by Bobby Casey

Who here reading this article believes the government is the best allocator of capital?

….crickets

None of you. The US government is notoriously inefficient at allocating your capital. Take a look at its scorecard.

- The US dollar has seen a decline of 97% in purchasing power over the last 100 years.

- The Obama administration plans to spend $16-20 million dollars in helping Indonesians get their masters degrees.

- The US government spent $175,857 to determine if cocaine makes Japanese quail engage is sexually risky behavior.

- The US government spent $30 million dollars to help Pakistani farmers increase their mango yield.

- They even spent $615,000 to fund the University of California at Santa Cruz in their efforts to digitize photos, t shirts and concert tickets belonging to the Grateful Dead.

- And let’s not get started on the ubiquitous ACA – Affordable Care Act – set to cost the US taxpayer hundreds of millions in tax increases over the next decade.

Maybe you’d be interested to learn the Federal Government has now taken it upon themselves to manage your retirement accounts, in addition to the 7.65% they already deduct for your social security retirement accounts.

This little gem is called – MyIRA.

At the 2015 State of the Union Address, the Obamessiah said;

“Let’s do more to help Americans save for retirement. Today, most workers don’t have a pension. A Social Security check often isn’t enough on its own. And while the stock market has doubled over the last five years, that doesn’t help folks who don’t have 401ks. That’s why tomorrow I will direct the Treasury to create a new way for working Americans to start their own retirement savings: MyIRA. It’s a new savings bond that encourages folks to build a nest egg. MyIRA guarantees a decent return with no risk of losing what you put in. And if this Congress wants to help, work with me to fix an upside-down tax code that gives big tax breaks to help the wealthy save, but does little to nothing for middle class Americans. Offer every American access to an automatic IRA on the job, so they can save at work just like everybody in this chamber can.”

Here are some of the key features of MyIRA:

- Workers can have part of their pay deducted for deposit into an account invested in U.S. government bonds.

- For tax purposes, it would be treated the same as a Roth IRA (tax-free earnings but not tax-deductible contributions).

- Available to people with annual household income up to $191,000 whose employers choose to participate.

- Initial investments can be as low as $25 and payroll contributions as low as $5.

- The plans are set up through the US Treasury Department.

Essentially, this plan is sold to the lower and middle income Americans as a way to “safely” invest retirement funds outside the realm of those evil Wall Street bankers, automatically, and managed by the US Treasury Department.

Sounds foolproof…..

Read between the lines. This is step one.

Mark my words. In the future, we will see some form of private retirement account nationalization like in Poland or Argentina.

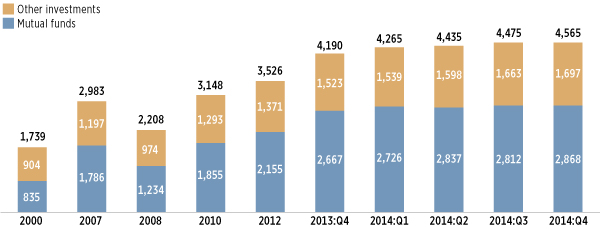

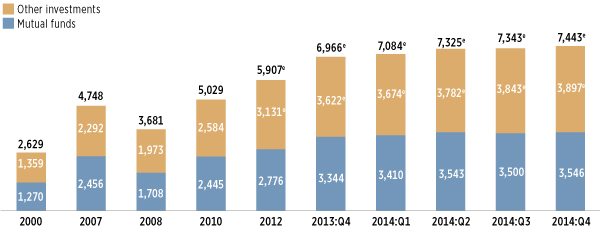

Take a look at the 2 graphs below:

The first graph shows the total amount of money in private 401k accounts. The second is the total amount of money in IRA accounts.

If you add them together, you have about $12 Trillion dollars.

That’s a lot of cash.

The largest amount of untaxed, untouched cash in America today in fact.

