by Mike Cobb, Hemispheres Publishing

For international travel to which the Montreal Convention applies (including domestic portions of international travel), United’s liability is limited to 1,131 SDR (Special Drawing Rights) per customer for checked and unchecked baggage.

That’s right. United Airlines uses SDR as part of its normal and customary business practices. Now technically, only a sovereign country can acquire and hold SDR (right now) so what United Airlines is doing is quoting SDR as a measure of value.

But it gets better. In 2011 there was a serious proposal to price oil, gold and other hard assets in SDR. This would, in one fell swoop, replace the US Dollar as the world reserve currency. As long as SDR are country to country, they represent a sovereign reserve. But when lost luggage is priced in SDR, and maybe oil too, this sounds like a new form of money.

And now, SDR have been proposed by the International Monetary Fund (IMF) as a possible global currency. In their own words: “In the even longer run, if there were political willingness to do so, these securities could constitute an embryo of global currency.” And, “(g)eneralized use of SDR as a unit of account for global trade invoicing would also create demand for SDR- denominated assets as both the public and private sectors develop exposure to SDR- denominated flows.”

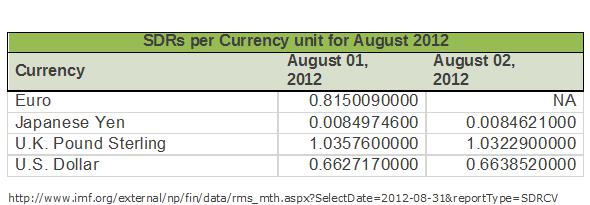

Where did all this start? The International Monetary Fund (IMF) invented the Special Drawing Rights (SDR) in 1969 to function as an “international reserve asset.” The SDR were created as part of the Bretton Woods Agreement, which operated on a gold/US dollar standard until 1973. Initially the SDR was tied to gold, but with Nixon’s breaking of the gold standard, the value basis was switched to a basket of currencies and has remained such since. Exchange rates for the SDR to the Euro, Yen, Pound and Dollar in August 2012 are as follows:

The SDR has now taken on a life of its own. The IMF now also sees the SDR as a means to create liquidity in the system. In 2009, when banks in the US and around the globe were teetering on the brink of collapse, the IMF “printed” about 180 billion new SDR to inject into the financial system. To help mitigate the effects of the financial crisis, a third general SDR allocation of SDR 161.2 billion was made on August 28, 2009.

Separately, the Fourth Amendment to the Articles of Agreement became effective August 10, 2009 and provided for a special one-time allocation of SDR 21.5 billion.

Money Magazine’s online edition reported in 2011, that “Dominique Strauss-Kahn, managing director of the IMF, acknowledged there are some ‘technical hurdles’ involved with SDR, but he believes they could help correct global imbalances and shore up the global financial system.” He went on to say, “Over time, there may also be a role for the SDR to contribute to a more stable international monetary system.” Recent proposals have been floated to increase the amount by another couple trillion more.

The IMF and member countries see the SDR as a powerful way to keep the financial system stabilized, but that stability rests on a house of cards created by the IMF and each country’s ability to print more money as needed. The US dollar still remains strong even with the trillions injected in various stimulus packages in the past decade. The main reason is that even though huge sums of new dollars entered the system, the velocity of those dollars is slow. Most of it has gone into propping up the capital reserves of regulated banks and financial institutions. If and when these dollars begin to circulate in the economy, the effect will be felt as inflation to the consumer.

In the last decade, the cost of commodities in dollar terms has sored. The HIRE act has wittingly or unwittingly made the US dollar difficult to utilize as an international means of settlement. In November of 2010, China and Russia stopped requiring companies to trade in dollars and settled accounts in Rubles and Yuan. What company would want to risk the seizure of 30% of their transfer just for the privilege of trading in dollars? As more and more companies decide to use their own currencies, the strength of the dollar is bound to fall. The SDR is the logical replacement and is being positioned to take its place.

China is running around the globe buying mining companies, oil production, and other hard assets with their huge stockpile of US dollars. They are effectively dumping dollars for commodities, or actually even better, the source and production of commodities. Talk about a long-term multigenerational play.

HIRE Act and Dollar Depreciation

Match this up with the draconian provisions of the HIRE Act, a strong form of US currency controls and, “The idea was that an off-market reserve pool managed by the Fund would provide an opportunity for large reserve holders to diversify their reserve assets while limiting the risk of market disruption, particularly a sharp depreciation of the dollar2.”

Where this will end up is anyone’s guess, but the push for a new currency that takes the US dollar out of its current role as the world reserve currency is not happening willy nilly. There is a strategic focus behind the change and the better we understand what is happening and why, the better we can protect ourselves and the value of our assets.

A group of concerned experts and panelists will be gathering in Belize early next month to discuss this and other important issues. The round robin brainstorming sessions are an excellent opportunity to hear what is on everyone’s mind at a level rarely put into writing. For more information on how you can participate in these discussions click here and receive an invitation.