Insurance is more than just risk protection – it’s a tool for managing and preserving wealth across borders. For high-net-worth individuals, it offers solutions to reduce taxes, protect assets, and ensure smooth wealth transfers. Here’s why it matters:

- Tax Efficiency: Insurance policies, like Private Placement Life Insurance (PPLI), allow investments to grow tax-free and provide tax-free payouts to heirs.

- Asset Protection: Offshore insurance structures shield assets from creditors and legal claims.

- Estate Planning: Policies help cover estate taxes, avoiding forced asset sales or financial strain for heirs.

- Global Flexibility: International insurance remains valid across borders, offering multi-currency options and broader investment opportunities.

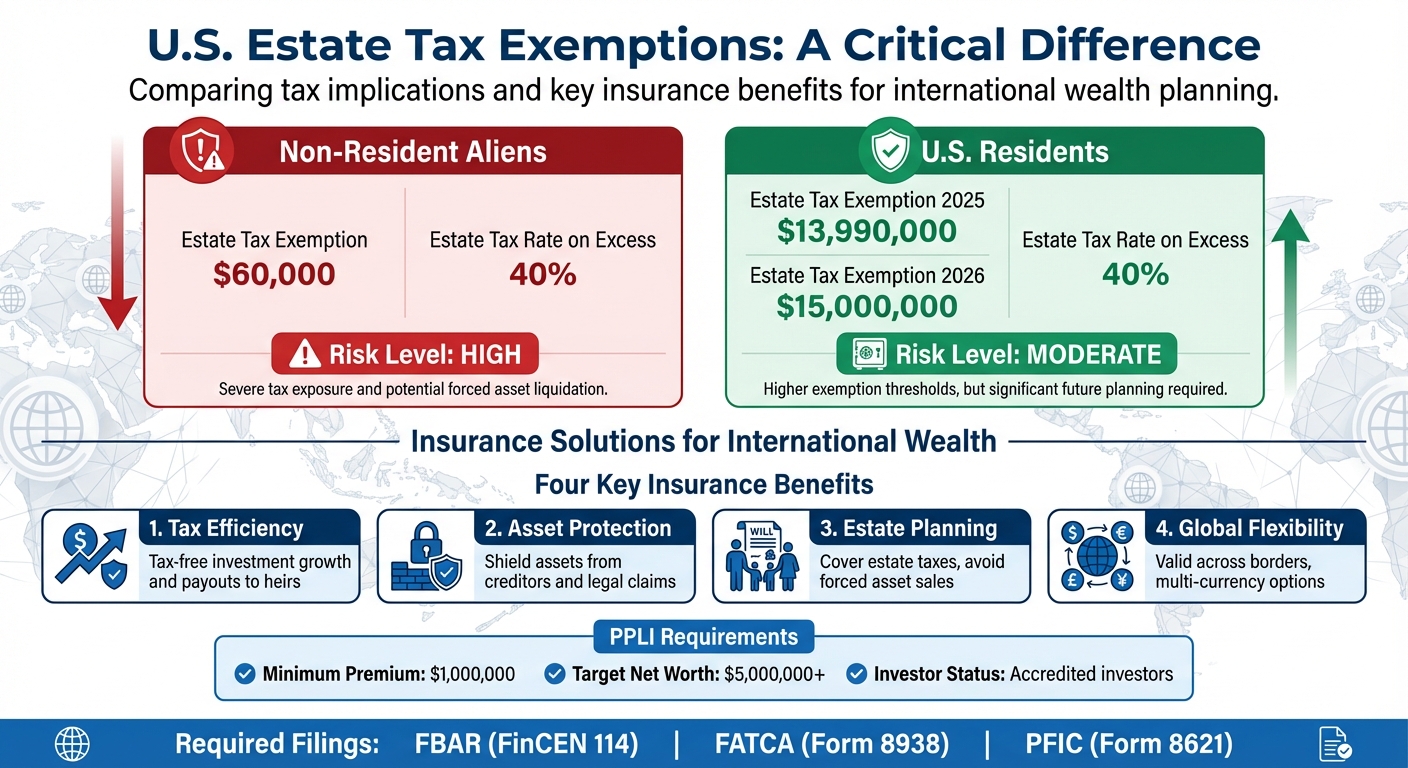

For example, U.S. estate tax exemptions for non-resident aliens are just $60,000, compared to $13.99 million for residents in 2025. Without proper planning, heirs could face steep taxes. Offshore insurance, combined with structuring offshore trusts, can solve this issue while adhering to compliance rules like FATCA and FBAR.

Insurance isn’t one-size-fits-all. It’s crucial to align your policy with your wealth, residency, and goals while ensuring compliance with international tax laws. With the right approach, insurance becomes a powerful financial tool for securing wealth and supporting future generations.

How Insurance Protects Wealth Across Borders

International insurance acts as a shield for your assets, safeguarding them from external risks. This protection is achieved by placing assets in segregated accounts managed by independent investment managers. These accounts are insulated from both the insurance company’s creditors and the policyholder’s personal liabilities, creating a robust layer of defense against legal or financial disputes that might arise across borders.

Jurisdictions like Bermuda and the Cayman Islands are particularly appealing for this purpose due to their strong creditor protection laws, which often surpass those found in many U.S. states. This reduces the likelihood of external claims reaching assets held within these policies. For non-resident aliens, U.S. life insurance offers another advantage: it is typically not classified as U.S. situs property. This means the death benefit can be passed to heirs without incurring the 40% U.S. federal estate tax that applies to other U.S.-based assets like real estate or stocks. These features make international insurance a key part of broader asset protection strategies.

How Insurance and Asset Protection Work Together

