In 2025, economic instability exposed serious flaws in traditional wealth protection strategies. A 10% drop in the U.S. dollar’s value, regulatory changes like Secure Act 2.0, and rising national debt highlighted the risks of relying solely on domestic investments. High-net-worth individuals faced challenges such as currency devaluation, legal vulnerabilities, and abrupt policy shifts. To safeguard assets, diversification across jurisdictions and currencies, proper use of trusts and LLCs, and offshore strategies emerged as critical solutions. Key takeaways include:

- Timing is crucial: Asset protection must be set up before liabilities arise to avoid legal challenges.

- Offshore strategies work: Jurisdictions like the Cook Islands and Nevis provide strong legal safeguards and currency diversification.

- Avoid common mistakes: Over-concentrating assets domestically, improper use of trusts/LLCs, and failing to meet compliance requirements can leave you exposed.

Common Asset Protection Mistakes Exposed in 2025

The financial challenges of 2025 highlighted some glaring missteps in how high-net-worth individuals safeguarded their wealth. As the economic landscape shifted, three major mistakes became clear: relying too heavily on domestic accounts, mishandling legal structures, and concentrating assets within a single country. These misjudgments left many exposed to risks like currency devaluation, lawsuits, and abrupt regulatory changes – issues that could have been mitigated with more strategic planning.

Keeping Too Many Assets in Domestic Accounts

Relying solely on U.S. dollar accounts turned out to be a precarious strategy in 2025. The dollar had its worst six-month performance since 1973, losing over 10% against the DXY index. For investors with entirely domestic portfolios, this meant a sharp decline in purchasing power and heightened vulnerability to U.S. legal risks.

The earlier collapses of Silicon Valley Bank and First Republic Bank in 2023 served as a stark warning about the dangers of concentrating deposits domestically. By 2025, with the U.S. national debt surpassing $31 trillion, concerns over long-term monetary stability grew louder. Diversifying assets internationally emerged as a way to reduce counterparty risks and safeguard wealth.

Failing to Use Trusts and LLCs Properly

Another common pitfall was the improper use of trusts and LLCs. Simply setting up these legal structures doesn’t automatically provide protection – how structuring offshore trusts for asset protection is handled matters immensely. A frequent mistake was relying on revocable living trusts, which don’t shield assets from creditors since the grantor retains control. Irrevocable trusts, when set up correctly, offer a stronger layer of defense.

Timing also played a crucial role. In Rush University v. Sessions, a $1.5 million transfer to a self-settled trust was invalidated as a fraudulent conveyance. Similarly, in United States v. Grant, Arline Grant faced a $36 million judgment after the government uncovered her continued control over offshore accounts routed through her children’s names. By 2025, the court issued a permanent injunction and held her in contempt, proving that even offshore structures can be dismantled when control is improperly retained.

Another oversight involved failing to retitle assets under legal entities. For example, neglecting to transfer real estate deeds or financial accounts into the name of a trust or LLC left those assets exposed to personal liability. Additionally, overlooking federal reporting requirements like FBAR (FinCEN Form 114) and FATCA (Form 8938) led to severe penalties for many individuals.

Concentrating Wealth in One Country

A final misstep was keeping assets confined to a single jurisdiction. This approach left wealth vulnerable to sudden legal changes or tax rulings that could jeopardize an entire portfolio. By spreading assets internationally, investors made it harder for creditors to stake claims.

Diversifying across countries and currencies also proved beneficial. For instance, holding assets like Swiss Francs or physical gold alongside U.S. dollars helped some investors maintain purchasing power during the economic turbulence of 2025. International diversification offered a practical way to navigate the uncertainties of the year while reducing exposure to localized risks.

sbb-itb-39d39a6

Best Offshore Structures for Asset Protection

The events of 2025 highlighted which offshore structures can effectively shield assets from creditor claims. Offshore trusts, LLCs, and insurance policies stood out as reliable options, creating multiple legal barriers that made pursuing claims both costly and time-consuming for creditors. Let’s dive into how these structures proved their value during a challenging period.

