Your financial privacy is under threat, and protecting it requires understanding the risks and taking legal, compliant steps to safeguard your information. Over the past decade, global regulations like FATCA and CRS, combined with data breaches, lawsuits, and creditor claims, have made financial details more exposed than ever. Banks, credit bureaus, and public records often make your personal data accessible, leaving you vulnerable to unwanted scrutiny.

Here’s how you can protect your financial privacy:

- Use Offshore Trusts: Jurisdictions like the Cook Islands and Nevis offer strong legal protections, making it harder for creditors to access your assets.

- Set Up Private US LLCs: States like New Mexico and Wyoming allow you to maintain anonymity in business ownership.

- Combine US and Offshore Structures: Layering domestic and offshore solutions increases privacy while remaining compliant with U.S. laws.

- Stay Compliant: File required forms like FBAR and FATCA to avoid hefty penalties and ensure your privacy strategies remain legal.

- Plan Ahead: Establish privacy structures before legal issues arise to prevent claims of fraudulent transfers.

Key takeaway: Financial privacy isn’t about hiding assets – it’s about structuring them legally to protect your information while meeting all reporting requirements. The right combination of tools and professional guidance can help you safeguard your wealth effectively.

Why Financial Privacy Is Under Threat

Before diving into strategies to safeguard your financial privacy, it’s crucial to understand the challenges that put it at risk. These threats generally come from three main areas: government reporting requirements, data breaches, and legal exposure. Each of these demands careful planning to protect your financial information.

