Offshore companies can help protect your assets from lawsuits, creditors, and other financial risks by leveraging foreign legal systems. Here’s what you need to know:

- What is an Offshore Company? A legal entity formed in another country that operates independently of you, shielding assets from U.S. court judgments.

- Why Offshore Asset Protection? The U.S. is highly litigious, with 5 million lawsuits filed in 2023. Domestic asset protection tools like LLCs or trusts often fall short due to U.S. court jurisdiction and disclosure requirements.

- How They Work: Offshore companies create legal barriers, forcing creditors to navigate foreign legal systems, often with higher costs and stricter rules.

- Key Features: Privacy, protection against U.S. judgments, and financial security through diversification.

- Top Jurisdictions: Anguilla stands out for its tax neutrality, confidentiality, and ease of company formation.

Offshore companies are particularly useful for high-risk professionals, cryptocurrency investors, intellectual property holders, and international real estate owners. While compliance with tax laws, like filing an FBAR for accounts exceeding $10,000, is essential, these entities offer a practical way to safeguard wealth.

The Problem: Risks of Relying Only on Domestic Asset Protection

Many U.S. investors believe that forming a domestic LLC or trust will effectively protect their wealth from creditors. Unfortunately, the reality is far more complicated. Domestic structures are fully under U.S. court jurisdiction, and when a judge orders asset seizure, there’s little to prevent compliance.

Main Threats to U.S.-Based Assets

U.S. courts, under the Full Faith and Credit Clause, can enforce judgments across state lines. This means that a domestic LLC or trust often provides only a thin layer of protection.

Consider this: liability claims in the U.S. have surged by 57% over the past decade. While roughly 20 states allow Domestic Asset Protection Trusts (DAPTs), their safeguards are limited. Many states include "exception creditors" – such as the IRS, ex-spouses seeking alimony, or children seeking support – who can bypass trust protections.

Recent legal cases highlight these vulnerabilities. For instance, in Greenspan v. LADT, LLC, a California court allowed a creditor to access trust assets to satisfy an $8.45 million arbitration award, even adding the trustee as a judgment debtor under the "alter ego" doctrine. Similar cases across the U.S. demonstrate that domestic structures often crumble under legal scrutiny.

Judges also have the authority to hold individuals in civil contempt for refusing to turn over assets held in domestic trusts. As Dominion aptly put it:

"If you have a sufficiently motivated judge after your money or assets, don’t expect your domestic trust to put up much of a fight".

These examples raise serious concerns about relying solely on domestic asset protection methods.

Why Domestic LLCs and Trusts Fall Short

The core issue with domestic structures is their jurisdictional vulnerability. A U.S. judge can compel you to repatriate assets, dissolve a trust, or release LLC distributions. Trustees, typically located within the same jurisdiction, are legally obligated to comply or face penalties.

While domestic LLCs offer some protection through charging orders – limiting creditors to distributions – this safeguard isn’t foolproof. Creditors can still access distributions and may even trigger tax liabilities on company profits.

Another major flaw is privacy. Domestic trusts don’t guarantee confidentiality, and litigation can expose your assets and trust details to public record. With over 80 countries maintaining beneficial ownership registers and more than 120 jurisdictions enforcing disclosure requirements, keeping assets private through domestic arrangements is becoming increasingly difficult.

The legal environment is also shifting. Courts now apply "substance over form" analysis, examining whether you maintain control over the assets. In Breitenstine v. Breitenstine, a Wyoming court ruled that a husband had created an asset protection trust solely to shield assets during a divorce. The court ordered the repatriation of those assets and held him in contempt for failing to comply.

