Protecting your wealth is more important than ever. With rising lawsuits, a declining U.S. dollar, and increasing national debt, relying solely on domestic systems exposes your assets to significant risks. An offshore Plan B offers a secure way to safeguard your money from legal battles, economic instability, and privacy vulnerabilities.

Key Takeaways:

- Economic Risks: The U.S. dollar fell over 10% against the DXY index in early 2025, and major banks collapsed in 2023.

- Legal Risks: 5 million lawsuits were filed in the U.S. in 2023, putting assets at constant risk.

- Privacy Concerns: Domestic systems lack privacy, making your wealth an easy target.

What Offshore Planning Provides:

- Asset Protection: Use trusts and LLCs in jurisdictions like the Cook Islands or Nevis to shield assets.

- Diversification: Spread wealth across currencies, countries, and asset types.

- Tax Compliance: Legally reduce tax burdens while meeting U.S. reporting requirements.

By setting up offshore trusts, LLCs, and accounts in stable jurisdictions, you create a legal barrier that protects your wealth from domestic threats. Start planning before issues arise to ensure your financial security.

Why You Need an Offshore Plan B: Understanding the Risks

When all your wealth is tied up in a single domestic portfolio, you’re leaving yourself open to three major risks: economic instability, political and legal threats, and privacy vulnerabilities. Recognizing these risks is a critical first step in creating a more secure and resilient financial plan. That’s where offshoring comes into play – it offers a way to protect your assets from these potential dangers.

Economic Instability

The recent performance of the U.S. dollar paints a concerning picture. In fact, its decline in early 2023 marked the worst six-month stretch since 1973. Add to that the collapse of Silicon Valley Bank, Signature Bank, and First Republic in March 2023, and it’s clear that vulnerabilities exist within the domestic financial system. While the FDIC insures deposits up to $250,000 per account, what happens if your net worth far exceeds that limit? Relying solely on dollar-denominated accounts puts you at risk of losing purchasing power during times of devaluation.

"When all your assets are in one country, you’re completely at the mercy of that country’s laws and economy. If things change for the worse, all your assets are affected at once." – The Nestmann Group

On top of this, the national debt has surpassed $31 trillion. Such staggering debt levels raise concerns about future government actions – higher taxes, currency restrictions, or even asset seizures during economic crises. Keeping all your wealth in U.S. dollars exposes you to what’s called "single-system risk", where a domestic downturn can jeopardize your entire portfolio.

Political and Legal Risks

The U.S. is home to one of the most litigious legal systems in the world, with roughly 5 million new lawsuits filed in 2023 alone. This means your assets – whether they’re in bank accounts, real estate, or investments – are constantly at risk of being frozen, seized, or liquidated through court orders. A single unfavorable legal judgment could wreak havoc on your financial stability.

"Interest in offshore asset protection is cyclical – it comes and goes depending on the political and economic climate… people are really starting to get scared. They’re scared of currency controls, of governmental expropriation of assets, of economic turbulence – and they’re scared of war. They want to put some money in a stable, secure offshore jurisdiction to know that it’s there." – Asher Rubinstein, Partner, Gallet Dreyer & Berkey, LLP

If all your assets are tied to a single legal system, you’re entirely at the mercy of policy changes and regulatory shifts. Diversifying through structuring offshore trusts introduces an extra layer of protection, insulating your wealth from domestic legal challenges.

Privacy and Security Concerns

Privacy is another area where domestic financial systems fall short. In the U.S., your account balances, real estate holdings, and investment details are easily accessible – to creditors, attorneys, and anyone conducting asset searches. This lack of privacy makes you an easy target.

"An offshore bank account gives you back some privacy, making you less of a target in the first place." – The Nestmann Group

Offshore structures can help by creating a legal separation between you and your assets. When set up correctly, these structures transfer ownership to entities in jurisdictions that don’t automatically enforce U.S. court rulings. For example, places like the Cook Islands and Nevis require creditors to re-litigate cases locally, which is both time-consuming and costly. This added hurdle acts as a deterrent, reducing the likelihood of opportunistic lawsuits.

