In an unpredictable global economy, protecting your wealth requires more than traditional strategies. Inflation, currency devaluation, and legal risks are eroding financial stability, while geopolitical shifts and systemic banking risks add further uncertainty. Here’s how you can secure your assets:

- Assess Risks: Identify threats like inflation, litigation, and jurisdictional risks. For example, in 2025, the U.S. dollar dropped over 10%, and national debt hit $36.8 trillion.

- Diversify: Spread assets across currencies, jurisdictions, and asset classes. Holding foreign currencies, gold, or real estate in stable regions can shield against inflation and devaluation.

- Use Legal Structures: Offshore trusts, LLCs, and multi-jurisdiction setups create barriers against lawsuits and creditors. Cook Islands and Nevis are known for strong protections.

- Maintain Compliance: File required forms like FBAR and FATCA to avoid penalties. Transparency is key to protecting assets legally.

- Plan for Mobility: Secondary residencies or citizenships in stable countries can provide flexibility and access to international banking.

Timing is critical – put protections in place before liabilities arise. Regularly review and adjust your strategies to stay aligned with shifting economic conditions.

Assess Your Financial Risks and Set Clear Goals

To safeguard your wealth effectively, you first need to understand what could jeopardize it. Start by evaluating your financial situation, pinpointing vulnerabilities, and setting clear objectives tailored to your circumstances. Without this groundwork, even the most advanced strategies might fall short.

Identify the Main Threats to Your Wealth

The first step in protecting your wealth is identifying the risks it faces. Jurisdictional risk is a major concern – if all your assets are tied to one country, they’re at the mercy of that nation’s laws, economy, and political climate. A change in regulations or economic downturn could leave your entire portfolio exposed.

Legal and liability risks are another constant challenge, especially for high-net-worth individuals. Rising litigation trends mean legal threats are more common than ever. Derek Thain, Vice President of Fidelity’s Advanced Planning team, explains:

"There’s no one-size-fits-all protection plan. Your plan needs to be sensitive to your personal circumstances and also to the types of creditors that you are trying to protect against."

Monetary and inflation risks can quietly erode your purchasing power. Currency devaluation and inflation chip away at cash reserves and investment value over time.

Event risks are becoming more frequent and impactful. For example, in June 2025, missile strikes between Iran and Israel drove oil prices up by 7% in a single day, exposing vulnerabilities in portfolios heavily reliant on energy sectors. Similarly, the 2023 collapses of Silicon Valley Bank, Signature Bank, and First Republic Bank highlighted the risks of relying on financial institutions, particularly for deposits exceeding FDIC insurance limits.

Counterparty and banking risks are often underestimated. If a bank collapses or freezes accounts, your liquidity can disappear overnight. Since 1980, the U.S. has experienced 308 weather and climate disasters causing over $1 billion in damages each, with total losses exceeding $2.085 trillion. Even large-cap stocks lose money on average about one out of every three years.

To pinpoint your vulnerabilities, consider extreme market scenarios: What happens if oil prices surge 10%? What if credit markets freeze? What if a cyberattack disrupts banking systems? Analyze your portfolio for over-reliance on certain assets, like tech stocks, which can magnify losses during market downturns.

These assessments lay the groundwork for setting specific wealth protection goals.

Define Your Wealth Protection Goals

Once you’ve identified your risks, the next step is to set clear objectives for protecting your assets. Asset protection is about shielding your wealth from lawsuits, creditors, and unexpected liabilities. This differs from wealth accumulation, which focuses on growth. For instance, as of 2024, half of Americans – and nearly 60% of millennials – view inheritance as crucial to their retirement plans. Yet, with 60% to 70% of people likely to require long-term care, even substantial portfolios can be depleted quickly.

Your goals will depend on your time horizon and risk tolerance. If retirement is decades away, you can afford to ride out market fluctuations and focus on growth. But if you’ll need liquidity in the near future, you’ll want more conservative, accessible investments.

