Want to protect your portfolio from domestic risks? Expanding investments internationally can shield you from currency fluctuations, government policies, and market volatility. For many, structuring offshore trusts provides an additional layer of security. Here’s a quick snapshot of how global diversification works:

- Offshore Real Estate: Provides income, currency hedging, and potential residency perks. Top destinations include Panama, Turkey, and Portugal.

- Foreign Bank Accounts: Spread currency risks and gain access to global banking systems. Consider Switzerland, Singapore, and Belize for stability.

- Precious Metals Storage: Safeguard gold and silver abroad in secure locations like Switzerland or Singapore.

- Alternative Assets: Private equity and cryptocurrency offer growth opportunities outside traditional markets.

Offshore Real Estate for Portfolio Diversification

Investing in international real estate offers a way to secure wealth beyond the influence of any one government. Unlike stocks or bonds, property provides tangible income and exposure to different economic cycles and currencies. In 2023, the global commercial real estate market reached an impressive $19.5 trillion, with cross-regional investments growing by 31% in the second half of 2024, totaling $37 billion. Let’s break down how these benefits translate into real-world advantages.

Why Invest in Offshore Real Estate

Owning foreign property can act as a hedge against domestic economic instability and currency fluctuations. For instance, if the U.S. dollar weakens, investments in Europe or Latin America can help preserve purchasing power in local markets. In 2023, non-USD investors experienced a +9.7 percentage point boost in U.S. property returns due to dollar strength, while USD-based investors holding non-dollar assets saw a –12.2 percentage point impact.

Real estate also offers steady income streams with low correlation to traditional investment portfolios. Globally, income accounts for 77% of total returns on unlisted real estate, ensuring cash flow even during stock market downturns. Properties in popular tourist destinations or areas with a strong expatriate presence often generate rental yields that outpace inflation, helping to maintain long-term purchasing power. Additionally, offshore property can provide asset protection through foreign LLCs or trusts, along with potential tax perks like depreciation, mortgage interest deductions, and capital gains exemptions.

On top of financial benefits, some real estate investments can qualify you for residency or citizenship programs, giving you added mobility and a second home base. This aligns with the strategy of building a globally diverse portfolio that mitigates domestic risks.

"Land accumulates in value because they’re not making more of it." – Andrew Henderson, Founder of Nomad Capitalist.

Best Countries for Offshore Real Estate Investments

Panama is a standout choice for its tax advantages. Offshore entities conducting business outside its borders face no income, corporate, capital gains, or estate taxes. This tax-friendly environment makes it an attractive hub for holding rental properties across Latin America while keeping profits shielded from heavy taxation.

Turkey is gaining attention with its robust growth, boasting a 38% nominal market increase in 2025. Property prices hover around €1,000 per square meter, and a $400,000 investment qualifies for citizenship.

Greece appeals to residency seekers with its Golden Visa program, requiring just a €250,000 investment. Rental yields, driven by strong tourism demand, average between 5.6% and 6.8%.

Hungary has revived its Golden Visa program, allowing residency through a €250,000 investment in state-approved real estate funds. Budapest saw an 11.8% market growth in 2025, with property prices around €2,500 per square meter.

Portugal remains a favorite, showing 10% annual price growth despite recent changes to its Golden Visa program. Lisbon properties average €5,300 per square meter, while Porto offers slightly lower pricing at €4,200 per square meter.

Italy offers some of the highest rental yields, averaging 7.6%. Properties in Florence, for example, are priced around €4,500 per square meter.

When exploring these markets, focus on deals measured in dollar cost per square meter. Be cautious of heavily marketed foreign properties, which often carry inflated premiums of 10–40%. To maximize value, enlist local experts to identify prime opportunities, ensure your borrowing currency aligns with the property’s income stream, and work with professionals to handle legal and tax compliance.

sbb-itb-39d39a6

Foreign Bank Accounts for Financial Stability

Opening a foreign bank account can give you access to global banking systems while shielding your finances from domestic economic challenges. Paired with offshore real estate, these accounts help spread out currency risks and offer a layer of legal separation from single-country policies. While real estate provides a solid, physical asset, foreign accounts enhance your financial strategy by adding currency diversification and jurisdictional safeguards. This combination ensures you’re not overly reliant on the policies of just one government. Let’s dive into the specific benefits of opening foreign bank accounts.

