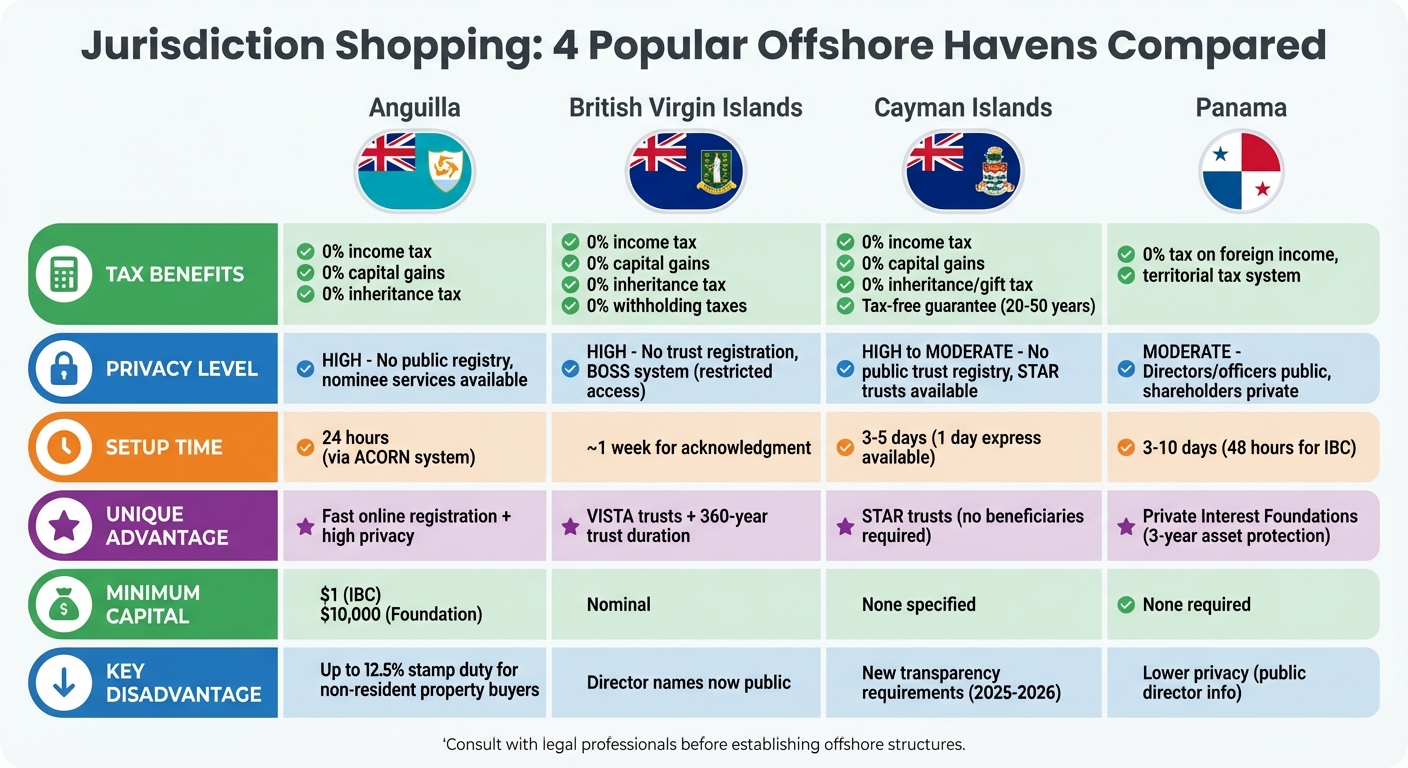

Looking to protect your wealth? Jurisdiction shopping involves choosing legal systems that offer tax advantages, privacy, and asset protection. Here’s a quick breakdown of four popular options:

- Anguilla: Zero taxes, strong confidentiality, and easy company setup via online registration.

- British Virgin Islands (BVI): Tax neutrality, private trust structures, and robust asset protection.

