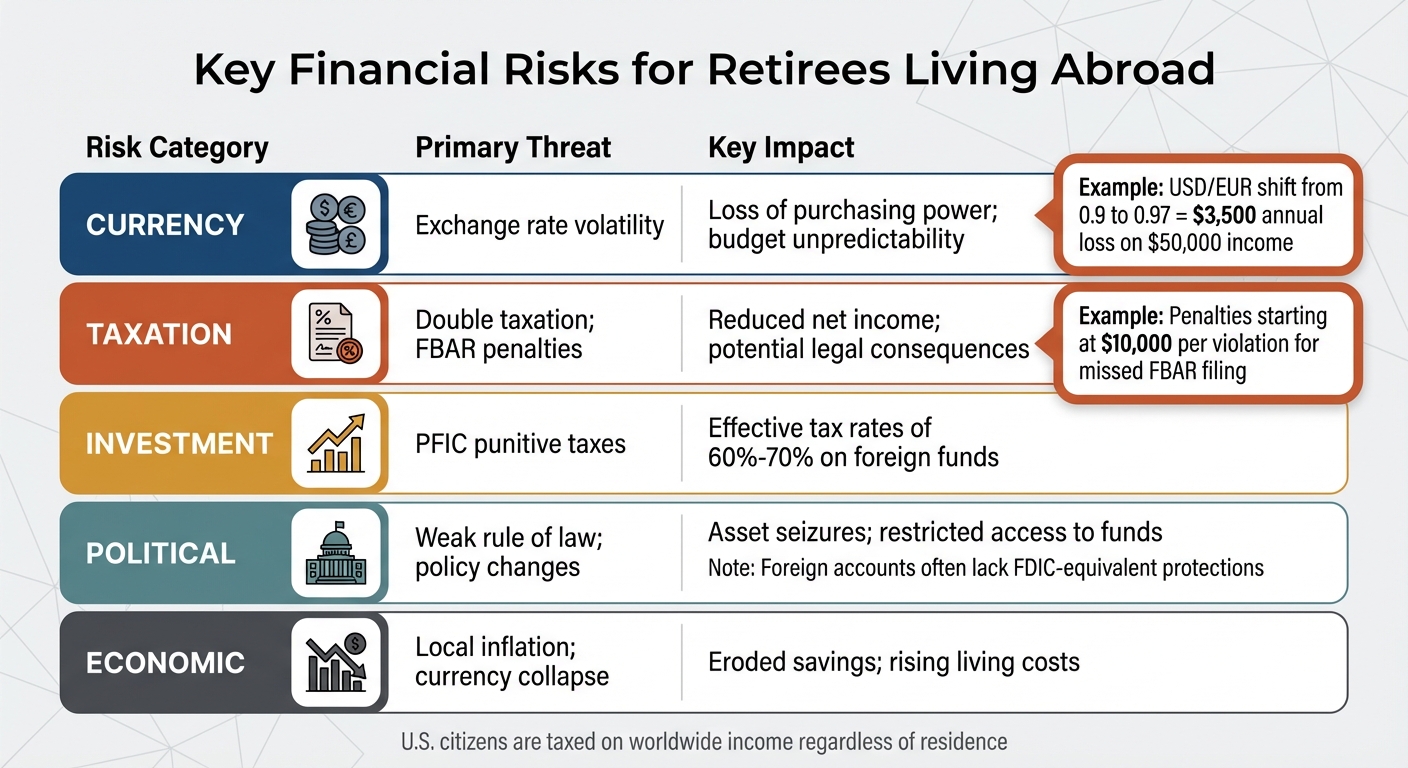

Retiring abroad can be appealing – lower costs, better weather, and a fresh lifestyle. But it comes with financial risks, including currency swings, double taxation, and political instability. For example, a change in the USD/EUR rate from 0.9 to 0.97 could cost a retiree $3,500 annually on a $50,000 income. U.S. citizens are also taxed on worldwide income, risking double taxation without proper planning. Offshore banking, diversified investments, and legal safeguards can help protect your savings. This guide explains how to manage these challenges, from selecting stable banking jurisdictions to avoiding tax traps like PFIC rules. The goal? To keep your nest egg secure while living abroad.

