Protecting your wealth from lawsuits requires proactive planning. Trusts and LLCs are two effective tools to shield your personal and business assets. An LLC separates business liabilities from personal finances, while trusts transfer legal ownership of assets, making them harder for creditors to access.

Key points:

- LLCs: Protect personal assets from business debts or lawsuits by creating a legal barrier.

- Trusts: Remove assets from your name, safeguarding them from creditors and simplifying wealth transfer.

- Timing matters: Set up these structures before legal trouble arises to avoid potential legal challenges.

- Combining both: A trust owning an LLC provides layered protection, privacy, and control.

For added security, structuring offshore trusts like Anguilla options offer privacy, limited creditor timelines, and tax neutrality. Work with professionals to ensure compliance and avoid common pitfalls like mixing personal and business finances.

Why Lawsuits Threaten Your Assets

Did you know that a new lawsuit is filed in the United States roughly every 30 seconds?. This staggering figure highlights just how vulnerable your wealth can be. Whether you’re a business owner, a property investor, or someone with significant assets, the reality is clear: the U.S. is one of the most litigious countries in the world, and that puts your finances at risk.

Lawsuit Exposure for Business Owners and Investors

If you own a business or invest in properties, you’re often seen as a prime target. Plaintiffs and their attorneys tend to pursue "deep pocket" defendants – those with substantial assets they can go after.

The types of lawsuits you might face are wide-ranging. Claims could stem from professional malpractice, disputes with tenants, slip-and-fall accidents on your property, or even breach of contract allegations. If you’re involved in managing employees or serve on a board of directors, you’re also exposed to employment-related claims like discrimination or wrongful termination.

The risks grow even more significant when business structures aren’t properly maintained. For example, courts can "pierce the corporate veil" if you blur the lines between personal and business finances. This could happen if you mix personal and company funds, use business assets for personal errands, or casually refer to company property as "mine" in emails. Once this protective barrier is removed, your personal assets – like your home, bank accounts, and investments – could be seized to satisfy business debts.

This is why creating legal structures to clearly separate personal and business liabilities isn’t just a good idea – it’s essential.

What Happens Without Asset Protection

Without proper safeguards, even one lawsuit can wreak havoc on your finances. The impact isn’t just about losing money today; legal judgments can also claim a portion of your future earnings, effectively putting a lien on your financial future. Beyond the financial toll, your professional reputation could take a hit, making it harder to secure loans, attract investors, or maintain strong business relationships. And if you try to shield your assets after a legal threat has surfaced, courts can undo those efforts, leaving you even more exposed.

"The goal of asset protection isn’t to dodge legitimate debts. It’s about legally structuring your finances to discourage frivolous lawsuits and give you the upper hand in settlement talks." – Commons Capital

In short, taking proactive steps to protect your assets isn’t just about avoiding financial loss – it’s about safeguarding your future.

sbb-itb-39d39a6

Using Trusts to Protect Your Assets

A trust transfers legal ownership of your assets to a trustee, removing them from your name and shielding them from creditor claims.

How Trusts Keep Assets Safe from Creditors

Trusts safeguard assets in three key ways: by transferring ownership to an independent trustee, enforcing spendthrift provisions that prevent beneficiaries from transferring their interests, and establishing irrevocability, which ensures assets cannot be reclaimed.

"The fact that the trust must be irrevocable is precisely what gives it defensive strength." – Offshore Law Center

An independent trustee can also delay distributions during legal disputes, adding another layer of protection. However, it’s essential to set up a trust while you’re financially stable. Transfers made during lawsuits or financial trouble might be classified as "fraudulent conveyances" and voided.

Types of Asset Protection Trusts

Revocable trusts are useful for bypassing probate but offer little asset protection since you retain control. On the other hand, irrevocable trusts provide stronger protection because you relinquish direct control, making them harder to dissolve unilaterally.