Benefits of Opening Foreign Bank Accounts

Foreign bank accounts can protect your wealth during domestic banking crises or when your home currency loses value. For instance, if the U.S. dollar weakens, holding funds in currencies like Swiss francs, euros, or Singapore dollars can help maintain your purchasing power across various markets. In times of extreme volatility, currency values can shift by 10% or more.

These accounts also offer legal diversification, meaning your assets are governed by different legal systems. This reduces your exposure to sudden regulatory changes or political instability at home.

"Jurisdictional diversification can help protect assets, provided you stay abreast of US tax and reporting requirements".

Another perk is the potential for higher interest rates. Offshore savings accounts can yield between 1.5% and 7%, far outpacing many domestic options. Plus, foreign banks often provide access to global investment products and wealth management services. For example, HSBC Holdings plc, which oversees more than $3 trillion in assets, offers international expertise and a range of innovative investment opportunities.

However, compliance is critical. U.S. citizens with foreign accounts must report them to the IRS via FBAR if their total value exceeds $10,000 at any point in the year. Non-compliance can lead to steep penalties, with fines for willful violations reaching $60,000 or more. To avoid these issues, always consult a tax professional to ensure your accounts are reported correctly.

With these benefits in mind, choosing the right banking jurisdiction becomes an essential part of the process.

How to Choose the Right Banking Jurisdiction

Start by focusing on stability. Look for countries with high sovereign credit ratings from agencies like S&P or Moody’s, strong regulatory frameworks, and political neutrality. Well-regarded regulators include Switzerland’s FINMA and Luxembourg’s CSSF, with many European nations offering deposit insurance of up to €100,000 per account.

Consider stable jurisdictions such as Switzerland, Singapore, Belize, or Portugal. Deposit requirements vary, ranging from $500 to over $250,000, depending on the bank. Ensure the bank provides multi-currency account options, typically offering CHF, EUR, and USD.

Align your currency exposure with your spending habits. For example, if you spend 40% of your time in Europe, aim to allocate 40% of your funds in euros.

U.S. citizens face unique challenges, as many European banks hesitate to accept American clients due to FATCA compliance hurdles. Before proceeding, confirm that the bank accepts U.S. persons and adheres to FATCA regulations.

"Offshore banking in Europe is about strategy, not secrecy".

Prepare a thorough KYC (Know Your Customer) package, including your passport, proof of address, and detailed documentation of your funds’ origins. Some banks offer pre-approval processes to verify your eligibility before you invest in notarization or translation services.

Lastly, account for transaction costs like international wire transfers, currency exchange fees, and account maintenance charges, as these can impact your overall returns. A practical approach might involve maintaining two accounts: one offshore for diversification and stability, and one domestic for local liquidity. Transfer funds between them as needed to balance your financial strategy effectively.

International Storage for Precious Metals

Gold and silver have long been trusted as a safeguard against currency fluctuations and economic instability. While storing these metals domestically provides a layer of security, opting for international storage can offer an added level of protection. By operating under different legal systems, international storage facilities make it considerably harder for domestic creditors or government actions to access your assets. This approach not only spreads risk but also complements broader strategies for protecting assets on a global scale.

Why Store Precious Metals Internationally

One of the key advantages of international storage is shielding your assets from potential government intervention at home. A historical example often cited is Executive Order 6102, issued in 1933, which criminalized private ownership of monetary gold in the U.S.. Although such actions are unlikely to happen again, the precedent drives many investors to store their metals offshore as an extra precaution. In international jurisdictions, assets are often protected from domestic court orders, as new legal proceedings would need to be initiated under local laws. For instance, Singapore’s legal framework treats gold and silver as commodities and does not impose reporting requirements on them.

International facilities also offer perks rarely found domestically. In Singapore, investors can purchase gold on leverage or use their stored metals as collateral for loans. Both Singapore and Switzerland operate free-trade zones, allowing investors to import and store precious metals without incurring value-added taxes or import duties.

When choosing a storage facility through private consultations, privately owned options are often the best choice, especially during banking freezes, as they ensure uninterrupted access to your holdings. It’s also crucial to confirm that your chosen facility provides full insurance coverage against theft or damage, along with annual audits and the option for personal inspections. For added peace of mind, consider "allocated and segregated" storage, where your metals are individually accounted for – making verification and retrieval far simpler.

Best Jurisdictions for Precious Metals Storage

Picking the right jurisdiction is essential to maximize the benefits of international storage. Here are some of the top destinations that combine security, efficiency, and investor-friendly policies.

