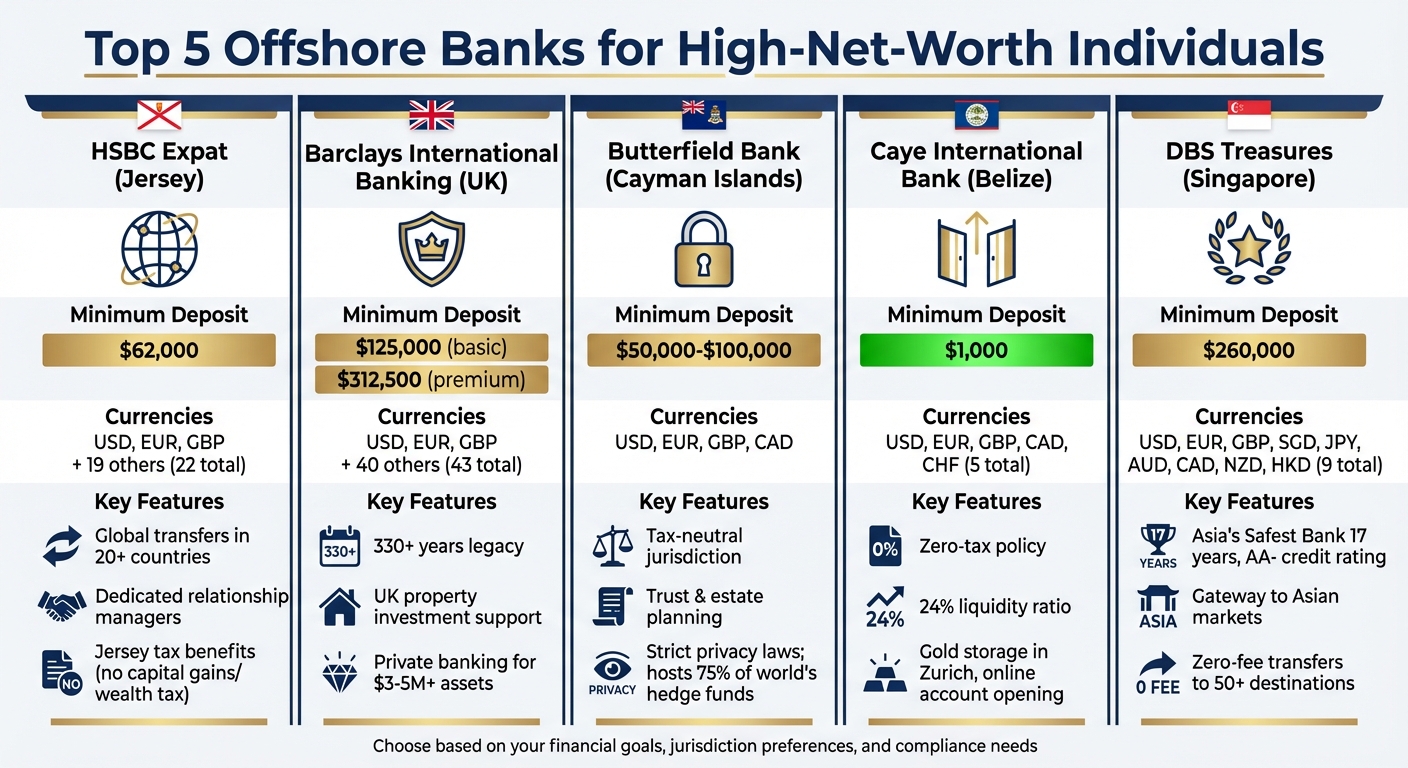

Offshore banking offers high-net-worth individuals a way to diversify wealth, protect assets, and access global financial opportunities. The focus has shifted from secrecy to transparency and legal compliance, with banks offering multi-currency accounts, wealth management services, and privacy protections. Here are five top offshore banks to consider:

- HSBC Expat (Jersey): Multi-currency accounts, global transfers, and personalized wealth management with a minimum deposit of $62,000.

- Barclays International Banking (UK): Requires $125,000 to open, with premium private banking for deposits over $312,500.

- Butterfield Bank (Cayman Islands): Tailored services for ultra-high-net-worth clients in a tax-neutral jurisdiction.

- Caye International Bank (Belize): Low entry at $1,000, offering asset protection and multi-currency accounts.

- DBS Treasures (Singapore): Minimum $260,000, strong regulatory framework, and access to Asia’s markets.

