When managing wealth across borders, inheritance planning becomes complex due to varying tax laws, legal systems, and reporting requirements. Without preparation, estates risk double taxation, legal disputes, and delays. Here’s what you need to know:

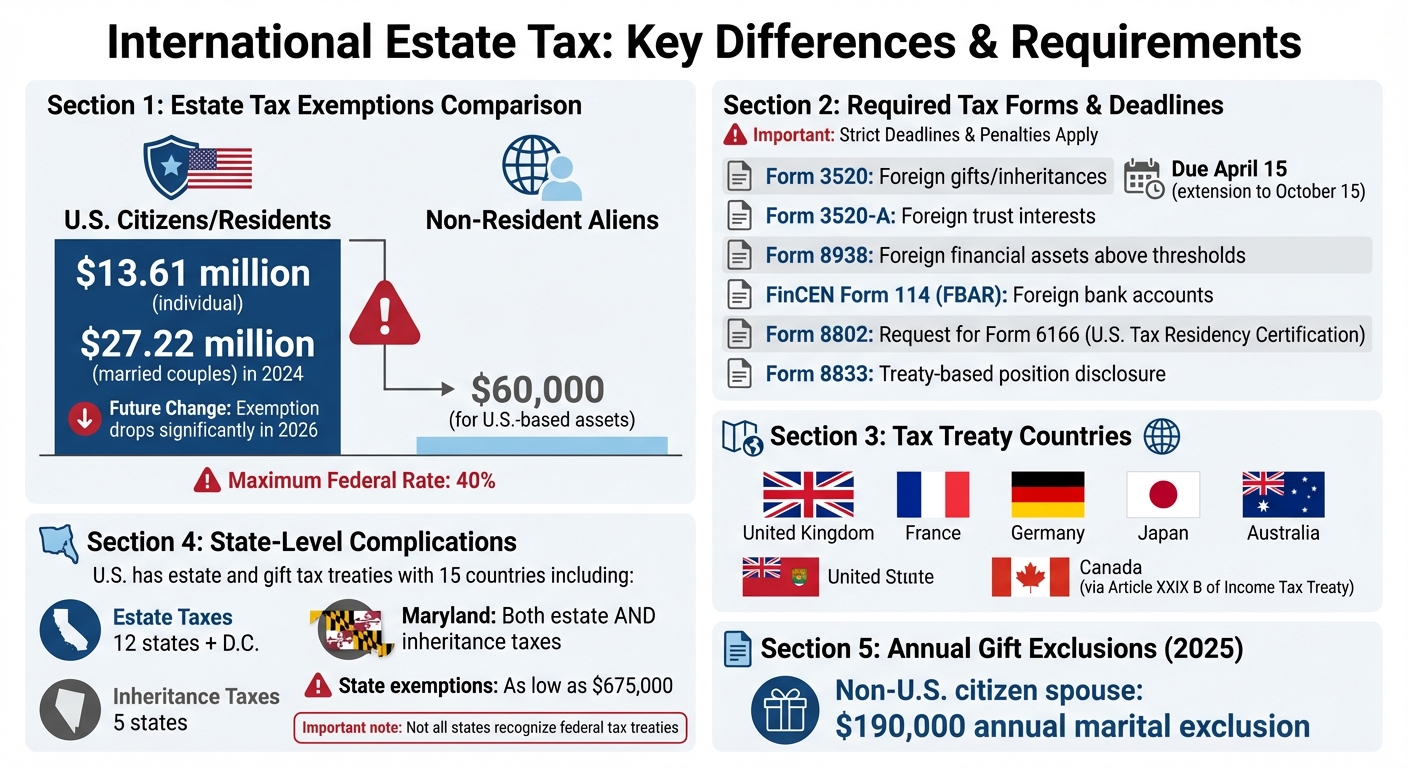

- Taxes: U.S. citizens are taxed on worldwide assets, while non-residents face stricter limits (e.g., $60,000 exemption for U.S.-based assets). Double taxation can be mitigated through tax treaties, but they require active claims.

- Legal Systems: Some countries enforce "forced heirship" rules, limiting asset distribution flexibility. Trusts may not be recognized in civil law countries, leading to unexpected taxes.

- Reporting Obligations: Forms like FBAR, FATCA, and others are mandatory for U.S. citizens with foreign assets. Missing deadlines can result in penalties.

- Planning Tools: International wills, trusts, and situs wills are critical for cross-border compliance. Coordination with local legal experts is essential to avoid conflicts.

To ensure smooth wealth transfer, focus on tax planning, legal compliance, and liquidity for estate expenses. Early preparation and professional guidance are key to protecting your assets and ensuring your wishes are honored.