Risks to Your Retirement Savings Overseas

Relocating abroad for retirement may sound like a dream, but it comes with challenges that can threaten your financial security. Currency volatility, political uncertainty, and complex tax systems can chip away at your savings if you’re not prepared. Let’s take a closer look at these risks – currency fluctuations, political instability, and tax obligations – and how they can impact your retirement.

Currency Changes and Inflation

Currency fluctuations can significantly affect the value of your income. For example, shifts in the USD/EUR exchange rate can shrink your purchasing power, leaving you with less money to cover your expenses. A weaker U.S. dollar means your retirement income won’t stretch as far.

Inflation in your host country adds another layer of complexity. Rising local costs, like rent, can outpace your fixed income, making it harder to maintain your standard of living.

"For retirees converting USD income into euros in Mediterranean countries, this [exchange rate shift] could mean swings of approximately $3,500 per year on a $50,000 annual income. These fluctuations can significantly impact budgeting and long-term financial security." – Federica Grazi, Founder, Mitos Relocation Solutions

Political and Economic Instability

Beyond currency issues, political and economic instability in your host country can put your savings at risk. Weak financial regulations or unstable governments can lead to sudden policy changes, like capital controls or even property seizures, that limit your access to funds. Unlike U.S. bank accounts protected by FDIC insurance, foreign accounts often lack similar safeguards.

Economic downturns can make matters worse. High inflation can drive up the cost of everyday essentials, while a collapsing local currency can erode the value of any investments you hold in that country.

Tax Obligations and Legal Compliance

U.S. citizens are taxed on their global income, which means you could owe taxes both in the U.S. and in your new country of residence. Without careful planning, you could face double taxation, even if tax treaties and foreign tax credits are available. Missing a filing deadline can result in steep penalties.

The paperwork alone can be overwhelming. If your foreign accounts exceed $10,000, you’re required to file an FBAR (Report of Foreign Bank and Financial Accounts). Failure to comply could result in penalties starting at $10,000 per violation – or even criminal charges. Additionally, investing in non-U.S. mutual funds may subject you to PFIC rules, which can push your tax rate as high as 60%-70%.

"Currency conversion losses and double taxation are particularly tricky without professional guidance." – Joe Cronin, President, International Citizens Insurance

| Risk Category | Primary Threat | Key Impact |

|---|---|---|

| Currency | Exchange rate volatility | Loss of purchasing power; budget unpredictability |

| Taxation | Double taxation; FBAR penalties | Reduced net income; potential legal consequences |

| Investment | PFIC punitive taxes | Effective tax rates of 60%-70% on foreign funds |

| Political | Weak rule of law; policy changes | Asset seizures; restricted access to funds |

| Economic | Local inflation; currency collapse | Eroded savings; rising living costs |

sbb-itb-39d39a6

Offshore Banking for Asset Protection

Offshore banking plays a key role in safeguarding your retirement savings abroad. It’s an effective way to protect your finances from risks like currency fluctuations, political instability, and economic downturns. By spreading your money across stable jurisdictions with strong financial systems, you can reduce your reliance on any single country’s economy. It’s all about spreading risk and taking advantage of services that go beyond what domestic banks offer.

Benefits of Offshore Bank Accounts

One of the standout advantages of offshore accounts is the ability to hold multiple currencies in a single account. This can save you from paying hefty conversion fees. For instance, if you’re receiving Social Security in U.S. dollars but paying rent in euros, you can manage your currency exchanges strategically, avoiding unfavorable rates rather than converting small amounts monthly at whatever rate your bank dictates.

Offshore accounts often come with privacy protections, which vary by jurisdiction. Many banking hubs enforce strict confidentiality laws while still adhering to international reporting standards. Switzerland, for example, is known for its strong financial security, privacy, stable currency, and low inflation rates. Some jurisdictions, like the Cayman Islands, also offer tax advantages – they don’t impose corporate, income, wealth, or property taxes and have no restrictions on moving funds in or out.

Beyond privacy and tax perks, offshore accounts provide access to global investment opportunities and wealth management services that U.S. banks might not offer. Singapore, for example, boasts a robust banking infrastructure and tax exemptions on interest earned from financial instruments, making it an appealing choice for retirees seeking both stability and growth. Additionally, some offshore banks offer higher interest rates on fixed-term deposits compared to domestic options.

With these benefits, choosing the right jurisdiction is crucial.