Pairing insurance with offshore trusts and LLCs creates a more comprehensive asset protection strategy. A common setup involves an offshore trust owning a life insurance policy, which may also hold an underlying LLC. This layered structure separates beneficial ownership from discretionary control, offering a stronger defense against legal claims or asset seizure.

However, maintaining these protections requires careful adherence to regulations. For example, policyholders should avoid directing specific trades within the insurance policy. Doing so could lead tax authorities to dismantle the structure, nullifying its benefits.

"Offshore life insurance is powerful when it’s a properly structured life insurance policy. It isn’t a loophole, a trading account in disguise, or a magic wand".

Next, we’ll look at how insurance compares to other asset protection methods.

Insurance Compared to Other Asset Protection Methods

Trusts and LLCs offer operational flexibility and legal separation of assets, but they lack the tax-efficient investment benefits provided by qualifying offshore life insurance. For example, direct ownership of investments through an LLC or trust can trigger Passive Foreign Investment Company (PFIC) taxation. In contrast, an insurance structure categorizes the investment as part of a life insurance contract, avoiding this tax burden.

The main differences boil down to control and taxation. LLC managers can make investment decisions directly, while insurance policyholders must delegate those decisions to independent managers to maintain the policy’s tax-deferred status. Additionally, while trusts and LLCs may pass taxable income to the owner, qualifying offshore life insurance allows investments to grow without triggering capital gains, dividend, or interest taxes, and eliminates annual income reporting requirements.

Another advantage of insurance is the immediate death liquidity event, which can be used to cover estate taxes. This is especially critical for non-resident aliens, who face a 40% U.S. estate tax on assets exceeding a $60,000 exemption.

The most effective strategy combines these tools, leveraging the specific strengths of each while ensuring compliance to retain all associated benefits.

sbb-itb-39d39a6

Private Placement Life Insurance (PPLI) for International Wealth

Private Placement Life Insurance (PPLI) is a tailored financial tool designed for high-net-worth individuals managing wealth across borders. Unlike standard life insurance policies that limit investment options to mutual funds, PPLI opens doors to alternative assets like hedge funds, private equity, real estate, private credit, and even tangible assets such as art or private jets. In this setup, the insurance company holds these assets in a separate account on your behalf, offering institutional-level pricing without additional commissions or surrender fees.