Switzerland remains a top choice for storing precious metals. Known for refining about 70% of the world’s gold, Switzerland also boasts the highest gold reserves per capita. The country’s financial system manages an estimated $6.5 trillion in assets, with over half coming from international clients. Its political system, based on direct democracy, makes it challenging for the government to implement measures like gold confiscation without voter approval.

"The Swiss electorate possess the power to deliver their own verdict and could never be persuaded to agree a gold ban, or accept any government confiscation of gold." – Swiss Gold Safe

Swiss laws also allow anonymous gold purchases up to 15,000 CHF, a much higher threshold compared to Germany’s €2,000 limit. Additionally, Switzerland’s low national debt – approximately CHF 105 billion in 2020 – adds to its financial stability when compared to its net worth of CHF 1,800 billion.

Singapore has quickly become Asia’s leading hub for precious metals. Since 2012, the government has allowed tax-free import and sale of investment-grade gold, silver, and platinum. By 2015, Singapore held nearly one-eighth of the world’s offshore wealth. Investors benefit from competitive pricing, low premiums, and the ability to use stored metals as collateral for loans.

Canada is an appealing option for North American investors seeking stability without the historical risks of gold confiscation. As the fifth-largest gold producer in 2015, with nearly 150 tons of output, Canada offers a strong infrastructure and convenient proximity for U.S. investors who want easier access to their holdings.

Cayman Islands provides a tax-neutral setting with no import duties on gold, making it an attractive option for investors who value proximity to the U.S. while maintaining offshore advantages. The jurisdiction also supports IRA and RRSP accounts and offers competitive storage fees.

For U.S. investors, shipping gold overseas can be costly due to higher insurance premiums and the need for specialized carriers. In many cases, it’s more practical to sell domestic holdings and purchase new metals directly within the offshore jurisdiction. Additionally, physical gold stored in a private safe deposit box overseas is typically not reportable under IRS FATCA regulations, unlike gold held through financial institutions, which must be disclosed.

Alternative Asset Classes for International Portfolios

Looking beyond the usual stocks and bonds opens up a world of opportunities that many investors might miss. Private equity and cryptocurrency stand out as two distinct options for global diversification. Each offers unique benefits that can enhance an international portfolio. For example, private equity provides access to emerging markets and industries abroad, often operating under different regulations, while cryptocurrency allows for seamless, borderless wealth transfers without relying on centralized systems.

From 2005 to 2023, private equity consistently outperformed other asset classes. At the same time, global investments in alternative assets are expected to grow from $16.3 trillion in 2023 to $24.5 trillion by 2028. This shift highlights how sophisticated investors are rethinking their strategies, especially as traditional investments are projected to yield just 5% annually over the next decade.

By including options like private equity and cryptocurrency, investors can diversify their global portfolios even further. While these assets require careful attention to liquidity, regulation, and risk, they offer benefits that go beyond just boosting returns.

International Private Equity Investments

Private equity is a different game compared to buying shares on public exchanges. When you invest in private equity, you’re taking ownership in companies that aren’t publicly listed, with the goal of actively increasing their value. As PIMCO explains:

"Private equity investments… take an ownership position in companies or securities that typically are not listed on a public stock exchange. The goal is to add value by providing capital to help new businesses grow".

Adding an international angle to private equity investments brings even more opportunities. It reduces over-reliance on U.S. markets by exposing investors to sectors that are underrepresented in American indices. Think Swiss pharmaceuticals or European consumer staples – industries operating in entirely different political and economic environments. This geographic diversity can help stabilize returns by reducing reliance on any single country’s performance.

The returns often justify the added complexity. As Fidelity Investments points out:

"Private equity outperformed US small and large cap equities, illustrating the return premiums that investors expect when they sacrifice liquidity by owning private versus public equities".

The appeal is clear to institutional investors – around 86% of large pension funds and endowments now allocate funds to private equity and similar strategies.

However, international private equity isn’t for everyone. To invest directly, you typically need to qualify as an accredited investor, which means earning at least $200,000 annually or having a net worth of over $1 million (excluding your primary residence). These investments often require long-term commitments of 5 to 10 years with limited liquidity. For those who meet these requirements, working with seasoned advisors is critical to navigate foreign regulations, currency risks, and the varied performance of private equity managers. "Fund of funds" structures can also help spread risk across different managers and regions, minimizing the impact of underperforming investments.

While private equity offers exposure to tangible businesses and emerging markets, cryptocurrency provides another avenue for international diversification.

