Trump’s tax plan came with a generous leap in the estate and gift tax thresholds. Now is the time to set up a trust and max out your benefits before the door closes!

April 30,2019

By: Bobby Casey, Managing Director GWP

Every election cycle, Americans sit around wondering what’s coming next. That sort of uncertainty affects the stock market, and even general market activity. Sadly, the government is so intertwined with the US market, confidence in who takes (or might take) office is inextricably linked to consumer confidence.

2016 was a high stakes election. And while I don’t agree with Trump on a lot of issues, I’m always agreeable to tax cuts and higher thresholds.

Say what you will about President Trump, but he threw the gates wide open for asset protection. His tax cuts put more money back into their rightful owners’ hands. Despite how the media spun it, and regardless of how people “felt” or what they “believed”, the fact is the majority of tax payers saw more of their paycheck.

In the case of Donald Trump, there’s a strong possibility that he takes his tax cuts with him if he’s not reelected in 2020. No matter which democrat gets into office, the first thing they will go for is a reversal on his tax plan.

Trump’s plan expires in 2025 regardless, so the clock is ticking. I created GWP Insiders to help people capitalize on these small windows of opportunity, so they don’t get side-swiped by the next wave of plunderers.

I’ve seen the motley crew of Democrats that are coming up against Trump, and it’s not pretty. Not pretty at all.

- There’s Andrew Yang and his VAT (Value Add Tax) and UBI (Universal Basic Income).

- There’s Elizabeth Warren and her offer to forgive all student loans.

- What bout Bernie Sanders and his eagerness to push Medicare for all!

- Kamala Harris and her “Lift the Middle Class Act” that is poised to wreck the economy.

These are not cheap ideas. These are ideas that require money. Money that will come from every American, living and yet to be born.

Once policies like those get instituted, it’s nearly impossible to get them undone. Look at Obamacare! Trump could NOT undo it, and I sincerely believe he wanted to.

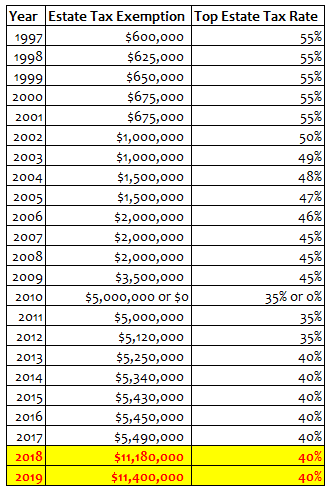

One of the major changes that came with the Trump tax cuts, was the ENORMOUS jump in the gift and estate tax thresholds: from $5.49 million per individual to $11.4 million per individual. The tax rate of 40% after that threshold remained the same… but the non-taxable amount is over double what it was under Obama.

It’s hard to plan for your estate, when the estate tax and gift thresholds change with the political climate. In getting one’s affairs in order, you work with the existing thresholds.

The gift tax and the estate tax have the same threshold and rate. That’s not a coincidence. What usually happens is, individuals gift their money and assets to trusts up to that threshold, for their loved ones who are expected to survive them.

$11.4 million sounds like a lot, but in terms of net worth, it can add up rather quickly. If you own a business, hold investments, own properties, have a life insurance policy, you can reach that threshold before you know it.

A couple of duplexes and a boat in Los Angeles could get you to the old threshold of $5.49 million, regardless of what you paid for it.

Now is the time to get your affairs in order. The $11.4 million for individual threshold is unprecedented. I mean, look at this!

It doesn’t matter if you’re young and in peak health. In fact, if you have more years ahead earning, all the more reason to take advantage of this.

What do I mean by getting your affairs in order? I mean get a trust. A trust is a way of creating some distance between yourself and your assets. As it says on my website: “Own nothing, control everything.” Trusts play a critical role in this.

While the thresholds are high, you can max out the assets you secure in that trust, so even if the political tides drop the threshold later, you’re grandfathered in at the levels that were valid at the time you set up your trust.

All trusts are not the same. The bottom line is: Which trust will give your assets the most protection against creditors, the government, and litigation?

Join GWP Insiderstoday, and you can learn:

- The difference between a revocable and irrevocable trust. Each has pros and cons.

- Why jurisdiction is important. A trust in the US has benefits, but a trust offshore has more!

- Who are all the players in a trust? Can you be the beneficiary of your own trust?

- Learn why I recommend offshore irrevocable trusts, and which jurisdiction makes the most sense.

- As a GWP Insider, you get unlimited consultations, so let me walk you through the entire process, and answer any questions you might have.

I believe everyone should keep as much of what they built and earned as possible. If you have a legacy to leave behind, keep the government out of it.