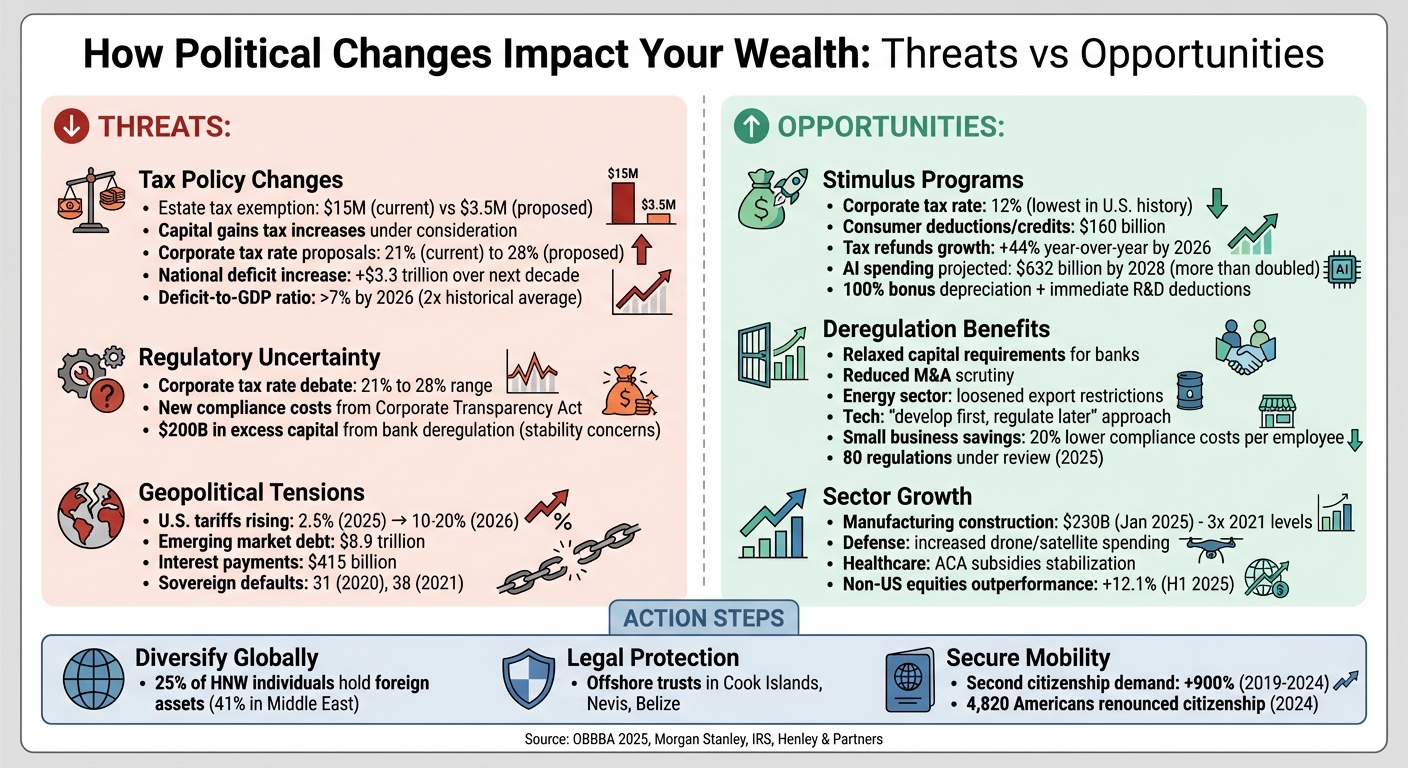

Political decisions directly impact your wealth – shaping taxes, investments, and regulations. For example, the estate tax exclusion is set to drop from $13.61 million to $7 million per individual in 2026, unless new legislation intervenes. Meanwhile, corporate tax rates and tariffs are expected to fluctuate, creating ripple effects across markets.

Here’s what you need to know:

- Tax Changes: Expiring tax laws could mean higher taxes for individuals and businesses.

- Regulatory Shifts: New compliance rules and deregulation can affect industries differently, impacting investments.

- Geopolitical Tensions: Rising tariffs and global conflicts may disrupt supply chains and investment returns.

- Opportunities: Stimulus programs, tax incentives, and deregulation are fostering growth in sectors like AI, energy, and manufacturing.

To safeguard your wealth:

- Diversify investments globally to reduce risk.

- Use legal tools like offshore trusts for asset protection.

- Secure second citizenship or residency for financial mobility.

The bottom line? Stay informed and flexible to navigate risks and seize opportunities.

