Offshore banking offers benefits like asset protection, currency diversification, and international business solutions. But for U.S. citizens, strict compliance with tax laws and reporting requirements is essential.

Here’s what you need to know:

- Do: Choose stable jurisdictions (e.g., Switzerland, Singapore) and work with licensed banks. Report foreign accounts exceeding $10,000 to the IRS via FBAR and FATCA forms.

- Don’t: Skip reporting, use unlicensed banks, or expect anonymity – global data-sharing agreements like FATCA ensure transparency.

- Key Risks: Offshore accounts often involve higher fees, slower access, and variable regulations. Verify deposit protections and stay updated on political and economic conditions.

Offshore banking can be a smart way to manage wealth, but only if you follow the rules, maintain proper documentation, and seek expert advice.

What You Should Do When Banking Offshore

Select the Right Jurisdiction

When choosing where to bank offshore, prioritize political and economic stability. Countries such as Switzerland and Singapore have long-standing reputations for protecting assets. The jurisdiction you pick should align with your specific financial goals.

For example, zero-tax jurisdictions like the British Virgin Islands and Cayman Islands are ideal for holding companies, while territorial tax systems in places like Hong Kong and Panama cater well to international trade. If your focus is on tax treaties, locations like Cyprus and the UAE can offer relief on withholding taxes.

"Offshore banking isn’t just about moving money abroad, but it’s about building a smarter, more agile way to operate globally".

Additionally, choose jurisdictions with stable currencies like USD, EUR, or CHF, and consider whether they allow for remote account opening. Keep in mind that the reputation of the jurisdiction matters. Banks are becoming more selective, and entities tied to poorly regulated or "cheap" jurisdictions often face rejection when dealing with international banks. Opt for jurisdictions that comply with global standards like FATCA and CRS to ensure the long-term viability of your account.

Once you’ve identified a suitable jurisdiction, make sure the financial institution you choose is equally reliable.

Use Licensed Financial Institutions

Always work with banks that are licensed by respected regulatory authorities. This ensures your deposits are protected and that the institution adheres to international banking standards. Before opening an account, verify the bank’s licensing status and confirm whether deposit protection applies to non-resident accounts.

Look for banks that offer segregated client funds and a broad range of international banking services. Some banks allow accounts to be opened with as little as $300, while others may have higher minimum deposit requirements.

Pay attention to ongoing costs like minimum balance fees. While the initial deposit might be low, monthly maintenance fees or penalties for falling below the minimum balance can add up and affect the overall value of your account.

Follow US Tax Reporting Rules

If you’re a U.S. citizen, staying compliant with tax reporting rules is essential. File your FBAR (Foreign Bank Account Report) by April 15 (or October 15 with an extension) if the total value of your foreign accounts exceeds $10,000. Keep records for at least five years.

You’ll also need to disclose your foreign accounts on Part III of Schedule B when filing your tax return. Depending on the total value of your foreign financial assets, you might need to file FATCA Form 8938 with your federal tax return.

For joint accounts, each account holder must report the full value on their own FBAR unless a spousal exception applies, which requires completing Form 114a. If you’ve missed filing in previous years, consider using the Streamlined Filing Compliance Procedures or the BSA E-Filing System to submit late reports and potentially avoid penalties.

Once your tax reporting is in order, gather all necessary documents to complete your offshore banking setup.

Gather All Required Documents

To open an account, you’ll need to verify your identity with a valid passport, driver’s license, or another government-issued ID. You’ll also need proof of residence, such as a recent utility bill or lease agreement dated within the last three months. U.S. citizens must provide their Taxpayer Identification Number (TIN), typically their Social Security Number (SSN), to comply with reporting requirements.

Financial references are also standard. Be prepared to provide bank statements from the past 6 to 12 months or a reference letter from your current bank confirming a satisfactory relationship. Documentation proving the source of your funds is critical to meet anti-money laundering (AML) requirements. This could include pay stubs, investment statements, sales contracts, or letters from estate executors in the case of inheritances.

In some jurisdictions, you may need an Apostille to authenticate your documents. While some banks accept notarized copies, it’s always a good idea to check directly with the institution you’re applying to, as requirements can vary. Additionally, you may be asked to provide a narrative statement explaining the source of your funds and the purpose of your transactions to comply with "know your customer" (KYC) protocols.

