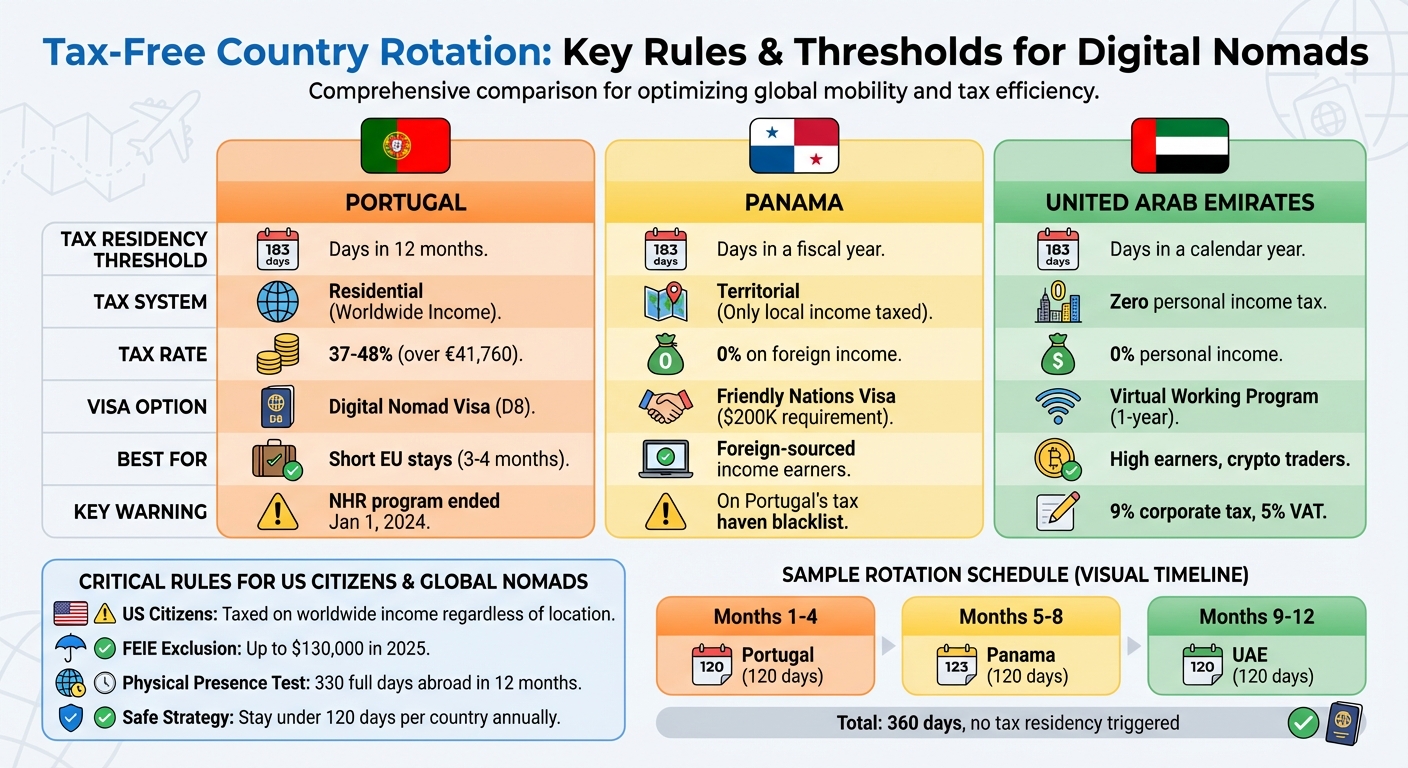

Rotating between 2–3 countries annually without becoming a tax resident in any of them can help you reduce or avoid income taxes legally. Here’s how it works:

- Understand Tax Residency Rules: Most countries use the "183-day rule" to determine tax residency – spending fewer than 183 days usually keeps you exempt. However, some countries have shorter thresholds (e.g., Switzerland: 90 days, Singapore: 60 days).

- Track Your Days: Use apps to monitor your time in each country and ensure you don’t exceed residency thresholds. Avoid creating strong personal or economic ties (e.g., owning property, having family) in any one location.

- Choose Tax-Friendly Countries: Focus on jurisdictions with favorable tax systems:

- Zero-Tax: UAE

- Territorial Tax: Panama

- Short-Stay Options: Portugal (under 183 days)

- Leverage Special Visas: Digital nomad or investment visas can allow you to stay legally without triggering taxes on foreign income.