The tax advantages of PPLI are considerable: investments grow without taxation, liquidity can be accessed tax-free via policy loans, and beneficiaries receive a tax-free death benefit. However, these perks come with strict rules. You must relinquish control over investment decisions to an independent manager. If you attempt to direct trades or vote on securities, tax authorities may dismantle the structure entirely. Below, we’ll delve into how PPLI operates offshore, its tax benefits, and the compliance requirements you need to meet.

"Offshore PPLI is a strategy that delivers tax-free investment growth, international asset protection, and access to institutional-level investments inside one of the most powerful wrappers in the financial system." – Falcon Wealth Planning

How PPLI Functions in Offshore Jurisdictions

Offshore PPLI thrives in places like Bermuda, the Cayman Islands, and Luxembourg, where regulatory frameworks and creditor protection laws create an attractive environment for managing international wealth. These jurisdictions typically have lower premium thresholds – around $1 million – compared to the $2 million to $5 million often required for domestic policies. This lower entry point, coupled with broader access to global alternative investments, makes offshore PPLI particularly appealing for globally mobile families.

The structure relies on Insurance Dedicated Funds (IDFs) or Separately Managed Accounts, where the insurance company legally owns the assets, but you retain beneficial ownership through the policy. Offshore carriers often allow "in-kind" premium contributions, meaning you can fund the policy with existing assets like private equity stakes instead of cash. This flexibility is especially useful if you want to move existing holdings into the tax-efficient framework without triggering a taxable event. For instance, Bermuda’s "Private Acts" extend the definition of insurable interest to include grandparents, great-grandparents, or even corporate directors. These legislative nuances enable estate planning strategies that might be restricted in other locations. Additionally, offshore PPLI offers robust asset protection, shielding wealth from legal claims or political risks, adding another layer of security to your financial strategy.

Tax Benefits of PPLI

The standout feature of PPLI is tax-free compounding – your investments grow without incurring capital gains, dividend, or interest taxes. Over time, this can lead to significantly greater wealth accumulation compared to taxable accounts. You can also tap into your policy’s cash value without triggering taxes, either through withdrawals (up to your cost basis) or policy loans. This allows you to cover expenses or seize opportunities without creating a taxable event.

For estate planning, PPLI provides a tax-free death benefit to your heirs, bypassing the lengthy and often public probate process. When paired with an Irrevocable Life Insurance Trust (ILIT), the death benefit can also be excluded from your taxable estate. This is particularly important as the federal estate tax exemption – $12.06 million per individual in 2022 – is set to drop to approximately $5.45 million (adjusted for inflation) on January 1, 2026, unless Congress acts. Furthermore, PPLI eliminates the burdensome Passive Foreign Investment Company (PFIC) taxation that applies to directly held foreign investments. Since the investments are part of a life insurance contract, you avoid complex PFIC reporting, punitive tax rates, and annual income disclosures for the policy’s internal gains.

Who Should Use PPLI and Compliance Requirements

PPLI is not for everyone. It’s best suited for high-net-worth individuals with substantial international assets – those who can meet the $1 million minimum premium threshold. It’s especially beneficial for individuals facing combined marginal tax rates above 50%, managing intricate global investment portfolios, or aiming to transfer significant wealth to heirs while minimizing estate taxes. If you’re juggling alternative investments across borders or looking for a unified, tax-efficient structure, PPLI is worth exploring.

Compliance is non-negotiable. U.S. residents using offshore PPLI must file FBAR (FinCEN 114) for foreign accounts exceeding $10,000, FATCA (Form 8938) for specified foreign financial assets, and potentially PFIC filings (Form 8621) depending on the investments. Under the Common Reporting Standard (CRS), offshore jurisdictions report policy values and withdrawals to tax authorities. Missing these obligations can result in hefty penalties.

