Offshore banking involves holding accounts in foreign banks, offering benefits like privacy, asset protection, and access to global financial opportunities. While legal for U.S. citizens, accounts exceeding $10,000 must be reported to the IRS to avoid penalties. Offshore banking has shifted toward transparency due to regulations like FATCA and CRS, focusing on legitimate strategies rather than secrecy.

Key Takeaways:

- Privacy: Offshore accounts provide confidentiality, shielding assets from public view and domestic legal claims.

- Asset Protection: Foreign jurisdictions like Switzerland and the Cayman Islands offer robust legal barriers against lawsuits and creditor claims.

- Currency & Investment Options: Multi-currency accounts and access to global markets diversify financial portfolios and mitigate risks tied to USD fluctuations.

- Compliance: U.S. taxpayers must file FBAR and FATCA reports for foreign accounts, with penalties for non-compliance reaching up to 50% of account balances.

Popular Offshore Banking Destinations:

- Switzerland: Known for stability and privacy, requires $250,000–$1M minimum deposits.

- Singapore: Offers access to Asian markets with efficient account setup; $200,000–$500,000 minimum.

- Cayman Islands: Focuses on wealth management with lower entry thresholds from $10,000.

To open an account, prepare documentation like passports, proof of address, and income sources. For added protection, offshore accounts can be paired with legal structures like trusts or LLCs. Always consult a tax professional to ensure compliance and avoid risks.

Why Use Offshore Banking

Offshore banking provides U.S. residents with enhanced privacy, robust asset protection, and opportunities for currency and investment diversification. Let’s break down how these benefits work.

Privacy Protection

Offshore banking jurisdictions are known for their strict confidentiality laws, which safeguard depositor identities and financial activities from public scrutiny – something rarely found in domestic U.S. banking systems.

Robert Siciliano, CEO of Protect Now, explains that offshore banks operate under stringent secrecy laws, offering clients a higher level of confidentiality.

These accounts are generally shielded from domestic legal discovery and creditor claims. However, with regulations like FATCA and the Common Reporting Standard (CRS), this privacy mostly applies to non-governmental third parties.

This brings us to another key advantage: the ability to protect assets from domestic legal challenges.

Asset Protection

Offshore accounts go beyond privacy by offering a significant layer of defense against domestic legal threats. By placing assets in foreign jurisdictions, account holders create barriers that make it harder for domestic creditors to access their funds. Countries like Switzerland, Singapore, and the Cayman Islands have legal systems designed to protect assets from lawsuits, creditor claims, and even government seizures during times of economic or political instability.

Jessica Merritt of U.S. News & World Report highlights: "The legal frameworks of offshore bank accounts may shield assets from potential legal threats. Holding assets in these accounts can protect them from lawsuits, creditors, or government seizure".

It’s estimated that between $7 trillion and $10 trillion – or around 10% of global assets – are held in offshore tax havens.

Currency and Investment Diversification

Offshore banking also opens doors to multi-currency holdings and international investment opportunities, offering options that domestic banks simply don’t provide. While U.S. accounts are typically limited to USD, offshore accounts let you hold multiple currencies at once. This flexibility can act as a hedge against U.S. dollar depreciation, especially during volatile market conditions, where currency values can swing by 10% or more.

Additionally, offshore banking grants access to global investment products, including foreign equities, international bonds, and exclusive funds unavailable through U.S. institutions. Some offshore jurisdictions even offer higher interest rates on savings accounts, though it’s essential to account for potential wire transfer fees and currency exchange costs.

| Feature | Domestic U.S. Banking | Offshore Banking |

|---|---|---|

| Privacy | High transparency, subject to legal discovery | Protected by strict local secrecy laws |

| Asset Protection | Vulnerable to domestic court orders and seizure | Shielded by foreign legal frameworks |

| Currency Options | Primarily USD only | Multi-currency accounts available |

| Investment Access | Limited to U.S. markets/products | Access to international markets and funds |

| Reporting | Automatic IRS reporting | Requires FBAR/FATCA filings for accounts over $10,000 |

To make the most of offshore banking, consider private wealth consultations. They can help you align offshore accounts with your financial strategy while ensuring compliance with reporting requirements to avoid penalties.

sbb-itb-39d39a6

Best Offshore Banking Jurisdictions

When selecting an offshore banking destination, your choice should align with your financial goals, the level of asset protection you need, and the capital you have available. Below, we dive into the unique advantages offered by some of the most well-regarded offshore banking hubs.

