If you’re looking to protect your assets, offshore trusts and private interest foundations can offer strong legal safeguards, privacy, and tax advantages. The five best jurisdictions for asset protection include Anguilla, Nevis, the Cayman Islands, the British Virgin Islands (BVI), and the Cook Islands. Each has unique features, like rejecting foreign judgments, short statutes of limitations for claims, and strict privacy laws. Here’s a quick breakdown:

- Anguilla: Rejects foreign judgments, offers 0% tax rates, and ensures strong privacy with closed registers.

- Nevis: Requires creditors to post a $100,000 bond before lawsuits, has a 1–2 year statute of limitations, and enforces strict confidentiality.

- Cayman Islands: Known for STAR trusts, excludes foreign laws, and allows indefinite trust durations.

- BVI: Offers VISTA trusts for business control, exempts trusts from registration, and has a 360-year trust lifespan.

- Cook Islands: Pioneers in asset protection trusts, requires claims to be litigated locally, and enforces a high burden of proof for creditors.

Quick Comparison

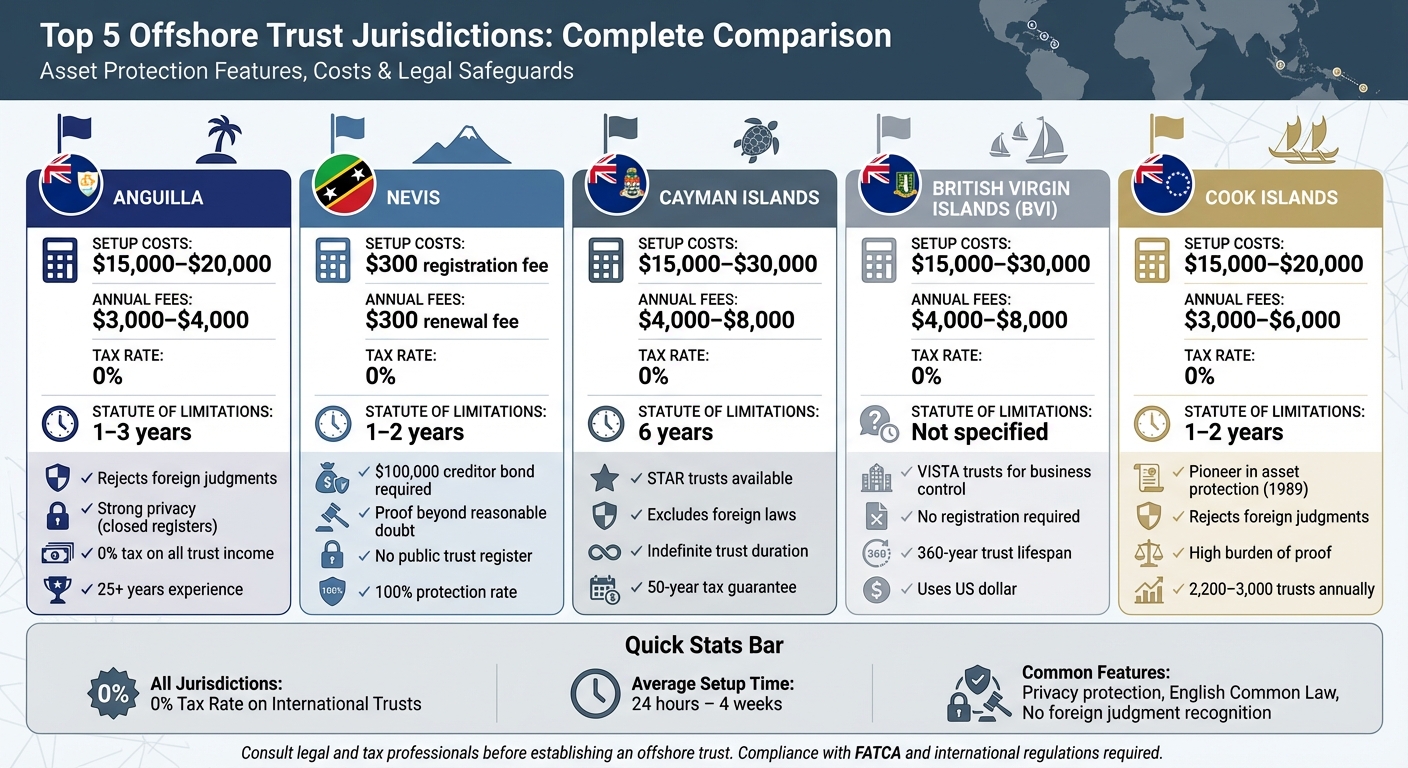

| Jurisdiction | Key Features | Setup Costs | Annual Fees | Tax Rate | Statute of Limitations |

|---|---|---|---|---|---|

| Anguilla | Rejects foreign judgments, strong privacy, 0% taxes | $15,000–$20,000 | $3,000–$4,000 | 0% | 1–3 years |

| Nevis | $100,000 bond for lawsuits, high burden of proof, short limitations | $300 registration fee | $300 renewal fee | 0% | 1–2 years |

| Cayman Islands | STAR trusts, excludes foreign laws, indefinite trust duration | $15,000–$30,000 | $4,000–$8,000 | 0% | 6 years |

| BVI | VISTA trusts, no registration, 360-year trust lifespan | $15,000–$30,000 | $4,000–$8,000 | 0% | Not specified |

| Cook Islands | Rejects foreign judgments, high privacy, 2-year claim limit | $15,000–$20,000 | $3,000–$6,000 | 0% | 1–2 years |

Each jurisdiction offers strong legal frameworks to safeguard assets, but the best choice depends on your specific needs. Consult legal and tax professionals to ensure compliance with international laws and regulations.

1. Anguilla

Anguilla stands out as a top choice for offshore asset protection. Thanks to the International Trust Act of 2007, assets placed in Anguillian trusts are shielded from forced heirship claims and insolvency. Additionally, its laws explicitly reject foreign judgments, meaning creditors must take legal action under Anguillan law to make any claims.