- Plan Your Schedule: Rotate strategically – spend a few months in each country while staying under residency thresholds. Example: 4 months in Portugal, 4 in Panama, and 4 in the UAE.

- US Citizens: You’re taxed on worldwide income but can use the Foreign Earned Income Exclusion (FEIE) to exclude up to $130,000 in 2025 if you meet specific criteria.

Key Takeaway: This lifestyle requires careful planning, consistent tracking, and understanding local tax laws. Seek professional advice to ensure compliance and avoid risks.

How Tax Residency Rules Work

Understanding tax residency rules can help you navigate living in multiple countries without taking on unexpected tax obligations. Each country has its own criteria for determining tax residency, and these rules can vary significantly. While some countries focus solely on how many days you physically spend there, others factor in where you live, work, and maintain personal or economic ties.

At its core, the concept is simple: if you meet a country’s tax residency requirements, that country has the right to tax your income – including income earned globally. To avoid this, it’s crucial to stay below the residency thresholds set by each country and understand the specific criteria they use. This section provides an overview of the basics, setting the groundwork for strategies to avoid triggering tax residency later.

Basic Tax Residency Terms

Several terms are key to understanding how countries determine tax residency. Tax residency itself defines who is obligated to pay taxes in a country, regardless of citizenship or immigration status.

The center of vital interests refers to where your strongest personal and economic connections lie. Tax authorities look at factors like where your family resides, where you own property, where your bank accounts are held, and where you maintain professional relationships. If most of these ties point to one country, that country may claim it as your tax home, even if you spend limited time there.

Domicile represents your permanent home – the place you always intend to return to – while habitual abode refers to where you live most of the time, even if you travel frequently. Countries with British common law traditions often use domicile as a factor in taxation. Meanwhile, your tax home is the area where you conduct most of your work or business, which is particularly relevant for U.S. citizens seeking certain tax benefits. Next, we’ll explore how the widely used 183-day rule and its variations impact tax residency determinations.

The 183-Day Rule and Country Variations

The 183-day rule is a common benchmark for establishing tax residency. Many countries consider you a tax resident if you spend 183 days or more within their borders in a given calendar year. Once you cross this threshold, you’re typically subject to that country’s tax laws, including taxes on worldwide income and assets. For example, in Spain, spending more than 183 days in a year generally makes you a tax resident, subject to taxation on all global income. To avoid this, careful planning is essential to ensure you spend fewer than 183 days in any single country.

However, not all countries rely strictly on day counts. Some also look at other factors, such as where you maintain a primary residence or conduct your financial activities. These differences make it important to research the specific rules of each country before planning your travels.

While many countries follow these general principles, U.S. tax laws stand out for their unique approach to taxing citizens and green card holders.

US Tax Residency Requirements

The United States takes a fundamentally different approach to tax residency. U.S. citizens and green card holders are taxed on their worldwide income, no matter where they live. Even if you spend an entire year abroad, you’re still required to report all global income to the IRS.

"US citizens and resident aliens must report their worldwide income to the IRS, regardless of where they live." – Greenback Expat Tax Services

This includes wages, dividends, rental income, and other earnings. The system also opens the door to double taxation, where the same income could be taxed by both the U.S. and a foreign country. While non-citizens are subject to the Substantial Presence Test to determine U.S. tax residency, citizens and green card holders are automatically considered U.S. tax residents.

For U.S. expats, relief options are available. The Foreign Earned Income Exclusion (FEIE) allows eligible individuals to exclude up to $126,500 of foreign earnings from U.S. taxation in 2024. To qualify, you must meet either the Physical Presence Test (spending at least 330 full days in foreign countries over a 12-month period) or the Bona Fide Residence Test (establishing genuine residence in a foreign country). Another option is the Foreign Tax Credit (FTC), which provides a dollar-for-dollar reduction in U.S. tax liability for income taxes paid to foreign governments. Additionally, the U.S. has signed double taxation agreements with over 90 countries to help alleviate these issues.

How to Avoid Triggering Tax Residency

Once you’ve got a handle on how tax residency rules work, the next step is figuring out how to stay under those thresholds. This takes careful planning, consistent tracking, and a solid understanding of how residency programs in different countries operate. The ultimate goal? Keeping your mobility intact while managing your tax obligations in a predictable and minimal way.

Assess Your Tax Risk by Country

Start by understanding the tax systems of the countries you plan to visit. Some countries, like Spain or Canada, operate under a residential taxation system, meaning they tax your worldwide income once you’re deemed a resident. Others, such as Malaysia, Singapore, and Panama, have territorial tax systems, which only tax income earned within their borders. Then there are zero-tax countries like the UAE, where personal income tax isn’t a thing. On the other hand, the United States stands out with its citizenship-based taxation, which taxes citizens and green card holders on worldwide income no matter where they live.