Combine with Asset Protection Structures

To enhance privacy and safeguard your assets, consider pairing offshore banking with structures like offshore companies or trusts. These arrangements can help separate personal and business assets, offering an extra layer of legal protection. However, jurisdictions such as the British Virgin Islands, Cayman Islands, and UAE may require proof of real operations – like having office space or local decision-making processes – under economic substance rules for activities such as fund management or intellectual property-related operations.

If the process feels overwhelming, using a licensed intermediary or "introducer" in jurisdictions like the UAE or Singapore can simplify compliance and streamline onboarding.

sbb-itb-39d39a6

What You Should Avoid When Banking Offshore

Now that you’re familiar with the basics of offshore banking, let’s talk about some common mistakes you’ll want to steer clear of.

Don’t Skip Reporting Requirements

Failing to report your offshore accounts to the IRS is a mistake that can cost you dearly. If your foreign accounts exceed $10,000, you’re required to file an FBAR (Foreign Bank Account Report). Missing this step can result in penalties of up to $10,000 for non-willful violations. For willful violations, the penalties are even harsher – either $100,000 or 50% of your account balance, whichever is greater. And that’s not all: criminal violations could lead to fines and even up to five years in prison.

It’s crucial to report all offshore accounts, regardless of whether they generate income or not. U.S. citizens are taxed on worldwide income, and since foreign banks don’t follow the same reporting rules as U.S. banks, the responsibility falls on you. Full disclosure isn’t just a good idea – it’s a legal requirement that can save you from major consequences down the line.

Don’t Use Unlicensed Banks or Advisors

Choosing the right bank or financial advisor is just as important as following the rules. Unlicensed or unregulated banks come with serious risks. These institutions often skip the stringent documentation processes that legitimate banks use to prevent money laundering and other illegal activities. Without proper oversight, you’re more vulnerable to scams, sudden bank closures, and financial losses.

Be cautious of banks or advisors that promise complete anonymity or offer to bypass verification steps. These are major red flags. Reputable offshore banks will require detailed personal information and thorough documentation to meet international compliance standards. Working with unlicensed entities could not only result in financial losses but also implicate you in illegal activities, leading to heavy fines, criminal charges, or even imprisonment. Always verify the licensing and regulatory status of any bank or advisor before proceeding.

Don’t Overlook Political and Economic Instability

Even if you initially choose a stable jurisdiction, you need to stay alert to potential risks over time. Some countries may freeze assets during financial crises, leaving you unable to access your funds. Currency instability is another significant concern. A sudden crash in the local currency could drastically reduce the value of your account overnight.

For a safer experience, stick to jurisdictions known for strong governance, independent regulators, and stable currencies like the Swiss Franc or Singapore Dollar. Additionally, avoid putting all your money offshore. Keep enough liquid assets in domestic accounts to cover immediate expenses or unforeseen legal costs.

Don’t Apply Without Proper Documentation

Incomplete or improperly authenticated documents can slow down the account-opening process – or even get your application rejected. Legitimate offshore banks typically require notarized or Apostille-stamped documents to confirm their authenticity. You’ll also need to prove the source of your funds, whether through wage slips, investment statements, or inheritance documentation, to comply with anti-money laundering regulations.

If a bank seems willing to cut corners on documentation, consider it a warning sign. Trustworthy institutions take compliance seriously and won’t accept vague or incomplete paperwork. To avoid delays, gather all required documents ahead of time and confirm with the bank what level of authentication is needed.

Don’t Expect Complete Anonymity

The days of total secrecy in offshore banking are long gone. International agreements like FATCA (Foreign Account Tax Compliance Act) and the Common Reporting Standard have created systems for automatic information sharing between countries. Today, over 100,000 financial institutions report details of U.S. account holders directly to the IRS.

Modern offshore banking is about offshore asset protection, diversification, and access to multiple currencies – not hiding money. If someone promises you complete secrecy, they’re either misinformed or trying to mislead you. Instead, focus on using offshore accounts in a way that complies with regulations, safeguards your wealth, and meets all reporting obligations.