Liquidity is just as important as protection. Keep liquid reserves for short-term needs and begin estate planning early to ensure your legacy is preserved. Having cash on hand provides flexibility during emergencies. Melody Townsend, CFP and Founder of Townsend Financial Planning, offers this advice:

"The goal is to raise good stewards, not just heirs."

For business owners, planning your exit strategy at least five years in advance is critical. This gives you time to train successors and optimize tax arrangements. In 2025, the annual gift tax exclusion is $19,000 per recipient, with a lifetime exemption of $13.99 million. However, this exemption is set to decrease significantly in 2026.

Tax residency also plays a key role in protection planning. U.S. citizens and resident aliens are taxed on their global income, regardless of where their assets are held. Structuring your holdings carefully ensures compliance while meeting your protection goals.

Timing is everything. Asset protection strategies must be in place before any potential liabilities arise. Transfers made after a liability is anticipated can be reversed as "fraudulent conveyances", leaving you vulnerable despite your planning.

Know Your Compliance and Reporting Requirements

With risks assessed and goals defined, it’s essential to align your strategies with legal obligations. Ignoring compliance requirements doesn’t just risk penalties – it can dismantle your entire plan.

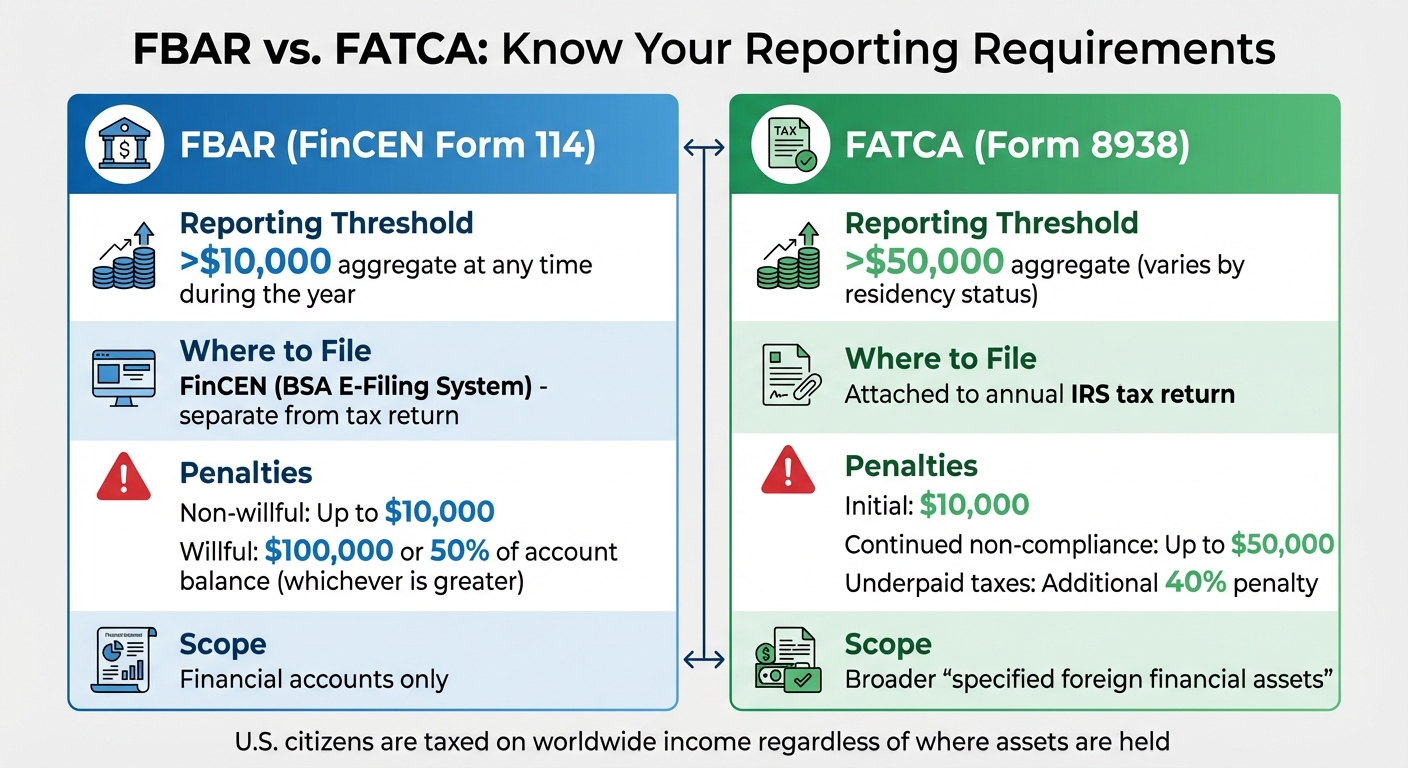

FBAR (FinCEN Form 114) is required if your foreign financial accounts total more than $10,000 at any point during the year. This form must be filed electronically with FinCEN, separate from your annual tax return. Non-willful failure to file can result in penalties up to $10,000, while willful violations can incur penalties of $100,000 or 50% of the account balance, whichever is greater.

FATCA (Form 8938) mandates U.S. taxpayers to report specified foreign financial assets exceeding $50,000 (with thresholds varying for those living abroad) on their annual tax return. Failure to file triggers an initial penalty of $10,000, which can increase to $50,000 for continued non-compliance. Additionally, underpaid taxes tied to undisclosed foreign assets face a 40% penalty.

| Requirement | FBAR (FinCEN 114) | FATCA (Form 8938) |

|---|---|---|

| Reporting Threshold | >$10,000 aggregate at any time | >$50,000 aggregate (varies by residency) |

| Where to File | FinCEN (BSA E-Filing System) | Attached to annual IRS tax return |

| Penalties | Up to 50% of account balance (willful) | $10,000 to $50,000 + 40% tax penalty |

| Scope | Financial accounts only | Broader "specified foreign financial assets" |