Each bank caters to different financial needs, from asset protection to global investment access. Below is a quick comparison of their key features.

Quick Comparison

| Bank | Minimum Deposit | Currencies | Key Features |

|---|---|---|---|

| HSBC Expat | $62,000 | USD, EUR, GBP, 19 others | Global transfers, tailored wealth management, Jersey’s tax benefits |

| Barclays International | $125,000 | USD, EUR, GBP, 40 others | UK stability, private banking for high-tier clients |

| Butterfield Bank | $50,000–$100,000 | USD, EUR, GBP, CAD | Cayman tax neutrality, trust services, strict privacy laws |

| Caye International | $1,000 | USD, EUR, GBP, CAD, CHF | Belize’s zero-tax policy, gold storage, flexible account setup |

| DBS Treasures | $260,000 | USD, EUR, GBP, SGD, 6 more | Singapore’s stability, multi-currency accounts, access to Asian markets |

Choosing the right bank depends on your financial goals, jurisdiction preferences, and compliance needs. Offshore banking can help secure and grow wealth, but professional advice is essential for navigating regulations.

1. HSBC Expat

HSBC Expat operates out of Jersey, Channel Islands, a well-regarded offshore financial hub recognized by the OECD as one of the world’s top international finance centers. The bank offers accounts in three major currencies: USD, EUR, and GBP. With a global network covering over 60 countries and territories, HSBC is equipped to handle intricate international financial needs.

Multi-currency account options

HSBC Expat provides the flexibility to manage up to 19 currencies through both instant access and fixed-term accounts. For those dealing with foreign exchange, the bank offers a 24-hour trading service accessible via online or mobile banking. Features like "Global View" and "Global Transfers" allow clients to link their HSBC accounts across the globe, enabling instant, fee-free transfers between eligible accounts in more than 20 countries.

Tailored wealth management services

HSBC Expat offers personalized financial advice through dedicated Relationship Managers and global wealth experts. Their services focus on four main areas: education planning, retirement planning, wealth management, and personal asset protection. To qualify for HSBC Expat Premier, clients need to maintain deposits or investments of at least £50,000 (around $62,000) or have an annual salary of at least £100,000 (around $125,000). The bank’s innovative portfolio management technology was recognized at the Professional Wealth Management (PWM) Wealth Tech Awards in June 2020. These tailored solutions are complemented by the regulatory benefits of Jersey’s financial system.

Jurisdictional advantages

Jersey offers several perks for offshore banking, such as the absence of capital gains, capital transfer, or wealth taxes. The jurisdiction has signed over 60 international agreements and is regulated by the Jersey Financial Services Commission, ensuring compliance with global standards of transparency and stability. Additionally, the Jersey Bank Depositors Compensation Scheme protects eligible deposits up to £50,000 (approximately $62,000). HSBC Expat accounts do not charge monthly fees if eligibility requirements are met, though an underfunding fee may apply if minimum criteria are not maintained. Together, these regulatory advantages and HSBC’s expertise create a strong framework for safeguarding wealth.

2. Barclays International Banking

Barclays International Banking, based in the United Kingdom, boasts a legacy spanning over 330 years and serves clients across more than 45 markets. To open an international account, clients must deposit a minimum of £100,000 (approximately $125,000), and the service is available to residents in over 35 countries. Assia Stephansen, Head of International Banking at Barclays, highlights the bank’s appeal:

"The main reason they come to us is for safety, they want their assets to be held in a bank with a long history".

This enduring reputation forms the foundation of Barclays’ global financial services.

Multi-currency Account Options

Barclays offers international accounts in three major currencies: Sterling (GBP), Euros (EUR), and US Dollars (USD). Additionally, clients can access accounts in over 40 other currencies, enabling better financial management and reducing exposure to currency market fluctuations. Account holders enjoy 24/7 access via a mobile app, which also includes secure document storage.

Personalized Wealth Management Services

Clients with a minimum of £250,000 (around $312,500) gain access to a UK-based Relationship Manager who provides tailored guidance, including assistance with UK property investments for overseas clients. Nav Singh, Head of International Markets at Barclays, explains:

"Offshore banking can also give you access to products and services that may not be available to you in your home country. An example of this is that we can support clients wishing to purchase a UK property while still residing in South Africa".

For clients with investable assets of £3–5 million, Barclays offers Private Banking services, featuring a dedicated Private Banker and specialists who address complex needs like succession planning.