Offshore vs. Onshore Banking Risks

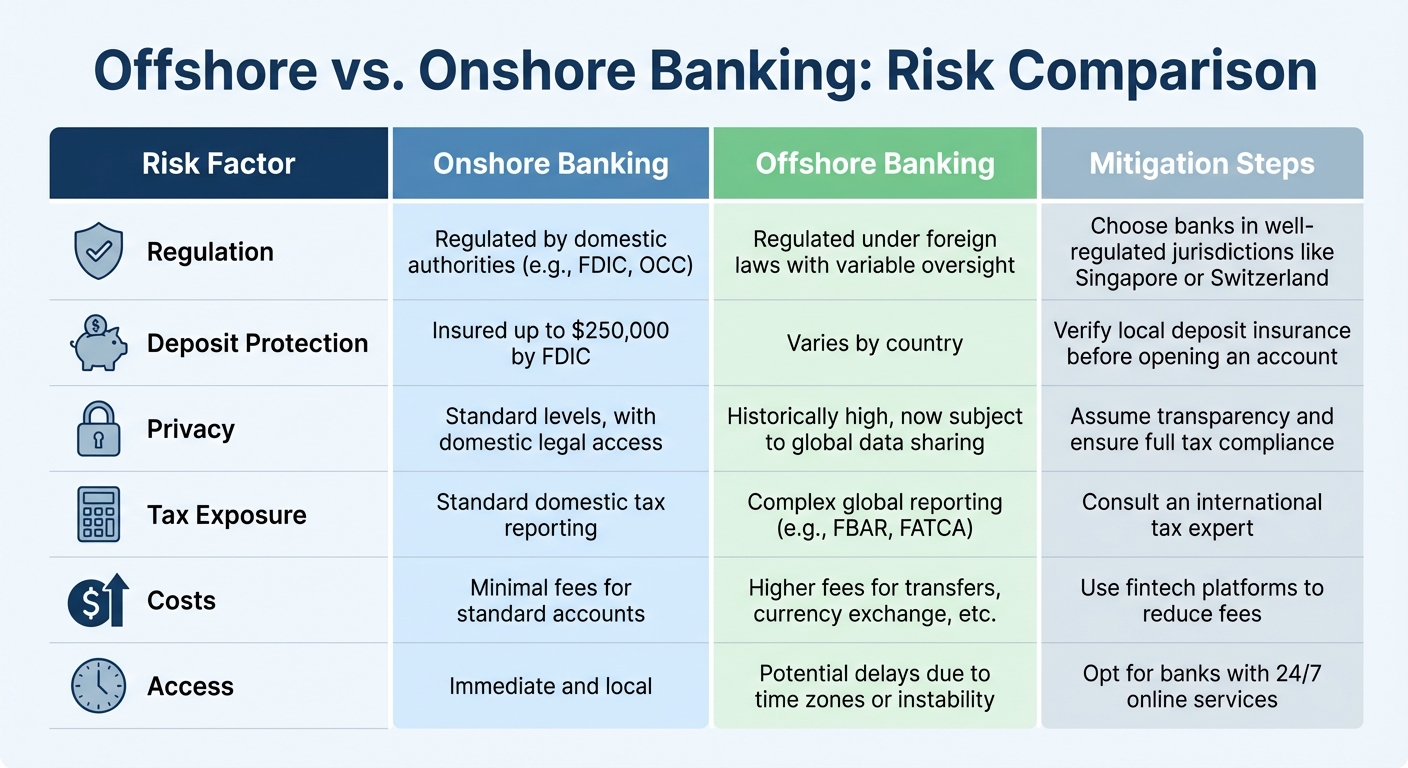

When comparing onshore and offshore banking, the differences in risk profiles are crucial to grasp. Each comes with its own set of challenges, particularly in areas like regulation, tax compliance, and access.

One of the most notable distinctions is regulation and oversight. Onshore banks in the U.S. are closely monitored by federal agencies like the FDIC and OCC, ensuring deposits are insured up to $250,000. Offshore banks, on the other hand, operate under foreign jurisdictions, and their regulatory standards can vary widely. While countries like Singapore, Hong Kong, and Switzerland are known for their strong banking regulations, other jurisdictions might offer limited or no deposit protection. It’s essential to confirm the availability of local deposit insurance before opening an offshore account.

Tax compliance is another critical factor. Domestic accounts follow standard reporting guidelines, but offshore accounts bring additional global reporting responsibilities. For example, U.S. citizens with offshore accounts must file forms such as FBAR (Report of Foreign Bank and Financial Accounts) and Form 8938 under FATCA regulations. Failure to comply can result in severe penalties. Working with an experienced international tax professional is a must to avoid costly errors.

Costs and accessibility also set these banking options apart. Onshore banking often comes with minimal or no fees for standard services. Offshore banking, however, tends to involve higher costs, including wire transfer fees, currency exchange charges, and legal or trustee fees. Access to funds can also be slower with offshore accounts, especially due to time zone differences or political instability. To minimize these drawbacks, consider banks with robust 24/7 digital platforms or fintech solutions that offer lower foreign exchange and transfer fees.