The Common Reporting Standard (CRS) has created a global system for automatic sharing of financial account information between countries. Offshore secrecy is no longer an option – transparency is now the standard. As The Nestmann Group states:

"Offshore asset protection is NOT about tax evasion. U.S. citizens are taxed on worldwide income, no matter where their assets are held."

Some specialized entities require additional reporting. Foreign trusts must file Forms 3520 and 3520-A, while foreign corporations need Form 5471. Passive Foreign Investment Companies (PFICs) face complex tax rules and stringent reporting requirements.

The Corporate Transparency Act (CTA) now mandates that certain entities disclose their true owners to FinCEN’s Beneficial Ownership Information (BOI) Registry. This regulation aims to prevent the misuse of anonymous shell companies, further reducing financial opacity.

To navigate these complexities, work with professionals who understand both protection strategies and compliance. Many reputable offshore banks won’t accept U.S. clients without proper introductions due to FATCA compliance costs. Professional intermediaries can ensure due diligence and help you establish legal barriers to protect your wealth while maintaining full transparency with tax authorities.

sbb-itb-39d39a6

Build Multi-Jurisdiction Asset Protection Structures

Taking the time to establish multi-jurisdiction asset protection structures can significantly strengthen your financial defenses. Once you’ve assessed potential risks and ensured compliance, the next step is to build legal frameworks that safeguard your wealth from creditors. These structures work by spreading assets across multiple legal systems, making it more expensive and challenging for creditors to pursue litigation. Additionally, diversifying assets across jurisdictions helps protect against the economic or legal instability of any single country.

One of the biggest advantages of these structures is the legal barriers they create against lawsuits. For instance, jurisdictions like the Cook Islands and Nevis do not enforce U.S. judgments. This forces creditors to start fresh legal proceedings under local laws, which can be prohibitively expensive. In Nevis, creditors must post a $25,000 cash bond just to file a lawsuit against a trust or LLC, and they face short statutes of limitations (typically one to two years) and high burdens of proof. These hurdles make successful claims extremely rare.

Modern asset protection strategies focus on transparency and compliance while making it costly for creditors to challenge them. As James G. Bohm, an attorney at Bohm Wildish & Matsen, LLP, explains:

"Offshore asset protection is still viable, but it’s no longer a ‘hidden vault.’ Today, it’s most effective as part of a transparent, legally compliant, and professionally structured estate and asset plan."