- Cayman Islands: No direct taxes, flexible STAR trusts, and long-term tax guarantees.

- Panama: Territorial tax system (offshore income untaxed), strong banking privacy, and Private Interest Foundations for wealth security.

Quick Tip: Anguilla stands out for its fast online setup and high privacy measures, while Panama offers unmatched protection through its Private Interest Foundations. Each jurisdiction has unique strengths depending on your priorities.

Keep reading to explore how these jurisdictions compare across taxes, privacy, ease of setup, and asset protection.

1. Anguilla

Anguilla operates under an English Common Law framework that provides strong legal support for offshore wealth protection. Key legislation like the Trusts Act 1994 and the International Trust Act 2007 offers a solid foundation for establishing and managing trusts, focusing on confidentiality and safeguarding assets. For those interested in setting up foundations, the Anguilla Foundation Act 2008 provides a legal structure inspired by systems used in Monaco, Liechtenstein, Panama, and Nevis. These laws offer appealing advantages in terms of taxes, privacy, and ease of setup.

Tax Benefits

Anguilla provides a zero-tax environment for offshore entities. Trusts with trustees based in Anguilla are exempt from local taxes on income or gains, and foundations enjoy similar exemptions from taxes and duties. Additionally, there’s no inheritance tax when a settlor passes away, avoiding the need for probate.

Privacy Protections

Anguilla ensures strong privacy measures by not requiring public registration of trusts, which keeps details confidential. For foundations, only a Certificate of Registration is publicly recorded, while the identities of founders and beneficiaries stay private. International Business Companies (IBCs) also benefit from these privacy safeguards, as there is no public registry for shareholders or directors. To enhance privacy further, nominee council members can be appointed for foundations. However, it’s wise to assign a guardian – often the founder – to oversee investments and retain the power to replace council members if needed.

Ease of Setup

Anguilla simplifies the registration process with its Commercial Online Registration Network (ACORN), allowing remote registrations that are often completed within 24 hours. An IBC can be established with just one director and one shareholder (who can be the same person) and requires no minimum capital beyond $1.00. Foundations, on the other hand, need an initial endowment of $10,000 and are typically registered within one business day. Incorporation fees are about $250, with additional government registration fees around $200.

Asset Protection Strength

Anguilla foundations operate as separate legal entities, offering protection against foreign creditor claims, insolvency, and bankruptcy. The jurisdiction also includes "firewall" provisions to block the enforcement of foreign judgments on trusts established locally. However, U.S. residents should remember that they are required to report worldwide income to the IRS.

sbb-itb-39d39a6

2. British Virgin Islands (BVI)

The British Virgin Islands (BVI) is a prominent offshore financial hub. It operates under English Common Law and provides modern trust legislation designed for tax efficiency and asset protection, though many believe the myth about offshore trusts is that they are only for the ultra-wealthy. Let’s explore the key advantages of choosing the BVI.

Tax Benefits

The BVI offers a tax-neutral environment for offshore structures. This means no income, capital gains, wealth, estate, inheritance, or gift taxes for individuals or offshore companies. Additionally, dividends, interest, rents, and royalties are free from withholding taxes. Trusts in the BVI also enjoy tax exemptions, provided no beneficiaries are local residents, and the trust neither owns local land nor conducts business in the territory. Establishing a trust involves a nominal duty of $200. The absence of exchange controls further simplifies the transfer of funds for trading and investments.

Privacy Protections

BVI trusts are not subject to registration, ensuring that details about settlors, beneficiaries, and trust assets remain private. No public records are maintained, safeguarding sensitive information. The jurisdiction uses the Beneficial Ownership Secure Search System (BOSS), which limits access to beneficial ownership details to authorized law enforcement and government agencies. However, recent laws now require the names of company directors to be publicly accessible through the Registrar of Companies, while other corporate information remains confidential.