Considering the perpetual budget deficits and debt crisis facing America today, I have to imagine legislators’ wheels are starting to turn about how to get their dirty little fingers into that pie.

In reality, it is quite simple.

You could take Poland’s lead and just blatantly steal 50% of all private retirement accounts in order to pay off government debt….for the people of course.

Or you could take Argentina’s lead and steal 100%.

But I don’t think that’s how it will play out in America. It will be more subtle. More indirect and sold as a way of protecting the public from those evil Wall Street bankers….

The logical solution for legislators is to pass a law requiring a portion of that money be held in US Treasury bonds.

Imagine a law getting passed mandating 10% of all money held in private retirement accounts be held in US Treasury bonds.

That one piece of legislation flips the switch at your IRA or 401k custodian forcing them to sell a portion of your assets and buy US treasuries.

Voila….it also plugs a $1.2 Trillion dollar hole in the US budget, lowers interest rates, stimulates housing and business loans, and is sold as a way to save the American worker from those evil Wall Street bankers……

Are you starting to get the drift yet?

The real question is, what will you do about it?

Should you cash in your IRA or 401k and put it under the mattress?

I suppose that depends on how much money you have in that account. But if you have any sizable amount of assets in your IRA or 401k, there is are better options.

Many people call them Self-Directed IRA’s and Self-Directed Solo 401k’s. In reality, all IRA and 401k accounts are self-directed.

The problem is that your traditional custodian is not interested in allowing you to invest in real estate, precious metals, private businesses, business loans, tax lien certificates or anything else that would inhibit their ability to siphon money from your account.

You see, traditional custodians want you to buy stocks, bonds, or even better – their own funds. They make fees on your trading and the fund management.

They don’t make that much money when you buy rental property you hold for 10 years, or a horse farm in Wyoming, or make business loans to your successful entrepreneur friends.

For purposes of this article however, I will call these vehicles, Self-Directed IRA’s and Self-Directed Solo 401k’s.

If you have your money in a Self-Directed IRA or Self-Directed Solo 401k, your investment options are virtually limitless. It also puts you in the driver seat managing your own financial future.

You are only restricted from transactions where you get immediate personal benefit, collectables, and deals with family. Of course I am simplifying here, but you can invest in virtually anything as long as you don’t violate just a few very simple rules.

Essentially the way it works is you find a custodian that will allow you to invest in any qualified asset and avoid any disqualified persons as mentioned above. There are many of them out there.

If you have existing IRA or 401k funds, you can easily transfer them to your new custodian. From there, you have 2 options.

One, you can direct your custodian to wire funds to the necessary account in order to facilitate the investment. The custodian retains title to the asset on your IRA or 401k behalf.

You will need to engage the custodian for each and every transaction you wish to make. This option is the lowest cost up front, but ongoing fees are higher since you pay for each transaction.

Option two; you register an LLC – owned by your IRA or 401k and managed by you – and direct your custodian to wire the funds into the LLC account.

As LLC manager, you have full managerial control over your investments and can direct them as you wish – no need to engage your custodian for each transaction. This option is more expensive to set up on the front, but you have more control and lower cost ongoing. This also gives you significant asset protection benefits and eliminates the risk of government confiscation or mandated US Treasury investments.

If you are interested in investing in foreign assets, you can do exactly the same thing using an offshore LLC as well. As a matter of fact, I highly encourage it for at least a portion of your assets. This further strengthens your asset protection strategy and opens up a whole new world of investment options.

In fact, you can split the investment assets if you wish between your US and your offshore LLC.

Or if your spouse also has an IRA or 401k, you can even combine your funds and invest together.

If you are interested in taking control of your IRA or 401k and self manage your own assets in any asset class of your choosing, send me an email here, and one of our team members will contact you for details.

If you are a GWP Insiders member, we offer huge discounts on setting up your IRA or Solo 401k as well as US or offshore LLC’s for managing those assets. You can click here to learn more about GWP Insiders.

Until next time, live well.