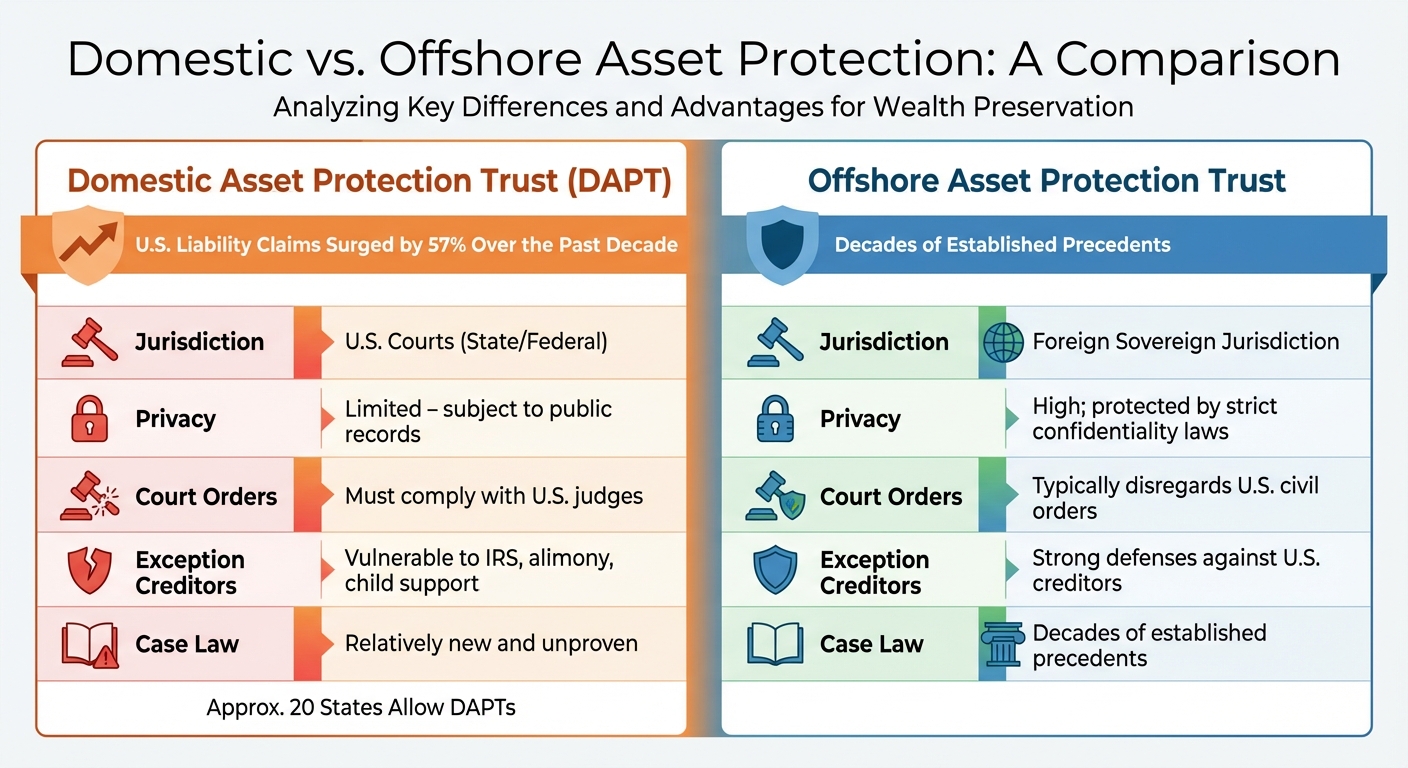

A side-by-side comparison of domestic and offshore asset protection strategies shows just how limited U.S.-based structures can be:

| Feature | Domestic Asset Protection Trust (DAPT) | Offshore Asset Protection Trust |

|---|---|---|

| Jurisdiction | U.S. Courts (State/Federal) | Foreign Sovereign Jurisdiction |

| Privacy | Limited – subject to public records | High; protected by strict confidentiality laws |

| Court Orders | Must comply with U.S. judges | Typically disregards U.S. civil orders |

| Exception Creditors | Vulnerable to IRS, alimony, child support | Strong defenses against U.S. creditors |

| Case Law | Relatively new and unproven | Decades of established precedents |

Ultimately, while domestic structures might mitigate some risks, they are still subject to U.S. judicial authority, disclosure requirements, and enforcement mechanisms. For those facing significant threats, relying solely on domestic asset protection leaves them exposed. Offshore options, like those available in jurisdictions such as Anguilla, provide a more secure alternative.

When You Need an Offshore Company

Offshore companies can be a game-changer if you’re managing significant wealth, working in high-risk professions, or facing considerable legal exposure. They provide a layer of protection that’s hard to achieve through domestic structures alone.