Strength of Asset Protection Laws

Built on the principles of English Common Law, Anguilla’s legal system relies on established precedents and solid statutory protections to counter creditor disputes. The jurisdiction also boasts a 0% tax rate on international trusts – no income, capital gains, inheritance, or gift taxes apply. This ensures that the full value of your assets remains intact.

The Anguilla Financial Services Commission (AFSC) regulates all trust companies, ensuring compliance with global standards. With over 25 years of experience in providing offshore solutions, Anguilla has earned a strong reputation for reliability.

Privacy and Confidentiality Provisions

Anguilla excels in safeguarding privacy. Its closed registers and limited public access to trust documents ensure confidentiality. Unlike many jurisdictions in the United States, Anguilla does not require public disclosure of trust beneficiaries or the directors and shareholders of related International Business Companies (IBCs). This balance of privacy and adherence to international regulations makes trust formation both secure and efficient.

Ease of Trust Formation and Ongoing Administration

Setting up a trust in Anguilla is a straightforward process. It involves appointing a licensed local trustee and registered agent, drafting a detailed trust deed, and conducting regular reviews to stay compliant and aligned with personal circumstances.

"The trustee plays an important role in protecting your assets and managing the trust’s operations." – First Anguilla Trust Company Limited

Periodic reviews are especially important after major life events like marriage, divorce, or the birth of a child. These updates help ensure the trust continues to meet your evolving needs.

sbb-itb-39d39a6

2. Nevis

Nevis stands out as another premier destination for asset protection, offering a unique set of features that make it a stronghold for safeguarding wealth. One of its key deterrents against frivolous lawsuits is the requirement for creditors to post a US$100,000 bond with the Nevis Ministry of Finance before initiating legal action against a trust. This alone discourages many from pursuing baseless claims.