As of 2025, 21 U.S. states allow Domestic Asset Protection Trusts (DAPTs), up from 17 states in mid-2022. Setting up a DAPT generally costs between $3,000 and $7,000, but they are still subject to federal court orders and bankruptcy laws under the Full Faith and Credit Clause.

Offshore Asset Protection Trusts (OAPTs) operate outside U.S. jurisdiction and typically do not recognize foreign court judgments. Establishing one costs between $5,000 and $20,000, with annual trustee fees ranging from 0.5% to 2% of trust assets (minimums between $2,000 and $5,000).

Specialized trusts cater to specific needs. For instance, Medicaid Asset Protection Trusts (MAPTs) help preserve assets while ensuring eligibility for long-term care, which is critical given Medicaid’s strict asset limits. Similarly, Lifetime Asset Protection Trusts (LAPTs) are designed to protect inheritances from future creditor claims or divorce settlements.

For those seeking even stronger legal safeguards, offshore trusts offer distinct advantages. Understanding why offshore asset protection is so effective can help you decide if this level of security is right for your situation.

Why Anguilla Works Well for Offshore Trusts

If you’re looking for protection outside U.S. borders, Anguilla stands out as a top choice for offshore trusts. Anguilla’s courts do not enforce U.S. rulings on matters like divorce, inheritance, bankruptcy, or taxes. This means creditors must file claims locally and meet a much tougher burden of proof. Under the Fraudulent Dispositions Ordinance, creditors have only three years from the asset transfer date to challenge it, and they must prove insolvency – a difficult hurdle.

The Anguilla Trust Act of 2014 eliminated the Rule against Perpetuities, allowing trusts to exist indefinitely. Privacy is another major benefit, as the Trust Charter filed with the government does not disclose the names of the settlor or beneficiaries. Additionally, Anguilla imposes no income, capital gains, inheritance, or gift taxes on offshore trusts.

The process to register a trust in Anguilla is quick and cost-effective. It takes just 24 hours, costs $250 USD, and requires no annual government renewal fees. Operating under British Common Law, Anguilla offers a familiar legal framework for U.S. attorneys, combined with modern protective measures. For added control, you can structure your trust to form an offshore company, allowing you to manage assets directly while keeping them legally safeguarded.

How LLCs Protect Your Personal Assets

A Limited Liability Company (LLC) creates a legal barrier between your personal assets and your business. By treating the LLC as a separate legal entity, it ensures that your home, savings, and other personal belongings are shielded from business-related debts or lawsuits. This protection is at the heart of what makes an LLC a powerful tool for business owners.

The Liability Shield Offered by an LLC

One of the key benefits of an LLC is that it limits creditor claims to the business’s assets. This means your personal bank accounts, home, and other property are generally out of reach. In the event of a personal lawsuit, creditors can only go after potential distributions through a charging order.

This protection is critical, especially when you consider that nearly 90% of U.S. corporations face some type of lawsuit, and about 45% of those lawsuits involve small businesses. The average liability suit costs at least $54,000, a figure that could be devastating for many entrepreneurs. Attorney Patrick Ivy puts it plainly:

"Without personal asset protection, a $54,000 judgment could be financially devastating and lead to the dissolution of a small business or personal bankruptcy."

How to Strengthen Your LLC’s Protection

To keep your LLC’s liability shield intact, you must maintain a clear distinction between your business and personal finances. One of the most common errors that can weaken this protection is commingling funds – mixing your personal and business expenses. Courts may use this as a reason to "pierce the corporate veil", which could leave you personally liable for business debts.

Here’s how to avoid this pitfall:

- Open a dedicated business bank account.

- Obtain an EIN (Employer Identification Number) to separate tax responsibilities.

- Sign contracts and take on loans under the LLC’s name, not your own.

Additionally, it’s wise to draft a detailed operating agreement. This document should outline ownership, decision-making processes, and rules for transferring interests. Attorney Blake Harris emphasizes the importance of this step:

"The clearer the boundary between personal and business finances, the stronger your LLC’s shield against personal liability."