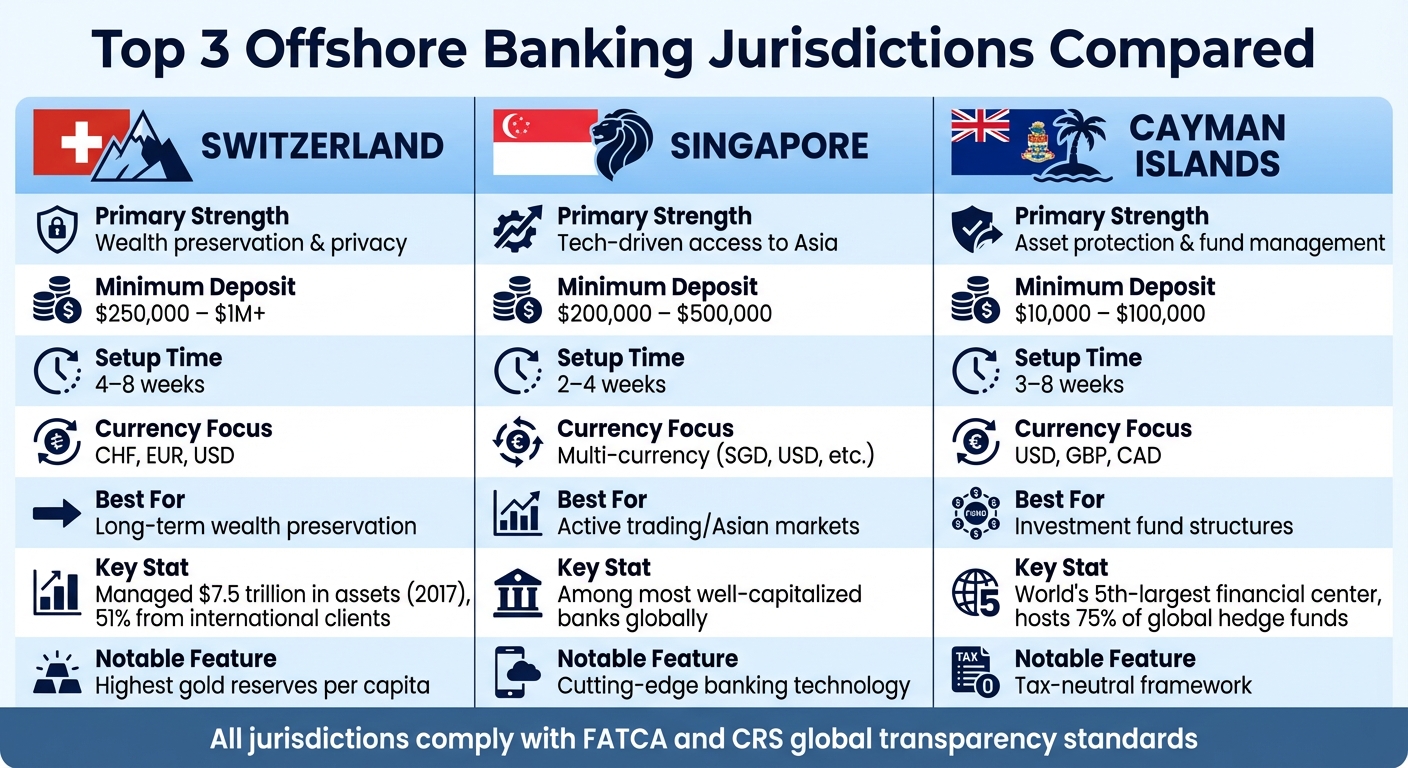

Switzerland is often considered the ultimate destination for safeguarding wealth. In 2017, Swiss banks managed an estimated $7.5 trillion in assets, with about 51% of that coming from international clients. Known for its economic stability, Switzerland operates without a national deficit and boasts one of the highest gold reserves per capita in the world. The Swiss Franc (CHF) is also viewed as a solid hedge against global economic instability. That said, the bar for entry is high – private banking typically requires a minimum deposit of $250,000, with some accounts demanding over $1,000,000. The account setup process is thorough, taking 4–8 weeks and requiring detailed documentation to verify the source of your wealth.

Singapore serves as Asia’s leading financial hub, offering cutting-edge banking technology and multi-currency accounts tailored for access to the region’s fast-growing markets. Singaporean banks are among the most well-capitalized globally, ensuring a high degree of financial security. Minimum deposits range from $200,000 to $500,000, with premium services starting at $1,000,000. The account opening process is relatively efficient, typically taking 2–4 weeks, but still involves submitting extensive paperwork.