Strength of Asset Protection Laws

Nevis’s asset protection laws are designed to create significant hurdles for creditors. For instance, creditors must prove fraudulent conveyance beyond a reasonable doubt – a much higher standard than in many other jurisdictions. Adding to this, Nevis courts do not recognize foreign judgments. Any claim must be re-litigated locally, under Nevis’s legal system, using local attorneys who cannot charge contingency fees. The statute of limitations is also notably short: just one year from the settlement date or two years from the cause of action.

Nevis further strengthens its defenses by banning Mareva injunctions against international trusts. If a foreign court attempts to compel actions that conflict with a trust’s interests, Nevis law automatically removes and replaces the trustee.

"Analysis of court cases shows Nevis trusts have never been successfully penetrated by U.S. courts when properly established outside the fraudulent conveyance period: a 100% protection rate that exceeds all competing jurisdictions." – NTL Trust

Privacy and Confidentiality Provisions

Privacy is a cornerstone of Nevis’s trust framework. The jurisdiction does not maintain a public register of trust settlors, beneficiaries, or protectors. Non-criminal judicial proceedings involving international trusts are conducted privately, with publication of details prohibited unless explicitly authorized by a court.

Banking secrecy is rigorously enforced, requiring a specific court order for authorities to access financial information. The Confidential Relationships Act takes this a step further, making it a criminal offense to disclose any professional or business information related to Nevis trusts. Moreover, trust records can be stored outside Nevis, with no obligation for filing annual accounts or public disclosures.

"Nevis is a byword for discretion, and has established itself as a discreet hideaway for the rich and famous." – TrustNevis.com

These robust privacy measures are complemented by a straightforward trust formation process.

Ease of Trust Formation and Ongoing Administration

Setting up a trust in Nevis is quick and efficient, typically taking just 24–72 hours after submitting the required documents. The government charges a US$300 registration fee, with an annual renewal fee of US$300 and an optional certificate of good standing available for US$50.

To qualify under the International Exempt Trust Ordinance, a trust must have at least one trustee (which can be a Nevis corporation), and both the settlor and beneficiaries must reside outside Nevis. Many settlors choose to fund their trusts by having them own a Nevis LLC, which allows the settlor limited managerial control until a legal challenge arises.

Reputation and Stability of the Jurisdiction

Nevis’s reputation as a leader in offshore asset protection is well-established, with over 30 years of experience in the field. Its International Exempt Trust Ordinance, introduced in 1994, remains a cornerstone of its legal framework. Despite its strict privacy laws, Nevis is recognized as a cooperative jurisdiction for tax purposes by the European Union. Adding to its appeal, Nevis imposes a 0% tax rate on international trusts, exempting them from income, capital gains, inheritance, or gift taxes.

With its blend of robust legal protections, privacy safeguards, and efficient administration, Nevis continues to be a top choice for those seeking reliable asset protection.

3. Cayman Islands

After exploring Anguilla and Nevis, the Cayman Islands stands out as a premier destination for offshore trusts, offering a mix of legal reliability, privacy, and efficient administration. With decades of legal evolution and the Privy Council as its ultimate appellate authority, the Cayman Islands has firmly established itself in this space.

Strength of Asset Protection Laws

The Cayman Islands’ asset protection laws are built on solid legal principles. Cayman law exclusively governs all trust-related matters, explicitly rejecting the application of foreign laws. This means foreign judgments that conflict with local statutes – such as those involving forced heirship or jurisdictions that don’t recognize trusts – cannot be enforced.

"The choice of Cayman law as the governing law is conclusive and any questions arising in connection with the trust will be determined according to Cayman law and the application of foreign law is excluded." – Ogier

A key feature is that a trust established by a solvent settlor becomes protected from creditor claims after six years. The Special Trusts (Alternative Regime) (STAR trusts) offer another layer of security, allowing settlors to deny beneficiaries access to trust information entirely, with enforcement rights assigned to a designated enforcer. Moreover, firewall provisions ensure trustees can legally refuse foreign court orders to repatriate trust assets, provided the trust includes a properly structured duress clause.

These legal protections not only strengthen asset security but also pave the way for robust privacy measures.