How Political Changes Threaten Your Wealth

Political shifts can have a direct impact on your financial stability, often through higher taxes, changing regulations, or global unrest. Let’s break down these challenges and how they might affect your portfolio.

Tax Policy Changes and Wealth Redistribution

Tax policies are one of the most immediate ways political changes can affect personal wealth. For example, the OBBBA, enacted on July 4, 2025, preserved several provisions from the Tax Cuts and Jobs Act but highlighted just how quickly tax burdens can shift. Under this legislation, the estate tax exemption stands at $15 million for individuals and $30 million for married couples. However, earlier proposals from some lawmakers suggested reducing this exemption to $3.5 million. Similarly, potential increases in capital gains taxes could prompt high-net-worth individuals to rethink their investment strategies, possibly selling assets early to lock in lower rates.

Corporate tax changes also play a role in personal wealth. While the OBBBA reduced the effective corporate tax rate to as low as 12% for certain manufacturers, other proposals aimed to raise it to 28%. Such fluctuations can directly affect stock valuations and retirement accounts.

Additionally, the OBBBA is expected to add $3.3 trillion to the national deficit over the next decade, pushing the deficit-to-GDP ratio above 7% by 2026 – more than twice its historical average. Higher government debt often leads to increased interest rates, which can hurt bond prices and make borrowing more expensive.

Regulatory Reforms and Financial Market Impact

Regulatory uncertainty can create market volatility, impacting portfolio performance. For instance, debates over corporate tax rates – ranging from the current 21% to proposals as high as 28% – can significantly shift S&P 500 earnings projections, affecting stock prices.

New financial disclosure requirements, such as those introduced under the Corporate Transparency Act, have also increased compliance costs and audit risks for businesses. On the other hand, recent bank deregulation could free up $200 billion in excess capital held by large U.S. banks. While this might boost financial activity, it raises concerns about oversight and stability.

These regulatory changes demand careful financial planning. Staying informed and adaptable is key to protecting your assets in such an unpredictable environment.

Geopolitical Tensions and Financial Consequences

Global conflicts and trade disputes can have serious financial repercussions for investors. For instance, U.S. tariffs are projected to rise to between 10% and 20% by 2026, up from just 2.5% in early 2025. Higher tariffs squeeze corporate profits, drive inflation, and reduce investment returns.

"Government policy and geopolitical events can shift with little to no warning. It’s important to know what to watch for so that you can begin to prepare for any volatility that might occur."

– Chris Hyzy, Chief Investment Officer, Merrill and Bank of America Private Bank

Emerging markets add another layer of risk. By 2024, external debt in low- and middle-income countries had reached $8.9 trillion, with $415 billion in interest payments alone. Sovereign defaults have become more frequent, with 31 recorded in 2020 and 38 in 2021. For international investors, these defaults can result in significant losses.

Recent geopolitical flashpoints, such as tensions involving Greenland in early 2026, show how quickly new risks can emerge and disrupt markets. These examples highlight the importance of diversifying and strengthening your portfolio to withstand such uncertainties.

sbb-itb-39d39a6

How Political Changes Create Wealth Opportunities

Political shifts don’t just pose risks to wealth – they can also open the door to profitable investment opportunities. Whether through fiscal stimulus or deregulation, strategic policy changes often create fertile ground for growth and innovation, offering investors a chance to capitalize.

Stimulus Programs and Economic Growth

Government initiatives like tax cuts and spending programs can energize markets and unlock new investment potential. A prime example is the One Big Beautiful Bill Act (OBBBA), which slashed the effective corporate tax rate to an unprecedented low of 12% – the lowest in U.S. history.

In addition to corporate tax cuts, the OBBBA introduced $160 billion in consumer deductions and credits, with tax refunds projected to grow by 44% year-over-year by 2026.

"A lower corporate tax burden is likely to support capital spending in advanced tech sectors like semiconductors and AI data centers."

– Monica Guerra, Head of US Policy, Morgan Stanley Wealth Management

The act’s provisions for 100% bonus depreciation and immediate R&D deductions have encouraged businesses to reinvest in critical areas. Industries like artificial intelligence, semiconductors, and energy infrastructure have seen significant gains, with AI spending alone expected to more than double, reaching $632 billion by 2028. For high-net-worth investors, these incentives present opportunities to tap into emerging technologies and infrastructure projects poised for growth.

While stimulus programs provide a boost, the benefits are amplified when paired with deregulation.

Deregulation and Business Expansion

Reducing regulatory hurdles can further accelerate growth by encouraging risk-taking and investment. The current administration’s focus on deregulation is creating favorable conditions across a variety of industries.

