Those countries are France, Germany, Italy, Spain and the UK. Folks, the western world is tightening the noose around your necks.

The window of opportunity is quickly fading for Americans to implement offshore banking into your asset protection planning. I could tell you countless stories of Americans who have had their domestic accounts seized without any due process of law. The only way to truly keep your money safe is to internationalize your assets.

In addition to the agreement reached yesterday between the US Treasury Department and the five European nations, the IRS also released the new proposed regulations for implementation of the 2010 law known as Foreign Account Tax Compliance Act, or FATCA.

For reference, you can read an article I wrote in December on EscapeArtist titled, “FATCA – Is 2012 the Last Year for Opening an Offshore Bank Account for Americans?”

As of this week though, the IRS is further clarifying those regulations. Essentially it means that foreign financial institutions must report US account holders to the IRS or be subject to US tax penalties.

In other words, the US has said if every country in the world doesn’t play by our rules, we are going to penalize them.

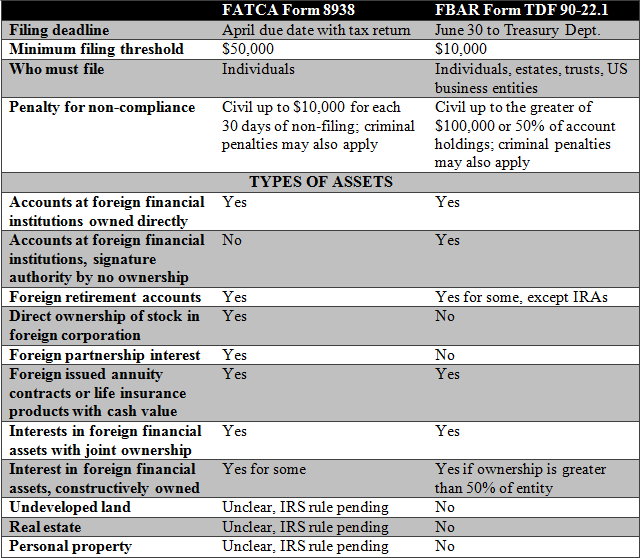

Many individuals now with offshore assets will need to file two separate disclosure forms with Big Brother in 2012 or risk draconian penalties. Take a look at the table below:

As you can see from the above table, the rules can be quite complicated and now you can actually be in violation of both sets of rules making you liable to both sets of penalties.

Long term, this means that many foreign financial institutions will stop accepting American clients due to the draconian laws the US is attempting to impose on the world.

The only way to be truly free from the constraints imposed by the US or any other nation is to internationalize your assets and your life. Now is the time to implement an offshore company and offshore banking into your asset protection plan.

As 2012 progresses, the noose will continue to tighten. Hopefully we won’t all be hanged by Christmas.