Multi-member LLCs often provide stronger protection than single-member ones, as courts are less likely to disrupt the interests of non-debtor members. Choosing to form your LLC in states like Delaware, Nevada, or Wyoming can also enhance asset protection due to their favorable business laws. Beyond these structural safeguards, LLCs offer another valuable layer of protection: privacy.

Privacy as an Additional Layer of Protection

Privacy can play a significant role in protecting your assets by making it harder for potential litigants to connect you to valuable holdings. In many states, LLCs can be formed without requiring the owners’ names to appear in public records. This anonymity makes it more difficult for someone to target you personally.

You can further enhance privacy by using nominee managers or corporate entities in public filings. As Attorney Blake Harris explains:

"Keeping your name off public business filings adds a layer of financial privacy. … Reducing visibility makes it harder for potential claimants to target you personally, enabling financial privacy."

For even greater privacy, some offshore jurisdictions, such as Anguilla, omit founders’ and beneficiaries’ names from public records and enforce strict creditor standards. These measures can make it significantly harder for anyone to connect your identity to your assets, giving you added peace of mind.

Trusts vs. LLCs: Which One Do You Need?

Deciding between a trust and an LLC comes down to understanding what you want to protect and how you plan to manage your assets. Each serves a distinct purpose, so knowing their differences can help you make the best choice for your situation.