Why Offshore Trusts Are Effective

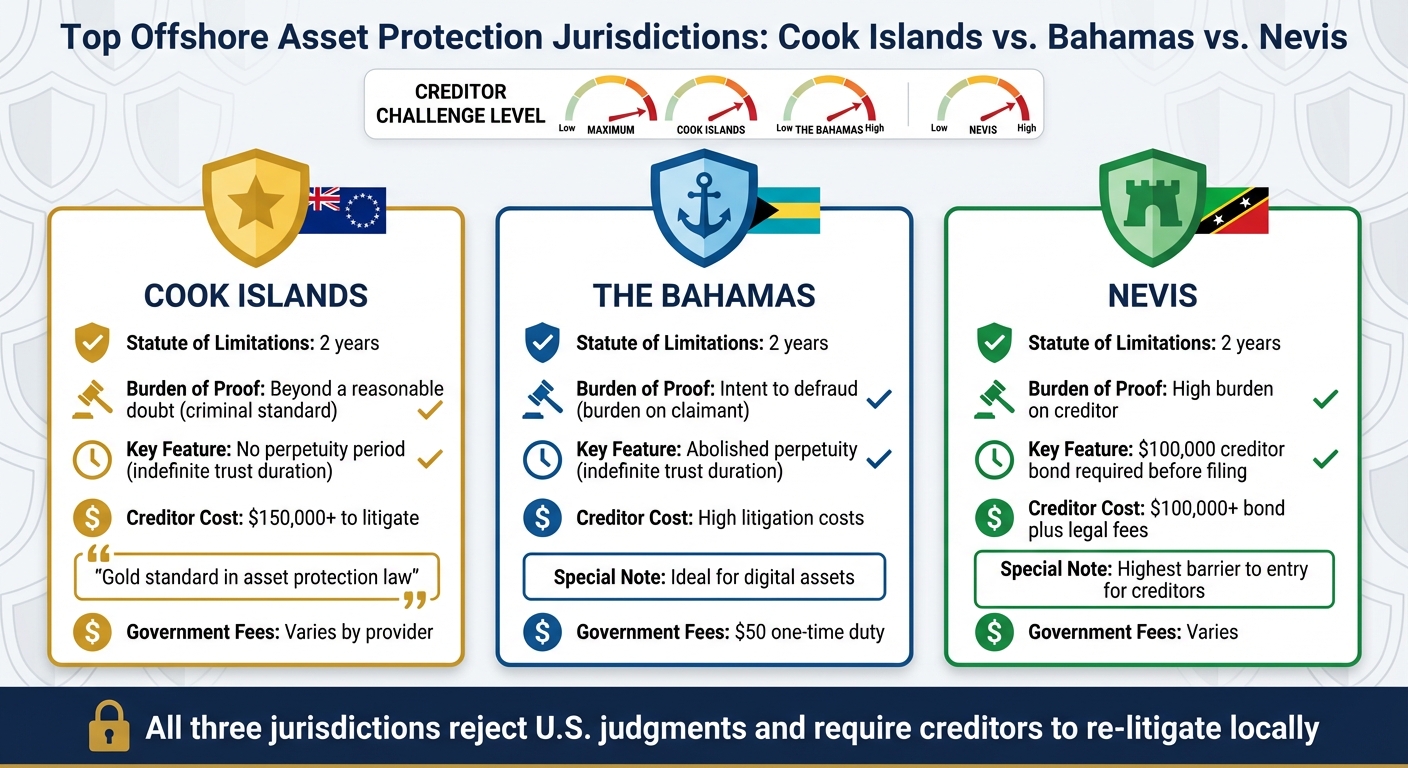

Offshore trusts in jurisdictions like the Cook Islands, Nevis, and the Bahamas demonstrated their resilience by rejecting U.S. judgments outright. Since domestic judgments often require creditors to re-litigate cases in these jurisdictions, the process becomes prohibitively expensive and complex.

The Cook Islands, often referred to as the "gold standard" for asset protection, imposes a high burden of proof on creditors. They must establish fraudulent transfer "beyond a reasonable doubt", a much tougher standard compared to the "preponderance of evidence" used in U.S. civil cases. Legal battles in this jurisdiction can easily cost creditors over $150,000.

"The Cook Islands trust law is considered the gold standard in asset protection law, and other jurisdictions have copied it."

– White & Bright, LLP

Nevis, on the other hand, requires creditors to post a $100,000 bond before filing any legal action. The Bahamas offers its own advantages, including a one-time government trust duty of just $50.

These jurisdictions also provide "firewall protections", which ignore foreign forced-heirship or divorce claims, ensuring that assets remain shielded from domestic legal disputes. Additionally, current laws allow limited settlor control, such as overseeing investments, without jeopardizing the trust’s validity. However, excessive control could expose the trust to U.S. court challenges.

| Jurisdiction | Statute of Limitations | Burden of Proof | Key Feature | Government Fees |

|---|---|---|---|---|

| Cook Islands | 2 years | Beyond a reasonable doubt | No perpetuity period (indefinite) | Varies by provider |

| The Bahamas | 2 years | Intent to defraud (on claimant) | Abolished perpetuity (indefinite) | $50 one-time duty |

| Nevis | 2 years | High burden on creditor | $100,000 creditor bond required | Varies |

Offshore trusts also provided a hedge against domestic instability. For instance, the Corporate Transparency Act (CTA) faced significant legal challenges in 2025, including a temporary halt by the Fifth Circuit in December 2024. While many domestic structures were left in limbo, offshore trusts remained a stable and reliable option.