To keep the policy’s tax benefits intact, you must adhere to IRC §7702 (life insurance qualification) and IRC §817(h) (diversification rules), which generally require at least five different investments, with no single holding exceeding 55% of the account value. Additionally, the "investor control doctrine" mandates that an independent manager handles all investment decisions – you cannot direct trades or exercise voting rights. Funding the policy too quickly can also trigger Modified Endowment Contract (MEC) status, which eliminates the ability to take tax-free loans.

"The policyowner must surrender all control over the investment decisions for this account (the ‘investor control doctrine’)." – Brian M. Balduzzi, Faegre Drinker Biddle & Reath LLP

Given the intricate rules and severe penalties for non-compliance, enlisting specialized tax attorneys and advisors is critical. A coordinated approach with financial advisors, tax experts, and estate planners ensures your PPLI fits seamlessly into your global financial strategy while meeting all regulatory requirements.

Using Insurance for Tax Efficiency and Estate Planning

Insurance isn’t just about protection – it’s also a smart way to manage taxes and pass on wealth efficiently. For families with assets spread across different countries, the right insurance setup can reduce tax liabilities and ensure beneficiaries receive payouts quickly. By combining tax-deferred growth, trust strategies, and policy loans, insurance can be a cornerstone of a well-rounded financial plan. Let’s break it down.

Tax-Deferred Growth and Transferring Wealth to Heirs

Insurance policies like Private Placement Life Insurance (PPLI) offer a major advantage: tax-free compounding. This means your wealth can grow faster compared to taxable accounts. Even better, when the policyholder passes away, beneficiaries usually receive the death benefit without paying taxes on it. This immediate payout is especially helpful for covering estate taxes, which are often due within nine months of death.

Take this example: A billionaire family used an Irrevocable Life Insurance Trust (ILIT) to hold a $100 million policy. By doing so, they avoided over $40 million in estate taxes, ensuring their heirs received the full benefit. In another case, a family-owned business used a $20 million life insurance policy to fund a buy-sell agreement. When the founder passed away, the insurance payout allowed the heirs to keep the business intact, avoiding the need to sell off assets to cover estate taxes.

Combining Insurance with Trusts for Estate Planning

Pairing insurance with trusts takes estate planning to the next level. An ILIT, for instance, keeps both the policy’s death benefit and cash value outside the taxable estate. This strategy is particularly useful in jurisdictions where estate taxes can climb as high as 40%. Trusts also provide a way to control how and when beneficiaries receive their inheritance. For families with assets in multiple countries, international trusts can simplify cross-border wealth transfers and reduce tax complications. Jurisdictions like Bermuda and the Cayman Islands are often favored for their stronger creditor protections.

"A life policy written in trust is often kept outside the taxable estate for IHT, speeding payouts and avoiding probate delays." – Offshore Pro Group

One key tip: don’t name your estate as the beneficiary. Doing so could subject the insurance proceeds to probate, leading to delays and potential tax issues. Instead, designate the trust or specific individuals as beneficiaries. Another strategy? Insure younger family members within a PPLI policy held in a trust. This approach lowers insurance costs and ensures the policy stays active for a longer time. Combined with the liquidity provided by insurance payouts, these trust-based strategies create a solid estate plan.

Accessing Tax-Free Cash Through Policy Loans

Permanent life insurance policies offer a lesser-known benefit: policy loans. By borrowing against the policy’s cash value, you can access funds without triggering a taxable event. These loans don’t require credit checks or income verification, making them an easy way to cover expenses, seize investment opportunities, or fund lifestyle needs – all while allowing the policy’s investments to keep growing tax-deferred.

Here’s how it works: You can withdraw up to the amount of premiums paid (the policy’s “basis”) tax-free or borrow against the remaining cash value. Just be careful to fund the policy gradually to avoid turning it into a Modified Endowment Contract (MEC), which could trigger taxes.