Government Reporting Requirements

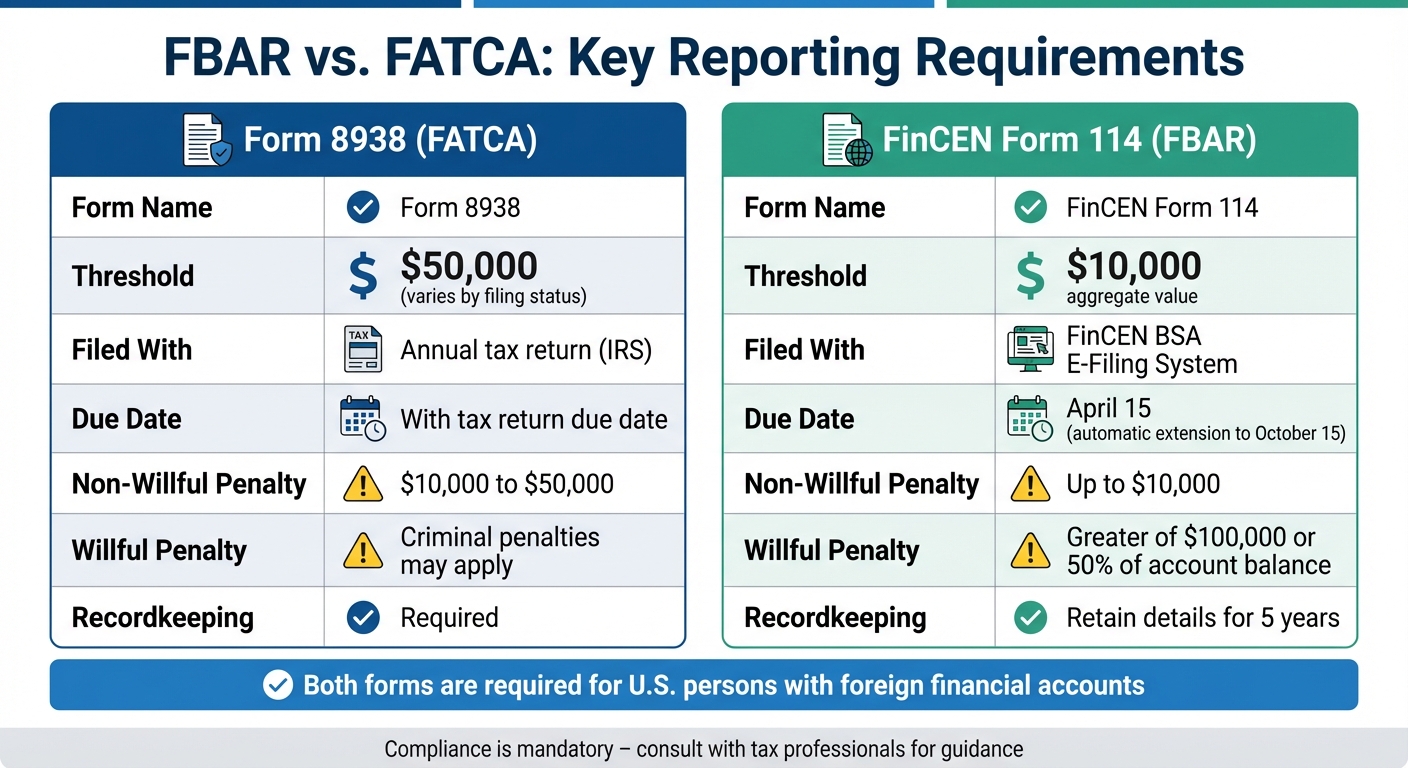

Government regulations impose strict reporting rules on foreign financial assets, making privacy harder to maintain. For instance, under FATCA, if your foreign financial assets exceed $50,000, you’re required to file IRS Form 8938. Additionally, foreign banks report your account details directly to the IRS, creating a dual layer of disclosure.

Another layer of compliance comes with the Report of Foreign Bank and Financial Accounts (FBAR). If the total value of your foreign accounts exceeds $10,000 at any point during the year, you must file FinCEN Form 114. Failure to comply can result in steep penalties. For Form 8938, fines range from $10,000 to $50,000. Willfully neglecting FBAR requirements can lead to penalties of $100,000 or 50% of your account balance – whichever is greater.

| Requirement | Form 8938 (FATCA) | FinCEN Form 114 (FBAR) |

|---|---|---|

| Threshold | $50,000 (varies by status) | $10,000 |

| Filed With | Annual tax return | Electronically with FinCEN |

| Willful Penalty | Criminal penalties may apply | Greater of $100,000 or 50% of balance |

These reporting requirements not only increase administrative burdens but also expose your financial information to potential breaches.

Data Breaches and Public Records

Financial institutions store massive amounts of personal data, making them prime targets for cyberattacks. When breaches occur, hackers can access sensitive information like account usernames, passwords, and other identifiers. This data can then be used to file fraudulent tax returns or drain accounts.

Credit bureaus add another layer of risk. They sell consumer data to lenders and insurers for prescreening purposes – often without your explicit consent. This practice increases the exposure of your financial details.

Public records also play a role in eroding privacy. Real estate titles, for example, are publicly available. Anyone can access these records to identify property ownership and estimate your equity. By piecing together information from public sources, individuals or entities can form a detailed picture of your financial situation.

Lawsuits and Creditor Claims

Legal proceedings can further jeopardize financial privacy. Through court orders, financial institutions may be compelled to disclose private records, making your transaction histories part of the public domain. During the discovery phase of a lawsuit, opposing parties may gain access to your personal financial information, increasing your vulnerability.

Assets held in your name are particularly at risk. Creditors, for example, can conduct asset searches to uncover bank accounts, investments, and property ownership tied to your name. If you attempt to transfer assets after a claim has been filed, fraudulent conveyance laws allow courts to reverse those transfers.

Without proper safeguards, litigation and creditor claims can expose your financial records, leaving you open to further risks. Up next, we’ll explore how offshore asset protection can provide an added layer of protection against these threats.

sbb-itb-39d39a6

Using Offshore Structures to Protect Financial Privacy

Offshore structures create a legal barrier between you and your assets, making ownership less visible. This section dives into specific tools designed to shield your assets from scrutiny and legal claims.

Offshore Trusts for Privacy and Protection

An offshore trust transfers legal ownership of your assets to a professional trustee in a foreign jurisdiction. This means your name no longer appears on account statements or property titles, though you still retain the beneficial interest.