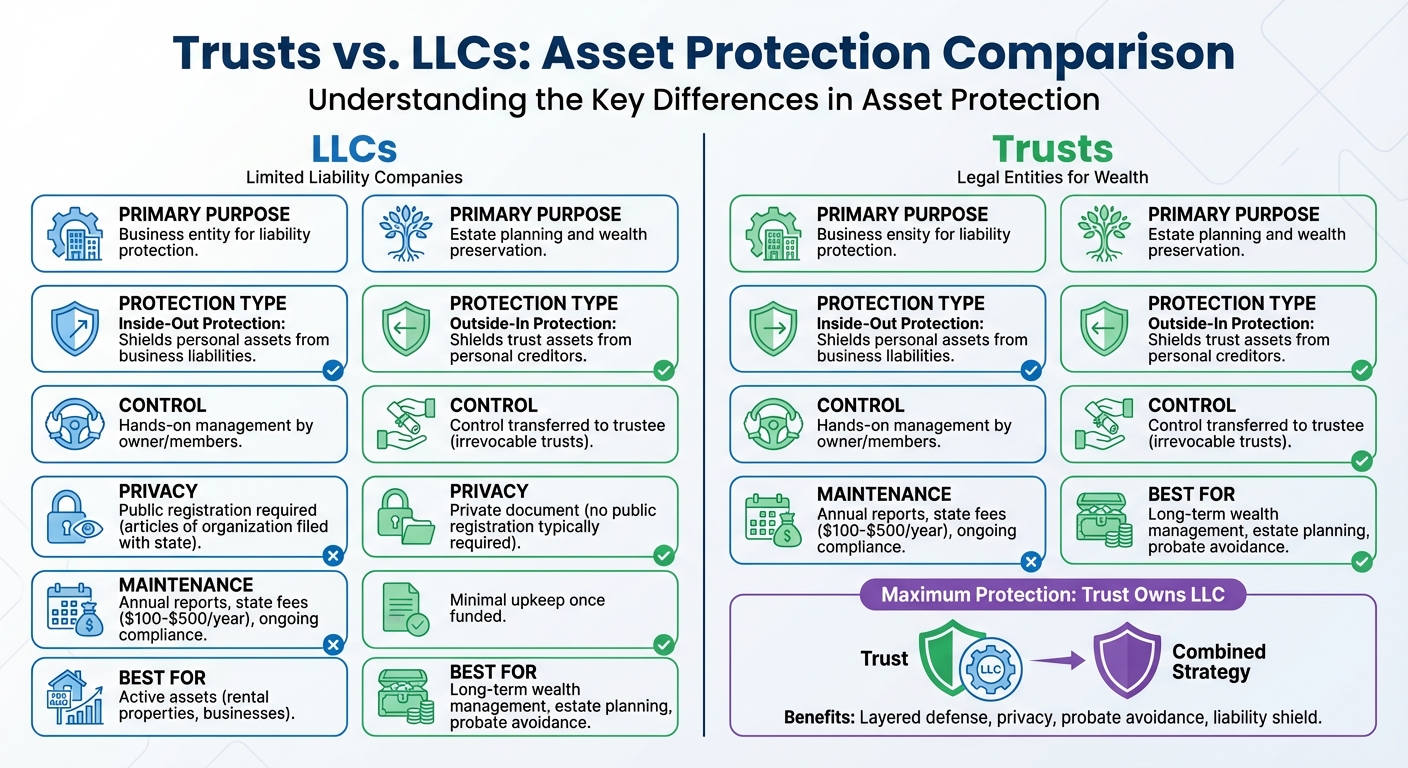

Main Differences Between Trusts and LLCs

Trusts and LLCs are designed for different goals. LLCs shield personal assets from business-related risks, while trusts secure wealth by separating ownership legally.

An LLC provides inside-out protection, meaning it protects your personal assets – like your home or savings – from business liabilities. For example, if a tenant sues your rental property LLC, your personal assets remain safe. On the other hand, trusts offer outside-in protection, shielding the assets held within the trust from personal creditors.

Another difference lies in control. LLCs allow hands-on management, while irrevocable trusts transfer control of assets to a trustee. As the Offshore Law Center puts it:

"At its core, an LLC is a business entity, while a trust is primarily for estate planning."

Privacy is another key distinction. Trusts are private documents and don’t typically require public registration. In contrast, LLCs must file articles of organization with the state, which often makes ownership details publicly accessible.

Maintenance is also simpler for trusts. LLCs require ongoing compliance, such as filing annual reports and paying state fees that range from $100 to $500. Trusts, once funded, generally demand less upkeep.

When to Use a Trust vs. an LLC

While LLCs are great for protecting business assets, trusts are better suited for long-term wealth management and privacy.

Use an LLC when you own active assets, like rental properties or businesses. The liability shield ensures that lawsuits related to these assets won’t affect your personal finances. For example, if you own multiple rental properties, setting up separate LLCs for each property can help isolate liability risks.

Opt for an irrevocable trust for maximum asset protection. Unlike revocable trusts, which offer limited protection because you retain control, irrevocable trusts transfer ownership completely. This makes them ideal for high-net-worth individuals who want to safeguard their assets from lawsuits or plan for long-term wealth preservation.

Trusts also bypass probate, simplifying the transfer of wealth to heirs. As attorney Michael K. Elson explains:

"The LLC is designed to protect your personal assets from lawsuits, while the Living Trust preserves your estate from probate costs and inheritance taxes when you die."

For married couples, certain trust strategies can even save up to $1,000,000 in estate taxes. However, trusts require precise legal drafting to work effectively, so professional setup is crucial.

Using Trusts and LLCs Together

Combining trusts and LLCs can provide layered protection, addressing multiple vulnerabilities at once. A common strategy involves a trust owning the membership interests of an LLC, creating a dual layer of defense.

In this setup, the LLC acts as the "operating" layer, protecting personal assets from business-related lawsuits. The trust functions as the "holding" layer, adding privacy, avoiding probate, and managing the distribution of LLC interests to heirs. This structure can also keep your name off public state filings, especially if paired with a professional registered agent.

For more advanced protection, some use a trust owning a Wyoming Holding LLC, which then owns a local Operating LLC (e.g., in California). This approach leverages Wyoming’s strong asset protection laws while maintaining operational presence where needed.