Best Uses for Offshore Companies

Offshore companies are particularly effective for individuals and businesses in specific scenarios:

- High-risk professionals: Doctors, surgeons, lawyers, architects, and real estate developers often turn to offshore companies to separate their personal wealth from professional liabilities. With around 5 million new lawsuits filed in the U.S. in 2023 alone, this legal separation can be critical for protecting assets in litigious industries.

- Intellectual property holders: Holding trademarks, patents, or proprietary technology in an offshore company – like a BVI IBC or an Anguilla entity – can safeguard these valuable assets. By licensing them back to a U.S.-based operating company, the intellectual property remains protected even if the domestic business faces legal judgments.

- Cryptocurrency and digital asset investors: Offshore LLCs are increasingly popular for managing crypto portfolios. Blockchain-friendly jurisdictions such as Anguilla offer zero corporate tax and simplified reporting, creating a legal buffer between personal assets and trading activities.

- International real estate investors: Using offshore LLCs to hold property in countries like Panama or Mexico can streamline inheritance planning, bypass local probate, and keep ownership details private. This approach simplifies administration and enhances privacy.

- Business owners and executives: For those concerned about personal liability from business operations, offshore structures provide a way to shield personal wealth. Properly structured foreign entities can protect board members and executives from risks tied to corporate activity.

These examples highlight how offshore companies, especially in jurisdictions like Anguilla, offer practical solutions for asset protection across various industries and circumstances.

Key Benefits of Offshore Asset Protection

Offshore companies deliver several broad advantages that extend beyond individual use cases.

One major benefit is jurisdictional control. Many offshore jurisdictions, such as Nevis and the Cook Islands, do not recognize U.S. court judgments. Creditors must re-litigate the case in the foreign jurisdiction, often needing to post a significant cash bond first. This added complexity can discourage frivolous claims.

Another advantage is financial privacy. Jurisdictions like Anguilla maintain no public registries of shareholders or directors, ensuring that sensitive financial details remain confidential. Anguilla, in particular, is known for its strong legal framework, making it a top choice for safeguarding assets.

Geopolitical and currency diversification is also a key factor. With the U.S. national debt surpassing $31 trillion and the U.S. Dollar experiencing a 10% drop against the DXY in early 2025, holding assets in multiple currencies – such as Swiss francs or euros – can help mitigate risks tied to a single economy or political system.

At the heart of offshore protection is legal separation. As OVZA Legal Affairs puts it:

"The value of an offshore company lies in jurisdictional control. Countries like the British Virgin Islands, Nevis, and the Marshall Islands have built corporate and trust laws specifically designed to discourage frivolous claims."

This separation treats the offshore company as an independent legal entity, insulating personal assets from business liabilities. Establishing these structures proactively ensures their effectiveness.

| Feature | Domestic LLC/Trust | Offshore Company (Nevis/Anguilla) |

|---|---|---|

| Judgment Recognition | U.S. judgments enforced across state lines | Foreign judgments not recognized; re-litigation required |

| Privacy | High transparency requirements | No public ownership registries in select jurisdictions |

| Creditor Requirements | Standard civil litigation processes | May require cash bonds or higher proof burdens |

| Cost | Lower setup and maintenance costs | Typically $1,000–$5,000+ for formation and compliance |

| Control | Direct owner control | Often managed by professional trustees for stronger legal separation |

It’s important to note that compliance is non-negotiable. U.S. taxpayers must file an FBAR (FinCEN Form 114) if their offshore accounts exceed $10,000 at any point during the year. Offshore asset protection isn’t about hiding wealth – it’s about creating legal hurdles that make enforcement more difficult and costly for creditors, all while maintaining transparency with tax authorities.

Why Anguilla Is the Top Offshore Jurisdiction

When it comes to offshore asset protection, few places compare to Anguilla. This British Overseas Territory combines a stable legal system rooted in English Common Law with modern corporate laws tailored to safeguard wealth. For U.S. individuals looking for tax neutrality, privacy, and operational ease, Anguilla offers a compelling option.