Jurisdictions like the Cook Islands and Nevis are known for their strong asset protection laws. For instance, the Cook Islands does not automatically honor U.S. court judgments. If a creditor wants to pursue assets in a Cook Islands trust, they must re-litigate the case under local laws. Additionally, the Cook Islands requires creditors to meet a much higher burden of proof – "beyond a reasonable doubt" – compared to the "preponderance of evidence" standard used in most U.S. civil cases.

Nevis adds another layer of protection by requiring creditors to post a $100,000 bond before filing a lawsuit against a trust. Both jurisdictions also enforce a two-year statute of limitations on challenging asset transfers. Cook Islands courts have consistently upheld these protections, ensuring trusts are not forced to repatriate assets to satisfy foreign judgments. These legal frameworks safeguard privacy while maintaining compliance with reporting requirements.

Setting up an offshore trust typically costs around $10,000, with additional annual fees for trustee services and regulatory compliance.

In addition to trusts, offshore companies offer effective privacy solutions.

Offshore Companies to Conceal Ownership

International Business Companies (IBCs) and offshore LLCs provide another layer of privacy by masking beneficial ownership. In jurisdictions like Anguilla, Dominica, and Belize, the names of company owners and directors are not included in public records.

Anguilla and Belize, in particular, have strict confidentiality laws. For example, Anguilla’s Offshore Banking Act of 2005 prohibits bank employees from disclosing account information without explicit consent. Similarly, in Belize, a court order tied to a criminal investigation is required to access such information.

By holding assets through an offshore company, tracing ownership becomes significantly more difficult.

Choosing Jurisdictions with Strong Privacy Laws

The choice of jurisdiction plays a critical role in enhancing privacy and asset protection. The Cook Islands and Nevis are often considered top choices due to their resistance to enforcing foreign court judgments and their well-established trust laws.

Other notable options include Anguilla, which operates under English Common Law and enforces strict confidentiality measures. The Bahamas, known for being the first Caribbean nation to adopt banking secrecy laws, requires a Supreme Court order for any financial disclosure. The British Virgin Islands also offers privacy advantages, as it has no tax treaties with other countries.

When selecting a jurisdiction, it’s essential to consider whether it participates in the Common Reporting Standard (CRS) or has Tax Information Exchange Agreements with the U.S., as these factors can affect the level of privacy offered. Additionally, ensure the jurisdiction has a stable legal system and requires licensed registered agents for oversight.

Attorney James G. Bohm explains, "Offshore asset protection is still viable, but it’s no longer a ‘hidden vault.’ Today, it’s most effective as part of a transparent, legally compliant, and professionally structured estate and asset plan."

Currently, around $4 trillion in U.S. private wealth is held in offshore accounts, with nearly half located in jurisdictions considered tax havens. This highlights that offshore structures remain a practical option for those seeking privacy and asset protection while adhering to legal requirements.

Protecting Privacy with Private US LLCs

Private U.S. LLCs offer a way to protect ownership information without getting entangled in international complexities. Four states stand out for their privacy-focused LLC laws: New Mexico, Wyoming, Delaware, and Nevada. New Mexico takes the lead by not requiring owner names in formation documents and eliminating annual reporting obligations altogether. Wyoming and Delaware require owner identities to be disclosed to the state, but this information is not made public. Meanwhile, Nevada includes owner names in formation documents but keeps this data confidential.

When it comes to costs, fees vary by state. Here’s a quick breakdown:

- New Mexico: Minimal filing fees with no annual reporting requirements.

- Delaware: Filing costs around $100, with a $300 annual fee.

- Wyoming: Formation costs roughly $100, with a $60 annual fee.

- Nevada: Higher costs at about $425 to form and $350 annually.

"New Mexico’s approach to LLC privacy exceeds all other states through a unique combination of minimal disclosure requirements and absence of ongoing reporting obligations", says Alex Recouso, Co-founder and CEO of CitizenX.

If you plan to operate an anonymous LLC in a different state, you’ll need to register as a foreign LLC. Keep in mind, this could reduce some of the privacy benefits you’d gain from forming in a privacy-focused state.

To further protect your identity, consider using nominee services or registered agents.

Using Nominee Services and Registered Agents

Nominee services and registered agents are valuable tools for keeping your personal details out of public records. A registered agent is a professional with a physical address in the LLC’s formation state. They handle legal notices and government correspondence on your behalf, ensuring your personal or business address remains private.