It’s important to note that offshoring isn’t about hiding money – it’s about making your wealth more secure and less vulnerable to threats. By addressing privacy and legal risks through offshore strategies, you can strengthen your financial defenses and reduce exposure to unnecessary risks.

What You Gain from an Offshore Plan B

Setting up an offshore Plan B creates a robust safety net against legal, economic, and strategic risks. Here’s a closer look at how offshore strategies can provide protection, diversification, and tax advantages.

Asset Protection

One of the standout benefits is the ability to shield your assets through legal mechanisms. By transferring assets to offshore trusts and LLCs, you effectively shift legal ownership, making it much harder for domestic creditors to access them.

Certain jurisdictions, like the Cook Islands and Nevis, are particularly strong in this regard. These places don’t recognize U.S. court judgments, adding another layer of defense. For instance, in Nevis, creditors face significant hurdles, including posting a $25,000 bond to file a lawsuit and meeting an incredibly high burden of proof – "actual fraud" beyond a reasonable doubt, which requires over 90% certainty.

"Think of an offshore asset protection trust as a legal fortress for your assets – like the moat around a castle." – The Nestmann Group

Diversification

Relying solely on one country’s financial system can leave you vulnerable to single-country risk. Whether it’s a downturn in the U.S. economy, a weakening dollar, or sudden regulatory changes, having all your assets in one place can be risky. Offshore diversification spreads these risks across multiple jurisdictions, currencies, and legal frameworks.

For example, diversifying into stable currencies like the Swiss Franc or Euro can help protect your wealth. Additionally, investing in tangible assets such as real estate in countries like Portugal, Panama, Mexico, or Costa Rica offers further insulation from the policies of any single government.

Tax Optimization

It’s important to note that offshore structures don’t automatically reduce U.S. income taxes. The U.S. taxes worldwide income, and most offshore trusts are classified as "foreign grantor trusts", meaning all income must be reported on your personal tax return (Form 1040).

"Representations that an offshore trust is an effective means for a U.S. resident beneficiary to avoid U.S. income tax are false and misleading." – Nikki Nelson, Customer Service Manager, Wolters Kluwer

That said, legitimate tax advantages can still be achieved. Offshore strategies often involve tax neutrality for global investments and avoiding double taxation through treaties. Tools like Private Placement Life Insurance (PPLI) allow for tax-deferred or tax-free investment growth while also offering strong creditor protection – though these typically require a minimum investment of $2 million. Additionally, some high-net-worth individuals improve their tax positions by relocating to jurisdictions such as the UAE or Monaco, which have favorable policies on capital gains and inheritance taxes.

Compliance is non-negotiable. You must file an FBAR (FinCEN Form 114) for foreign accounts exceeding $10,000 and a FATCA (Form 8938) for specified foreign financial assets. Non-compliance carries severe penalties, potentially exceeding the value of the assets themselves.

Offshore Asset Protection Tools

When it comes to safeguarding your wealth, layering different offshore tools can create a powerful shield. Each tool serves a specific purpose, and combining them enhances overall protection.

Offshore Trusts

Offshore trusts, especially those set up in the Cook Islands or Nevis, are highly effective in shielding assets from domestic claims. These trusts transfer legal ownership of your assets, putting them beyond the reach of U.S. courts, which have no jurisdiction over foreign trustees.

In the Cook Islands, creditors face the daunting task of re-litigating their case locally – a process that is both costly and lengthy. Nevis adds another layer of difficulty by requiring creditors to post a $100,000 bond just to file a lawsuit. These jurisdictions also allow you to be both the settlor (creator) and beneficiary of the trust, a flexibility not typically available with domestic trusts.