Ease of Setup

Setting up a BVI trust is straightforward. It requires a written instrument processed through a Registered Agent. License applications are usually acknowledged within a week. The Virgin Islands Special Trust Act (VISTA) allows settlors to retain management control over shareholdings. Additionally, settlors can establish Private Trust Companies to act as trustees for family trusts, enabling family members to participate in investment decisions.

Asset Protection Strength

Recent updates to the Trustee Act have strengthened firewall provisions, protecting BVI trusts from foreign forced heirship claims and court orders. The jurisdiction does not recognize foreign forced heirship rights, ensuring that the validity of a trust remains secure, regardless of the settlor’s domicile laws. Discretionary trusts in the BVI provide robust asset protection. Non-charitable trusts can last up to 360 years, while charitable and purpose trusts can continue indefinitely.

3. Cayman Islands

The Cayman Islands operates under English common law and is known for its advanced trust legislation, which prioritizes both privacy and asset protection. These features enhance the jurisdiction’s reputation as a reliable choice for safeguarding assets.

Tax Benefits

The Cayman Islands imposes no direct taxes on income, capital gains, profits, or wealth. There are also no death, inheritance, or gift taxes, making wealth transfer seamless. Additionally, the absence of forced heirship rules ensures that individuals have full control over how their estates are distributed.

"The Cayman Islands levies no capital gains, income, profits, corporation or withholding taxes (whether on the investment fund or its investors or managers)." – Appleby

One of the standout features is the tax-free undertaking, a written government guarantee ensuring that entities remain tax-free even if new taxes are introduced. Exempted companies receive this guarantee for 20 to 30 years, while exempted limited partnerships, LLCs, and unit trusts can secure protection for up to 50 years. Moreover, funds can be moved freely without currency restrictions.

| Entity Type | Tax-Free Guarantee Period |

|---|---|

| Exempted Company | 20 – 30 Years |

| Exempted Limited Partnership (ELP) | 50 Years |

| Limited Liability Company (LLC) | 50 Years |

| Unit Trust / Exempted Trust | 50 Years |

Privacy Protections

The Cayman Islands ensures confidentiality for trust arrangements by not maintaining a public register of trusts. While company documents must be filed with the Registrar of Companies, they are not accessible to the public.

"The Cayman Islands has a well-established and flexible trusts regime allowing for privacy and asset protection, both in the commercial and private wealth spheres." – Mourant Ozannes

The STAR Act (Special Trusts Alternative Regime) adds another layer of privacy. Under this framework, only an appointed "enforcer" has access to trust information and the authority to enforce its terms. Beneficiaries can be legally excluded from receiving any information. Wealthy families often use Private Trust Companies to maintain confidentiality while retaining control over trust assets.

While the Cayman Islands has enhanced transparency measures, such as participating in the Common Reporting Standard with 130 countries, privacy remains a priority. Starting in 2025, the Beneficial Ownership Transparency Act will allow individuals with a "legitimate interest" to request access to certain ownership details. Additionally, new regulations set for 2026 will extend tax reporting obligations to include digital and crypto assets under the Crypto-Asset Reporting Framework.

Ease of Setup

Establishing a trust or company in the Cayman Islands is a smooth process. Standard registration for companies, exempted limited partnerships, and LLCs typically takes three to five business days. For urgent cases, an express service can reduce this to just one business day.

Company incorporation involves working with a licensed corporate services provider to file a memorandum and articles of association with the Registrar of Companies. Trusts, on the other hand, are created through a formal written instrument, such as a Settlement of Trust or Declaration of Trust. All entities must maintain a registered office in the Cayman Islands and comply with the Beneficial Ownership Transparency Act and Economic Substance Act.

The STAR trust framework offers unique flexibility, allowing for trusts without identifiable beneficiaries. This makes it a popular choice for both commercial and personal wealth purposes.

Asset Protection Strength

The Cayman Islands’ legal framework provides strong asset protection through its firewall provisions. These rules ensure that a trust governed by Cayman law cannot be invalidated or overridden based on the claims of individuals related to the settlor or beneficiaries.