Nominee services take privacy a step further. In states like Delaware and Wyoming, you can appoint a nominee manager or organizer to sign formation documents, so your name doesn’t appear on public filings. While this protects your identity in public records, you’ll still need to verify ownership with banks and financial institutions through private documents like your operating agreement and IRS filings.

For even greater privacy, you can combine these domestic tools with offshore structures.

Combining US and Offshore Structures

To maximize asset privacy, consider merging the benefits of anonymous U.S. LLCs with offshore ownership. This creates a layered approach to privacy, making it harder to trace the ultimate owner. For example, you could form an anonymous U.S. LLC in New Mexico or Wyoming and have it owned by an offshore entity.

In this setup, U.S. public records would only show the name of the offshore company, while the offshore jurisdiction keeps beneficial ownership confidential. This strategy not only strengthens privacy but may also open up opportunities for tax planning. However, it’s crucial to remain compliant with U.S. reporting requirements, including IRS filings for foreign-owned entities.

Staying Compliant While Maintaining Privacy

Privacy doesn’t mean evasion. It’s entirely possible to keep your financial matters confidential while adhering to all U.S. reporting obligations. The key lies in understanding what to report and when.

Reporting Requirements for Offshore Accounts

If you’re a U.S. person with foreign financial accounts, there are two major reporting requirements to keep in mind. First, the FBAR (Foreign Bank Account Report) must be filed if your combined foreign account balances exceed $10,000. Second, under FATCA (Foreign Account Tax Compliance Act), you’ll need to file if your specified foreign assets surpass certain thresholds. These filings go directly to the U.S. Treasury and IRS, ensuring your financial information remains secure.

Here’s how it works:

- FBAR: File electronically through FinCEN’s BSA E-Filing System by April 15, with an automatic extension to October 15.

- Form 8938 (FATCA): Submit this form with your annual tax return by the standard tax deadline.

- Recordkeeping: Retain account details for at least five years.

Failing to comply can result in steep penalties. For instance, a non-willful FBAR violation can cost up to $10,000, while willful violations may lead to fines of $100,000 or 50% of the account balance – whichever is greater. FATCA violations start at $10,000 and increase with continued non-compliance.

| Form | Threshold | Where to File | Due Date | Non-Willful Penalty |

|---|---|---|---|---|

| FBAR (Form 114) | Aggregate value > $10,000 | FinCEN BSA E-Filing System | April 15 (auto-extension to Oct 15) | Up to $10,000 |

| FATCA (Form 8938) | Typically > $50,000 | Attached with annual tax return | With tax return due date | $10,000 to $50,000 |

Additionally, if you’re involved with a foreign trust, you’re required to file Form 3520 for specific transactions, such as creating the trust or transferring property into it. The trust itself must also file Form 3520-A annually.

To avoid last-minute headaches, it’s wise to establish privacy structures well in advance of any potential issues.

Timing and Fraudulent Transfer Laws

Timing is everything when it comes to setting up privacy structures. Creating these structures before any legal trouble arises is critical to avoid claims of fraudulent transfer. As Collas Crill explains:

"Provided the trust is established and the assets are contributed prior to such claim arising, the settlor… will no longer be the legal or beneficial owner of the assets, and any claim will therefore need to be made against the trustee of the trust."

Courts tend to scrutinize any asset transfers made during legal disputes. For example, moving assets into an irrevocable trust while creditors are pursuing you could be deemed a fraudulent conveyance. However, jurisdictions like Jersey and Guernsey offer legal protections, such as firewall legislation, which shield trusts from foreign judgments – provided the trust was established well before any legal challenges.

By planning ahead, you can ensure your privacy strategies align with your broader goal of safeguarding financial confidentiality while staying compliant.

Working with Privacy Professionals

Navigating these complex requirements can be daunting, which is why professional guidance is invaluable. Experienced advisors can help you develop privacy strategies that are both effective and compliant. They’ll guide you through the maze of filing requirements, ensuring that you disclose only what’s necessary while meeting all legal obligations.