"Properly established offshore trusts are tools that effectively protect your money from creditors and aggressive lawyers." – Asset Protection Planners

Many offshore trusts include "flee clauses", enabling trustees to relocate the trust to another jurisdiction if legal or political challenges arise. Setting up an offshore trust typically costs between $3,000 and $20,000, with annual fees ranging from $1,000 to $10,000. Financial advisors generally recommend these trusts for individuals with a net worth of at least $1,000,000 or a minimum of $250,000 in liquid assets.

Timing is everything. To ensure protection, you must establish the trust before any legal claims arise. Transfers made after a lawsuit is filed are vulnerable to being reversed as fraudulent conveyances.

Offshore Companies

Offshore companies, often structured as LLCs or International Business Companies (IBCs), are designed to protect personal assets from business risks. Jurisdictions like Anguilla and the British Virgin Islands provide strong privacy protections by keeping ownership details out of public records.

These entities limit creditors to charging orders, which only allow them to claim distributions, not seize company assets directly. If no distributions are made, creditors have little recourse. Offshore companies also offer operational flexibility – they can hold bank accounts, own property, and conduct international business while maintaining a high degree of privacy. Pairing offshore companies with trusts further strengthens asset protection.

However, it’s crucial to avoid using foreign entities for U.S. real estate, as this can lead to unnecessary tax complications. For domestic property, private U.S. LLCs remain the preferred option.

Private US LLCs for Layered Protection

Private U.S. LLCs, particularly those formed in states like Wyoming or Nevada, provide strong charging order protections and are easier to manage for domestic operations. Their real strength lies in being combined with offshore structures.

For example, a Cook Islands trust that owns a Wyoming LLC allows you to manage daily operations while transferring legal control offshore. If creditors pursue claims against you, management can temporarily shift to the offshore trustee, forcing creditors to navigate foreign legal systems. This strategy merges the convenience of domestic operations with the security of offshore protection.

"The best asset protection doesn’t rely only on domestic or offshore solutions, but uses both." – The Nestmann Group

U.S. LLCs are particularly effective for holding domestic real estate, avoiding the complexities of offshore tax reporting. Meanwhile, offshore LLCs are better suited for liquid assets and international investments.

Offshore Bank Accounts and Investment Vehicles

Offshore bank accounts provide privacy and diversification, though they lack the legal insulation offered by trusts. By spreading assets across different banking systems, you reduce exposure to risks like economic downturns, banking failures, or sudden regulatory changes.

Switzerland remains a top choice, typically requiring a minimum of $1,000,000 for asset management accounts. Austria offers private banking services with lower minimums, generally between $250,000 and $300,000. Canada is another option, though it often requires legitimate local ties and offers more limited investment opportunities.

Offshore accounts also allow you to hold assets in multiple currencies, such as Swiss Francs, Euros, or even gold – helping to protect against dollar devaluation. For example, in early 2025, the U.S. dollar dropped over 10% against the DXY, marking its worst six-month start to a year since 1973.

For high-net-worth individuals, Private Placement Life Insurance (PPLI) offers tax-deferred or tax-free investment growth along with strong creditor protection. These plans usually require a minimum investment of $2,000,000.

"Offshore asset protection is still viable, but it’s no longer a ‘hidden vault.’ Today, it’s most effective as part of a transparent, legally compliant, and professionally structured estate and asset plan." – James G. Bohm, Partner, Bohm Wildish & Matsen, LLP

Modern offshore banking focuses on legal diversification and stability. When properly structured and reported, these tools provide a legitimate way to protect your wealth from economic uncertainties and legal risks.

Best Jurisdictions for Offshore Asset Protection

When it comes to safeguarding your assets, choosing the right jurisdiction is just as important as selecting the right legal tools. The laws of a jurisdiction play a major role in determining how well your assets are protected. Factors like the legal framework, the challenges creditors face, and how those laws hold up in court all influence the effectiveness of your strategy.

The Cook Islands is often considered the benchmark for offshore asset protection. Its legal framework is particularly strong, requiring creditors to prove fraudulent transfers beyond a reasonable doubt. This is a much tougher standard than the U.S. requirement of a "preponderance of evidence", which only demands 51% certainty.