Next, take a close look at your personal and economic ties. These include things like property ownership, where your family lives, where you hold bank accounts, and where your business activities take place. Permanent ties – like owning a home, having a spouse, or running a business – can easily trigger tax residency.

"The crucial figure for this evaluation was 183 days – effectively more than six months in a calendar year. If your duration of stay remained below this threshold, you would remain tax-exempt and, thus, not be required to file tax returns. While some governments, like the US government, still use a substantial presence test, the present situation has grown considerably more complex." – Manuel Garrido, Global Citizen Solutions

Once you’ve identified your risk levels, the next step is keeping a close eye on your days abroad.

Track and Limit Your Days in Each Country

Keeping track of your days is essential to avoid unintentionally triggering tax residency. While 183 days is the most common threshold, some countries have their own unique criteria. For example, in Cyprus, you could be considered a tax resident after just two months under certain conditions. In Mexico, having your main home there or earning a significant portion of your income locally could establish residency. The U.S. uses the Substantial Presence Test, which combines all current-year days with fractions of days from the previous two years. To steer clear of residency, staying under 120 days annually is often a safe bet.

In some countries, even shorter stays can lead to tax residency. Take Bali, for instance: digital nomads who stay more than 183 days may face local taxes. Similarly, in Spain, spending 183 days – or establishing strong economic ties – can result in taxation on worldwide income, with rates climbing as high as 47%. Beyond simply counting days, avoid creating a “center of life” in any one country. This means steering clear of long-term housing leases, avoiding reliance on local bank accounts, skipping local professional licenses, and not establishing residence for dependents.

Use Residency Programs Without Tax Consequences

After managing your stay lengths, consider residency programs designed to avoid local tax triggers. It’s important to remember that immigration residency (the right to live in a country) doesn’t always mean tax residency. Many digital nomad and residency-by-investment programs allow you to live legally in a country while exempting foreign income from local taxes.

For example, Portugal offers digital nomad and passive income visas, which, for many U.S. citizens, can keep freelance or employment income earned outside Portugal untaxed. Barbados has the Welcome Stamp, and Croatia’s digital nomad visa permits a 12-month stay without local tax obligations, provided you meet an income threshold of about $2,300 per month.

The UAE also offers a one-year remote work visa with no personal income tax, making it particularly appealing for high earners and crypto traders. Take Leila, a U.S. citizen who traded cryptocurrency full-time while living in Dubai. Thanks to the UAE’s tax policies, she didn’t owe any local taxes, though she still reported her gains to the U.S. government as required.

However, not all residency programs automatically shield you from taxes. Earning local income or overstaying your visa can still trigger tax residency. For instance, Thailand, which previously taxed only remitted foreign income, has recently updated its rules to tax global income for residents. Always double-check the fine print to avoid surprises.

How to Plan Your Multi-Country Schedule

Planning a multi-country rotation isn’t just about picking random destinations – it’s about creating a structured travel plan that aligns with tax residency rules while supporting your lifestyle. The key is to stay below tax residency thresholds in each country without compromising your personal or professional goals.

Build Your Annual Travel Plan

Start by identifying two or three countries that fit your tax strategy, visa options, and personal preferences. Focus on destinations with clear day-count rules and varying tax systems. For example, you could spend four months in Portugal on a digital nomad visa, another four in Panama under its territorial tax setup, and the remaining time in the UAE, which has a zero-tax policy. This approach helps you avoid exceeding the 183-day threshold in any one country.

When planning, consider visa requirements, entry restrictions, and travel logistics. Some countries allow visa-free stays of up to 90 days, while others might require pre-approved visas for extended visits. Keep in mind that your stay counts from the day after leaving the U.S., and only full 24-hour periods (midnight to midnight) count as days in a foreign country. Time spent over international waters doesn’t contribute to your count either.

Be sure to review the specific rules for each destination to avoid unintentional overstays. Once your plan is set, use a reliable tracking system to ensure compliance with these rules.

Track Your Days and Stay Compliant

Keeping track of your days is critical. Use apps that automate day counting, send alerts as you approach thresholds, and generate tax reports. Many of these tools use GPS tracking or sync with travel-related emails from airlines and hotels to keep your records accurate.

Choose a tracking tool that accounts for specific rules like the 183-day threshold, the Schengen Area’s 90/180 rule, and the U.S. Substantial Presence Test. The ability to export detailed reports can be a lifesaver if you need to prove your physical presence to tax authorities.