Global Reach and Stability

Barclays leverages its extensive history and international presence to hold client assets in economically stable regions, providing diversification against local market risks. With operations in key global wealth hubs – including the United Kingdom, Crown Dependencies (Jersey, Guernsey, Isle of Man), Monaco, Switzerland, Singapore, and the Middle East – the bank offers a strong framework for managing wealth on a global scale. This combination of stability and expertise ensures clients benefit from a secure and comprehensive approach to international banking.

3. Butterfield Bank

Butterfield Bank operates out of the Cayman Islands, catering to high-net-worth individuals with a suite of specialized offshore banking services. These include private banking, asset management, and trust and estate planning, all tailored to clients who meet the bank’s substantial minimum deposit requirements, typically in the multi-million-dollar range.

Jurisdictional Advantages

The Cayman Islands offer a unique blend of regulatory benefits that make them a prime location for offshore banking. As a tax-neutral jurisdiction grounded in English common law, the islands impose no taxes on income, capital gains, or corporate profits. At the same time, they maintain rigorous anti-money laundering measures. With nearly $7 trillion in deposits and hosting 75% of the world’s hedge funds, the Cayman Islands have cemented their place as a global financial hub.

Tailored Wealth Management Services

Butterfield Bank takes a highly selective approach to wealth management. Prospective clients must undergo a thorough vetting process, including providing professional and banking references covering at least three years to verify their financial history. The bank’s private banking services are designed for individuals with significant assets, often requiring deposit minimums far higher than those of typical offshore accounts. Butterfield also prioritizes clients with a clear rationale for banking in the Cayman Islands, such as residency, business ties, or family connections.

Privacy and Confidentiality

Butterfield places a strong emphasis on safeguarding client privacy, a cornerstone of offshore banking. The Cayman Islands’ regulatory framework enforces strict compliance and transparency standards, ensuring confidentiality for legitimate wealth management activities. Privacy is further bolstered when assets are held in offshore trusts or LLCs. To protect client data, Butterfield employs advanced security measures, including multi-factor authentication, sophisticated fraud detection systems, and dedicated cybersecurity teams.

4. Caye International Bank

Caye International Bank, located in Belize, operates under a Class A international banking license granted by the Central Bank of Belize. The bank has earned accolades such as the "Offshore Bank of the Year" award for 2024/2025 from the Central America Prestige Awards. Its President, Luigi Wewege, was also recognized as "Offshore Bank Executive of the Year". With a low minimum deposit requirement of $1,000, the bank provides an accessible entry point for clients. Designed to meet the needs of high-net-worth individuals, Caye International Bank offers a range of specialized offshore banking solutions.

Jurisdictional Advantages

Belize provides a favorable environment for international banking, including a zero-tax policy that exempts international accounts from all taxes, including capital gains. The Belizean dollar is securely pegged to the U.S. dollar at a 2:1 ratio, ensuring currency stability. For U.S. clients, Belize’s legal system – rooted in English Common Law – and the use of English as the official language make it a seamless jurisdiction for financial dealings.

"Essential bank reserve requirements in Belize are at least four times the reserve requirements of those in the United States for their local banks." – Luigi Wewege, President, Caye International Bank

Caye International Bank boasts a liquidity ratio of 24%, significantly higher than the typical requirements in the United States. Additionally, Belize imposes no exchange controls, allowing clients to move funds freely without government-imposed restrictions.

Multi-Currency Account Options

Clients of Caye International Bank can open multi-currency accounts in USD, EUR, GBP, CAD, and CHF. This feature allows for currency diversification, protection against devaluation, and convenient global banking. The bank also offers 24/7 online banking and a prepaid Visa card, which can be preloaded with up to $10,000 for worldwide use. For those interested in precious metals, the bank’s Gold Loan Program provides physical gold storage in Zurich, Switzerland, with access to a credit line of up to 75% of the gold’s market value.

Tailored Wealth Management Services

Caye International Bank employs a team of multilingual professionals who work closely with clients to offer personalized offshore asset protection and management. The bank integrates Belizean structures like International Business Companies (IBCs) and trusts to safeguard assets from potential legal challenges, such as lawsuits, judgments, or divorce settlements. Beyond traditional banking, Caye specializes in international lending for real estate and construction projects in Central America, offering flexible amortization terms. The entire account-opening process can be completed online, adding convenience to its array of services.