For those looking for additional safeguards, Nevis offers protections with some unique twists. Creditors must post a $100,000 cash bond before they can even begin legal proceedings against a trust. Additionally, Nevis has eliminated Mareva Injunctions, which are typically used to freeze assets during litigation.

If speed and privacy are priorities, Belize offers a compelling option. Assets transferred into a Belize trust are immediately shielded from fraudulent conveyance claims thanks to its short statute of limitations. However, Belize’s reputation isn’t as well-established, and its banking system lacks the infrastructure of other jurisdictions.

The Bahamas stands out for offering Dynasty Trusts, which can last indefinitely. However, it does allow foreign judgments to be enforced under certain conditions. Meanwhile, the Cayman Islands requires a six-year holding period for trust assets to gain full protection, but its STAR trust structure and strong reputation make it a popular choice.

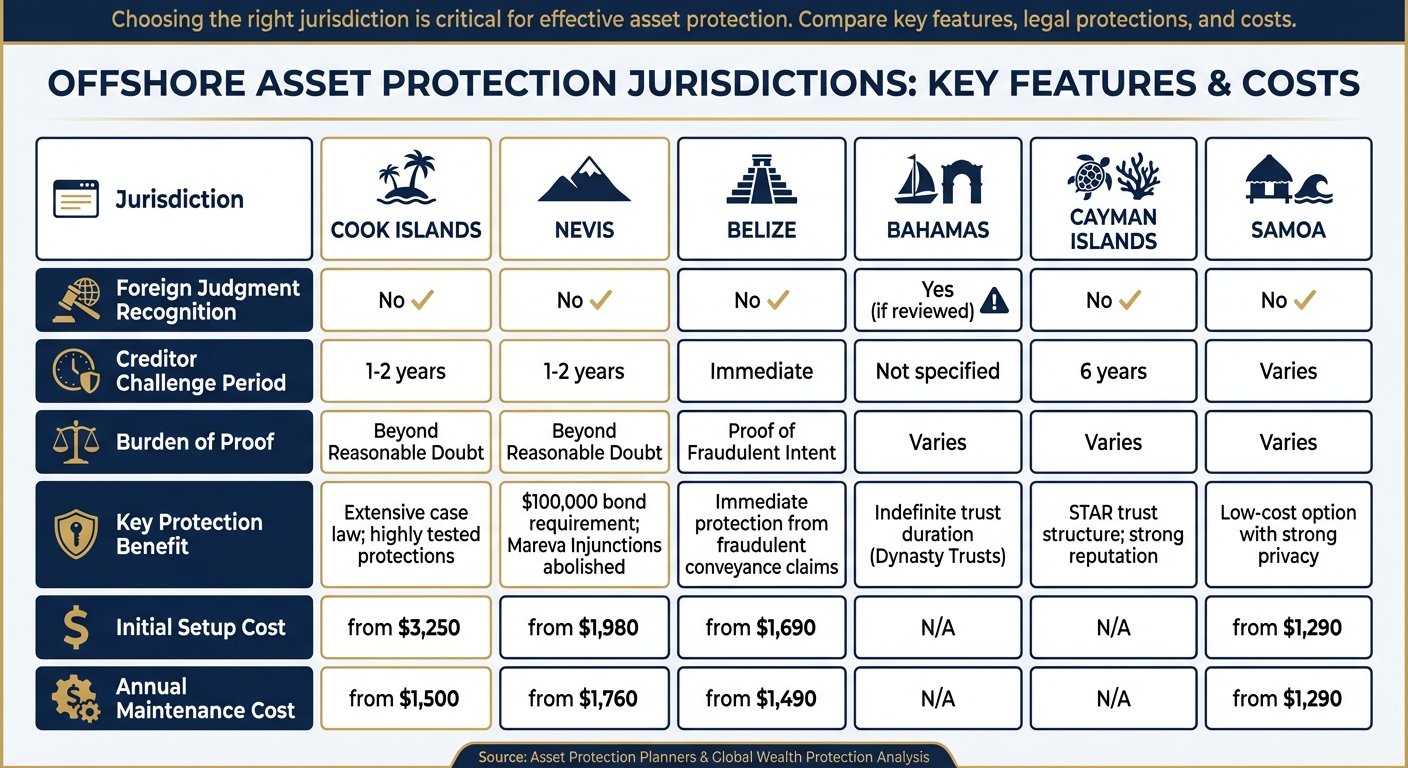

Jurisdiction Comparison Table

| Jurisdiction | Foreign Judgment Recognition | Creditor Challenge Period | Burden of Proof | Key Asset Protection Benefit | Initial Setup Cost (USD) | Annual Maintenance Cost (USD) |

|---|---|---|---|---|---|---|

| Cook Islands | No | 1–2 years | Beyond Reasonable Doubt | Extensive case law; highly tested protections | from $3,250 | from $1,500 |

| Nevis | No | 1–2 years | Beyond Reasonable Doubt | $100,000 bond requirement; Mareva Injunctions abolished | from $1,980 | from $1,760 |

| Belize | No | Immediate | Proof of Fraudulent Intent | Immediate protection from fraudulent conveyance claims | from $1,690 | from $1,490 |

| Bahamas | Yes (if reviewed) | Not specified | Varies | Indefinite trust duration (Dynasty Trusts) | N/A | N/A |

| Cayman Islands | No | 6 years | Varies | STAR trust structure; strong reputation | N/A | N/A |

| Samoa | No | Varies | Varies | Low-cost option with strong privacy | from $1,290 | from $1,290 |

"The best offshore trust jurisdictions aren’t new to asset protection. Select a jurisdiction that has allowed offshore trusts for many decades. This ensures that the laws governing trust protections have been tested in actual court settings." – Asset Protection Planners

Given the high rate of lawsuits in the U.S., selecting a well-established offshore jurisdiction can make all the difference. The specific features and costs associated with each jurisdiction directly influence the level of protection you can achieve.