Cryptocurrency for Cross-Border Wealth

Digital assets like Bitcoin and Ethereum bring something entirely different to the table: the ability to transfer value globally, almost instantly, and without intermediaries. Unlike physical gold, cryptocurrency can move across borders with minimal costs, making it a practical tool for international diversification, especially in times of geopolitical uncertainty.

The numbers show increasing institutional interest. By September 17, 2025, global bitcoin spot ETFs had seen $23.6 billion in net inflows for the year. BlackRock’s iShares Bitcoin Trust (IBIT) alone attracted $23.0 billion in that period, leveraging institutional-grade storage through Coinbase Prime, which managed $171 billion in assets as of early 2024. These ETFs provide a solution for investors who want exposure to cryptocurrency without dealing with the technical challenges of managing private keys or the risks of exchange-based holdings.

Bitcoin’s capped supply of 21 million units sets it apart from fiat currencies. As BlackRock notes:

"Bitcoin’s programmatic issuance schedule sits in contrast to fiat currencies, which can be more easily debased by the issuing government".

This scarcity, combined with its decentralized nature, has earned Bitcoin the nickname "digital gold." It’s seen as a hedge against inflation and currency devaluation. By mid-2025, Bitcoin’s market capitalization reached about $2.1 trillion, compared to gold’s $24 trillion.

Volatility remains a challenge. Since 2015, Bitcoin hasn’t had a single year with price swings under 60%. This level of fluctuation demands a long-term approach and careful portfolio allocation. Nic Puckrin, Founder of Coin Bureau, highlights:

"Bitcoin remains a compelling option given its status as a scarce, decentralized asset often viewed as digital gold. It has historically been one of the best-performing asset classes… making it a strategic hedge and growth asset".

For those considering cryptocurrency, starting small – no more than 5% of your portfolio – is a smart way to manage risk while capturing potential gains. Opt for liquid options like spot ETFs instead of trading directly on exchanges to avoid custody risks and high fees. Stick to a buy-and-hold strategy, as short-term trading is notoriously difficult due to Bitcoin’s price swings. Also, ensure compliance with IRS reporting requirements; while foreign currency holdings may not need to be reported on Form 8938, cryptocurrency held through foreign entities could trigger disclosure obligations if certain thresholds are met.