Privacy and Confidentiality Provisions

Cayman trusts are not required to be registered with the government, keeping their existence and details private. STAR trusts take this a step further by allowing settlors to exclude beneficiaries from receiving any information about the trust or its management.

"Flexibility and confidentiality are the principal advantages which a trust has over other legal forms designed to hold, preserve and transmit wealth." – Anthony Partridge, Partner, Ogier

Enhanced confidentiality is supported by strict privacy laws that prevent public access to trust records. At the same time, the Cayman Islands complies with global standards like FATCA and the Common Reporting Standard, ensuring financial data is shared with tax authorities such as the IRS when required.

Ease of Trust Formation and Ongoing Administration

Setting up a trust in the Cayman Islands is straightforward. It involves executing a trust instrument and transferring initial assets. The Cayman Islands Monetary Authority oversees the trust industry under the Banks and Trust Companies Act, requiring professional trustees to be licensed and subject to regular monitoring.

Initial setup costs generally range from $15,000 to $30,000, with annual maintenance fees between $4,000 and $8,000. For STAR trusts, at least one trustee must hold an unrestricted trust company license in the Cayman Islands.

Reputation and Stability of the Jurisdiction

As a well-established offshore financial hub, the Cayman Islands boasts extensive expertise in trust management. Many trust companies in the region are subsidiaries of prominent Canadian, British, and Swiss banks. The government also offers a written 50-year tax undertaking, guaranteeing that no taxes will be imposed on registered trusts – a term that can typically be renewed.

The jurisdiction imposes no corporate, capital gains, income, profits, or withholding taxes. Cayman trusts can last up to 150 years, and STAR trusts may exist indefinitely. This combination of tax neutrality, advanced legal frameworks, and institutional stability makes the Cayman Islands a favored choice for high-net-worth individuals seeking dependable asset protection.

4. British Virgin Islands

Building on the strong asset protection frameworks seen in places like Anguilla, Nevis, and the Cayman Islands, the British Virgin Islands (BVI) offers a blend of flexibility and control that appeals to many. Known for its progressive trust laws and operational ease, the BVI stands out as a top destination for offshore trusts. The Virgin Islands Special Trusts Act (VISTA) is a key feature, allowing trustees to hold shares in BVI companies while letting settlors or appointed directors retain control over business operations and safeguard assets [31,32].

Strength of Asset Protection Laws

The BVI’s legal framework provides robust protection for trust assets. Article 83 of the Trustee Act ensures that foreign heirship rules don’t interfere, allowing asset distribution strictly according to the trust deed. Settlors can also retain significant powers – like revoking the trust, appointing trustees, or directing investments – without affecting the trust’s validity. For those seeking even more control, a Private Trust Company can be established. As a British Overseas Territory operating under English Common Law, the BVI enjoys legal stability, access to a specialized Commercial Court, and oversight by the Privy Council as its highest appellate body. Additionally, BVI courts require foreign judgments to be re-litigated locally, adding another layer of protection. The VISTA framework enhances these protections by aligning with the traditional trust models discussed earlier.

Privacy and Confidentiality Provisions

Confidentiality is a cornerstone of BVI trusts. They are not subject to registration under the Registration and Records Act, meaning there’s no public record of settlors or beneficiaries. With no mandatory reporting or filing requirements, privacy is maximized. In addition, VISTA ensures that trustees are not involved in the day-to-day management of businesses, leaving control in the hands of directors.

"Trusts in the British Virgin Islands are exempt from registration under the Registration and Records Act and trustees are exempt from any reporting and filing requirements, ensuring a high degree of confidentiality." – Ogier

Ease of Trust Formation and Ongoing Administration

Setting up a BVI trust is straightforward. It can be established through a Settlement of Trust (involving both the settlor and trustee) or a Declaration of Trust (initiated solely by the trustee). Once the initial property is transferred, the trust becomes effective. There’s no requirement for a BVI-resident trustee, and the lack of registration or filing obligations keeps administration costs low. Typical costs include a one-time trust duty of US $200, setup fees ranging from US $15,000 to US $30,000, and annual maintenance fees between US $4,000 and US $8,000. Under VISTA, trustees are not burdened with daily management tasks, leaving operational control with company directors and requiring only minimal trustee involvement [12,31,32].