sbb-itb-39d39a6

How to Set Up Your Offshore Plan B with Global Wealth Protection

Creating an offshore Plan B isn’t something you can just jump into – it requires thoughtful planning, expert advice, and a clear understanding of your assets. Here’s how Global Wealth Protection guides you through the process to build a reliable offshore strategy that complements your overall asset protection plan.

Step 1: Assess Your Needs

The first step is figuring out what you’re protecting and why. Start by listing all your assets, organized by country. This includes everything from property deeds and bank statements to business registrations and investment accounts.

Next, you need to pinpoint your specific risks. For instance, a surgeon concerned about malpractice claims will need a different setup than a real estate developer worried about liability tied to projects. By clearly identifying your risks – whether they’re economic or legal – you can determine the level of protection required.

It’s also essential to evaluate your net worth and ensure you keep enough liquid capital accessible within the U.S. Offshore trusts are typically best suited for individuals with at least $1,000,000 in assets.

Step 2: Choose the Right Jurisdiction

Selecting the right jurisdiction is critical, and Global Wealth Protection carefully examines factors like political stability, asset protection laws, recognition of foreign court rulings, and how well the jurisdiction aligns with your asset types.

The legal framework of the jurisdiction plays a huge role. For example, common law jurisdictions such as the Cook Islands operate similarly to the U.S. legal system, while civil law jurisdictions like Switzerland manage trusts and asset titling differently. These distinctions can significantly impact how your assets are protected and managed. This analysis builds on your risk assessment, ensuring your strategy fits within a proven legal framework.

"The best plan is to set up protection years before any trouble. It’s like buying car insurance. You can’t get it after you’ve had an accident." – The Nestmann Group

Timing is everything. If you transfer assets after a lawsuit has already begun, those transfers could be reversed as "fraudulent conveyances". Global Wealth Protection ensures your structures are established proactively, standing up to legal scrutiny.