These structures also offer currency and inflation protection. Holding assets in stable foreign currencies like Swiss francs or Euros, or in tangible assets like foreign real estate and gold, can shield you from U.S. dollar devaluation. For example, the U.S. dollar saw its worst six-month performance in early 2025 since 1973, underscoring the importance of diversification.

Use Legal Entities to Separate Risk

Limited Liability Companies (LLCs) are a cornerstone of asset protection plans because they act as a firewall between personal wealth and business liabilities. When properly structured, an LLC limits creditor remedies to a "charging order." This means creditors can only collect distributions if the LLC decides to issue them, rather than accessing the underlying assets directly.

Certain jurisdictions, like Nevis, provide particularly strong charging order protections and do not recognize foreign judgments. Domestically, Wyoming LLCs offer similar benefits, including high levels of privacy and strong legal protections under U.S. law. Both Nevis and Wyoming keep ownership details out of public records, reducing the chances of becoming a target for lawsuits.

The most effective strategy involves separating your operating businesses from holding companies. The operating business handles income generation and day-to-day risks, while the holding company secures investments, real estate, or other valuable assets. This separation ensures that if the operating business faces a lawsuit, the holding company’s assets remain protected. This layered approach contains liability while maintaining flexibility for your operations.

Set Up Offshore Trusts and Foundations

Offshore trusts are among the strongest tools for long-term asset protection. Unlike domestic trusts, which remain subject to U.S. court orders, foreign asset protection trusts (APTs) operate outside U.S. jurisdiction entirely. The Cook Islands is widely regarded as the gold standard for offshore trusts due to its robust, court-tested legal framework. Nevis offers comparable protection at lower costs, while Anguilla provides a stable, English-speaking jurisdiction with strong privacy laws.

Offshore trusts work by transferring legal ownership of assets to a foreign trustee, allowing you to benefit from the assets while shielding them from U.S. creditors. For example, Cook Islands law requires creditors to prove fraudulent intent "beyond a reasonable doubt", a standard typically reserved for criminal cases. Combined with a one- to two-year statute of limitations for challenging transfers, this makes successful claims extremely rare.

Private interest foundations are another option, offering flexibility for succession planning. Unlike trusts, foundations are self-governing entities and don’t require a trustee. They are particularly useful for multi-generational wealth transfers or supporting specific family members or charitable causes over time.

For those with significant wealth, Private Placement Life Insurance (PPLI) structures – often requiring a minimum investment of $2 million – combine asset protection with tax-deferred growth.

| Jurisdiction | Key Benefit | Best Used For |

|---|---|---|

| Cook Islands | Does not enforce U.S. judgments; court-tested legal framework | Asset Protection Trusts (APTs) |

| Nevis | Strong protection laws; lower fees than Cook Islands | LLCs and Trusts |

| Anguilla | Stable legal system; English-speaking | Trusts and Foundations |

Combine Domestic and Offshore Structures

A hybrid approach that blends domestic and offshore entities can provide even stronger asset protection. For example, combining an offshore trust (like a Cook Islands or Nevis trust) with a domestic LLC (such as a Wyoming LLC) creates a robust "bridge" structure. This setup allows you to retain day-to-day control of your assets while the offshore trust acts as a legal shield against threats.

Here’s how it works: You establish a Cook Islands trust with a foreign trustee, which then owns your Wyoming LLC. You manage the LLC, maintaining control over investments, bank accounts, and operations. If a creditor obtains a judgment against you, the trustee can step in, remove you as manager, and relocate the assets beyond the creditor’s reach. Since the trust is governed by Cook Islands law, U.S. courts have minimal authority to force asset repatriation.

As Premier Offshore explains:

"The preeminent structure combines the Cook Island Trust or Belize Trust with a Limited Liability Company from Nevis, which allows you to maximize the benefits of both… and further diversifies your international trust structure."