Tax Consequences of International Wealth Transfer

When wealth crosses international borders through inheritance, it often creates tax obligations in more than one country. U.S. citizens and residents are taxed on their worldwide income, no matter where their assets are located. In contrast, non-residents who aren’t U.S. citizens are only taxed on assets sourced within the United States. These rules can make navigating international tax filings particularly tricky.

If you’re a beneficiary receiving a large foreign gift or inheritance, you’ll need to file Form 3520 by April 15, with an option to extend the deadline to October 15. Inheriting an interest in a foreign trust adds more paperwork, requiring both Forms 3520 and 3520-A. Missing these deadlines can lead to hefty penalties and extended IRS audits. Additionally, foreign financial assets above certain thresholds must be reported using Form 8938, while foreign bank accounts require FinCEN Form 114 (commonly known as FBAR).

How to Avoid Double Taxation

Tax treaties are crucial in handling double taxation issues. The United States has estate and gift tax treaties with 15 countries, including the United Kingdom, France, Germany, Japan, and Australia. For Canada, estate tax provisions are outlined in Article XXIX B of the U.S.–Canada Income Tax Treaty rather than in a standalone agreement.

These treaties often allow taxpayers to claim credits for foreign taxes paid, helping to avoid being taxed twice on the same income. To claim these benefits, you’ll need Form 6166 (Certification of U.S. Tax Residency), which is requested using Form 8802. If you’re a dual resident claiming treaty benefits, you must file Form 8833 with your tax return to explain your treaty-based position.

Estate and Inheritance Tax Rates by Country

In the United States, the federal estate tax reaches a maximum rate of 40% on estates exceeding $13.61 million for individuals or $27.22 million for married couples in 2024. However, non-resident aliens face a much stricter exemption – just $60,000 for U.S.-based assets, which pales in comparison to the multi-million-dollar exemption available to U.S. citizens.

State taxes can complicate things further. Twelve states and the District of Columbia impose their own estate taxes, and five states levy inheritance taxes. Maryland is unique in charging both. State-level exemptions can be as low as $675,000, significantly below federal thresholds. Not all states recognize federal tax treaties, so it’s essential to confirm state-specific requirements with local tax authorities.

In countries like France, civil law systems often impose much higher tax rates on inheritances left to distant relatives compared to those left to spouses or children. Generally, the country where real property is located taxes it first, while the taxpayer’s home country may offer credits to reduce the overall tax burden.

Using Tax Treaties to Lower Your Tax Bill

Tax treaties provide benefits for both U.S. citizens living abroad and foreign residents with U.S. tax obligations. They can reduce U.S. taxes for foreign residents while allowing Americans abroad to claim credits or deductions for taxes paid to other countries. It’s essential to review treaty provisions carefully to understand eligibility, exemptions, and applicable rates.

Treaties also include tie-breaker rules to resolve dual residency issues, determining which country has primary taxing rights. This prevents both countries from taxing your worldwide estate as if you were a resident. Additionally, if you’re a beneficiary of a foreign trust, your tax treatment depends on whether it’s classified as a "grantor" or "non-grantor" trust, as this affects who is responsible for reporting and paying taxes on the income.

State-level considerations can complicate matters further. Some states don’t recognize federal treaty benefits, which means you could still face state inheritance or income taxes even if a federal treaty provides relief. To avoid surprises, always confirm treaty applicability at both the federal and state levels before assuming you’re fully protected from double taxation.

sbb-itb-39d39a6

Legal Structures for International Inheritance

Once you’ve tackled tax considerations, the next step in cross-border wealth transfer is choosing the right legal structure. When assets span multiple countries, traditional estate plans often fall short. Instead, you’ll need tools that can navigate the complexities of different legal systems.

International Wills Explained

An international will, established under the 1973 Washington Convention, is designed to be valid across all treaty countries. Unlike a typical U.S. will, which might not hold up in foreign courts, an international will follows strict formatting rules to ensure cross-border recognition. For example, every page must be numbered and signed by you, along with signatures from two witnesses and an "authorized person." In the United States, this authorized person must be an attorney, not just a notary.

"One of the best ways to prepare for death while owning property in a foreign country is to execute an international will." – Jose A. Bernat Bacete, American Bar Association

The will must also include a signed certificate at the end, confirming that all execution procedures were properly followed. Countries recognizing international wills include France, Italy, Canada, the United Kingdom, Belgium, Portugal, and Slovenia. Within the United States, 23 states and the District of Columbia have adopted the Uniform International Wills Act.

If your assets are located in countries that don’t recognize international wills, you’ll need to create a "situs will" for each jurisdiction. These local wills should only cover assets within their specific regions. To avoid accidentally revoking these supplemental documents during updates, reference them in your primary will.

Now, let’s look at how trusts and offshore entities can add an extra layer of protection for international assets.