Step 3: Structure and Execute Your Plan

Once you’ve chosen the right jurisdiction, it’s time to implement your plan. This involves selecting the best tools for your needs, such as an Offshore Asset Protection Trust (OAPT) for maximum security, an Offshore LLC for day-to-day control, or Private Placement Life Insurance (PPLI) for tax-deferred growth.

Global Wealth Protection takes care of the intricate details, from appointing independent, non-U.S. trustees or service providers to legally transferring ownership of your assets to the new offshore entity. They also assist with setting up foreign custodial accounts. For instance, Swiss banks often require a minimum of $1,000,000 for asset management accounts, while Austrian private banks may accept accounts starting at $250,000 to $300,000. By completing these steps, you establish a solid offshore defense as part of a broader asset protection strategy.

Staying compliant with regulations is another crucial aspect. U.S. citizens must file FinCEN Form 114 (FBAR) if their foreign accounts exceed $10,000 at any point during the year, along with IRS Forms 3520/3520-A for foreign trusts. Global Wealth Protection ensures that all reporting requirements are met, helping you avoid penalties that could exceed the value of the account.

"In my 15+ years advising clients on asset protection, the most durable plans combine domestic protection (insurance, estate planning, entity structure) with limited, carefully documented offshore elements only after full legal and tax review." – Joel Baretto, CFP®

Many clients use a layered approach to asset protection, combining domestic measures like umbrella insurance with offshore strategies. A popular structure includes a Nevada LLC owned by a Cook Islands trust, which balances U.S. compliance with strong international protection. This multi-jurisdictional setup makes it much harder – and more expensive – for creditors to pursue your assets, as they would need to navigate multiple legal systems.

Risks and Compliance Requirements

Offshore structures can provide robust asset protection, but they come with strict compliance obligations. For U.S. citizens, all worldwide income is taxable, no matter where funds are held. Simply moving money offshore doesn’t reduce your tax liability – it just changes where the funds are located.

Regulatory and Tax Compliance

The U.S. Internal Revenue Service (IRS) enforces rigorous reporting rules for offshore accounts. If the total value of your foreign accounts exceeds $10,000, you must electronically file FinCEN Form 114 (FBAR). Additionally, Form 8938 (under FATCA) is required for specified foreign assets. Many foreign banks now directly report U.S. account data to the IRS, making non-compliance increasingly risky. In 2023 alone, authorities exchanged data on 123 million offshore accounts worth over €12 trillion.

Managing foreign trusts and corporations adds another layer of complexity. For foreign trusts, Forms 3520 and 3520-A are mandatory, while certain foreign corporations require Form 5471. Non-compliance with these forms can result in penalties that may even exceed the value of the account.

"Legitimate offshore planning is lawful; hiding assets or choosing not to report is not. Full reporting and transparency are essential." – FinHelp.io

Attempting to transfer assets after legal claims have been made against them can also backfire, as courts may classify such actions as fraudulent conveyance. These rules underscore the importance of ensuring full compliance – not just to meet legal obligations but also to avoid ethical and reputational pitfalls.

Ethical and Reputational Risks

Adhering to ethical standards is just as important as meeting legal requirements. Using offshore accounts for tax evasion or hiding assets from legitimate creditors can lead to severe reputational damage and even criminal charges. The days of secret offshore accounts are over. Global transparency initiatives like the Common Reporting Standard (CRS) and FATCA have made secrecy nearly impossible, pushing the focus toward legal and transparent structures.

To minimize operational risks, it’s crucial to work with trustworthy, regulated trustees and financial institutions in stable jurisdictions. Political instability, banking collapses, or sudden regulatory changes in certain regions could restrict access to your funds for extended periods. By choosing jurisdictions with strong legal frameworks and reliable governance, you can protect your assets within the bounds of the law. Global Wealth Protection emphasizes selecting locations with a proven track record, ensuring your wealth is safeguarded by legal protections rather than secrecy.