Anguilla’s Legal and Regulatory Benefits

Anguilla operates under English Common Law, bolstered by modern statutes like the International Business Companies Act and the Limited Liability Companies Act. This framework provides the predictability and stability essential for managing cross-border assets.

A standout feature is Anguilla’s tax neutrality. The jurisdiction imposes no taxes on corporate income, personal income, capital gains, gifts, inheritance, or estates – whether you’re a resident or a non-resident. As One IBC explains:

"Anguilla is a tax haven in its truest sense. This British Overseas Territory offers the lowest tax rates in comparison to international standards."

Privacy is another key advantage. Corporate details, such as by-laws and LLC agreements, remain private, as Anguilla does not require public disclosure. Additionally, breaches of confidentiality concerning International Business Companies (IBCs) are treated as criminal offenses, not just civil matters.

Anguilla LLCs also provide robust protection against creditors. If a judgment is issued, creditors can only claim distributions at the discretion of the LLC manager, leaving the assets themselves untouchable.

The jurisdiction’s ACORN (Anguilla Commercial Online Registration Network) system adds to its appeal. This fully computerized system allows for 24/7 company formation, often completed in under an hour. Anguilla was one of the first to implement such an online registration system, showcasing its focus on efficiency.

Corporate structures in Anguilla are highly flexible. Companies need only one director and one shareholder, who can be the same person or entity. There are no requirements for minimum authorized capital, annual meetings, or local residency for directors. Moreover, businesses can easily redomicile to or from Anguilla, offering adaptability in response to changing regulations or political climates.

Since the introduction of its corporate laws in 1994, Anguilla has incorporated over 25,000 companies. It’s also ranked as the fifth-largest jurisdiction globally for captive insurance, further underscoring its financial expertise.

These strengths lay the groundwork for understanding the specific benefits and considerations of forming an Anguilla IBC.

Anguilla IBCs: Pros and Cons

Anguilla IBCs build on the jurisdiction’s legal and regulatory foundation, offering a range of benefits along with a few requirements. Here’s a quick overview:

| Advantages (Pros) | Disadvantages / Requirements (Cons) |

|---|---|

| 0% Corporate and Income Tax – Tax-free on all income types | Licensed Registered Agent Required – A local licensed agent is mandatory |

| 1-Hour Rapid Formation – ACORN system enables same-day incorporation | Bearer Share Restrictions – Bearer shares must be held by a licensed custodian |

| No Mandatory Audits or Meetings – No financial audits or annual general meetings required | Economic Substance Requirements – Certain sectors must meet local substance rules |

| High Confidentiality – No public registry for directors or shareholders; breaches are criminal offenses | Annual Fees Apply – Government fees start at $200, plus registered agent costs |

| Redomiciliation Permitted – Companies can easily change jurisdiction | Business License for Certain Activities – Additional licenses may be required for specific business types |

| Corporate Directors Allowed – Directors can be individuals or entities | Not Suitable for Local Business – IBCs cannot operate within Anguilla |

| Strong Statutory Protection – Protects company assets from seizure during member bankruptcy | No Double Taxation Treaties – Anguilla has no agreements to prevent double taxation |

Costs are competitive given the level of protection offered. Forming an LLC costs about $1,495, while incorporating a Business Company is approximately $2,500. Annual government maintenance fees are around $200. For those seeking a complete solution, management packages – including formation, bank account setup, and nominee services – are available for roughly $3,495.

For enhanced asset protection, experts often recommend pairing an Anguilla LLC with a Cook Islands Trust. This strategy creates multiple legal barriers for creditors while ensuring compliance with U.S. tax reporting requirements.

sbb-itb-39d39a6

How to Set Up an Anguilla IBC with Global Wealth Protection

Setting up an Anguilla International Business Company (IBC) is a straightforward process. Thanks to Anguilla’s ACORN system, forming an IBC often takes just 24 hours once all the necessary documents are submitted. Global Wealth Protection handles everything from verifying the company name to delivering your corporate kit, ensuring a smooth process while keeping everything compliant. This approach forms a solid foundation for offshore asset protection.