In financial services, relaxed capital requirements and reduced scrutiny of mergers and acquisitions are driving up bank valuations and bolstering community banking . The energy sector is also thriving, thanks to loosened restrictions on natural gas exports and reduced permitting requirements for nuclear power and fossil fuel extraction . Meanwhile, technology companies – particularly in AI and cybersecurity – are benefiting from a "develop first, regulate later" approach, which fosters rapid innovation without the immediate constraints of federal oversight.

"For businesses, a lower regulatory burden can decrease wage expenses related to regulation. This allows company management to redirect revenues toward growth initiatives, potentially spurring innovation and reducing costs."

– Monica Guerra, Head of Policy, Morgan Stanley Wealth Management

Small businesses, in particular, stand to gain. Regulatory compliance costs are 20% higher per employee for small firms compared to larger ones, so easing these burdens can have a transformative impact. Additionally, the Congressional Review Act has identified around 80 regulations for review in early 2025, targeting sectors like energy, financials, and healthcare.

These policy changes are creating clear opportunities for investors who align their portfolios with the right sectors. Defense contractors are thriving on increased spending for drones and satellite technology, while the healthcare sector is stabilizing as policy uncertainties ease and ACA subsidies may be reinstated. Manufacturing is also booming, with construction spending hitting $230 billion in January 2025 – almost triple the levels seen in 2021 – fueled by CHIPS Act investments and reshoring efforts.

How to Protect and Grow Wealth During Political Changes

Political shifts don’t have to spell trouble for your finances. By spreading investments across borders, leveraging specialized legal tools, and securing mobility options, high-net-worth individuals can safeguard their wealth while staying ready to seize opportunities worldwide.

Diversify Investments Across Borders

Keeping all your assets in one country exposes you to risks like currency devaluation, tax increases, and even asset freezes. Spreading your investments across multiple countries and currencies can help protect your purchasing power and minimize exposure to local legal and economic turbulence. For example, non-US equities outperformed US equities by 12.1% in the first half of 2025.

History shows the risks of staying too localized. After the Brexit referendum in 2016, the British pound plunged by over 10% against the US dollar, leaving UK investors without diversified currency holdings at a disadvantage. Similarly, domestic courts often lack authority over foreign accounts, offering an additional layer of protection. In 2022, following the invasion of Ukraine, over €21.5 billion in Russian private assets were frozen within the European Union, prompting more than 15,000 wealthy individuals to move their wealth to neutral jurisdictions like the UAE and Armenia.

Diversification isn’t just about safety – it can also be strategic. If 40% of your expenses are in Europe, holding 40% of your assets in Euros shields you if the dollar weakens. As of 2023, 25% of high-net-worth individuals held assets outside their home country, with this figure rising to 41% for Middle Eastern ultra-high-net-worth individuals. This trend highlights the growing importance of financial flexibility and mobility.

Once you’ve diversified geographically, advanced tools like offshore trusts can provide even stronger protection.

Use Offshore Trusts and Foundations for Asset Protection

Geographical diversification is just the beginning. Specialized legal structures, like offshore trusts, offer an additional layer of security. These trusts operate under foreign jurisdictions – such as the Cook Islands, Nevis, or Belize – placing assets beyond the reach of domestic courts. Offshore jurisdictions often require creditors to relitigate claims locally, adding significant costs and hurdles for potential challengers.

The legal protections in these jurisdictions can be formidable. For instance, the Cook Islands imposes stricter standards of proof for claims like "fraudulent transfer" compared to the US. Some places, like Nevis, require creditors to post bonds before filing lawsuits and prohibit contingency-fee arrangements, forcing claimants to pay upfront. Additionally, Belize and the Cook Islands enforce short statutes of limitations, narrowing the window for creditors to challenge asset transfers.

"The key to a successful asset protection strategy is to set everything up before any threat of litigation."

– Blake Harris, Founding Principal, Blake Harris Law

Timing is critical – transferring assets under the threat of litigation can lead to them being classified as "fraudulent conveyance". While setup costs for these structures range from $1,000 to $5,000, with annual fees between $2,000 and $10,000, they offer privacy and control. However, they must comply with tax reporting requirements, such as the IRS’s FATCA rules, to avoid penalties.

To further enhance your financial security, consider securing second citizenship or residency.

Secure Second Citizenship or Residency

A second passport can be a game-changer during political instability, offering the freedom to relocate assets and family if needed. Unlike your primary passport, which can be revoked without notice, a second citizenship ensures you retain mobility even in uncertain times.

"If you have the financial capacity, you should be as diversified in terms of your domicile options as possible, because nowhere is perfect."