Reputation and Stability of the Jurisdiction

The BVI has earned its place as a leading offshore financial hub, thanks to its tax-neutral environment. Trusts with nonresident beneficiaries are exempt from gift, estate, income, and capital gains taxes, provided they don’t involve local real estate or businesses operating within the territory. Trusts can last up to 360 years, making them ideal for preserving wealth across generations. Charitable and purpose trusts can even be perpetual. The use of the US dollar as the official currency adds an extra layer of financial security for American settlors.

"The BVI has a sophisticated professional trust sector, modern trusts legislation and an effective judicial system." – Carey Olsen

With its advanced legal framework, strong asset protections, and simple administrative processes, the BVI is an appealing choice for families looking to secure their wealth while maintaining control over their businesses for generations to come.

5. Cook Islands

The Cook Islands stands out as a top choice for offshore asset protection, thanks to its pioneering asset protection trust laws introduced in 1989. With over three decades of legal experience, the jurisdiction has gained a strong reputation for safeguarding assets. Each year, around 2,200 to 3,000 new trusts are established here, reflecting consistent trust in its legal framework. Its combination of strong legal protections and efficient trust management makes it a preferred destination.

Strength of Asset Protection Laws

The Cook Islands has built significant legal defenses against creditor claims. Courts in the jurisdiction do not honor foreign judgments, requiring creditors to present their case locally – a process that is both expensive and challenging. Creditors also face a high burden of proof, needing to demonstrate fraudulent intent beyond a reasonable doubt.

The jurisdiction enforces a short statute of limitations, barring claims if they are not filed within two years of the creditor’s cause of action or within one year of the asset transfer. Trustees are also protected under an "impossibility to act" standard, allowing them to disregard U.S. court orders issued under coercion. Additionally, the Cook Islands does not recognize foreign bankruptcy rulings, ensuring that trust assets remain unaffected by such proceedings.

"A Cook Islands Trust provides a layer of insurance for something that cannot be insured – the unforeseeable." – Jennifer A. Davis, Chief Executive, Cook Islands Financial Services Development Authority

Privacy and Confidentiality Provisions

The Cook Islands takes privacy seriously. Trust deeds and information about beneficial owners are not made public, and strict laws prevent unauthorized disclosures. Breaching these privacy rules can result in fines exceeding $100,000. The jurisdiction’s association with New Zealand, a country ranked #1 on the Global Corruption Perceptions Index, further enhances its credibility in maintaining confidentiality.

Ease of Trust Formation and Ongoing Administration

Setting up a trust in the Cook Islands is a straightforward process. It involves four steps: choosing a licensed trust company, completing due diligence, signing the trust deed, and funding the trust. Once all documents are in place, the process typically takes two to four weeks. Many individuals establish a Cook Islands LLC owned by the trust, giving them control until any legal challenges arise.

Costs for setting up a trust range between $15,000 and $20,000, with annual maintenance fees of $3,000 to $6,000. Trustee fees are generally between $3,700 and $4,000 per year. An essential requirement is signing an "Affidavit of Solvency", which confirms that transferring assets will not leave the settlor insolvent – a key step in countering fraudulent transfer claims. U.S. residents must also file IRS Forms 3520 and 3520-A annually. However, the Cook Islands imposes no local income, capital gains, or estate taxes on these trusts.

Reputation and Stability of the Jurisdiction

The Cook Islands has developed a robust and reliable asset protection system, comparable to jurisdictions like Anguilla, Nevis, and the Cayman Islands. With over 30 years of legal precedents, its framework is well-defined and time-tested. As a self-governing territory in free association with New Zealand, the Cook Islands benefits from political stability while maintaining its own specialized trust laws. The Financial Supervisory Commission oversees all trustee companies, ensuring they meet stringent licensing requirements.