Selecting the Right Banking Jurisdiction

When selecting an offshore banking location, prioritize jurisdictions with political and economic stability, strong financial regulations, and customer protections. Top choices include Switzerland, Singapore, and Hong Kong, all of which have well-established banking systems and deposit insurance schemes. For example, Hong Kong, the third-largest global financial market as of September 2024, offers zero taxes on external income and deposit insurance for most local banks.

"Regulatory standards in global banking centers range from very high to almost nonexistent in some of the more exotic offshore banking locales." – Peter Sengelmann, MBA, CFA, Creative Planning International

Before opening an offshore account, ensure you have the necessary documentation – this usually includes government-issued IDs, proof of address, and income verification. Investigate whether the jurisdiction offers deposit insurance similar to the FDIC in the U.S., as many offshore accounts lack comparable government-backed protections. Also, consider practical aspects like time zones, language barriers, and the availability of remote account management tools.

| Jurisdiction | Primary Benefits | Key Protections |

|---|---|---|

| Switzerland | Strict privacy, stable currency, low inflation | High financial security; deposit protection scheme |

| Singapore | Stable economy, extensive infrastructure | Tax exemptions on interest from financial instruments |

| Hong Kong | Zero taxes on external income | Deposit insurance for most local banks |

| Cayman Islands | No income, wealth, or property taxes | Zero restrictions on money transfers |

| Panama | Strict banking secrecy, foreign income tax exemptions | Unrestricted capital movement |

Common Mistakes to Avoid

While offshore banking offers many advantages, it’s important to avoid common pitfalls that could undermine its benefits.

First, don’t confuse offshore banking with tax evasion. U.S. citizens are required to report worldwide income, no matter where it’s held. Additionally, if the total value of your foreign accounts exceeds $10,000 at any point during the year, you must file an FBAR (Foreign Bank Account Report) to avoid penalties starting at $10,000 per violation.

Offshore accounts also require ongoing compliance. This includes annual filings, staying informed about changing regulations, and avoiding investments that could lead to excessive tax burdens. For example, non-U.S. mutual funds or pooled investments can trigger PFIC (Passive Foreign Investment Company) rules, which come with higher tax liabilities.

Another common mistake is keeping all your cash offshore without maintaining liquid funds in the U.S. It’s wise to keep 3 to 6 months’ worth of essential expenses in a readily accessible domestic account. Lastly, confirm that your offshore bank allows online or phone-initiated international wire transfers. Some institutions require in-person visits for such transactions, which can be impractical if you’re living abroad.

Diversified Investments for Retirees Abroad

Expanding your investment portfolio is an effective way to provide an extra layer of financial security, especially when retiring abroad. By spreading your retirement savings across various asset classes, you can reduce the impact of market fluctuations and currency changes, ensuring a steadier financial footing even during localized economic challenges.

One smart approach is to align the currency of your investments with your future expenses. For instance, if you’re living in France and paying bills in euros, allocating more to European stocks and bonds can help minimize currency risks. Peter Sengelmann, a wealth manager at Creative Planning International, explains:

"Retirees can manage their long‐term currency risk by aligning investments with local currency expenses".

This strategy ensures your U.S. dollar investments retain their purchasing power, even if exchange rates shift unfavorably.

A well-balanced portfolio for retirees living abroad might include a mix of U.S. and international stocks, bonds, investments in emerging markets, and tangible assets like real estate or precious metals.

Investing in Precious Metals

Precious metals, such as gold and silver, provide a reliable option for diversifying your investments. These tangible assets often serve as a hedge against inflation and economic instability. When markets falter or currencies weaken, metals like gold tend to retain or even increase their value. However, if you decide to invest in physical metals, make sure you have secure storage and comply with any reporting obligations.

Real Estate Investments Abroad

Purchasing property in your host country can be another effective diversification strategy. Real estate not only offers the potential for price appreciation and rental income but also helps offset currency risks by tying your investment to the local market.

Before buying, research local property ownership rules, as they can vary widely. Some countries may offer full ownership rights ("fee simple"), while others may only allow leasehold arrangements. Additionally, local inheritance laws might differ significantly from those in the U.S. For example, property rents in Portugal rose by 49% between 2017 and 2022, showcasing both potential opportunities and risks tied to local inflation.

It’s a good idea to visit prospective properties in person and account for upfront costs like legal fees, shipping expenses, and visa charges before finalizing any purchase.