For those looking at the Caribbean, the Cayman Islands presents an appealing option. Known for its expertise in private wealth management and asset protection, the Cayman Islands operates within a tax-neutral framework. It’s the world’s fifth-largest financial center and hosts 75% of global hedge funds. Entry requirements are more accessible, with deposits ranging from $10,000 to $100,000, though high-end accounts may require up to $1,000,000. Applicants need to show "real economic ties" to the islands, such as regular visits or verified business interests, to qualify for an account. Account setup can take 3–8 weeks, depending on the institution.

| Feature | Switzerland | Singapore | Cayman Islands |

|---|---|---|---|

| Primary Strength | Wealth preservation & privacy | Tech-driven access to Asia | Asset protection & fund management |

| Typical Minimum | $250,000 – $1M+ | $200,000 – $500,000 | $10,000 – $100,000 |

| Setup Time | 4–8 weeks | 2–4 weeks | 3–8 weeks |

| Currency Focus | CHF, EUR, USD | Multi-currency (SGD, USD, etc.) | USD, GBP, CAD |

| Best For | Long-term wealth preservation | Active trading/Asian markets | Investment fund structures |

All these jurisdictions adhere to global transparency standards, including FATCA and CRS. To open an account, you’ll need a well-prepared documentation package, which typically includes certified copies of your passport, recent utility bills, and 1–3 years of tax returns. For compliance and tax planning, consult an international tax expert.

How to Open an Offshore Bank Account

Choosing a Jurisdiction and Bank

When selecting an offshore bank, ensure it complies with FATCA (Foreign Account Tax Compliance Act). This U.S. regulation requires foreign banks to report information about American account holders to the IRS. Choosing a FATCA-compliant bank helps you stay on top of your tax obligations and avoid potential issues.

It’s also wise to select a bank that has no branches, subsidiaries, or partnerships in the U.S.. Banks with ties to the U.S. are more susceptible to legal actions, which could compromise the advantages of holding assets offshore. Carefully research the bank’s corporate structure to steer clear of any hidden risks.

Minimum deposit requirements vary significantly depending on the jurisdiction. For instance, Panama often requires deposits around $25,000, while the Cayman Islands may set the bar as high as $1,000,000. Assess your financial resources and choose a location where you can comfortably meet these thresholds. If you’re planning international transactions or want to hedge against dollar fluctuations, look for banks offering multi-currency accounts with competitive exchange rates.

Another factor to consider is whether the bank allows remote account setup or requires an in-person visit. Countries like Panama and Portugal often facilitate online account openings, making the process more convenient. On the other hand, jurisdictions like Switzerland may require face-to-face meetings and stricter "Enhanced Due Diligence" procedures. If travel is necessary, factor in the associated costs and time.

Once you’ve chosen your jurisdiction and bank, it’s time to gather the necessary documents to support your application.

Preparing Required Documents

Start by preparing a digital copy of your valid passport and a government-issued photo ID. Some banks may also request additional identification, such as a birth certificate or Social Security card.

You’ll also need to provide proof of your residential address. This typically comes in the form of a utility bill or bank statement (dated within the past 90 days) showing your full name and address. Note that mobile phone bills are generally not accepted.

Be ready to submit 6–12 months of bank statements, tax returns, and evidence of where your funds originate. These could include wage slips, investment records, inheritance documents, or real estate sale contracts, as required by anti-money laundering laws.

Complete the necessary FATCA forms for the bank. Additionally, many jurisdictions require your documents to be certified with an apostille rather than a regular notary stamp. Confirm this requirement early to avoid delays in the process.

Once your documents are in order, you can proceed with submitting your application and making your initial deposit.

Submitting Your Application and Initial Deposit

Submit your completed application and documentation through the bank’s preferred channel, whether that’s an online portal, email, or registered mail. To minimize the risk of rejection, consider working with licensed introducers or consultants. They often have established relationships with the bank’s compliance teams, which can streamline the process.

After submission, the bank will review your application and may request additional documents. This review period can take anywhere from 1 to 8 weeks, depending on the jurisdiction’s policies. Be prepared to clarify any unusual transactions or income sources if asked.

Once approved, the bank will provide instructions for transferring your initial deposit. Keep in mind that most offshore banks charge fees for receiving international wire transfers. Double-check the deposit amount, including any setup fees, to ensure you meet the minimum requirement. Save all wire transfer receipts and related correspondence, as these will be necessary for your annual FBAR and FATCA filings with the IRS.

Legal Compliance and Risk Management

Opening an offshore account comes with strict legal responsibilities. The IRS requires all U.S. taxpayers to report worldwide income from foreign accounts and pay taxes at the appropriate rates. These responsibilities are enforced through specific reporting rules, which are outlined below.