Privacy and Confidentiality

Caye International Bank places a strong emphasis on client privacy. Belize enforces strict bank secrecy laws while adhering to international regulations like FATCA. The country’s legal framework is designed to protect client assets from external claims, though proper verification and self-disclosure are required during the account setup process. For added privacy, clients can pair their accounts with Belize trusts or Limited Duration Companies (LDCs), which benefit from short statutes of limitations on fraudulent transfer claims, typically one to two years.

"Belize has a stable growing economy with a zero-tax jurisdiction, and strong bank secrecy laws, which benefits Caye bank clients through increased privacy and confidentiality." – Caye International Bank

Caye International Bank stands out for its robust asset protection, privacy measures, and tailored services, making it a strong choice for high-net-worth individuals seeking offshore banking solutions.

sbb-itb-39d39a6

5. DBS Treasures

DBS Treasures operates out of Singapore, a country celebrated for its political stability and rigorous financial regulations. Recognized as "Asia’s Safest Bank" for an impressive 17 years straight (2009–2025), DBS boasts stellar credit ratings of AA- and Aa1. Singapore’s strong legal framework and anti-corruption policies make it a trusted hub for wealth preservation, while its position as a financial gateway to Asia adds to its appeal. Like other top-tier banks, DBS Treasures blends regulatory strength with cutting-edge financial services.

Jurisdictional Advantages

DBS benefits from Singapore’s highly regarded regulatory framework, which it calls "Singapore Standards." This approach combines robust oversight, institutional stability, and expert investment guidance. The country’s business-friendly tax policies and simplified processes for wealth transfers and trust setups further enhance its appeal. Non-residents can even open accounts remotely through third-party notary certification. Strategically headquartered in Singapore, DBS connects clients to dynamic markets like India, Indonesia, and Greater China.

Personalized Wealth Management Services

Leveraging its strong regulatory foundation, DBS provides bespoke advisory services through dedicated Relationship Managers who cater to clients in their preferred languages. Backed by a top-tier research team analyzing over 700 Asian companies, these managers deliver tailored investment advice. To access DBS Treasures, clients need a minimum of S$350,000 in Singapore or HK$1 million in Hong Kong. The DBS digibank app offers a seamless experience, with a single dashboard for equities, funds, and currencies, along with personalized alerts for better portfolio management.

Multi-Currency Account Options

The DBS Multi-Currency Account is a standout feature, supporting nine major currencies: USD, EUR, GBP, AUD, CAD, JPY, NZD, SGD, and HKD. Additionally, DBS Remit allows same-day, zero-fee international transfers to over 50 destinations in 19 currencies. The DBS Treasures Visa Debit Card adds further convenience, enabling spending in 11 currencies without foreign exchange fees and offering free overseas ATM withdrawals. These tools are designed to help clients manage currency exposure and maintain global portfolios with ease.

Privacy and Confidentiality

DBS takes privacy and security seriously, adhering to tax regulations while implementing a Vulnerability Disclosure Policy to protect client data and assets. The bank ensures secure onboarding through third-party notary certification or local employee verification, depending on the market. Combined with Singapore’s reputation for financial discretion, these measures provide a dependable framework for safeguarding wealth in a fully regulated environment.

Bank Comparison Table

Below is a detailed table summarizing the key features of each bank, offering a clear snapshot to help guide your financial decisions.

| Bank | Minimum Deposit | Currencies | Wealth Management | Privacy Protections | Jurisdictional Advantages |

|---|---|---|---|---|---|

| HSBC Expat | Varies by account type | USD, EUR, GBP, and other major currencies | Dedicated relationship managers, global investment access | Strong UK regulatory framework and confidential banking practices | UK-based with global reach and international access |

| Barclays International Banking | £100,000 ($125,000) for a basic account; £250,000 ($312,500) for premium management | GBP, USD, EUR, and similar currencies | Personalized advisory at higher tiers with bespoke investment solutions | Regulated by UK authorities with secure client data protocols | Located in London’s financial hub with an established reputation |

| Butterfield Bank | $50,000–$100,000 initial deposit | USD, EUR, GBP, CAD, and others | Tailored wealth planning and trust services | Cayman Islands confidentiality laws and strong asset protection | Cayman Islands stability with a favorable tax environment |

| Caye International Bank | Varies by account structure | USD, EUR, GBP, and multi-currency corporate accounts | Offshore corporate banking with asset protection strategies | Belize’s 24% liquidity requirement | Benefiting from Belize’s favorable regulatory environment |

| DBS Treasures | Varies by region | Multiple major currencies | Dedicated Relationship Managers | Robust regulatory framework with secure onboarding | Strategically positioned in Asia with political stability |

The minimum deposit requirements differ significantly, from Barclays’ higher thresholds to the more flexible options offered by Butterfield and Caye International Bank. These variations allow you to identify the institution that aligns with your financial goals and needs.