Conclusion: Securing Your Financial Future with an Offshore Plan B

With over 5 million lawsuits filed in the U.S. in 2023 and a national debt exceeding $31 trillion, safeguarding your wealth has become more critical than ever. An offshore Plan B isn’t about secrecy or tax evasion – it’s about creating strong, legal protections for your assets.

"Think of it like having multiple locks on your door instead of just one. By placing assets in carefully chosen foreign locations with favorable laws, you make it much harder for others to get to your money." – The Nestmann Group

Timing is everything. Establishing offshore structures well in advance of any legal disputes helps protect against fraudulent conveyance claims and provides a significant deterrent to aggressive lawsuits. Combine this with asset diversification, currency hedging, and enhanced privacy, and you’ve built a solid financial shield.

These strategies form the backbone of a compliant and expertly managed offshore plan. Partnering with professionals like Global Wealth Protection ensures your plan is both effective and fully compliant. From selecting the best jurisdiction to managing operational details, expert guidance simplifies complex reporting requirements and maximizes asset protection. Whether it’s a Cook Islands trust, a Nevis LLC, or a layered structure, the goal is clear: maintain control, enhance security, and achieve peace of mind.

Don’t wait – take action now to establish your offshore Plan B before challenges arise. Your financial future depends on it.

FAQs

What should I know about the legal aspects of setting up an offshore trust?

Setting up an offshore trust means establishing a legal arrangement that operates under the laws of a foreign jurisdiction rather than U.S. law. These trusts often come with added features like a trust protector, whose role is to oversee the trustee and ensure the settlor’s interests are upheld. Additionally, they may include provisions to relocate or safeguard assets under specific legal circumstances.

However, for U.S. citizens, offshore trusts do not eliminate tax responsibilities or reporting obligations. Both settlors and beneficiaries are required to adhere to regulations such as filing FBAR (Foreign Bank Account Report) and FATCA (Foreign Account Tax Compliance Act) disclosures. Ignoring these requirements can lead to steep penalties. Furthermore, U.S. courts can invoke fraudulent-transfer laws to reverse a trust if assets were shifted to avoid creditors.

While offshore trusts can offer extra protection by requiring legal actions to take place in foreign courts, this can also make disputes more complicated and expensive. To ensure the trust is both effective and compliant, meticulous planning and adherence to legal requirements are crucial.

How does offshore asset protection enhance financial privacy?

Offshore asset protection offers a powerful way to safeguard financial privacy by establishing a legal buffer between your assets and external threats, such as creditors or lawsuits. Jurisdictions like the Cook Islands, Nevis, and Belize are well-known for their stringent confidentiality laws. These regions often avoid maintaining public registries for trust beneficiaries or company owners, making it much more challenging for others to trace or access your financial information.

Structures like offshore trusts, LLCs, or foundations also play a key role in separating personal identity from asset ownership. This separation minimizes the risk of lawsuits targeting individuals with significant wealth and helps shield against risks like data breaches or identity theft. Many offshore jurisdictions further enhance privacy with strict banking secrecy laws, ensuring your financial dealings remain discreet while staying compliant with U.S. reporting obligations such as FBAR and FATCA. Together, these measures provide a sense of security and give you greater control over your financial future.

What are the risks of failing to meet offshore reporting requirements?

Failing to meet offshore reporting requirements can lead to serious financial and legal trouble for U.S. individuals. Penalties can include hefty civil fines, criminal charges, and other significant financial repercussions. On top of that, neglecting obligations like FBAR (Report of Foreign Bank and Financial Accounts) or FATCA (Foreign Account Tax Compliance Act) filings might result in limited access to your foreign accounts – or even having those accounts closed.

To steer clear of these issues, it’s crucial to understand your reporting duties and ensure all filings are accurate and submitted on time. Staying compliant not only protects your finances but also ensures continued access to international banking and investment opportunities.