Retirement Accounts and International Options

For most retirees, U.S.-based retirement accounts – such as IRAs, Roth IRAs, and 401(k)s – remain cost-effective, highly liquid, and easier to manage from a tax perspective compared to foreign options. These accounts benefit from favorable long-term capital gains tax rates of 15%–20%, which are often better than the rates applied to non-U.S.-registered mutual funds.

Stick to U.S.-registered ETFs and mutual funds to avoid triggering Passive Foreign Investment Company (PFIC) rules, which can result in hefty tax penalties. If your host country has a tax treaty with the U.S., verify that it protects the tax-deferred status of your retirement accounts to avoid being taxed twice.

For self-employed retirees, a solo 401(k) allows you to defer up to $69,000 annually starting in 2024, offering a powerful tool for continued savings.

| Investment Type | Primary Benefit | Key Risk/Requirement |

|---|---|---|

| U.S. Stocks/ETFs | High liquidity, low fees | Subject to U.S. capital gains tax |

| Foreign Real Estate | Diversification, potential growth | Complex ownership laws, local inflation |

| Precious Metals | Protection during uncertainty | Storage and reporting requirements |

| U.S. IRAs/Roth IRAs | Tax-advantaged growth | Complex cross-border tax treaty rules |

Legal Structures for Asset Protection

Protecting your retirement savings often involves using legal structures designed to shield assets from creditors, simplify estate planning across borders, and maintain privacy. The goal is to pick strategies that align with your financial needs and potential risks. Below, we’ll explore two key options.

International Trusts for Estate Planning

An Offshore Asset Protection Trust (OAPT) is a powerful tool for retirees with substantial assets. These irrevocable trusts are set up in jurisdictions like the Cook Islands, Nevis, or the Cayman Islands, which are known for their debtor-friendly laws.

"Offshore trust jurisdictions are typically friendly to debtors – foreign trustees are not subject to the laws of the United States and they are not required to comply with any orders issued by domestic courts." – White and Bright, LLP

This structure makes it challenging for creditors to pursue claims since they would need to litigate in the trust’s jurisdiction, often under stricter legal standards. Timing is crucial – these trusts must be created and funded before any legal disputes arise. Courts can reverse transfers made to defraud known creditors, so proactive planning is essential. Additionally, international trusts can simplify asset transfers to heirs and help avoid conflicts with succession laws.

If you own property abroad, consider drafting a situs will, which is specifically designed for assets in a particular country. Be cautious to limit its scope to local assets to avoid unintentionally overriding your U.S. will.

For U.S. citizens, reporting requirements include filing IRS Form 3520 for foreign trusts, with an annual Form 3520-A for the trust itself. While these trusts offer strong protection, they come with high setup and maintenance costs, making them better suited for wealthier retirees who face significant legal risks.

Now, let’s look at a simpler, more affordable option: private U.S. LLCs.

Private US LLCs for Privacy and Protection

A private U.S. LLC is a straightforward way to protect assets while keeping costs and complexity manageable. Forming an LLC in states like Wyoming or Nevada, which have strong privacy laws, creates a corporate shield that separates your personal liability from the LLC’s assets.

This structure works well for holding U.S.-based assets such as brokerage accounts, rental properties, or business interests. Its pass-through taxation means income flows directly to your personal tax return, avoiding complicated international tax rules like PFIC or CFC regulations. Compliance is relatively simple, typically requiring only state filing fees and basic recordkeeping.

One major advantage is privacy. By holding assets in the LLC’s name, it becomes harder for creditors to trace your personal holdings. However, unlike offshore trusts, U.S. LLCs are still subject to U.S. court jurisdiction, offering moderate protection rather than complete immunity.