FATCA and CRS Reporting Requirements

If you have foreign accounts, two key reporting requirements apply. First, you must file an FBAR (Foreign Bank Account Report) using the FinCEN BSA E-Filing System if the total value of your foreign accounts exceeds $10,000 at any time during the year. The FBAR is due April 15, but there’s an automatic extension to October 15. Second, you need to attach Form 8938 to your federal tax return if your account values meet thresholds based on your filing status. Additionally, you must complete Part III of Schedule B on your tax return to disclose the existence and location of your foreign accounts.

Failure to comply with these requirements can result in severe penalties. For non-willful violations of FBAR filing, you could face a civil penalty of up to $10,000. Willful violations carry much steeper fines – the greater of $100,000 or 50% of the account balance. For Form 8938, penalties start at $10,000, with additional $10,000 fines accruing every 30 days after an IRS notice, up to a maximum of $60,000. Criminal penalties may include fines and up to five years in prison.

"By law, U.S. taxpayers are not permitted to use offshore accounts, such as foreign bank and securities accounts as well as trusts, to avoid paying tax." – IRS

To stay compliant, maintain detailed records for at least five years from the FBAR deadline. These records should include account numbers, bank names and addresses, account types, and maximum annual values. Convert foreign account values into U.S. dollars using the Treasury Bureau of the Fiscal Service exchange rate from the last day of the calendar year. If you missed previous filings, the IRS may waive penalties if you have reported your income, paid the taxes owed, and have not been contacted about an audit.

Choosing Trusted Banks

To navigate these complex reporting rules, it’s crucial to choose a reliable offshore bank. Focus on well-established financial hubs like Switzerland, Bermuda, or the Cayman Islands, which are known for their strong regulatory systems and reliable banking practices.

Reputable offshore banks typically require extensive documentation to open an account. For example, they may ask for an apostille stamp – a certification that ensures compliance with international legal standards – rather than a standard notary. You’ll also need to provide proof of the source of your funds, such as pay stubs, investment records, or documentation of inheritance, to comply with anti-money laundering laws. Additionally, most banks will request a financial reference from your current domestic bank, covering six to 12 months of account history. Before opening an account, verify that the bank can provide the support needed to meet U.S. reporting requirements.

Understanding Costs and Fees

Managing costs is another key consideration when maintaining an offshore account. These accounts often come with fees for international wire transfers, monthly maintenance, and currency exchanges. Monthly maintenance fees can vary widely – some banks offer fee-free accounts under specific conditions, while others charge recurring fees. Currency exchange fees are typically embedded in the exchange rate when you deposit or withdraw funds in a currency different from your account’s base currency.

Before opening an offshore account, consult a tax professional or legal advisor to ensure you understand all legal and financial obligations.

Combining Offshore Banking with Asset Protection Structures

Expanding on the idea of safeguarding wealth, combining offshore banking with well-designed legal structures takes asset protection to the next level. Offshore banking offers privacy and protection, but when paired with strategic legal frameworks, it adds an extra layer of security against creditors and legal challenges.

Offshore bank accounts are most effective when integrated with structures like trusts or companies. This combination creates a robust defense by positioning assets beyond the reach of domestic courts.

Using Offshore Companies and Trusts

A powerful method involves pairing an offshore trust with an offshore company that holds the bank account. Jurisdictions such as the Cook Islands and Nevis are particularly appealing because they don’t enforce U.S. judgments. This means creditors must file lawsuits locally, often under stricter legal standards like "beyond a reasonable doubt", compared to the more lenient U.S. "preponderance of evidence" standard.

"In countries such as the Cook Islands and others, a judgment rendered in the U.S. (or any other country) cannot be enforced in the trust jurisdiction." – Robert J. Mintz, Attorney

A common setup involves an offshore trust owning an LLC, which in turn holds the bank account. This arrangement creates a buffer between you and your assets while maintaining flexibility. In the Cook Islands, the settlor (the person establishing the trust) can also be a beneficiary, offering more control than most domestic trusts in the U.S.. However, it’s crucial to establish these structures before any legal disputes arise, as transferring assets after litigation begins could be classified as fraudulent conveyance.

For those seeking a balance between domestic convenience and offshore benefits, there’s another option to consider.

Private US LLCs

The "Safety Valve" strategy provides a practical solution by combining offshore protection with domestic accessibility. In this setup, an offshore trust owns a private U.S. LLC – often based in Nevada or Wyoming – which holds assets in domestic bank accounts for everyday use. If legal trouble arises, funds can be quickly transferred from the U.S. account to an offshore account controlled by the trust.