Steps to Form Your Anguilla IBC

The process begins with choosing a company name that meets Anguilla’s compliance requirements. It’s a good idea to have alternate names ready, as the Anguilla Registrar of Companies must verify availability. The name must end with an approved suffix like Ltd, Corp, Inc, SA, NV, or GmbH. However, restricted terms like "Bank", "Trust", or "Royal" are prohibited unless you have special licensing.

Next, you’ll need to gather the required Know Your Customer (KYC) documents. These typically include:

- A valid passport

- Proof of physical address, such as a utility bill

- A character reference from a bank or professional source

These documents are required for every director and shareholder involved. Once submitted, Global Wealth Protection prepares your Memorandum and Articles of Association, files the incorporation documents, and pays the government fee, which ranges from $200 to $250.

After approval, you’ll receive a complete corporate kit. This typically includes the Certificate of Incorporation, share certificates, and company registers. Professional incorporation services usually cost around $2,500. The next step involves opening a corporate bank account, which can be set up in locations like Europe, Hong Kong, or Singapore. This requires submitting additional KYC and Anti-Money Laundering (AML) documents.

Anguilla IBCs are flexible in their structure. You only need one director and one shareholder, and they can be the same person or entity, regardless of residency. Additionally, the company must maintain a registered office and agent in Anguilla. There’s no requirement for annual meetings, audits, or public financial filings. These features make an Anguilla IBC an effective tool for protecting wealth from U.S. legal claims while maintaining operational freedom.

Adding Extra Protection with Trusts and Foundations

To strengthen your asset protection plan, consider combining your IBC with offshore trusts for asset protection or foundation structures. This layered approach creates stronger legal barriers, making it harder for creditors to access your assets. For example, an Anguilla foundation can include provisions like "restrictions against alienation", which safeguard property from being seized or sold in cases of bankruptcy.

This strategy, often referred to as a "Plan B", blends the flexibility of an IBC with the added security of a trust or foundation. Global Wealth Protection can customize these solutions to meet your specific asset protection needs, giving you peace of mind and enhanced security.

Maintaining Compliance and Measuring Results

Once your Anguilla IBC is established, staying compliant is essential to avoid penalties and ensure your asset protection strategy works as intended. This requires attention to specific details and regular evaluations to confirm that your offshore structure is delivering the privacy, legal protection, and tax benefits you aim for.

Compliance Requirements for Anguilla IBCs

To maintain your company’s active status, you must pay a fixed annual renewal fee to the Commercial Registry. The minimum government fee is $200, but total annual costs – including registered agent fees and basic record-keeping – usually range between $500 and $2,000. Missing this payment will cause your company to lose its active status, potentially weakening your asset protection strategy.

While Anguilla IBCs are not obligated to file annual financial statements or undergo audits, you are required to keep accurate financial records. These corporate records must be stored at your registered office and made available if regulators request them.

If you’re a U.S. citizen, additional reporting obligations apply. For example, if your offshore accounts exceed $10,000 at any point during the year, you must file an FBAR (FinCEN Form 114). Consulting with a tax professional can help you navigate these requirements and avoid serious penalties.

Certain industries, such as banking, insurance, fund management, shipping, or intellectual property, face stricter rules. Companies in these sectors must meet economic substance requirements by demonstrating adequate local control, staffing, and physical presence. Additionally, your registered agent must maintain information about beneficial owners, and by 2023, Anguilla has been moving toward a more transparent registry system.

How to Measure Your Asset Protection Success

Once compliance is in order, it’s important to assess whether your offshore structure is meeting its goals. Key performance indicators for success include privacy, legal protection, and tax efficiency – all of which support your broader asset protection strategy.

Privacy: Confidentiality is critical. Your corporate records, such as the names of directors and shareholders, should remain private. If you’re using nominee services for added anonymity, ensure your personal information stays out of public registries.

Legal Protection: The effectiveness of your structure can be measured by how well it shields assets from domestic creditors. In Anguilla, creditors are limited to an "economic interest", meaning they can only receive distributions when made. They cannot access company assets, vote, or interfere with management. This charging order protection adds significant barriers, making it costly and challenging for creditors to pursue your offshore assets.