"The uncertainty surrounding the implementation of the CTA underscores the importance of creating a diversified asset protection strategy. Offshore trusts are just one part of the puzzle."

– Blake Harris, Founding Principal, Blake Harris Law

Offshore LLCs: Privacy and Flexibility

Offshore LLCs emerged as critical tools for maintaining privacy, offering flexibility, and creating legal separation. In jurisdictions like the Cook Islands, LLC member and ownership information is kept private with registered agents rather than being listed in public registries. This confidentiality is especially valuable as litigation costs in the U.S. have surged, increasing liability claims by 57% over the past decade.

A key feature of offshore LLCs is charging order protection. This limits a creditor’s remedy to placing a lien on distributions rather than allowing them to seize LLC interests or underlying assets. This structure works particularly well for high-risk assets such as real estate and digital assets.

In 2025, many investors adopted a dual-structure approach where an offshore trust owned the LLC, adding additional layers of protection [12,14]. The Bahamas also gained traction as a preferred jurisdiction for holding digital assets through LLCs, supported by specialized advisers managing digital wallet structures.

"Cook Islands LLCs provide owners with liability protection while allowing flexible management structures governed primarily by the operating agreement rather than rigid statutory requirements."

– Offshore Protection

However, it’s important to note that LLCs are not immune to all risks. The case of United States v. Rogan in 2025 showed that if an individual retains a financial interest in an LLC, it can be garnished. Additionally, transfers made after legal threats arise may be challenged as fraudulent. When paired with tailored insurance policies, offshore LLCs can round out a strong asset protection strategy.

The Role of Insurance in Offshore Strategies

Offshore insurance policies added another layer of security to wealth protection plans in 2025. These policies were designed to safeguard specific asset classes, such as qualified retirement accounts and investment portfolios, from lawsuits and creditor claims.

Often integrated into hybrid setups, these policies combined domestic and offshore elements. For instance, a Cook Islands trust could be paired with a domestic structure to balance U.S. compliance with foreign legal protections. This approach gained popularity as transparency requirements under FATCA and CRS reporting standards pushed asset protection strategies away from secrecy and toward professional organization.

All offshore insurance structures must be disclosed on FBAR (FinCEN Form 114) and IRS Form 8938 to avoid legal complications. U.S. courts continue to scrutinize these arrangements, especially if there’s evidence of "de facto control" by the settlor. Transfers made after a claim arises are often deemed fraudulent and can result in assets being repatriated.

How to Strengthen Your Wealth Protection in 2026

The financial upheavals of 2025 served as a stark reminder: waiting for trouble to strike is a risky gamble. Building a solid plan to protect your wealth requires foresight, smart diversification, and expert advice. Here’s how to safeguard your assets and stay ahead in 2026.

Review and Diversify Your Assets

Start by taking stock of all your assets. This step can uncover gaps in your current protection strategy and help you identify areas that need attention.

Diversifying your assets across different jurisdictions and currencies can make it significantly harder for creditors to pursue claims. Splitting your holdings across multiple countries forces creditors to navigate separate legal systems, which adds time, cost, and complexity to their efforts. Similarly, diversifying into currencies like Swiss francs or tangible assets like physical gold can act as a hedge against domestic financial instability.

Combining domestic and offshore strategies can further strengthen your defenses. For example, umbrella insurance and well-structured LLCs can protect you locally, while offshore trusts add another layer of security by separating personal and business liabilities. Moving assets like real estate or bank accounts into a Cook Islands trust can also shield them from U.S. legal claims, provided all compliance and reporting requirements are met. Timing is critical here – these structures need to be in place well before any liabilities arise, as courts often reverse transfers made after claims are filed, labeling them as fraudulent.

Once your assets are diversified, choosing the right jurisdictions becomes the next step.

Selecting the Right Offshore Jurisdictions

Not all jurisdictions offer equal protection. Look for countries with stable legal systems and strong safeguards against fraudulent transfers. The Cook Islands and Nevis stand out as top choices for asset protection trusts. Their courts don’t recognize U.S. judgments, forcing creditors to re-litigate their claims locally – a process that can be both expensive and time-consuming.

It’s also essential to evaluate the political and legal stability of your chosen jurisdiction. For example, Portugal has gained popularity among investors for its reliable legal system and strong property rights within the European Union. Beyond the laws themselves, consider the reputation and independence of local trustees, banks, and service providers. These factors can be just as critical as the jurisdiction’s legal framework.

"Think of an offshore asset protection trust as a legal fortress for your assets – like the moat around a castle."

– The Nestmann Group

Getting Professional Guidance

Even the best-laid plans can fall apart without expert oversight. With nearly 5 million court cases filed in the U.S. in 2023 alone, the risks of going it alone are too high. Professional advisors play a vital role in ensuring your protection plan remains effective and legally compliant.