This hybrid model also simplifies compliance. The domestic LLC makes it easy to open U.S. bank accounts, conduct business, and file taxes, while the offshore trust remains in the background, ready to activate only when needed. This balance offers strong protection without creating unnecessary administrative burdens. The Nestmann Group sums it up well:

"The best asset protection doesn’t rely only on domestic or offshore solutions, but uses both."

Timing is crucial for these structures. They must be set up and funded before any legal claims arise. Transfers made after a lawsuit is anticipated can be undone as "fraudulent conveyances", leaving your assets vulnerable despite the effort and cost of creating the structure. To avoid this, work with experienced legal counsel in both the U.S. and your chosen offshore jurisdiction. This ensures proper setup and compliance with reporting requirements like Forms 3520, 3520-A, FBAR, and Form 8938.

Diversify Across Currencies, Jurisdictions, and Asset Classes

Creating multi-jurisdiction structures is just one piece of the asset protection puzzle. To truly safeguard your wealth, it’s crucial to spread it across different currencies, regions, and investment types. This strategy helps mitigate risks that no single market can address, such as inflation spikes, currency devaluation, or political instability that might hit one area while another thrives.

For example, in early 2025, the U.S. dollar dropped by over 10%, while non-U.S. equities outperformed by 12.1%. Keeping all your assets tied to one currency or country leaves you vulnerable to unforeseen market changes. Diversification acts as a shield, offering protection against these unpredictable shifts.

Spread Assets Across Multiple Jurisdictions

Adding geographical diversity to your portfolio complements legal structures and helps protect your wealth from localized disruptions. Holding assets in multiple stable jurisdictions reduces reliance on a single banking system or legal framework. Take the 2023 collapses of Silicon Valley Bank and Signature Bank as a reminder of domestic banking risks. In contrast, countries like Singapore and Austria boast banking systems with decades-long records of stability, free from bank failures.

When choosing where to hold assets, focus on jurisdictions with strong financial stability and transparent legal systems. Look for banks with a Tier-1 capital ratio of at least 15% for commercial banks or 20% for private banks. Switzerland remains a popular choice for its stability, though most Swiss banks require a minimum deposit of $1 million linked to asset management. Austrian private banks, on the other hand, typically allow access with deposits ranging from $250,000 to $300,000. In Singapore, non-resident accounts require minimum deposits of $50,000 to $200,000.

Many of these jurisdictions also offer multi-currency accounts, enabling you to hold major currencies like Swiss francs, Euros, and British pounds in one place. For U.S. citizens, compliance is straightforward: foreign accounts exceeding $10,000 must be reported via FBAR (FinCEN Form 114), and Form 8938 is required for foreign financial assets as per IRS regulations.

Protect Against Currency and Inflation Risks

Currency devaluation and inflation can quietly erode your wealth over time. With U.S. national debt surpassing $31 trillion, concerns about the dollar’s long-term stability loom large. In April 2025, Fidelity’s lead inflation analyst, Collin Crownover, estimated that newly announced U.S. tariffs could push inflation up by as much as 2 percentage points.

One way to counteract these risks is by maintaining a basket of major currencies through offshore accounts. For instance, if you split your time between the U.S. and Europe, aligning your holdings with a 60/40 mix of U.S. dollars and Euros can help balance your spending needs. This approach not only guards against inflation but also strengthens your multi-jurisdiction protection strategy.

Treasury Inflation-Protected Securities (TIPS) offer another layer of security, as these U.S. government bonds adjust for inflation by modifying both interest payments and principal. If you’re seeking higher returns, foreign term deposits in stable emerging markets can be a good option. In Armenia, for example, banks offer up to 5% interest on U.S. dollar deposits and as much as 10% on local currency deposits (Dram).

Real assets like global real estate, gold, and commodities have historically held their value during inflationary periods. For example, property prices in Tbilisi, Georgia, surged by 30% over two years, even after a 6% drop during a 2008 conflict. For gold, consider physical storage in neutral jurisdictions such as Singapore or Switzerland. Singapore now allows investors to start with as little as a single gold coin, making offshore storage more accessible. These strategies provide a solid foundation for structuring cross-border investments.