Trusts and Offshore Entities for Asset Protection

Trusts can simplify the transfer of assets to beneficiaries, bypassing probate in multiple countries. This not only saves time and legal fees but also ensures privacy and shields assets from creditors. For non-U.S. individuals managing U.S.-based investments, Personal Investment Companies (PICs) can help mitigate certain tax exposures. Cross-Border Trusts (CBTs), specifically designed for managing assets between two countries – such as the U.S. and Canada – can also help families avoid double taxation on inherited property.

However, the treatment of trusts varies widely between jurisdictions. Common law countries like the U.S. and U.K. offer a lot of flexibility in trust arrangements, but civil law countries like France, Germany, Japan, and Brazil often don’t recognize trusts as legal entities. In these countries, trust distributions may be taxed as direct inheritances, sometimes at rates as high as 50%.

If you’re a U.S. citizen involved with a foreign trust, be prepared for strict IRS reporting requirements. Forms 3520 and 3520-A must be filed to avoid hefty penalties. Also, make sure your trust structures align with local wills, especially when dealing with real property in foreign countries. This ensures compliance with local laws without disrupting your overall estate plan.

Local Inheritance Laws You Need to Know

To transfer wealth internationally, you’ll need to seamlessly integrate wills, trusts, and local legal requirements. Real estate, in particular, is subject to local laws, meaning that properties in countries like Spain or France must adhere to local succession rules.

"A will that disposes of real property must usually comply with the law where the property is located. A home in Spain or a cottage in Ontario will be subject to local succession law regardless of a U.S. will’s terms." – FinHelp

In civil law countries, "forced heirship" rules often apply, requiring specific portions of your estate to go to protected heirs, such as your children. For instance, in France, assets typically pass directly to heirs upon death, unlike in the U.S., where an executor oversees the estate through probate.

Your legal domicile – the place you consider your permanent home – determines which country’s rules apply to personal property like bank accounts and investments. This is distinct from residency, which is where you live temporarily. Misunderstanding this distinction could lead to unexpected tax liabilities or inheritance issues across multiple countries.

To avoid complications, work with local attorneys in each jurisdiction to synchronize your estate planning documents and beneficiary designations. Pay special attention to whether beneficiary designations on financial accounts are valid under local law, as some countries allow their inheritance rules to override these contracts.

How to Plan Cross-Border Estate Transfers

When navigating cross-border estate planning, focus on three key areas: managing asset ownership, timing transfers effectively, and seeking professional guidance.

Spreading Assets Across Multiple Countries

Start by creating a detailed inventory of your assets, organized by country. Include information such as ownership details, title locations, and contact information for local experts. It’s essential to document the legal location, or situs, of each asset and clarify domicile details to understand tax obligations across jurisdictions.

Understanding situs rules is crucial for tax planning. For example, real estate is taxed where it is physically located. Meanwhile, the rules for stocks and bonds can be more nuanced. Non-residents holding U.S. real estate or shares in U.S. corporations are subject to federal estate tax on those assets. However, publicly traded U.S. bonds might qualify for the "Portfolio Exemption". Be sure to review the tax rules specific to each type of asset.

Your domicile – where you legally intend to make your permanent home – plays a significant role in determining which country’s succession laws apply to personal property like bank accounts and investments. This differs from residency, which is simply where you live. If you have connections to multiple countries, document those ties – such as property ownership, family relationships, voter registration, or tax filings – to establish a clear domicile. Without proper documentation, you could face taxation as a domiciliary in more than one jurisdiction.

Once your assets are organized, consider transferring some of them during your lifetime to reduce tax liabilities.

Transferring Assets Before Death

Proactively transferring assets during your lifetime can help minimize estate taxes and simplify the eventual distribution process. Gifting assets is one effective strategy to reduce the size of your taxable estate. For 2025, the U.S. estate tax exclusion is set at $13.99 million per person. Additionally, there’s a $190,000 annual marital exclusion for gifts to non-U.S. citizen spouses. Keep in mind that these exclusion levels are scheduled to decrease in 2026, making timely planning especially important.

Strategic gifting can also help ensure liquidity for covering estate expenses. For example, transferring assets in advance can prevent heirs from having to sell real estate or other location-bound assets under unfavorable conditions. However, it’s important to verify whether the receiving country recognizes the tax-advantaged status of certain financial vehicles, such as 529 college savings plans.

"A laissez-faire attitude to estate planning is far less justified if the U.S. citizen client is married to a non-U.S. citizen." – Roger Healy, MBA, CFP®, EA, TEP, Creative Planning International

To avoid liquidity issues, maintain cash reserves or secure insurance to cover foreign probate fees and taxes. This preparation ensures your heirs won’t be forced to liquidate assets at inconvenient times.