Comparing Protection Structures

Here’s a comparison of the main asset protection options for retirees:

| Structure | Protection Level | Privacy | Setup Cost | Tax Effects | Best Use Case |

|---|---|---|---|---|---|

| Offshore Trust | Highest; bypasses U.S. court orders | High | High; ongoing trustee/legal fees | Neutral; requires IRS reporting (Form 3520) | Best for high-net-worth retirees with litigation risks |

| Private US LLC | Moderate; corporate veil | High; in privacy-friendly states (e.g., WY, NV) | Moderate; annual state fees | Pass-through taxation; simple U.S. reporting | Ideal for holding U.S. assets like rentals or investments |

| Offshore Company | Moderate; cross-border litigation required | High; depends on local registries | Moderate to high; compliance costs | Complex; subject to PFIC or CFC tax rules | Useful for foreign business interests or real estate |

| Retirement Accounts | Statutory protections (federal/state laws) | Low; reported to U.S. institutions | Low; standard account fees | Tax-deferred or tax-free (Roth) | Excellent for tax-advantaged savings and FBAR-exempt |

Combining these strategies can enhance protection. Start with domestic safeguards like retirement accounts and liability insurance. Then, layer in offshore options if needed. Always keep enough liquid funds in U.S. accounts to cover legal expenses, as regulatory changes could limit access to offshore assets.

Best Jurisdictions for Retirees

Top Countries for Financial Security

Planning to retire abroad? It’s not just about the scenery – it’s about understanding tax policies, banking access, and economic stability. These factors play a big role in protecting your nest egg while ensuring compliance with legal obligations. Some countries even have territorial tax systems, meaning they only tax income earned within their borders. This can be a huge advantage for retirees relying on U.S. Social Security, pensions, or investment income.

Take Panama, for example. Its Pensionado visa program requires just $1,000 per month in pension income. On top of that, Panama offers territorial taxation, no inheritance tax, and discounts on utilities and medical bills. If you’re looking for other options, Panama also provides a Person of Means visa for a $300,000 investment or a Forestry Investor visa for $60,000.

Costa Rica is another standout. Its territorial tax system ensures U.S. portfolio income remains untaxed locally. Add in affordable private healthcare and a stable democracy, and you’ve got a recipe for a secure retirement.

In Greece, retirees enjoy a flat 7% tax on all foreign income for 15 years – a major drop from the typical 44% rate. To qualify, you’ll need to invest at least €250,000 in real estate. Similarly, Italy offers a 7% flat tax for retirees relocating to small Southern towns with populations under 20,000, but this benefit lasts for 10 years.

France eliminates local taxes on U.S. retirement account distributions, including Roth IRAs. This exemption helps retirees avoid the double taxation that can occur elsewhere. Malta, on the other hand, uses a remittance-based system, taxing foreign income only when it’s brought into the country. For retirees with sufficient funds, this approach can be highly effective.

Closer to home, Mexico offers a lower cost of living and proximity to the U.S. However, its retirement visa requires proof of about $7,321 in monthly pension income or $292,859 in savings (2024 requirements). If you meet certain criteria – like maintaining a home outside Mexico and earning over 50% of your income from U.S. sources – you may even qualify as a non-resident for tax purposes.

For those seeking zero-tax environments, places like the UAE, Monaco, and the Bahamas eliminate income taxes altogether. However, these jurisdictions often come with higher living costs and residency requirements tied to property purchases or minimum deposits.

| Country | Key Tax Benefit | Residency/Visa Requirement |

|---|---|---|

| Panama | Territorial taxation; no inheritance tax | $1,000/month pension (Pensionado) |

| France | Exempts U.S. retirement/Roth distributions | Standard residency |

| Greece | 7% flat tax on foreign income (15 years) | €250,000 investment or passive income |

| Italy | 7% flat tax in Southern regions (10 years) | Relocation to a small Southern town (<20,000 residents) |

| Costa Rica | Territorial taxation | Real estate purchase or fixed income |

| Malta | Remittance-based taxation | Malta Retirement Programme |

Beyond tax perks, securing residency in one of these countries can strengthen your financial and asset protection strategies.

Residency and Citizenship Options

Once you’ve chosen a financially stable country, the next step is securing residency or citizenship. These programs not only provide legal status but also ensure smoother banking access and a backup plan if U.S. conditions become less favorable.

Residency-by-investment programs are a popular choice. For example, Greece’s €250,000 real estate investment grants access to the EU’s Schengen zone, while Panama offers residency options starting at $60,000 for forestry investments or $300,000 for broader investment opportunities. Portugal’s Non-Habitual Residency program used to be a strong contender for foreign income tax breaks, though recent changes have reduced its appeal.

Residency often simplifies opening offshore bank accounts, as many banks require proof of legal residence. Countries like Costa Rica, Malaysia, and Thailand even tie visa requirements to minimum bank deposits. Establishing residency not only legitimizes your presence but also helps you comply with U.S. reporting rules like FBAR and FATCA.