Specialists can help you navigate complex regulations like FATCA and the Common Reporting Standard, ensuring that your structures meet all legal requirements while still offering robust protection. They also understand the nuances of different jurisdictions – such as why the Cook Islands offers stronger creditor barriers or when a hybrid onshore-offshore setup might work best. Additionally, they handle the ongoing maintenance of your structures, including annual filings and documentation, to prevent legal challenges that could jeopardize your assets.

A key area where professionals add value is maintaining legal separation. Courts often scrutinize setups where individuals maintain too much direct control over their assets. To address this, advisors frequently recommend appointing independent trustees or including "protector" provisions to ensure the required separation.

"There’s no one-size-fits-all protection plan. Your plan needs to be sensitive to your personal circumstances and also to the types of creditors that you are trying to protect against."

– Derek Thain, Vice President, Fidelity‘s Advanced Planning team

For added security, consider dual-counsel reviews to document legitimate business purposes and ensure compliance. Partnering with reputable firms like Global Wealth Protection can help you create a well-structured, compliant plan while steering clear of questionable low-cost options or unreliable promoters.

Conclusion: Creating a Durable Wealth Protection Plan

Looking back at the lessons from 2025, it’s clear that having a well-thought-out, layered strategy for protecting your wealth is more important than ever. The legal and economic turbulence we’ve seen highlights the need to take proactive steps to shield your assets from potential risks.

Start by building a strong foundation with liability insurance. Then, consider separating high-risk assets using domestic LLCs. For an added layer of security, explore offshore trusts in jurisdictions like the Cook Islands or Nevis. These structures can make it significantly harder – and more expensive – for creditors to pursue claims, as they may have to re-litigate their cases in foreign courts. This kind of multi-layered approach is key to creating a robust defense.

Offshore planning, when done properly, establishes transparent and legal frameworks that align with reporting requirements. With rising national debt and ongoing geopolitical uncertainties, diversifying both geographically and across currencies will be critical as we move into 2026.

There’s no better time to take action. Partner with experienced professionals who are well-versed in both U.S. and international legal systems. They can help you design a plan that not only complies with regulations but also positions you to face the challenges of 2026 with confidence.

FAQs

What are the advantages of using offshore trusts to protect your assets?

Offshore trusts can be an effective way to protect your wealth from various risks. When you move assets into an irrevocable foreign trust, you create a clear legal boundary between those assets and your personal estate. This separation makes it much harder for creditors or lawsuits to reach your wealth, often discouraging legal actions altogether.

Beyond protection from creditors, offshore trusts offer an added layer of privacy. Jurisdictions like the Cook Islands or Belize are known for keeping trust details confidential. These trusts are also a practical tool for estate planning, allowing you to transfer assets to your heirs smoothly, potentially sidestepping probate and reducing estate taxes. Additionally, they can act as a financial safety net by placing your wealth in jurisdictions that are legally secure and economically stable.

In uncertain times, offshore trusts can be a reliable strategy for safeguarding and preserving your assets.

How does diversifying across countries and currencies help protect my wealth?

Diversifying your wealth across different countries and currencies can act as a safeguard against challenges like economic slumps, political unrest, or currency devaluation in a specific region. By allocating assets through various legal frameworks – such as trusts or LLCs in countries known for strong creditor protections – you can minimize the chances of a single event significantly impacting your entire portfolio.

Holding funds in multiple currencies, such as U.S. dollars, euros, or Swiss francs, is another way to protect your purchasing power from exchange rate fluctuations. For instance, maintaining a mix of 60% in USD and 40% in euros can offer stability if you regularly conduct business in both the United States and Europe. This approach keeps your wealth adaptable and resilient, even in uncertain times, while ensuring compliance with U.S. reporting obligations like FBAR and FATCA.

What mistakes should I avoid when setting up offshore trusts and LLCs?

When establishing an offshore trust or LLC, picking the wrong jurisdiction can be a costly misstep. Some locations lack robust creditor protection or fail to recognize self-settled spendthrift trusts, which can undermine your entire asset protection strategy. Another major error? Selecting an inexperienced or unqualified trustee. This choice can result in compliance problems or even challenges to the legitimacy of the trust.

For LLCs, holding too much control or ownership can backfire, potentially leading to the entity being labeled as a fraudulent conveyance under U.S. law. Additionally, it’s crucial to adhere to proper formalities. This includes maintaining separate bank accounts, filing required annual reports, and keeping detailed records. Blending personal and business finances or skipping these steps can erode the LLC’s liability protections and expose you to legal risks.

To steer clear of these common pitfalls, invest time in researching jurisdictions, work with seasoned professionals, and stay on top of compliance and reporting obligations. These steps can go a long way in safeguarding your assets and fortifying your protection plan.