Working with Estate Planning Professionals

Cross-border estate planning requires collaboration with legal experts across multiple jurisdictions. These professionals ensure that your wills, trusts, and beneficiary designations align and don’t conflict with one another. Engage attorneys from your domicile and any other relevant jurisdictions, and make sure they work together to avoid accidental revocations or inconsistencies.

Your advisors should also help you claim treaty benefits in all applicable filings. Additionally, they need to confirm that beneficiary designations on financial accounts comply with local laws, as some countries may override these arrangements with their inheritance rules.

If you’re planning to move to a new country, consult your advisors to evaluate whether your existing trusts will be recognized or penalized in the new jurisdiction. Some civil law countries may not recognize trusts at all or may tax beneficiaries at rates as high as 50%. Regular updates to your estate plan, guided by international experts, are essential as laws and personal circumstances evolve.

Conclusion

Key Considerations for Transferring Wealth Across Borders

When managing international wealth transfers, it’s crucial to focus on three main areas: tax planning, legal compliance, and liquidity preparation. For U.S. citizens, estate taxes apply to worldwide assets, which can lead to double taxation if not carefully planned. Tax treaties play a vital role in minimizing these burdens.

Legal systems differ significantly between countries. For instance, the U.S., a common law country, allows flexibility through wills and trusts, whereas civil law countries enforce forced heirship rules that can override personal wishes. Using an international will under the Washington Convention can ensure your estate plan is recognized in multiple jurisdictions. However, if you own real estate in different countries, coordinating local wills is essential to avoid legal conflicts.

"Failure to secure liquidity to pay foreign probate fees is one of the most common causes of delayed estate settlement." – FinHelp

Ensuring liquidity is another critical step. Immediate expenses like foreign probate fees and inheritance taxes should be covered by cash reserves or life insurance. Without this preparation, heirs may be forced to sell assets under unfavorable conditions. With the U.S. estate tax exemption dropping significantly in 2026 from its current $13.99 million, now is the time for strategic gifting and estate restructuring.

Why Comprehensive Planning Matters

Proper planning is essential to protect your wealth and avoid future complications. Without it, your heirs could face conflicting legal claims, unexpected tax bills exceeding 40%, and delays in settling estates across multiple countries. According to the American Bar Association, the cost of upfront planning is minor compared to the financial and logistical headaches that arise during probate.

Regularly reviewing your estate plan with international experts is critical, especially if you’re considering relocating. Some civil law countries don’t recognize trusts and may impose taxes as high as 50% on distributions to beneficiaries. A well-structured plan ensures your wealth is preserved and distributed according to your wishes, while staying compliant with the laws of each jurisdiction.

FAQs

How can I avoid being taxed twice on an inheritance from another country?

When dealing with international inheritance, double taxation can become a concern. One way to address this is by checking if there’s an estate or gift tax treaty between the United States and the other country involved. These treaties are designed to align tax rules and potentially reduce or eliminate overlapping taxes. To navigate these complexities, it’s wise to consult a tax professional experienced in cross-border treaties.

You might also consider implementing estate planning tools like trusts or ensuring full compliance with U.S. reporting rules for foreign assets and gifts. Taking a proactive approach and staying informed can help you manage tax obligations effectively, saving both money and time while staying aligned with international and U.S. tax laws.

What legal challenges can arise when using trusts internationally?

Using trusts internationally can get tricky because of the differences in laws, tax rules, and how trusts are recognized from one country to another. A key hurdle is that not every country acknowledges or enforces foreign trusts, and each has its own set of rules for how trusts should be created and managed. This makes it challenging to ensure a trust stays valid and functional across borders.

Taxes are another major concern. Countries might categorize trusts differently – like labeling them as grantor or non-grantor trusts – which affects tax liabilities and reporting obligations. On top of that, inheritance or estate taxes tied to trust assets can differ widely between nations. Navigating these complexities often involves understanding international tax treaties, which can be daunting without expert help. Careful planning and professional legal advice are crucial to ensure everything stays compliant across the various jurisdictions involved.

How do international tax treaties affect estate planning for cross-border assets?

International tax treaties play a crucial role in estate planning, especially when managing assets across borders. These agreements are designed to prevent double taxation and clearly define tax obligations between countries, helping to ease the financial burden on heirs and beneficiaries.

Take the United States, for instance – it has tax treaties with several nations that determine which country has the right to tax specific assets. These treaties typically cover important aspects like tax residency, applicable exemptions, and the steps required to claim treaty benefits. By understanding these agreements, individuals can make smarter choices about how they structure their estates, decide on asset ownership, and utilize legal tools such as trusts or wills. This not only makes the transfer of assets smoother but also helps reduce potential tax liabilities.