In addition to tracking your movements, make sure your business operations align with your travel lifestyle.

Coordinate Business Operations with Travel

If you’re managing a business while rotating between countries, your business structure should complement your mobility. Many digital nomads register their companies in tax-friendly jurisdictions and adopt structures that reduce the risk of creating a permanent establishment.

Just as you track your physical presence, document your business activities carefully. Record where you work, meet clients, and sign contracts to show you’re not establishing permanent ties in any one location. Keeping detailed records will help you manage tax liabilities effectively.

sbb-itb-39d39a6

Best Countries for Tax-Free Rotations

Picking the right countries for your rotation strategy is crucial if you’re aiming for tax-free living. The best destinations have clear residency rules, simple visa options, and tax systems that don’t penalize short-term stays. Here’s a closer look at some top choices to consider as part of your plan.

Portugal

In Portugal, you become a tax resident if you stay more than 183 days (consecutive or not) within any 12-month period tied to the fiscal year. Alternatively, if you establish a habitual residence – essentially a home you intend to use as your primary residence – you’ll also trigger tax residency, regardless of how many days you’ve spent there.

To avoid this, keep your stay under 183 days and avoid setting up a permanent home base. Portugal’s Digital Nomad Visa (D8) makes short-term stays easier, offering access to the EU and an English-friendly environment without forcing you into tax residency. However, if you do become a tax resident, be prepared for progressive income tax rates ranging from 37% to 48% on earnings over €41,760 annually. It’s also worth noting that the Non-Habitual Resident (NHR) tax breaks ended on January 1, 2024, so new applicants can no longer benefit from that program.

Portugal is ideal for short stays as part of a broader rotation plan. For example, you could spend three to four months in Lisbon or Porto and then move on before hitting the 183-day threshold.

Panama

Panama’s territorial tax system is a big win for digital nomads. It only taxes income earned within its borders, so if your earnings come from clients or businesses located outside Panama, you won’t owe taxes there – even if you’re living in the country.

This setup makes Panama particularly appealing for those earning abroad. You can secure residency through the Friendly Nations Visa by meeting property or deposit requirements of $200,000, all without triggering tax liability on foreign-sourced income. Just make sure your income qualifies as foreign-sourced and not local.

Another advantage? Panama allows visa-free travel to over 140 countries. However, keep in mind that Panama is on Portugal’s "blacklist" of tax havens. So, if you rotate between Panama and Portugal and become a Portuguese tax resident, any income linked to Panama could face higher scrutiny or tax rates of up to 35%.

United Arab Emirates

The UAE is a standout choice for tax-free living, thanks to its 0% personal income tax policy. Dubai’s Virtual Working Program offers a renewable one-year digital nomad visa, giving you easy access to the Middle East.

While personal income remains untaxed, the UAE has introduced a 9% corporate tax for onshore companies and applies a 5% VAT on goods and services. For those looking to establish a more formal presence, free-zone companies offer an attractive option. You can get a tax residence certificate with minimal office requirements – even a hot desk will do.

If you’re thinking long-term, the UAE Golden Visa is worth exploring. It requires an investment of at least 2 million AED (around $540,000) in public investments or real estate held for a minimum of ten years.

When coordinating rotations, keep in mind the differing tax rules between the UAE and Portugal. The UAE works particularly well as a base for part of the year, allowing you to maintain zero personal income tax while rotating through other destinations to avoid residency thresholds elsewhere. These insights can help you stay mobile while keeping your tax exposure in check.

How to Stay Compliant and Avoid Risks

Common Risks and Anti-Avoidance Rules

Relocating abroad doesn’t automatically free you from tax obligations. Tax authorities are more interested in where your personal and financial life is centered than your visa status.

"The problem isn’t malice; it’s assumption. People assume that moving means a clean slate. The truth is that the tax system tracks you until you actively sever your ties." – Escape Artist

One common misconception is that having a visa or residency permit automatically makes you a tax resident. It doesn’t. Similarly, not having one doesn’t necessarily mean you’re exempt from taxes. Spending more than 183 days in a single country – even if you’re on a tourist visa – can establish tax residency.

If you’re a trustee of a revocable trust, moving abroad can create unexpected complications. The trust may become tax resident in your new country, leading to additional administrative costs and potential tax obligations.

Taking proactive steps to address these risks can save you from major headaches. A big part of that is having proper documentation to back up your claims.