For example, a high-net-worth individual invested $30 million into a PPLI policy. The policy allowed their investments to grow tax-deferred, avoided estate taxes, and maintained confidentiality. On top of that, they had access to future tax-free liquidity whenever needed. This combination of growth, protection, and flexibility makes policy loans a powerful financial tool.

Choosing the Right Insurance for Your Situation

Finding the right insurance isn’t just about comparing premiums. It’s about aligning your choice with factors like your net worth, residency status, investment goals, and long-term plans. The right policy not only helps protect your wealth but also ensures smoother wealth transfers while reducing tax risks.

Key Factors in Insurance Selection

Start by assessing your net worth and investor status. For example, solutions like Private Placement Life Insurance (PPLI) are designed for accredited investors. Typically, these policies require a net worth of at least $5,000,000 and minimum premiums around $1,000,000. If these thresholds don’t apply to you, traditional life or universal life insurance may be a better fit.

Your residency and domicile also play a major role in determining tax obligations. U.S. taxes differ significantly depending on whether you’re classified as a "resident alien" (taxed on worldwide income) or a "non-resident alien" (taxed only on U.S.-sourced income). Additionally, U.S. domicile provides a higher estate tax exemption compared to non-domiciled statuses. This distinction is critical for foreign nationals with U.S. assets, as estate taxes can climb to 40% on amounts exceeding the exemption.

Next, consider your investment profile. Offshore PPLI structures are ideal if you’re seeking access to institutional-level alternative investments like hedge funds, private equity, or real estate. These policies offer more flexibility than domestic options. Also, evaluate your liability exposure – if you face significant creditor risks, jurisdictions like Bermuda or the Cayman Islands provide stronger asset protection laws than most U.S. states.

These factors will help you narrow down whether a domestic or offshore insurance solution suits your needs.

When to Choose Offshore Insurance

Offshore insurance is an excellent option if you need global portability or advanced investment flexibility. For individuals who frequently relocate – such as expatriates or digital nomads – offshore policies remain valid regardless of how many times you move. This eliminates the need for repeated medical exams or underwriting.

Offshore PPLI is also advantageous if you want investment flexibility that goes beyond domestic policy limits. These policies allow access to global alternative investments and often accept "in-kind" premiums, meaning you can fund the policy with existing securities or business interests instead of cash. Additionally, offshore PPLI typically has a leaner cost structure, with institutional pricing that avoids retail commissions and surrender charges.

However, it’s important to note that offshore insurance comes with higher compliance requirements. You’ll need to handle filings like FBAR (FinCEN 114), FATCA (Form 8938), and potentially PFIC disclosures. It’s also crucial to avoid "investor control", which involves directing specific trades within the policy. Violating this rule could strip the policy of its tax advantages. To stay compliant, ensure that an independent investment manager oversees the policy’s investment decisions.

Evaluating Costs and Benefits of Insurance Options

Once you’ve considered the key factors and whether offshore insurance suits you, take a closer look at the costs and compliance involved. For example, offshore PPLI typically requires a minimum premium of $1,000,000, and policies often target individuals with a net worth of $5,000,000 or more. International life insurance premiums are generally higher than domestic ones because they account for cross-border mobility and broader underwriting risks.

Pay attention to the cost structure. Offshore PPLI avoids retail fees, commissions, and surrender charges, offering institutional pricing instead. In contrast, domestic policies often include retail elements that can reduce your returns over time.

Don’t overlook compliance costs. For instance, maintaining offshore PPLI may require quarterly diversification certifications to avoid tax penalties. Professional consultations to structure your policy correctly can cost around €500 (approximately $540) for a 60-minute session. Aligning your policy’s currency (USD, GBP, EUR) with your income or your beneficiaries’ future needs can also help manage exchange rate risks. Lastly, confirm that any U.S.-based policy will remain valid if you move overseas, as some policies are tied to specific residency and underwriting conditions.