If you’re retiring abroad, keeping a U.S. mailing address is crucial. Whether it’s a physical address or a virtual mailbox service (starting at around $10/month), this step can prevent U.S. financial institutions from closing your accounts. Many brokerages restrict services to non-residents, and maintaining a U.S. address ensures continued access to domestic investment options, which often come with lower fees than foreign alternatives.

"U.S. retirees living abroad may also earn a foreign tax credit in the country of residence for taxes paid to the U.S. That can also sometimes offset the tax burden in your country of retirement." – Crystal Stranger, Senior Tax Director and CEO, OpticTax.com

Before making any long-term commitments, consider trial stays to assess local infrastructure, healthcare quality, and living costs. It’s also wise to hire tax professionals familiar with both U.S. and local tax systems. Misaligned tax years and reporting requirements can lead to expensive errors. Lastly, check if your chosen country has a bilateral tax treaty with the U.S., as this can prevent double taxation on Social Security and pension income.

With approximately 760,000 Americans already receiving Social Security benefits while living abroad, retiring overseas is more achievable than ever. Choose a destination that aligns with your financial goals and lifestyle preferences – strategic residency planning can make all the difference in securing a comfortable retirement.

Implementation and Compliance

Your Asset Protection Action Plan

Start by creating a global asset inventory. This list should include all assets by country, along with key details like account numbers, title deeds, and local legal contacts. Think of it as your master guide for ensuring compliance and staying organized during estate planning.

Next, consider consolidating investments in U.S. brokerage accounts. This approach can help reduce fees and simplify IRS reporting. Keep most of your savings in the U.S. to avoid complications with Passive Foreign Investment Companies (PFICs). Use local bank accounts in your country of residence strictly for daily expenses and managing local currency income. This can help you avoid unnecessary conversion fees and keep budgeting straightforward.

"PFIC rules can easily push tax rates on investment income to as high as 60%-70%. These are some of the reasons why we believe U.S. expat investors should avoid owning non-U.S. mutual funds." – Peter Sengelmann, MBA, CFA, Creative Planning International

When it comes to estate planning, organize your documents carefully. Draft a primary U.S. will to cover major assets and create local wills for properties in foreign countries. These local wills should be limited to addressing property in their respective jurisdictions and must not inadvertently revoke your primary will. Additionally, keep 3–6 months’ worth of essential expenses in cash for emergencies.

If you’ve missed reporting foreign assets in previous years, the IRS offers Streamlined Foreign Offshore Procedures for non-willful violations. To qualify, you must have spent at least 330 full days outside the U.S. during one of the last three years and not maintained a U.S. residence. This program allows you to catch up on filings without penalties for failure-to-file or FBAR violations.

Once you’ve organized your assets, the next step is ensuring compliance with international filing rules.

International Legal Requirements

To fully protect your assets, you’ll need to stay on top of global tax and reporting obligations.

As a U.S. citizen or resident, you are taxed on worldwide income. This means filing Form 1040 annually, along with any additional forms required for foreign assets. Two key reporting requirements are FBAR and FATCA.

- FBAR (FinCEN Form 114): If the total value of your foreign financial accounts exceeds $10,000 at any point during the year, you must file this form with the Treasury Department. The deadline is April 15, but there’s an automatic extension to October 15. Records must be kept for at least five years. Criminal violations can lead to fines and up to five years in prison.

- FATCA (IRS Form 8938): If you’re living abroad and your financial assets exceed $300,000, you’ll need to file this form with your annual tax return. Keep in mind that FATCA thresholds differ from FBAR, and in some cases, you may need to file both forms.

Here’s a quick comparison of FBAR and FATCA requirements:

| Requirement | FBAR (FinCEN Form 114) | FATCA (IRS Form 8938) |

|---|---|---|

| Reporting Threshold | >$10,000 aggregate at any time | >$300,000 for expats |

| Where to File | Treasury Department (FinCEN) | Internal Revenue Service (IRS) |

| Due Date | April 15 (auto-extension to Oct 15) | Filed with annual tax return |

| Recordkeeping | 5 years required | Follows tax return rules |

Owning foreign entities or trusts adds more layers of compliance. For instance, Form 3520 is required for foreign trusts and large gifts, Form 5471 for foreign corporations, and Form 8865 for foreign partnerships. A tax advisor familiar with cross-border treaties can help you navigate these requirements. Treaties can also prevent double taxation on Social Security and pension income, though benefits vary depending on the country.