"The choice of Cayman law as the governing law is conclusive and any questions arising in connection with the trust will be determined according to Cayman law and the application of foreign law is excluded." – Ogier

Under the Fraudulent Dispositions Act, asset transfers can only be challenged if a creditor proves intentional fraud and undervaluation. For solvent settlors, creditors have a six-year window to contest the trust. After this period, the assets are generally well-protected. The legal system, based on English common law, is further strengthened by the Judicial Committee of the Privy Council in London, which serves as the ultimate appellate court.

Next, Panama offers its own distinct advantages.

4. Panama

When it comes to offshore asset protection, Panama stands out for its combination of tax advantages and strong legal protections. The country operates under a territorial tax system, meaning only income earned within its borders is taxed. Offshore entities conducting business solely outside Panama are entirely exempt from major taxes.

"Panama’s legal and tax structures make it a pure tax haven: that is, the country levies no taxes at all [on offshore entities]." – Investopedia

Tax Benefits

Panama’s territorial tax system ensures that foreign income remains untaxed. Additionally, Private Interest Foundations are completely exempt from taxes on their earnings. There are no restrictions on money transfers, thanks to the absence of exchange controls. While Panamanian offshore companies can engage in local business, such activities are taxed at local rates. Alongside these fiscal perks, Panama also provides strong privacy safeguards.

Privacy Protections

Beyond its tax advantages, Panama is known for its commitment to privacy. While the names of directors and officers are publicly accessible, shareholder information remains confidential. Banking secrecy laws are strictly enforced, preventing banks from disclosing account details unless mandated by a court order tied to a criminal investigation. Furthermore, under Law 129 of 2020, Panama maintains a private Beneficial Ownership Register, which is accessible only to authorized authorities. With over 350,000 registered international business companies, Panama ranks third globally, following Hong Kong and the British Virgin Islands.

Ease of Setup

Establishing a company in Panama is relatively quick and straightforward. Once KYC (Know Your Customer) approval is obtained, the process usually takes 3 to 10 business days, with International Business Companies often incorporable within 48 hours. Each entity must appoint a licensed Panamanian resident agent. A Sociedad Anónima (S.A.) requires at least three directors and three officers, who can be the same individuals regardless of nationality. Notably, there is no minimum paid-in capital requirement. However, opening a corporate bank account typically extends the timeline by an additional 1 to 3 weeks.

Asset Protection Strength

Panama’s Private Interest Foundations provide exceptional asset protection by creating a separate legal entity that shields assets from lawsuits, creditors, and inheritance disputes. Once assets are transferred to a foundation, they are protected from seizure after three years, even in cases involving creditors or ex-spouses. Additionally, these foundations bypass the probate process, streamlining succession planning. For individuals seeking to safeguard their wealth, Panama’s legal framework offers a high level of security against creditor claims.

Advantages and Disadvantages by Jurisdiction

Different jurisdictions come with their own set of pros and cons when it comes to asset protection. Here’s a quick breakdown of some key factors to consider for each location.

| Feature | Anguilla | British Virgin Islands | Cayman Islands | Panama |

|---|---|---|---|---|

| Income Tax | 0% for residents and non-residents | 0% | 0% | 0% on foreign income |

| Capital Gains Tax | 0% | 0% | 0% | 0% on foreign income |

| Inheritance/Estate Tax | 0% | 0% | 0% | 0% |

| Privacy Level | High – no public filing of directors/shareholders | High | High to Moderate | Moderate – directors/officers are public |

| Unique Advantage | Online registration and nominee services | Standard benefits | STAR Trusts without beneficiaries | Private Interest Foundations |

| Key Disadvantage | Stamp duty for non-resident property buyers (up to 12.5%) |

This table highlights the standout features of each jurisdiction while also pointing out potential downsides.