Keep Records to Prove Your Residency Status

Good documentation is your best defense if tax authorities question your residency. Keep records like travel tickets, passport stamps, and utility or rental bills that clearly show where you’ve been. Organize these by tax year, and for digital copies, use clear file names to make retrieval easy.

For added security, store digital records in encrypted formats and keep physical documents in a fireproof safe [52,53,56,57,58].

"The more documentation and proof of what you claimed, the better." – Logan Allec, CPA and Founder, Choice Tax Relief

Once your records are in order, the next step is to get expert advice to ensure ongoing compliance.

Work with Tax Professionals

Managing multi-country tax laws can be tricky, but professional guidance makes all the difference. Experts can help you track your days, sever ties with your home country, and navigate tie-breaker rules under tax treaties. They’ll also ensure your final tax returns are filed correctly.

Global Wealth Protection offers private consultations tailored to your needs. Whether you’re structuring a rotation plan, clarifying residency rules, or maintaining compliance across jurisdictions, working with seasoned professionals can help you avoid costly errors and stay on the right side of the law.

Conclusion

Rotating between 2–3 countries without triggering tax residency is possible, but it requires careful planning and thorough record-keeping. The cornerstone of this approach is understanding how tax residency rules apply – both in your home country and in the countries you visit. For US citizens, this is particularly important since they must report and file federal taxes on their worldwide income, no matter where they live or work. This obligation doesn’t disappear simply because you’re abroad.

A key element of this strategy is tracking your days in each country. The 183-day rule is a common benchmark, but every jurisdiction has its own standards. Beyond counting days, factors like economic ties and personal connections can also influence your residency status. Keeping detailed records of your travel and financial activities is essential.

US citizens can take advantage of benefits like the Foreign Earned Income Exclusion (FEIE), which allows them to exclude up to $130,000 of foreign income in 2025. When structured correctly, this can significantly reduce or even eliminate federal income tax liabilities. However, a common mistake among digital nomads is assuming that earning or living abroad automatically exempts them from IRS requirements. This misconception can lead to hefty penalties, interest charges, and enforcement actions. To avoid these pitfalls, it’s wise to seek expert advice to navigate the intricacies of international tax laws.

Success in this lifestyle depends on maintaining comprehensive documentation and consulting with tax professionals who understand multi-country taxation. They can help you handle complex tie-breaker rules and ensure compliance with local and international regulations.

When executed correctly, this approach offers both tax efficiency and the freedom to live and work globally. But if mismanaged, it can result in dual taxation, fines, and legal complications. Treat tax compliance with the same level of attention as your travel planning – because in this lifestyle, they go hand in hand. By combining careful planning with professional guidance, you can enjoy the benefits of global mobility while staying on top of your financial responsibilities.

FAQs

How can I avoid becoming a tax resident while living in multiple countries each year?

To steer clear of establishing tax residency, it’s crucial to monitor the time you spend in each country. In many cases, staying under the 183-day rule can help you avoid being considered a tax resident. Keep thorough records of your travel, income, and any significant connections, like property ownership or family ties, to back up your non-resident status if questioned.

It’s also wise to avoid forming deep connections in any single location, such as owning a permanent home or making substantial financial commitments. Research countries with tax policies that are friendly to nomads and consider utilizing tax treaties to your advantage. For more complicated scenarios, it’s always a good idea to consult with a qualified tax professional to ensure you’re navigating international tax laws correctly.

What are the best tools to track how many days you’ve spent in different countries?

If you’re juggling travel across different countries, keeping an accurate record of your days is essential to comply with tax residency rules. Apps like Wanderlog, TripIt, and Flighty are great for this. They can track your travel history, helping you stay within the 183-day rule or other residency limits.

What makes these tools even more convenient is their ability to sync with your calendar or email. This means your travel dates can be logged automatically, sparing you the hassle of manual tracking. Using these apps not only saves time but also helps you steer clear of any potential tax issues.

What is the Foreign Earned Income Exclusion, and how can U.S. citizens qualify while living abroad?

The Foreign Earned Income Exclusion (FEIE) allows U.S. citizens living abroad to exclude up to $126,500 of foreign earned income from U.S. taxes (starting in 2025). This can significantly lower your tax burden while working overseas.

To be eligible, you’ll need to meet these key requirements:

- Your tax home must be in a foreign country.

- You must satisfy either the Physical Presence Test (spending at least 330 full days in a foreign country within a 12-month period) or the Bona Fide Residence Test (establishing full-year residency in another country).

To claim this exclusion, you’ll need to file IRS Form 2555 along with your tax return. Staying compliant with U.S. tax laws is essential, so keep detailed records to back up your claim.