You’ve heard the adage, “A penny saved is a penny earned”? What if I told you a penny doubled for 30 days is several million earned??

October 2, 2024

By: Bobby Casey, GWP Managing Director

Yesterday, I was flying from New York City to Panama City for our spring conference – Global Escape Hatch. Sitting on the plane next to me was a very intelligent young man named Mike.

Normally, when I get on the plane, I am asleep before the plane is pushed back from the gate and wake up when the wheels touchdown at the destination. But this time, Mike and I chatted for most of the flight.

I have been thinking about writing this article for a few weeks, but the conversation between Mike and I gently pushed me into action.

Mike has been a reader of self-help and business books for a couple of years now. He shared with me his goals and dreams for building a business of his own and creating wealth.

We started talking about creating wealth and economic freedom and I explained to him the concept of doubling a penny every day for 30 days.

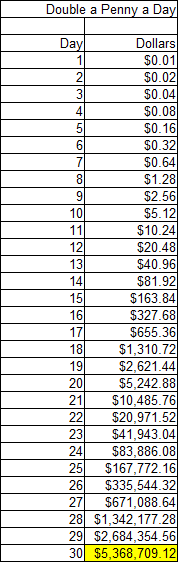

Take a look at the chart below:

The Power of Doubling a Penny a Day for 30 Days

As you can see, if you could double a penny a day, you have 2 pennies on day 2. Four on day 3. Eight on day 4 and so on. After 30 days, you have $5.3 million dollars.

This is the value of compounding returns.

Albert Einstein was reportedly asked once, “What is the greatest invention man has ever produced?” He replied “Compound interest”.

Clearly this example is just for intellectual stimulation and has no merit in the real world because there are many factors that go into wealth creation. For example, taxes.

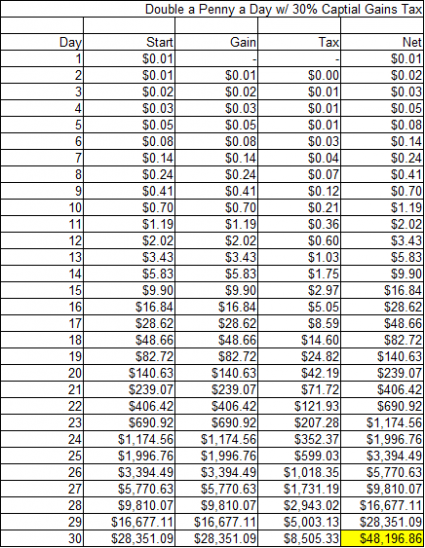

Take a look at this chart:

The Effect of Capital Gains Tax

In this chart, I have doubled a penny a day for 30 days just as before, except we have accounted for 30% capital gains for each day of profit. For example, day 1 you have one penny. Day 2 your gain is now one penny, but when you factor in a 30% capital gains tax, you end the day with 1.7 cents.

After 30 days accounting for your 30% capital gains tax, you are left with $48,000.

Let that sink in for a minute. This is the destructive power of taxation on your wealth.

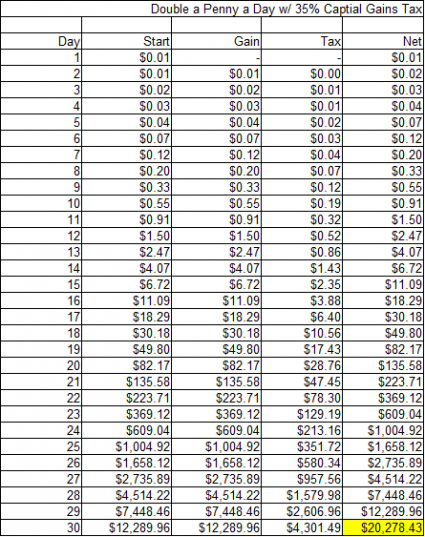

Now imagine we increase the capital gains tax from 30% to 35%. Take a look at the chart below:

The Impact of Increased Taxes

Now you are left with $20,000. Just from a 5 point increase in capital gains tax.

Again though, this exercise thus far has been purely a mathematical exercise. Let’s discuss how this would work in the real world.