Conclusion

Insurance plays a key role in international wealth planning, offering a range of benefits like tax-efficient investment wrappers, liquidity for estate taxes, asset protection, and smoother wealth transfers. The main point? It works best when combined with other tools like trusts, offshore structures, and diversified investments. That said, navigating the complex web of cross-border regulations is no small task.

For globally mobile individuals and high-net-worth families, the stakes couldn’t be higher. Consider this: the U.S. estate tax exemption for nonresident aliens is just $60,000, compared to the $15,000,000 exemption for resident aliens in 2026. Without proper insurance planning, the tax burden could be catastrophic.

The risks of missteps are real. Take the Swiss Life case from May 2021, where the company faced $77.3 million in penalties for helping U.S. taxpayers hide $1.45 billion in offshore assets through insurance wrappers. Or the Webber v. Commissioner ruling, where a PPLI policy lost its tax-deferral benefits because the investor retained too much control over the assets. These examples highlight the critical need for expert guidance from tax attorneys and fiduciary advisors.

When crafting your strategy, think holistically. Assess your net worth, residency, investment goals, and mobility. Align your policy currency with your income or beneficiaries to minimize exchange-rate risks. Also, carefully evaluate the financial health of offshore insurers, keeping in mind that some jurisdictions, like Bermuda, may lack government-backed guarantees. Above all, adhere to reporting requirements like FBAR and FATCA to avoid hefty fines.

A well-thought-out insurance plan doesn’t just manage risk – it becomes a powerful tool for preserving wealth across generations and borders.

FAQs

What tax benefits does Private Placement Life Insurance (PPLI) offer for high-net-worth individuals?

Private Placement Life Insurance (PPLI) is a financial tool that offers notable tax benefits for high-net-worth individuals. One of its key advantages is the ability to let investment assets within the policy grow tax-deferred. This means you won’t owe taxes on any gains as long as they stay within the policy.

What’s more, PPLI provides a way to access the policy’s cash value through tax-free loans or withdrawals, offering flexibility to meet financial needs without triggering a tax bill.

Another standout feature is how it handles wealth transfer. Upon the policyholder’s passing, the death benefits are usually passed on to beneficiaries income tax-free. This makes PPLI a valuable tool for estate planning and preserving wealth across generations. It’s a smart option for those looking to streamline their tax strategy while growing their financial legacy.

What do I need to know about staying compliant with offshore insurance policies?

To comply with offshore insurance policies like private placement life insurance (PPLI), it’s crucial to ensure these policies are legitimate and properly reported. U.S. policyholders must meet strict reporting standards, which include filing the Foreign Bank and Financial Accounts Report (FBAR) and adhering to the Foreign Account Tax Compliance Act (FATCA). These rules are designed to promote transparency and prevent the misuse of offshore insurance for tax evasion.

The IRS keeps a close eye on offshore insurance arrangements to ensure they serve a genuine insurance purpose rather than functioning as a tool for tax avoidance. To stay on the right side of the law, policyholders need to maintain proper documentation, report accurately, and ensure the policies meet all legal requirements. Misusing these products – such as employing them in tax schemes – can result in serious legal and financial penalties.

How can insurance and trusts work together in estate planning?

Combining insurance with trusts can be a smart move for estate planning. This approach provides stronger asset protection, helps with tax savings, and offers more control over how your assets are distributed. One popular option is an irrevocable life insurance trust (ILIT). When a life insurance policy is held by an ILIT, the proceeds from the policy are kept out of the insured’s taxable estate. This can lower estate taxes while also providing liquidity to cover taxes or other expenses.

Trusts also allow for flexibility in how insurance benefits are distributed. For instance, you can set specific terms in the trust about when and how beneficiaries receive their funds. This not only shields the assets from creditors or lawsuits but also ensures your wealth is passed on according to your intentions. To take full advantage of these benefits, it’s crucial to collaborate with a skilled estate attorney or tax advisor who can design a plan tailored to your situation and ensure it aligns with legal requirements.