Structure Cross-Border Investments

Once you’ve diversified your assets, international brokerage accounts and offshore entities can help protect and grow your wealth. Using offshore LLCs and brokerage accounts allows you to safeguard investments, maintain privacy, and optimize taxes. For instance, rather than holding international property in your name, placing it in an offshore LLC can simplify transfers, enhance privacy, and create a legal barrier between you and the asset.

International brokerage accounts open doors to foreign stock exchanges, enabling you to diversify beyond U.S. markets. Real Estate Investment Trusts (REITs) are another effective tool, offering geographic and sector diversification without the risks tied to owning a single property. Some REITs come with expense ratios as low as 0.13%, making them a cost-effective way to gain broad real estate exposure.

Emerging markets often present opportunities that developed markets like the U.S., U.K., and Canada might not. For example, properties in city centers across Georgia, Cambodia, or Turkey can sometimes be purchased for around $1,000 per square meter or less, often yielding higher rental returns than properties in more established markets.

To ensure everything is set up and managed correctly, work closely with experienced legal counsel both in the U.S. and in your chosen foreign jurisdictions. Regularly rebalancing your portfolio – ideally once a year – helps realign your investments with your target allocations, reducing the risk of over-concentration in any one area. This disciplined approach ensures your diversification strategy remains effective as markets evolve.

Use International Banking and Mobility Strategies

Protecting your wealth isn’t just about spreading your assets across different countries; it’s also about creating flexibility in where you bank and where you can legally live. These strategies help shield your finances from risks like political instability, currency fluctuations, or changing legal landscapes. The key is to act early and establish these systems before they’re urgently needed. Let’s break down how to put these strategies into action.

Open Bank Accounts in Multiple Countries

Important: U.S. citizens must report foreign accounts exceeding $10,000 and comply with FATCA regulations.

Keeping bank accounts in multiple countries provides a safety net against domestic banking issues and grants access to a variety of currencies. Offshore accounts can also offer some privacy, potentially reducing your exposure to lawsuits. For context, approximately 5 million new court cases were filed in the U.S. in 2023 alone. However, while these accounts create legal separation from creditors, they don’t exempt you from tax obligations.

To open an offshore account, you’ll generally need:

- A valid passport

- Proof of address (like a utility bill)

- Bank references

- A letter explaining the source of your funds (in some cases)

Minimum deposit requirements vary. For example, Swiss banks often require at least $1 million tied to asset management, while Austrian private banks accept deposits between $250,000 and $300,000.

"I advise clients to get the ball rolling as early as possible, as there are several big items you’ll need to check off your list to ensure a smooth transition."

– George Lee, CFP®, CWS®, Schwab Wealth Advisory

A dual-account system can be particularly effective: one account in the U.S. for daily use and another offshore for long-term savings. This setup allows you to move funds strategically and safeguard assets from domestic risks. If you spend time in multiple countries, consider aligning your currency holdings with your expenses. For instance, if 40% of your spending is in Euros, aim to hold 40% of your liquid assets in that currency.

Keep in mind that some banks are closing accounts held by U.S. citizens due to the compliance burdens of FATCA. To mitigate this risk, consider opening at least two offshore accounts in different jurisdictions.

Obtain Secondary Residencies or Citizenships

Having a second residency or citizenship gives you the legal right to live, work, and bank in another country. This can be a crucial safeguard if your home country becomes unstable or imposes restrictions on wealth holders. As Project Blackledger puts it, "In today’s world, a second residency isn’t a luxury – it’s a financial firewall against uncertainty".

Residency programs typically fall into three tax categories:

- Zero-tax countries: Examples include the Bahamas, where there’s no income tax. However, these programs often require significant investments, usually $1 million or more in real estate or bonds.

- Territorial tax countries: Places like Panama tax only locally earned income, making them attractive for those with foreign-sourced earnings.

- Lump-sum tax countries: Italy and Anguilla charge a fixed annual fee regardless of income. For example, Italy offers a €100,000 flat tax on foreign income for up to 15 years.