Conclusion

Offshore trusts offer a practical way to protect assets from creditor claims, avoid probate, and maintain tax neutrality. Once assets are transferred, the trustee assumes legal ownership, keeping your financial details private and allowing assets to pass directly to beneficiaries without court interference.

Among the various options, Anguilla stands out for its efficiency and strong legal safeguards. Trusts in Anguilla can be established in under 24 hours, benefit from a strict three-year statute of limitations, and are shielded from foreign judgments. Creditors face a high burden of proof, needing to demonstrate insolvency at the time of the asset transfer to challenge the trust.

For added flexibility, combining an Anguilla trust with an Anguilla LLC lets you retain management control over your assets while the trustee provides protection in legal disputes. On top of that, Anguilla’s lack of income, capital gains, and inheritance taxes makes it an attractive choice for long-term wealth preservation.

Before setting up an offshore trust, consult legal and tax professionals to ensure compliance with international standards like FATCA and the Common Reporting Standard. You might also consider appointing a protector to oversee the trustee and ensure the trust aligns with your goals. Acting early is key – transfers made under legal scrutiny may be considered fraudulent and could undermine the trust’s effectiveness.

FAQs

What sets the top offshore trust jurisdictions apart for asset protection?

Offshore trust jurisdictions vary significantly in areas like creditor protection, privacy regulations, tax structures, cost of setup, and political stability. Take Anguilla, for instance – it’s a popular choice thanks to its strong asset protection laws, no local taxes, and relatively low setup costs, typically between $3,000 and $5,000. On the other hand, the Cook Islands come with higher setup costs, starting at $10,000, but they’re renowned for their exceptional creditor protection, featuring a short claim period and stringent proof requirements.

Nevis is another standout option, offering a mix of solid privacy measures and moderate setup costs. Belize appeals to those seeking budget-friendly solutions, as it’s known for its affordable setup and its refusal to recognize most foreign court rulings. The Cayman Islands, while on the pricier side, are highly regarded for their political stability, flexible trust laws, and the absence of direct taxes. Each jurisdiction brings its own set of benefits, giving U.S. investors the flexibility to align their choice with their asset protection needs and financial objectives.

How do offshore trusts protect your privacy and keep your assets confidential?

Offshore trusts are powerful legal tools designed to protect your identity and keep your asset details private. For instance, jurisdictions like Anguilla enforce strict privacy laws, ensuring that trust registers stay confidential. Trustees in these regions are legally bound to maintain the privacy of all information related to the settlor and beneficiaries, creating a secure environment for U.S. clients.

What’s more, many offshore jurisdictions, including Anguilla, don’t acknowledge foreign court judgments and impose tight deadlines for creditors to contest a trust. These legal safeguards, coupled with the stringent fiduciary responsibilities placed on trustees, make it exceptionally challenging for anyone to access your trust details without a rare court order. Altogether, these features offer a strong layer of privacy and protection for your assets.

What should I look for when selecting the best offshore trust jurisdiction?

When selecting an offshore trust jurisdiction, focusing on strong asset-protection laws is crucial. Look for jurisdictions that limit the recognition of foreign judgments, impose short timeframes for claims (often just 1–3 years), and require creditors to meet a high burden of proof. These measures can safeguard your assets from legal threats and make it challenging for U.S. courts to enforce judgments internationally.

The jurisdiction’s tax environment is another critical consideration. Opt for tax-neutral locations – places without income, capital gains, inheritance, or gift taxes for non-residents. These environments help preserve wealth while avoiding unnecessary U.S. reporting complications. Privacy also plays a significant role. Jurisdictions like Anguilla, which follow English common law and don’t publicly register trusts, provide a blend of confidentiality and legal familiarity for U.S. investors.

Lastly, don’t overlook practical factors such as setup and maintenance costs, political and economic stability, and access to skilled trustees and legal experts. Establishing a basic trust typically costs between $4,000 and $8,000, with additional annual fees. By weighing these elements carefully, you can choose a jurisdiction that supports both your asset-protection and wealth-preservation objectives.