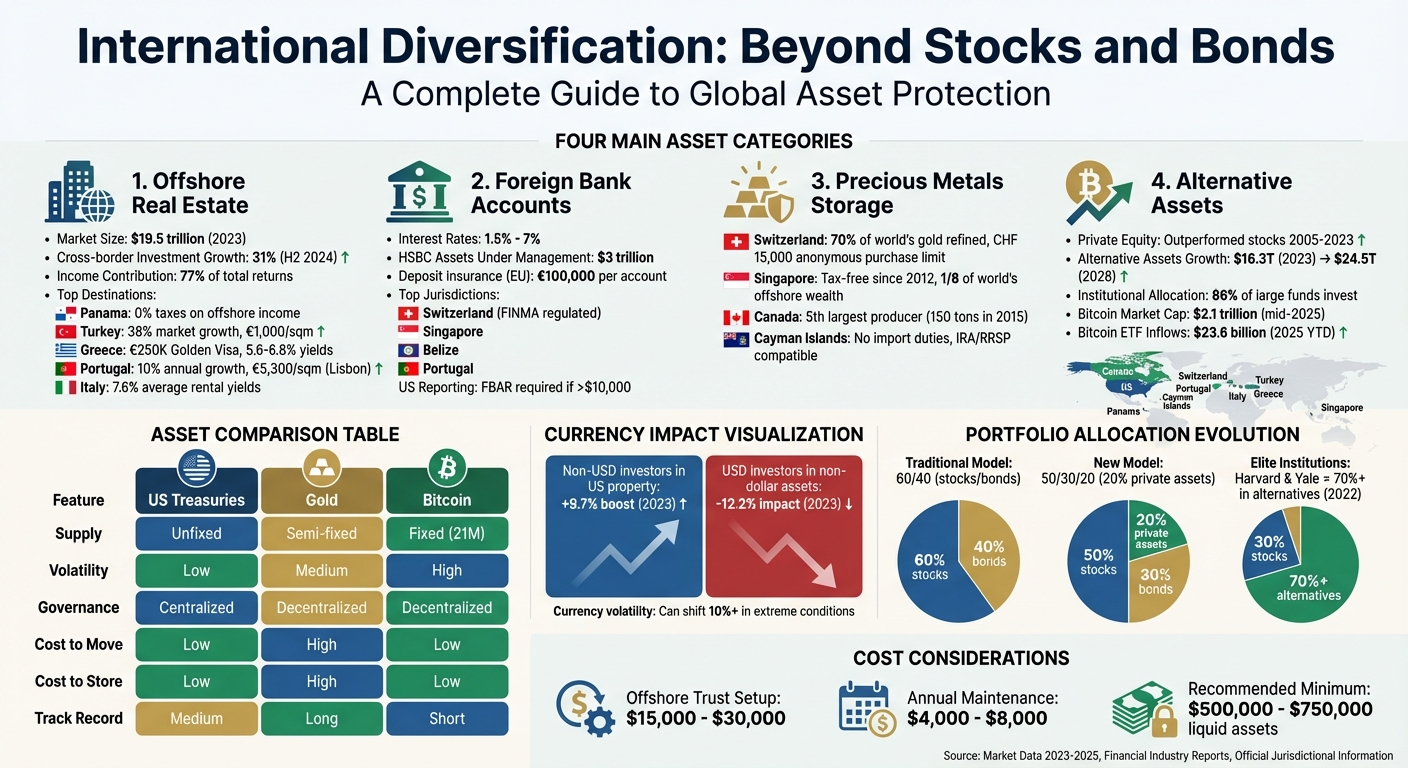

| Feature | U.S. Treasuries | Gold | Bitcoin |

|---|---|---|---|

| Supply | Unfixed | Semi-fixed | Fixed (21M) |

| Volatility | Low | Medium | High |

| Governance | Centralized | Decentralized | Decentralized |

| Cost to Move | Low | High | Low |

| Cost to Store | Low | High | Low |

| Track Record | Medium | Long | Short |

Source: BlackRock internal analysis, June 2025[25]

Both private equity and cryptocurrency complement other strategies like offshore real estate and foreign banking, creating a well-rounded, globally diversified portfolio.

How to Combine International Wealth Protection Strategies

Building Your International Portfolio

Start by clearly defining your objectives – whether you’re aiming for asset protection, tax efficiency, or long-term growth. These goals will guide your choice of jurisdictions and structures to implement your strategy effectively.

To reduce currency exchange risks, align your investment currencies with your future expenses. For instance, if you plan to retire in Portugal, consider holding Euros. Matching the currency of your investments with anticipated costs like mortgages, tuition, or daily living expenses can help minimize costly conversion losses.

Diversifying across jurisdictions is another key step. This approach helps shield your assets from being controlled by the legal system of any single country. For example, a foreign trustee in the Cook Islands isn’t obligated to comply with a U.S. court order. This forces creditors to re-litigate cases overseas, creating significant financial and logistical hurdles.

"Diversification only works if you actually diversify" – Brandon Roe, Wealth Protection Specialist at Nestmann Group.

Keep an organized and detailed inventory of your assets by country. This includes title deeds, bank statements, registration numbers for precious metals storage, and documentation for private equity investments. A well-maintained inventory ensures that all legal structures are properly coordinated and facilitates smoother implementation of your strategies.

Once your portfolio is structured and risks are mitigated, the next step is to bring in experts who can help you put these plans into action effectively.

Working with Professionals for Implementation

After defining your portfolio and aligning it with your goals, professional guidance becomes essential for proper execution. Collaborate with a domestic estate attorney, foreign legal counsel in each jurisdiction where you hold assets, and a tax advisor familiar with cross-border treaties. This team can help you avoid costly errors, such as unintentionally triggering Passive Foreign Investment Company (PFIC) rules, which can result in tax rates on investment income soaring to as high as 60% to 70%.

Opt for fee-based Registered Investment Advisors (RIAs) who act as fiduciaries. These professionals are legally obligated to prioritize your best interests, unlike commission-based brokers who may push high-cost offshore products for their own benefit. This is particularly important when navigating complex U.S. reporting requirements like FBAR (for accounts over $10,000) and FATCA (for assets exceeding $50,000).

Professionals can also help you identify the best jurisdictions for your needs. For example, The Bahamas offers no income or estate taxes along with flexible trust laws, while Switzerland is known for its strong banking privacy but comes with higher associated costs. Consultants can provide detailed comparisons, helping you match your goals with the most suitable offshore locations for asset protection, banking, or residency options.

Be prepared for upfront costs. Setting up an Offshore Asset Protection Trust typically costs between $15,000 and $30,000, with annual maintenance fees ranging from $4,000 to $8,000. These strategies are generally recommended for individuals with liquid assets of $500,000 to $750,000 or more. For those who meet these thresholds, the benefits – such as enhanced protection and tax savings – can often justify the investment, provided everything is executed correctly with expert assistance.