Anguilla stands out for its zero taxation policies, strong privacy measures, and quick company formation processes. However, it’s worth noting that non-resident property buyers could be subject to stamp duties of up to 12.5% of the property value.

Panama offers robust asset protection through its Private Interest Foundations, but privacy is somewhat compromised as director and officer details are publicly accessible.

Conclusion

When considering offshore asset protection, Anguilla often stands out as a top choice. Its complete absence of direct taxation is a rare advantage, and as a British Overseas Territory, it offers legal stability rooted in English Common Law – something that reassures international investors. The ACORN system allows for quick, remote company formation, adding convenience to its list of benefits. On top of that, Anguilla provides strong privacy safeguards, as director and shareholder details are not publicly filed, and nominee services are available for added discretion.

Anguilla’s LLC laws also include charging order protection, which can serve as a deterrent to creditors. In some cases, creditors may even face tax liabilities on company profits without receiving any distributions. This makes Anguilla a compelling option for those looking to protect their assets.

Global Wealth Protection specializes in crafting strategies that leverage Anguilla’s unique benefits. Whether you’re setting up a standalone LLC, a trust, or a more complex multi-jurisdictional structure, professional guidance ensures your assets are secure while remaining compliant with your home-country regulations.

Choosing the right jurisdiction isn’t just about minimizing taxes – it’s about creating a stable, private, and efficient environment where your wealth can thrive without unnecessary legal risks. For many, Anguilla provides the ideal balance of these qualities.

FAQs

What should I look for in a jurisdiction to protect my assets?

When choosing a jurisdiction for asset protection, it’s important to weigh several key factors to ensure your wealth stays secure and aligns with your objectives. Legal protections should be at the top of your list. Look for jurisdictions that reject foreign judgments, have short statutes of limitations, and enforce stringent standards to shield assets from creditors.

Another critical consideration is privacy. Opt for locations with robust confidentiality laws that safeguard your personal and financial details from prying eyes.

Tax advantages can also make a big difference. Jurisdictions like Anguilla often provide tax-neutral environments – no income tax, no capital gains tax, and no inheritance tax – making them attractive for maintaining and growing wealth.

Don’t overlook the cost and simplicity of setup either. Some places offer quick, hassle-free, and affordable incorporation processes, which can save you time and money. Lastly, focus on stability and a reliable legal framework, ideally one rooted in common law, for consistent and dependable asset protection. Balancing these factors will help you select a jurisdiction that truly protects your assets.

Why is Anguilla considered a top choice for privacy in offshore asset protection?

Anguilla stands out as a top choice for offshore asset protection, thanks to its stringent confidentiality laws. The jurisdiction ensures that sensitive data stays secure by not requiring public disclosure of trust beneficiaries, company directors, or shareholders of International Business Companies (IBCs). This level of privacy is a key reason why many turn to Anguilla for safeguarding their assets.

At the same time, Anguilla aligns with global standards, including the OECD guidelines on anti-money laundering and tax transparency. By maintaining this balance between privacy and international compliance, it offers a secure and discreet environment for individuals and businesses to manage their wealth effectively.

What risks should I consider when choosing an offshore jurisdiction for tax benefits?

When choosing an offshore jurisdiction for tax benefits, it’s essential to understand the potential risks involved. One of the biggest concerns is staying compliant with U.S. tax laws. Failing to properly report offshore accounts or assets can lead to severe penalties, including steep fines or even criminal charges. Tax authorities like the IRS may interpret aggressive offshore strategies as attempts to dodge taxes, which could result in audits or legal action.

The stability and reputation of the jurisdiction is another important factor to consider. Some so-called tax havens are under increased scrutiny from international regulators, which can lead to reputational damage or additional compliance requirements. Global regulatory changes – such as those introduced by FATCA or OECD standards – can also limit the privacy and tax benefits that these jurisdictions once promised.

While places like Anguilla offer potential tax advantages, it’s critical to weigh these risks carefully and ensure you comply with all relevant laws to steer clear of unnecessary complications.