Lastly, confirm your legal domicile, as this often determines succession rules and tax residency more than your physical location. If you’re married to a non-U.S. citizen, keep in mind that the unlimited marital deduction doesn’t apply, and estate taxes can reach 40%. However, as of 2024, you can give up to $185,000 per year to a non-citizen spouse without triggering gift taxes.

Conclusion

Retiring abroad can be an appealing option, but ensuring your financial security requires careful planning. The strategies highlighted here – like managing currency risks, staying compliant with tax regulations, and using offshore accounts or legal entities – are key to safeguarding your financial future while living overseas.

According to recent data, nearly 760,000 Americans receive Social Security benefits while living abroad, and over 1 in 6 seniors are exploring the idea of relocating internationally. These numbers highlight just how important it is to have a well-thought-out asset protection plan.

"The number one mistake is just assuming that your tax and financial situation will be the same when you move abroad as it is in the U.S." – Alex Ingrim, Financial Adviser

To build on these strategies, consider assembling a cross-border financial team, staying compliant with global reporting requirements, and focusing key investments in U.S.-registered accounts to avoid unnecessary tax complications. Additionally, ensure your estate plan accounts for assets in multiple jurisdictions to prevent legal hurdles down the road.

Global Wealth Protection specializes in creating tailored solutions for international asset management. Whether you need help setting up offshore companies, exploring private U.S. LLC structures for added privacy, or crafting a personalized financial strategy, working with experienced professionals can help secure your retirement savings. In today’s increasingly complex regulatory landscape, expert advice is critical to protecting the wealth you’ve worked so hard to build.

FAQs

How can retirees living abroad avoid being taxed twice on their income?

Retirees can sidestep double taxation by leveraging U.S. tax treaties with other countries. These treaties are specifically designed to prevent the same income – such as pensions, Social Security, or investment earnings – from being taxed by both the U.S. and a foreign government.

Another effective approach is utilizing the Foreign Tax Credit (FTC). This credit lets U.S. taxpayers reduce their U.S. tax bill by the amount of taxes they’ve already paid to a foreign government. To claim this credit, you’ll generally need to file IRS Form 1116, which details foreign income and taxes paid. It’s crucial to stay on top of U.S. tax filing rules, even if a treaty applies to your situation.

For tailored advice, it’s wise to consult a tax professional with expertise in international tax matters. They can help ensure accurate reporting, help you maximize tax benefits, and steer clear of potential penalties.

What are the advantages of offshore banking for retirees living abroad?

Offshore banking offers retirees several practical benefits for managing their finances while living overseas. One standout advantage is asset protection. Many offshore accounts are based in jurisdictions with robust legal frameworks that help safeguard funds from risks like political instability, economic challenges, or potential legal claims back home.

Another perk is access to diverse investment options. Offshore banks often provide a broader selection of global financial products, currencies, and markets. This allows retirees to spread their investments across different areas, lowering overall risk. On top of that, offshore accounts can be designed to enhance tax efficiency and offer greater financial privacy, giving retirees more control over their wealth.

For retirees, offshore banking can play a key role in preserving savings, managing currency fluctuations, and ensuring financial flexibility while enjoying life abroad.

What are the best countries for American retirees looking for tax advantages abroad?

Several countries provide appealing tax advantages for American retirees, making it easier to stretch your retirement savings while enjoying life overseas.

Belize is a standout option, as it only taxes income earned locally. Retirees who join its Qualified Retirement Program can even import personal belongings without paying duties. To qualify, you’ll need a minimum monthly retirement income of $2,000.

Greece offers another enticing opportunity with a flat 7% tax rate on foreign pension income for up to 15 years. This program, designed specifically for foreign retirees, is a stark contrast to Greece’s regular tax rates, which can climb as high as 44%.

Other destinations worth considering include Portugal, Panama, and Costa Rica. These countries are known for their low tax burdens and agreements with the U.S. that help prevent double taxation. However, it’s essential to remember that U.S. citizens must still file annual tax returns, no matter where they reside.

When planning your retirement abroad, thoroughly research each country’s tax laws, residency requirements, and how these align with your financial goals to make the most of this exciting chapter.