– Dominic Volek, Global Head of Private Clients, Henley & Partners

Demand for investment migration has surged in recent years. Between 2019 and 2024, interest from US citizens grew by over 900%. In 2024 alone, 4,820 Americans formally renounced their citizenship – a 48% increase from the previous year – reflecting concerns about political polarization and heightened tax scrutiny.

When choosing a jurisdiction, look for political stability, favorable tax policies, and strong legal protections. The UAE, for example, attracted the most high-net-worth individuals in 2022 due to its zero-tax policy and high safety levels. Meanwhile, Australia is expected to gain prominence thanks to its natural resources and proximity to Asian markets. For individuals in countries with weaker passports – about 17.2% of high-net-worth individuals globally – securing stronger residency or citizenship options can significantly enhance global mobility.

Banks are increasingly "de-risking" by closing accounts based on nationality rather than individual risk. Additionally, the US and its allies have frozen at least $58 billion in private wealth tied to sanctioned individuals. A second residency in a stable country with good international relations ensures continued access to banking and mobility when domestic options become restricted.

Steps to Build Political Resilience

Creating financial resilience in the face of political turbulence requires more than just staying informed – it calls for deliberate actions. Below are key steps to help you pinpoint vulnerabilities, safeguard your assets, and prepare for shifts in policy that could affect your financial future.

Conduct a Wealth Audit

Start with a financial stress test to see how your wealth would hold up under extreme conditions. Imagine scenarios like losing your primary income, a sudden spike in inflation, or the abrupt end of a federal program you depend on. This exercise will highlight weak points in your financial setup.

Take a close look at where your assets are located. If they’re heavily concentrated in one region, you might be taking on more risk than you’re comfortable with. Diversification could be key here.

Pay special attention to your tax filings. Review the past five years of returns, including international disclosures like FBAR and Form 8938, to ensure accuracy. Mistakes or oversights could lead to “covered expatriate” status if you decide to relocate, triggering a hefty exit tax on unrealized gains. If your net worth exceeds $2 million or your average annual tax liability is over $190,000, you may already be at risk.

Also, evaluate legislative risks in your portfolio. Model how potential policy changes could affect your tax obligations.

| Assessment Area | Key Vulnerability to Check | Recommended Action |

|---|---|---|

| Tax Compliance | Accuracy of 5-year tax filings | Conduct a professional tax audit |

| Geographic Risk | Over-concentration in one country | Diversify across multiple jurisdictions |

| Liquidity | Risk of account freezes | Open non-U.S. banking or brokerage accounts |

| Regulatory | Expiring tax laws (e.g., TCJA) | Model future tax rate scenarios |

| Mobility | Dependence on a single passport | Pursue dual residency or citizenship |

This audit will serve as the foundation for developing a comprehensive strategy with the help of experts.

Work with Experts and Specialized Services

After identifying your vulnerabilities, it’s time to bring in the pros. Political and tax landscapes can change quickly, and specialized guidance will help you stay ahead of the curve. Advisors can interpret complex legislative updates and craft strategies to mitigate risks before new rules take effect.

"The tax landscape is very uncertain. I think it’s complicated. I think people are really worried about what kind of legislation we’re going to see."

– Shaun Hunley, Executive Editor, Thomson Reuters

Financial planners often use scenario modeling to predict how political changes – like tariffs, tax hikes, or the loss of deductions – might impact your portfolio. This allows you to adjust your strategy proactively. Legal experts in offshore structures can guide you toward jurisdictions like the Cook Islands or Nevis, which offer strong asset protection laws that disregard foreign court rulings.

Tax attorneys are critical for navigating international reporting requirements. For instance, FBAR filings increased 8.8% in 2024, reaching over 1.7 million accounts, as the IRS increased scrutiny on foreign assets. These professionals can help you correct past errors through amnesty programs and avoid severe penalties. If you’re considering expatriation, they can also help structure your finances to stay below the $2 million threshold that triggers the exit tax.

Immigration attorneys add another layer of security by helping you secure a second passport or residency in a stable country. Between 2019 and 2024, interest in investment migration among U.S. citizens surged by over 900%. These experts ensure you have a backup plan if domestic risks escalate.

Monitor Political Developments and Adjust Your Plans

Building political resilience is an ongoing process. Staying updated on political and regulatory changes is essential to keeping your strategies effective. Subscribe to tax law updates, attend relevant events, and consult with your advisors regularly.

Focus on actions, not words, when evaluating political developments. Politicians often make bold claims that never translate into policy. Patti Brennan, CEO of Key Financial, explains:

"Words are one thing; actions are quite another. If it’s just words, higher prices are sure to be right around the corner."