Real-World Wealth Creation Scenario

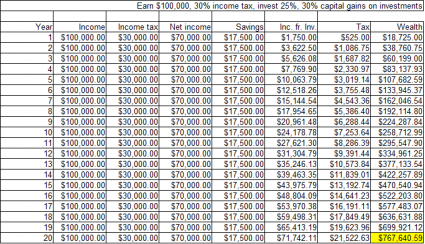

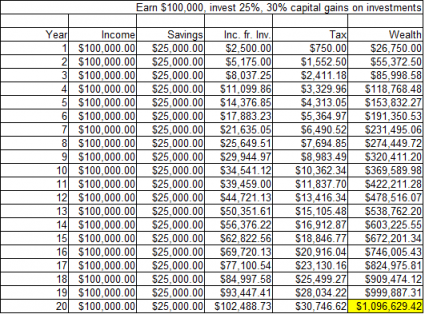

Let’s assume, for simplicity’s sake, you earn $100,000 per year for the next 20 years. You pay a net 30% income tax rate and are a diligent saver, putting 25% of your net income aside for your investment portfolio. We can also assume you are willing to take a medium level of risk and your investments earn 10% per year.

Take a look at the chart below:

As you can see from the chart, you pay $30,000 in tax leaving you a net income of $70,000. As a diligent saver you put aside $17,500 per year and invest it earning 10% per year. After 20 years, you are left with $767,000.

Not bad.

How Moving Abroad Could Help You Save More

But you can certainly do better. “But how”, you may ask.

Simple, move outside your country of citizenship.

If you are American, you can take advantage of the FEIE (foreign earned income exclusion), that equates to about $100,000 per year. Essentially if you qualify as a non-resident American citizen, you can exempt your first $100,000 from US taxation.

If you are non-American, you can forgo taxation and even tax filings in your home country with no limitation on exempt income, like Americans, so this is even better for you.

From the perspective of wealth creation, take a look at the chart below for comparison:

As you can see from this chart, you still earn $100,000 per year, but pay no income tax. Now instead of saving $17,500, you are saving $25,000 per year and as above, investing it with a 10% annual return. In this scenario you are still paying 30% capital gains tax on your investment portfolio.

After 20 years, you are left with about $1.1 million dollars. That is significantly better than if you were paying income tax as in the previous example. It’s 43% more wealth to be precise.

Achieving Financial Freedom Sooner

An interesting note here is that in year 20, your investment income has fully replaced your earned income. This is what’s known as financial freedom where your passive income has equaled or surpassed the income you can earn from working.

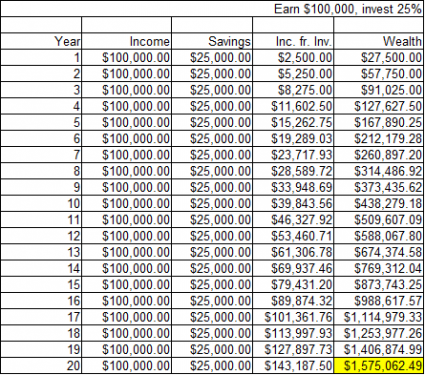

But it is possible to do even better! Take a look at the chart below:

The Benefits of Foreign Non-Grantor Trusts (FNGT)

In this example, you have moved outside your country of citizenship as before. If you are American, you have taken advantage of the FEIE of $100,000. And now you have moved all of your investments offshore and into a foreign non-grantor trust (FNGT). (For more information about FNGT’s, you can join GWP Insiders – http://www.GWPInsiders.com – for the full scoop and how you can set one up for yourself).

By doing this, you have “gifted” your assets into a FNGT and invested in non-US assets giving you the ability to invest tax free or tax deferred.

As you can see, after 20 years you are now left with nearly $1.6 million dollars and your passive income surpassed your earned income at year 17. That is a 109% increase over scenario #1, and a 45% increase over scenario #2.

The Emotional Aspects of Moving Abroad

For many of you, the concern may be leaving your homeland, your family, or your friends. And rightly so. That can be an emotional decision to make, but strictly from a financial perspective, if you are capable of earning a living away from your homeland, this is a no-brainer (for our GWP Insiders subscribers we offer many solutions to take your business virtual – http://www.GWPInsiders.com).

Until next time, live well.