To preserve these protections, it’s critical to avoid mixing personal, trust, and LLC funds. Lauren Wolven, an Estate Planning Partner at Levenfeld Pearlstein, LLC, highlights a common pitfall:

"Insurance premium payments are one of the areas where clients often think it is harmless to pay the premium directly, even if there is a trust or entity involved… paying directly – instead of having the entity-owner make the payments – could create a bad fact to help someone punch through the protections of the LLC."

Additionally, when transferring assets into a trust or LLC, ensure the entity is listed as the "named insured" on insurance policies rather than just an "additional interest." This step is essential to maintaining the liability shield. By combining the strengths of trusts and LLCs, you can create a comprehensive plan that protects both business and personal assets effectively.

How to Set Up Your Asset Protection Plan

Setting up an asset protection plan takes careful planning and professional execution. It’s about combining the right legal structures, choosing the best jurisdiction, and following all necessary regulations to ensure your assets stay protected.

Working with Professional Advisors

Creating trusts and LLCs isn’t a do-it-yourself project – it requires expert guidance to navigate the intricate legal, tax, and jurisdictional rules. Even a small mistake could jeopardize your entire protection strategy. That’s why it’s essential to work with a team of professionals, including an asset protection attorney, a tax advisor familiar with international reporting, and a licensed registered agent.

Your asset protection attorney will help integrate offshore structures with your estate plan, while your tax advisor ensures compliance with laws like FATCA and CRS. Keep in mind, having offshore structures doesn’t mean you can avoid taxes in your home country. For example, U.S. residents are taxed on their worldwide income, no matter where their assets are located.

Offshore service providers might not fully understand U.S. tax laws, so coordinating with a domestic accountant is critical to meet all foreign asset reporting requirements.

After assembling your professional team, the next step is selecting the right jurisdiction to maximize your asset protection.

Choosing the Right Jurisdiction

The jurisdiction you choose plays a huge role in how well your assets are protected. Ideally, you want a location with strong legal protections, non-recognition of foreign judgments, favorable statutes of limitations on creditor claims, and solid privacy laws.

Anguilla is an excellent example of a jurisdiction with these advantages. As mentioned earlier, Anguilla offers both speed and privacy. LLCs can be formed in just one business day, and trust registrations are usually completed within 24 hours. Additionally, the names of settlors, beneficiaries, and LLC members remain confidential and are not part of public records.

For even stronger protection, consider setting up a “fortress” structure. This involves creating an offshore trust that owns 100% of an Anguilla LLC. You can manage the LLC’s day-to-day operations, but if legal trouble arises, a licensed offshore trustee can step in to safeguard your assets.

Once you’ve chosen your jurisdiction, it’s vital to stay compliant with all legal requirements to maintain your protections.

Staying Compliant with Legal Requirements

Asset protection only works if you strictly follow the rules. Before transferring assets, document your solvency to guard against claims of fraudulent conveyance. Keep detailed financial records at your registered office, even though Anguilla doesn’t mandate formal audits or annual filings. Your trust charter should also include provisions for full accounting that can be accessed by the settlor, protector, or beneficiaries.

It’s also wise to appoint a trust protector who has the authority to replace trustees if they fail to act in your best interest. Additionally, ensure you have a qualified local registered agent to handle government notices and maintain your entity’s legal status. Update trust deeds to reflect major life changes – like marriage, divorce, or the birth of children – to keep the structure relevant and effective.

One critical point: never mix personal, trust, and LLC funds. Keep separate bank accounts for the trust and LLC, and make sure all entity-related expenses are paid from those accounts. This separation is key to preserving your liability shield. Also, make sure your entity is listed as the “named insured” on insurance policies, not just as an “additional interest.”

While there are annual fees for professional trustee services, these costs are a small price to pay for the level of protection they provide.

Conclusion

If you’re looking to shield your wealth from potential lawsuits, combining trusts and LLCs can be a powerful strategy. LLCs protect personal assets from business-related liabilities, while trusts create a separation between legal and beneficial ownership, making it harder for creditors to access your assets.