Conclusion

Choosing the right offshore bank is about aligning your financial goals with legal requirements. Among the options discussed – HSBC Expat, Barclays International Banking, Butterfield Bank, Caye International Bank, and DBS Treasures – each stands out for specific strengths. Whether you’re looking for asset protection, multi-currency accounts, regional investment opportunities, or tailored wealth management, these banks offer solutions to meet diverse needs.

The regulatory environment in different jurisdictions plays a major role in shaping the security and efficiency of your wealth management. Today’s offshore banking landscape prioritizes legal diversification and strategic planning. With global transparency standards like FATCA and CRS firmly established, staying compliant with your home country’s reporting requirements is non-negotiable.

Given the complexity of international banking, professional advice is crucial. Policies and regulations can shift quickly, and a knowledgeable advisor with expertise in both international banking and your home country’s tax laws can help you navigate these changes and avoid expensive missteps.

Instead of chasing one "ideal" bank, consider building relationships with multiple institutions. This approach allows you to address asset protection, transactional needs, and investment goals across various jurisdictions, creating a well-rounded and secure financial strategy.

FAQs

What are the key advantages of offshore banking for high-net-worth individuals?

Offshore banking offers a range of financial advantages tailored to high-net-worth individuals seeking greater control and security over their assets. One of the primary perks is asset protection. By placing funds in jurisdictions with strong legal protections, individuals can shield their wealth from lawsuits, creditors, and political instability.

Another significant benefit is the opportunity for tax optimization. Offshore accounts allow clients to take advantage of favorable tax regulations, helping to legally minimize income taxes, capital gains taxes, and even inheritance taxes.

Additionally, offshore banking provides currency diversification, which is particularly useful for managing funds across multiple currencies. This reduces vulnerability to exchange-rate swings and simplifies international transactions. On top of that, it ensures enhanced financial privacy, offering a layer of discretion over both personal and financial details.

These features make offshore banking an attractive option for wealth preservation and global financial management, offering the flexibility and security that high-net-worth individuals often prioritize.

What are the unique advantages of the top offshore banking jurisdictions?

Each offshore banking jurisdiction brings unique benefits, catering to various financial objectives:

- Switzerland stands out for its political stability, strong legal framework, and stringent privacy laws. While entry requirements can be steep, it’s a top choice for safeguarding wealth.

- Singapore and Hong Kong offer regulatory reliability, cutting-edge fintech ecosystems, and smooth multi-currency banking. These features make them perfect gateways to Asian markets with efficient digital banking options.

- The United Arab Emirates provides a tax-friendly environment, exempting foreign-sourced income from personal and corporate taxes, while serving as a hub for access to the Middle East and emerging markets.

- Panama and Mauritius attract entrepreneurs with flexible legal systems, moderate entry barriers, and tax neutrality on offshore income, offering cost-effective global banking solutions.

- The Cayman Islands specialize in asset protection, with zero direct taxes and a trusted legal framework supporting trusts and investment vehicles.

These destinations enable high-net-worth individuals to tailor their banking strategies to key priorities like privacy, market access, tax advantages, or securing assets.

What should I look for when choosing an offshore bank for managing my wealth?

When choosing an offshore bank for managing your wealth, start by examining the stability of the jurisdiction. Opt for a country with a reliable legal system and a politically stable environment. This reduces the chances of facing sudden policy changes or restrictions that could affect your access to funds. Additionally, prioritize privacy. Look for banks in locations that provide strong banking confidentiality while maintaining compliance with international regulations.

Next, evaluate the services and features the bank offers. Features like multi-currency accounts, intuitive digital platforms, and access to dedicated private bankers can make managing global assets much simpler. Take a close look at the bank’s minimum deposit requirements, fees, and interest rates to ensure they fit your financial objectives. Some offshore banks also provide wealth-management tools, including investment advisory, trust creation, and estate planning services.

Finally, assess the bank’s reputation and compliance standards. Choose a bank with a proven history of adhering to anti-money-laundering (AML) rules and transparent documentation practices. This ensures your assets are protected and accessible while meeting global financial regulations. By focusing on these key areas – stability, privacy, services, and trustworthiness – you can select an offshore bank that aligns with your financial needs and goals.