– Patti Brennan, CEO of Key Financial

Pay attention to actual legislative votes, regulatory filings, and negotiations rather than campaign promises or social media chatter.

Build flexibility into your financial plans. For example, increase your emergency savings beyond the typical three-to-six-month cushion during politically uncertain times. If you anticipate major policy changes, like tariffs or trade restrictions, consider making large purchases sooner to avoid potential price hikes.

Keep your international banking relationships updated. Financial institutions are increasingly “de-risking” by limiting services to clients from high-risk or sanctioned countries. Opening and funding non-U.S. accounts in advance can ensure your assets remain accessible if restrictions are placed on domestic accounts.

Finally, review your wealth strategy on a regular basis. Schedule quarterly check-ins with your advisors to confirm that your asset allocation, tax planning, and mobility options align with the current political climate. For instance, when over 90% of countries imposed travel bans in April 2020, people with only one residency or citizenship found themselves stuck. Don’t wait for a crisis to discover you need a backup plan.

Conclusion: Navigate Political Changes with Confidence

Political uncertainty is here to stay. In 2025, global net wealth reached around $477 trillion, reflecting a 4.3% increase from 2023. But this growth hasn’t come without challenges – asset freezes and tighter regulatory oversight are becoming more common.

The key to thriving in such an environment is preparation. Risks like these highlight why proactive strategies are crucial. Diversifying assets across different jurisdictions, securing second citizenship or residency, and building relationships with international financial institutions are no longer just options – they’re becoming necessities for anyone looking to safeguard their wealth.

Consider this: Between 2019 and 2024, U.S. demand for investment migration programs skyrocketed by over 900%. In 2024 alone, 4,820 individuals officially renounced their U.S. citizenship, marking a 48% jump from the previous year. These aren’t impulsive decisions – they’re deliberate strategies to create resilience in the face of political and economic uncertainty. This growing trend underscores the value of a diversified domicile strategy.

Securing your financial future requires planning well in advance. Steps like obtaining a second passport, opening offshore accounts, or adjusting your tax strategy take time to implement. Waiting until a crisis hits could leave you exposed. Start with a thorough wealth audit, consult experts in international financial structures, and keep a close eye on political shifts to adapt before risks escalate. Taking action now will help you stay ahead of potential challenges.

Don’t wait for policy changes to catch you off guard.

FAQs

How can I safeguard my wealth from unexpected tax changes?

Shielding your wealth from unexpected tax changes means staying ahead of the curve and diversifying your strategies. One effective approach is spreading your investments across multiple countries. This reduces reliance on a single tax system and helps protect against sudden shifts in domestic policies.

Another option to consider is using offshore accounts or asset protection tools. These can add a layer of security, especially in times of political uncertainty. For those looking for even more flexibility, obtaining second citizenship or residency in a politically stable country can be a game-changer. It allows you to move your assets – or even yourself – if tax laws in your home country take a turn for the worse.

Staying informed is also key. Keep an eye on potential legislative changes, like upcoming elections or expiring tax provisions, so you can adjust your plans proactively. And don’t underestimate the value of professional advice. Regular check-ins with tax and wealth management experts can help ensure your strategy remains in step with evolving laws, minimizing your exposure to sudden and unfavorable changes.

How can a second citizenship help protect your wealth during political changes?

Securing a second citizenship can act as a safety net for your wealth during times of political turmoil. Think of it as geopolitical insurance – an alternative legal residence that shields your assets from threats like unstable governments, currency restrictions, or unfavorable tax changes.

Beyond protecting your finances, a second citizenship opens doors to greater global mobility. It simplifies access to international markets and allows you to live in more stable countries. This added flexibility can be invaluable for safeguarding your business interests, ensuring personal safety, and maintaining uninterrupted operations during uncertain times.

In today’s unpredictable landscape, having a second citizenship is a smart way to diversify your legal residence options, minimize localized risks, and secure your financial future.

How do political tensions affect global investment strategies?

Political tensions can shake up global investments by stirring uncertainty and market volatility. Whether it’s an international conflict, a trade dispute, or political instability, these events often lead to sharp changes in asset values. Emerging markets, in particular, feel the heat more intensely due to their higher risk levels. Beyond that, such tensions can throw supply chains off balance, dampen investor confidence, and shift demand patterns – directly affecting the performance of stocks, bonds, and other investment vehicles.

To handle these challenges, many investors adjust their strategies. This might mean diversifying their portfolios across different regions, leaning toward steadier assets like bonds, or adding tangible assets to protect against inflation and sudden market shocks. Staying flexible and keeping a close eye on global political and economic developments can be key to protecting wealth and reducing risks during turbulent times.