losses in one currency with possible gains in another.

This approach not only shields your wealth from market swings but also opens doors to opportunities in currencies that are either more stable or gaining in value. It’s a smart move for anyone involved in managing global assets or handling cross-border financial dealings.