Tax Efficiency: Anguilla’s 0% tax rate on foreign-sourced income, capital gains, dividends, and inheritance is a key advantage. If you’re paying taxes on income that should be sheltered, your structure may need adjustments. A tax advisor can help identify and resolve any issues.

Operational Continuity: Renewing your IBC annually and retaining a licensed local agent and office are essential. Recurring compliance problems or losing a registered agent can undermine the protection your structure provides.

Regularly reviewing these metrics ensures your offshore structure remains effective. If you notice any shortcomings, consider consulting a service like Global Wealth Protection to fine-tune your setup and address any gaps.

Conclusion: Should You Form an Offshore Company?

Deciding whether to form an offshore company depends on how well the benefits align with your personal or business needs. For those prioritizing asset protection and privacy, establishing an offshore company in Anguilla could be a smart move.

If you’re dealing with high litigation risks, need enhanced privacy, or own real estate that could expose you to liability, an Anguilla International Business Company (IBC) can help safeguard your assets. As First Anguilla Trust Company Limited explains:

"Real estate is particularly suitable for offshore companies. It simplifies ownership and is an excellent form of asset protection because it insulates the owner of the offshore company from any personal liability".

Anguilla IBCs are especially beneficial for estate planning, offering a way to efficiently transfer wealth, avoid forced heirship laws, and protect against economic or political uncertainties. Pairing an IBC with a trust amplifies these advantages, creating a solid framework for managing and preserving wealth.

The administrative process is straightforward, with formation taking as little as one business day, annual fees averaging about US$200, and no requirements for audits or public filings. Since 1994, Anguilla has incorporated over 25,000 companies, highlighting its reliability as a jurisdiction.

Whether you’re concerned about creditor claims, privacy, managing international investments, or planning an estate, an Anguilla IBC offers a practical solution. For guidance tailored to your specific needs, consider consulting with Global Wealth Protection.

FAQs

What are the key advantages of setting up an offshore company for asset protection?

Using an offshore company for asset protection comes with several advantages worth considering.

One of the most appealing perks is privacy. In jurisdictions like Anguilla, strict confidentiality laws are in place to protect the identities of shareholders and directors. This ensures that your financial dealings remain private and shielded from public exposure.

Another key benefit is the legal protection it offers. By transferring assets to an offshore company, you create a legal barrier that makes it significantly more difficult for creditors to access those assets. This added security can help protect your wealth from legal claims or disputes.

Lastly, many offshore jurisdictions, including Anguilla, offer tax neutrality. This means there are no corporate, capital gains, or inheritance taxes to worry about. Combined with a simple and cost-effective setup process, these features make Anguilla an attractive option for safeguarding assets while improving tax efficiency. Offshore companies can be a powerful tool for anyone looking to protect and manage their wealth with greater control.

Why is Anguilla a top choice for offshore asset protection?

Anguilla has earned a reputation as a top destination for offshore asset protection, thanks to its tax-neutral policies and solid legal structure. With no corporate, capital gains, or estate taxes, it offers a practical and cost-efficient option for safeguarding wealth. Its legal system, rooted in Common Law, provides a dependable foundation, ensuring protections like confidentiality for shareholders and directors, alongside the refusal to enforce foreign judgments.

When stacked up against alternatives like the British Virgin Islands (BVI) or Belize, Anguilla stands out with lower costs, quicker incorporation times (often completed in just 24–48 hours), and stronger privacy measures. While BVI is well-established but pricier, and Belize lacks widespread global recognition, Anguilla strikes an ideal balance of affordability, security, and efficiency. This makes it a smart choice for U.S. investors seeking dependable offshore options.

What are the compliance requirements for using an offshore company?

When running an offshore company, compliance is all about staying transparent and following legal and international standards. This means keeping detailed and accurate records, such as certified IDs and proof of address for directors and shareholders. It also involves paying annual fees to keep the company in good standing.

Take Anguilla, for instance. Offshore companies there enjoy strong confidentiality protections and operate under a legal system rooted in English common law. That said, businesses still need to follow local rules, which include maintaining proper records and, when required, filing an Economic Substance (ES) return to show genuine economic activity within the jurisdiction. Staying compliant not only safeguards your assets but also helps you steer clear of legal troubles and meet global tax reporting requirements.