For a clearer view, here’s a side-by-side comparison of the risks associated with onshore and offshore banking, along with practical steps to mitigate them:

Risk Comparison Table

| Risk Factor | Onshore Banking | Offshore Banking | Mitigation Steps |

|---|---|---|---|

| Regulation | Regulated by domestic authorities (e.g., FDIC, OCC) | Regulated under foreign laws with variable oversight | Choose banks in well-regulated jurisdictions like Singapore or Switzerland |

| Deposit Protection | Insured up to $250,000 by FDIC | Varies by country | Verify local deposit insurance before opening an account |

| Privacy | Standard levels, with domestic legal access | Historically high, now subject to global data sharing | Assume transparency and ensure full tax compliance |

| Tax Exposure | Standard domestic tax reporting | Complex global reporting (e.g., FBAR, FATCA) | Consult an international tax expert |

| Costs | Minimal fees for standard accounts | Higher fees for transfers, currency exchange, etc. | Use fintech platforms to reduce fees |

| Access | Immediate and local | Potential delays due to time zones or instability | Opt for banks with 24/7 online services |

Understanding these differences can help you make informed decisions and manage risks effectively. Offshore banking can offer unique benefits, but only if approached with careful planning and due diligence.

Conclusion

Offshore banking can serve as a useful tool for managing wealth and protecting assets, but it comes with strict requirements for compliance, detailed documentation, and ethical practices. The United States stands out as the only developed country that taxes its citizens on their worldwide income and enforces stringent reporting rules, such as FBAR and FATCA. Failure to comply with these regulations can result in severe penalties.

These challenges highlight the importance of adhering to clear and lawful offshore banking practices.

"Legitimate offshore planning is lawful; hiding assets or willfully failing to report is not. Full reporting and transparency are essential." – FinHelp

To ensure your offshore banking strategy is effective and compliant, focus on several key elements: selecting the right jurisdiction, working with licensed financial institutions, and maintaining detailed records. Successfully navigating dual jurisdictions requires choosing banks with strong regulatory oversight and keeping accurate documentation to minimize potential legal risks.

Seeking advice from professionals experienced in U.S. and international laws is crucial. These experts can help evaluate jurisdictions, confirm the legitimacy of financial institutions, and ensure all transactions are properly documented. For instance, firms like Global Wealth Protection offer tailored consultations to help clients manage the complexities of offshore banking while prioritizing compliance and long-term security.

FAQs

What tax forms do U.S. citizens need to file for offshore bank accounts?

U.S. citizens holding offshore bank accounts have specific tax reporting obligations. If the combined value of all your foreign financial accounts exceeds $10,000 at any point during the year, you’re required to file the FBAR (FinCEN Form 114). On top of that, any income earned from these accounts must be reported on Schedule B of your tax return. Depending on the specifics of the accounts, you might also need to submit Form 8938 as part of FATCA requirements.

Staying on top of these rules is crucial to avoid potential penalties. To ensure everything is reported correctly and in line with IRS regulations, it’s a good idea to consult a tax professional.

What should I consider when choosing an offshore bank and jurisdiction?

When choosing an offshore bank and its jurisdiction, it’s essential to start by examining the stability and reputation of the country. Opt for a jurisdiction with a strong political and economic foundation, transparent banking regulations, and adherence to international compliance standards. These factors play a key role in safeguarding your assets and reducing potential risks.

After identifying a suitable jurisdiction, take a closer look at the bank itself. Prioritize financial institutions with a proven track record, positive client feedback, and transparent fee structures. Check if the bank provides services that match your needs – whether that’s multi-currency accounts, investment opportunities, or other specialized offerings. It’s also critical to confirm the bank’s financial health to ensure reliability.

Lastly, familiarize yourself with the legal and tax obligations associated with both the jurisdiction and your home country. Staying compliant with reporting requirements is essential to avoid legal complications and to secure your assets. By following these steps, you can establish a trustworthy and secure offshore banking arrangement.

What risks should I be aware of when using unlicensed offshore banks?

Using offshore banks that aren’t licensed can put your finances in jeopardy. These institutions often operate without the necessary regulations, which means they might not have the protections in place to secure your assets. If the bank fails or engages in shady practices, you could face significant financial losses. On top of that, dealing with unlicensed banks can create legal headaches, especially when it comes to fulfilling tax and reporting requirements. This could leave you facing fines or other penalties.

To protect your money, it’s crucial to confirm that any offshore bank you work with is fully licensed and adheres to international banking standards. Doing so provides better transparency, legal security, and confidence in managing your wealth.