"The advantage of this arrangement is that some clients prefer the protection of an Offshore Asset Protection Trust while maintaining the convenience of holding accounts in the U.S." – Robert J. Mintz, Attorney

This structure strikes a balance between offshore security and domestic usability. It also simplifies some reporting requirements until funds are moved overseas. Additionally, it forces creditors to navigate multiple legal systems, significantly raising their costs and discouraging pursuit.

Conclusion

Offshore banking continues to play a vital role in safeguarding assets, offering U.S. residents a way to protect their wealth, diversify currency holdings, and tap into global investment options that may not be accessible through domestic banks.

That said, these advantages come with significant responsibilities. U.S. taxpayers are required to report foreign accounts exceeding $10,000 through FBAR filings. Failure to comply can result in steep penalties, with willful violations carrying fines of up to $100,000 or 50% of the account balance – whichever is greater. Additionally, with 108 countries now participating in automatic information exchange, covering over €12 trillion in assets, transparency has become a global standard.

"Slow down, talk to a professional who is a normal trust and estate planner or wealth manager about your goals, and come up with an appropriate structure for those goals." – Bill Maurer, Professor of Anthropology and Law, University of California, Irvine

Consulting with a wealth manager or tax attorney experienced in international law is essential. These professionals can help align your offshore banking strategy with your financial goals, navigate compliance requirements like FATCA and FBAR, and guide you in selecting trustworthy jurisdictions while managing associated expenses.

When implemented with a clear plan and full transparency, offshore banking can be a powerful tool for protecting and growing wealth across borders. By working with experts, maintaining compliance, and setting clear objectives, you can minimize risks and maximize the benefits of this legitimate approach to long-term wealth management.

FAQs

What do U.S. citizens need to know about the legal requirements for opening an offshore bank account?

U.S. citizens are allowed to open offshore bank accounts, but there are strict reporting and disclosure rules to follow. If the combined value of all your foreign accounts exceeds $10,000 at any point during the calendar year, you’re required to file a FinCEN Form 114 (FBAR) electronically with the Treasury Department. This form is due by April 15, but there’s an automatic extension to October 15. Additionally, if the value of your foreign assets surpasses certain thresholds – like $50,000 on the last day of the tax year or $75,000 at any time during the year for single filers – you’ll also need to include IRS Form 8938 (Statement of Specified Foreign Financial Assets) when filing your annual tax return. Failure to meet these requirements can lead to hefty penalties, including fines of up to $100,000 or more, and even criminal charges.

To open an offshore account, banks usually ask for standard identification documents, such as a valid U.S. passport or driver’s license, proof of address (like a utility bill), and documentation confirming the source of your funds. You’ll also need to certify that the account will be used for lawful purposes and comply with U.S. regulations, including the Bank Secrecy Act and FATCA. By keeping detailed records and meeting all reporting obligations, you can legally maintain an offshore account while staying compliant with IRS rules.

How does offshore banking provide better asset protection than domestic accounts?

Offshore banking provides a layer of asset protection by placing your funds under the jurisdiction of foreign legal systems, which operate independently of U.S. courts and regulators. Countries like Switzerland, Singapore, and the Cayman Islands are well-known for their stringent privacy laws and limited agreements for sharing information. This makes it significantly harder for creditors or litigants to access or seize your assets. In comparison, domestic accounts in the U.S. are more exposed to risks like lawsuits, tax liens, or federal judgments.

Another advantage of offshore accounts is the ability to spread your wealth across multiple currencies and regulatory environments. This diversification can help shield you from U.S.-specific risks such as political uncertainty, currency fluctuations, or economic challenges. Many offshore banks also offer deposit insurance limits that go beyond the $250,000 coverage provided by the FDIC for U.S. banks, adding an extra layer of financial security. These benefits make offshore banking a practical option for protecting your assets and reducing potential vulnerabilities.

How can I comply with FATCA and FBAR regulations for my offshore accounts?

To meet FATCA and FBAR requirements, the first step is to identify all your foreign financial accounts. If the total value of these accounts hits $10,000 or more at any time during the year, you’re required to electronically file the FBAR (FinCEN Form 114) by April 15. Alongside this, you’ll need to report these assets on IRS Form 8938 as part of your annual tax return.

Make sure to keep thorough records of your accounts – this includes account numbers, balances, and the details of the financial institutions. It’s a smart move to consult a qualified tax professional to ensure you’re meeting all reporting obligations and steering clear of penalties. Staying organized and informed will help you stay on top of compliance.