Conclusion: Creating a Diversified Global Portfolio

It’s time to rethink the traditional 60/40 portfolio and consider a diversified global approach. The financial world is shifting toward a 50/30/20 model, where 20% is allocated to private assets like real estate, infrastructure, and private credit. This shift mirrors the strategies of leading institutions – Harvard and Yale, for example, allocated over 70% of their endowments to alternative and private market assets in 2022. The message here is clear: spreading investments across a range of asset classes and regions can help manage risk more effectively.

The key idea is straightforward: diversify your investments across currencies, geographies, and jurisdictions. This kind of international exposure has consistently shown its ability to protect purchasing power and smooth out returns over time.

"By including exposure to both domestic and foreign stocks in your portfolio, you’ll reduce the risk that you’ll lose money and your portfolio’s overall investment returns will have a smoother ride." – U.S. Securities and Exchange Commission

A global allocation strategy taps into a mix of assets to offset volatility at home. For example, precious metals stored abroad can act as a hedge against inflation during domestic economic instability. Offshore real estate can provide rental income in local currencies, while foreign bank accounts serve as an additional layer of financial protection that might be harder for domestic courts to access. Additionally, alternative investments like private equity and cryptocurrency offer growth potential that isn’t tied to traditional markets.

Your asset allocation should reflect your lifestyle and long-term goals. If you spend significant time abroad or plan to retire in another country, align your currency exposure to match your future needs. Keep meticulous records of your international assets and consult cross-border tax professionals to remain compliant with FBAR and FATCA requirements. A well-planned, balanced global portfolio not only shields you from local economic shocks but also lays the foundation for enduring financial security.

FAQs

What are the advantages of investing in real estate abroad?

Investing in real estate overseas opens the door to expanding your portfolio beyond the U.S. market. International properties often perform independently of domestic stocks and bonds, which can help lower overall portfolio risk while offering some protection against local economic or political shifts.

On top of that, certain global markets – think emerging economies or sought-after tourist hotspots – can deliver higher rental income and better chances for property value growth compared to U.S. markets. This means there’s potential for stronger returns overall.

Owning property abroad can also align with asset protection and lifestyle aspirations. Real estate in countries with solid legal frameworks can help safeguard wealth from domestic challenges, while also providing benefits like residency opportunities, vacation retreats, or access to new markets.

How do foreign bank accounts contribute to portfolio diversification?

Foreign bank accounts give U.S. investors the opportunity to hold assets in currencies beyond the U.S. dollar. This provides a built-in shield against currency swings and domestic inflation. By earning interest or dividends in currencies like the euro, pound, or yen, you can reduce exposure to currency risk while tapping into a return source that often behaves differently from U.S. stocks and bonds.

On top of that, offshore banks might offer perks like higher interest rates or specialized products, such as foreign-currency term deposits or multi-currency accounts – options that U.S. institutions typically don’t provide. These features can not only boost the income potential of your portfolio but also serve as a safeguard against geopolitical or systemic risks tied to relying solely on the U.S. banking system.

Having funds in foreign accounts can also make international transactions much smoother. Whether you’re purchasing real estate abroad or seizing global investment opportunities, holding money in foreign currencies eliminates the hassle and expense of frequent currency conversions. While U.S. taxpayers must meet reporting obligations like FBAR and Form 8938, the advantages – diversification, higher income potential, and greater financial flexibility – make foreign bank accounts a smart move for building a globally diversified portfolio.

What are the benefits of storing precious metals internationally?

Storing precious metals overseas offers a practical way to diversify your assets across different jurisdictions. This approach helps shield your wealth from risks tied specifically to U.S. policies, such as shifts in tax laws, lawsuits, or government restrictions. By choosing a country with robust property rights, you add an extra layer of protection, keeping your investments insulated from domestic uncertainties.

Another advantage of international storage is its ability to counter risks related to currency fluctuations and capital controls. For example, if the U.S. dollar weakens or financial regulations become more restrictive, your metals remain accessible and maintain their value in a stable foreign currency. Countries like Switzerland, Singapore, and the Cayman Islands are known for their secure storage facilities. These locations offer audited, insured vaults that ensure your holdings are both physically safeguarded and independently verified.

Precious metals also act as a tangible asset that can help stabilize your portfolio during times of economic or political turbulence. By storing these assets internationally, you not only protect their physical and monetary value but also diversify your exposure to legal and financial systems, preserving your investments for the long term.