For those with undisclosed accounts from previous years, professionals can recommend compliance options like the Streamlined Filing Compliance Procedures or the Delinquent FBAR submission process to minimize penalties.

Global Wealth Protection specializes in creating tailored privacy solutions that meet legal standards. Their expertise ensures your offshore trusts, private LLCs, or combined structures remain confidential while adhering to all reporting mandates.

Conclusion

Financial privacy is about legally structuring your assets to keep them confidential while fully complying with reporting requirements. As the Offshore Law Center explains:

"Asset protection is not about evading legitimate debts or hiding assets; rather, it’s about implementing lawful strategies to defend one’s property and financial resources".

The strategies discussed here – like offshore trusts in places such as the Cook Islands and Nevis or private U.S. LLCs with nominee services – can serve as effective tools to safeguard your financial information. By layering these structures, you can strengthen your financial privacy and establish a robust defense. However, it’s critical to put these measures in place well before any potential legal challenges arise.

This layered approach not only protects your privacy but also adheres to strict U.S. regulatory standards. Reporting obligations, including FBAR, FATCA, and trust-specific filings, must be met, ensuring all necessary information remains secure within government channels.

A well-thought-out privacy strategy is key to long-term asset protection. The intricacy of these setups – from selecting the right jurisdiction to maintaining clear boundaries between personal and trust assets – highlights the importance of professional expertise. By working with experienced advisors, you can create a compliant, private asset structure that meets all legal requirements. Firms like Global Wealth Protection specialize in crafting customized solutions to help shield your assets while staying within the bounds of the law.

FAQs

How can offshore trusts help protect my financial privacy?

Offshore trusts offer a way to protect your financial privacy by shifting the legal ownership of assets – like cash, real estate, or investments – from your name to a trust located in another country. In this setup, a trustee, often a professional entity based in the host country, manages the assets according to local laws. This arrangement makes it much harder for U.S. courts to access or disclose your holdings.

These trusts often come with features designed to enhance privacy. For example, trust protectors can oversee the actions of trustees, ensuring they act in the trust’s best interest. There are also distress clauses, which prevent the forced repatriation of assets under court orders, and flight clauses, allowing the trust to move to another jurisdiction if necessary. Additionally, many offshore jurisdictions don’t require public disclosure of the trust’s beneficial owners, adding another layer of confidentiality.

Although U.S. taxpayers must adhere to reporting obligations like FBAR and FATCA, the structure of offshore trusts helps limit how much personal information is exposed. This can be a valuable tool for maintaining privacy in an era where financial transparency is becoming the norm.

What are the consequences of not complying with FBAR and FATCA regulations?

Failing to comply with FBAR (Foreign Bank Account Report) or FATCA (Foreign Account Tax Compliance Act) can come with serious repercussions. Civil penalties alone can include fines that range from thousands of dollars to the greater of $100,000 or a large percentage of the unreported assets. In more severe cases, non-compliance might even lead to criminal charges, which could result in substantial fines or imprisonment.

Beyond financial and legal penalties, non-compliance often draws audits and increased scrutiny from the IRS, which can tarnish your financial reputation. To avoid these risks, it’s crucial to understand the reporting requirements and ensure that all foreign financial accounts and assets are accurately disclosed.

Why is it important to establish privacy structures before facing legal or financial challenges?

Creating privacy-focused structures before any legal troubles, audits, or creditor claims arise is a smart move that bolsters their credibility. If you transfer assets after a legal issue becomes likely, courts might see this as a fraudulent attempt to shield them and could reverse the actions, leaving your finances vulnerable. By setting up tools like trusts, anonymous LLCs, or offshore entities in advance, these arrangements are viewed as strategic and legitimate planning rather than last-minute maneuvers, making them far tougher to challenge.

Planning ahead also keeps you in line with U.S. reporting rules, such as FBAR and FATCA, helping you steer clear of costly penalties for non-compliance. Plus, it gives you the time to choose jurisdictions that work to your advantage and handle administrative tasks without the pressure of an active legal problem. Taking these steps early not only safeguards your financial privacy but also ensures your protections hold up under legal scrutiny.