For an even stronger layer of protection, consider combining these tools. For example, having an offshore trust own an LLC allows you to retain management control while benefiting from a strong legal barrier. But remember, timing is everything. Asset protection strategies need to be in place before any legal claims arise. If assets are transferred after a lawsuit or financial trouble begins, the move could be considered fraudulent and may undermine your entire plan.

When it comes to jurisdictions, Anguilla stands out. It offers a three-year creditor limit, tax neutrality, strong privacy protections, and quick trust registration processes that ensure confidentiality.

To navigate these complexities, it’s crucial to work with seasoned professionals – asset protection attorneys, tax advisors, and registered agents. Their guidance can help you avoid pitfalls and ensure your plan is effective. The investment in expert advice is a small price to pay for safeguarding what you’ve worked so hard to build. Take action now to secure your assets against the ever-present risk of legal challenges.

FAQs

How can trusts and LLCs work together to protect my assets from lawsuits?

Trusts and LLCs work together seamlessly to create a strong safeguard for your assets. Here’s how it works: a trust owns the LLC, and the LLC, in turn, holds your tangible assets – think real estate, vehicles, or investment accounts. Because the LLC operates as an independent legal entity, any claims or liabilities against it are generally confined to the assets within the LLC. This setup keeps the trust’s other holdings out of reach, adding an extra layer of protection.

On top of that, the trust allows beneficiaries to enjoy financial benefits, such as income or asset appreciation, without being listed as direct owners. This makes it far more difficult for creditors to target those underlying assets.

To ensure this structure works as intended, you need to follow some key practices. First, the trust should be carefully drafted – many people opt for a domestic asset protection trust for added security. Second, the LLC must be treated as its own entity. This means keeping separate bank accounts, maintaining detailed records, securing proper insurance, and steering clear of mixing personal and business finances. When done right, this dual-layer strategy creates a strong legal barrier that discourages lawsuits and makes it much tougher for creditors to access your wealth.

What are the advantages of creating an offshore trust in Anguilla?

Creating an offshore trust in Anguilla offers a combination of legal safeguards, tax benefits, and privacy, making it a smart option for protecting and managing wealth. Anguilla’s trust laws are designed with flexibility in mind, allowing for structures like discretionary and spendthrift trusts. Plus, the elimination of the Rule Against Perpetuities means your trust can exist indefinitely, offering long-term security. On top of that, Anguilla imposes no taxes on income, capital gains, inheritance, or gifts for non-residents, making it especially appealing for estate planning and passing wealth to future generations.

One standout advantage is that U.S. court judgments are not automatically enforceable in Anguilla. Creditors face significant hurdles, including a strict time limit – usually two to three years after assets are transferred – to file claims. This adds an extra layer of protection, making it challenging to contest the trust. Additionally, Anguilla prioritizes privacy, as trusts are not publicly registered. This ensures the identities of all parties involved remain confidential. For U.S. clients, the jurisdiction is particularly convenient: English is the official language, and the online trust management system is straightforward and efficient.

An offshore trust in Anguilla delivers strong asset protection, tax-free wealth growth, and lasting privacy, making it a reliable way to safeguard assets from lawsuits and other potential threats.

Why is it important to keep personal and business finances separate in an LLC?

Separating your personal and business finances is a key step in protecting the limited-liability benefits of an LLC. When your LLC is treated as a separate legal entity – with its own bank accounts, credit cards, and financial records – it reinforces the legal barrier that shields your personal assets from business-related debts or lawsuits. If personal and business funds are mixed, courts may disregard the LLC’s protections, leaving assets like your home or car vulnerable.

Beyond legal protection, keeping finances separate makes tax reporting much easier and helps you stay in line with IRS requirements. It allows you to track business expenses more accurately, claim deductions properly, and reduce the risk of audits. Plus, showing that your business operates independently can enhance your credibility with lenders and potential investors.

By treating your LLC as its own entity, you not only protect your personal wealth but also uphold the financial security that an LLC is meant to provide.