Here are some popular options for high-net-worth individuals:

| Program | Investment | Benefit |

|---|---|---|

| UAE Golden Visa | $272,000+ | Tax-free income and access to Middle Eastern markets |

| Portugal D7 Visa | €280,000+ | Path to EU citizenship and Schengen Area access |

| Greece Golden Visa | €250,000+ | Affordable EU residency through real estate investment |

| Singapore GIP | $1.8 million+ | Premier hub for Asian financial services |

| Anguilla Lump-Sum Tax | $75,000/year + $400,000 home | Caribbean lifestyle with predictable tax costs |

Physical presence requirements vary widely. Some countries grant residency with minimal stays, while others require over 183 days annually, which can trigger tax residency on global income. Additionally, many programs are shifting from simple "buy-in" options to requiring economic contributions, such as starting a business or creating local jobs.

Secondary residencies can also open doors to new banking opportunities. Many countries that are hesitant to open accounts for non-residents are more willing to serve legal residents. This becomes especially valuable if your home country’s banks impose restrictions or freeze accounts.

"The best residency strategies don’t just save taxes – they unlock new business, banking, and generational wealth opportunities."

– Project Blackledger

When choosing a jurisdiction, consider its reputation with tax authorities. High-reputation countries are less likely to raise red flags or trigger audits. Also, verify whether the residency program offers a pathway to citizenship, as not all do. Combining mobility strategies with international banking strengthens your overall asset protection plan.

Review and Adjust Your Structures Regularly

International banking and mobility strategies need to evolve with changing laws and economic conditions. Staying compliant and effective requires regular reviews.

For U.S. citizens, annual compliance is critical. You must file an FBAR if your foreign accounts exceed $10,000 at any point during the year. FATCA reporting (Form 8938) applies to holdings above $50,000 for U.S. residents or $300,000 for those living abroad. Missing these deadlines can lead to hefty penalties, so working with a cross-border CPA is essential.

"It’s worth your time to hire a cross-border CPA, because there are a lot of nuances. Not all accountants understand this."

– Susan Poss, CFP®, CWS®, Senior Wealth Advisor, Schwab Wealth Advisory

Here’s a checklist to keep your strategies on track:

- Currency Alignment: Make sure your currency holdings match your spending patterns, especially after major exchange rate shifts. For example, in 2025, the U.S. dollar dropped more than 10% against the DXY currency basket. If you expect further declines, moving funds to foreign accounts can secure better rates.

- Banking Relationships: Regularly check the status of your offshore accounts. Some banks close inactive accounts or change their compliance rules, so maintaining communication and activity is crucial.

- Residency Status: Ensure you meet physical presence requirements and renew residency permits on time. Tracking your days in each country can help you avoid accidentally triggering tax residency.

- Legal Structures: Keep offshore entities compliant by maintaining separate bank accounts and completing required filings. Neglecting these formalities could lead to courts disregarding the legal separation between you and your entities.

- Estate Planning: Update international wills and beneficiary designations, especially if you’ve acquired assets in new jurisdictions. Some countries and 19 U.S. states recognize uniform international wills, simplifying cross-border estate management.

Set a reminder to review these areas at least once a year, ideally with input from a cross-border tax advisor and legal counsel.

| Review Phase | Recommended Frequency | Key Actions |

|---|---|---|

| Strategic Planning | Every 2–3 years | Reassess jurisdictions, update documentation, evaluate new opportunities |

| Compliance Monitoring | Annually | File FBAR and Form 8938, review tax treaties, update entity filings |

| Banking Review | Every 6 months | Verify account status, rebalance currency exposure, maintain relationships |

| Residency Verification | Annually | Ensure residency permits are valid |

Proactively managing these strategies ensures your financial and mobility plans remain effective and compliant as circumstances change.

Conclusion

To safeguard your wealth effectively, consider building a multi-layered defense that integrates legal structures, geographic diversification, currency hedging, and strategic mobility. These strategies work together to highlight one key takeaway: having diverse legal and financial protections is crucial in an unpredictable economic landscape.

The most important takeaway here is timing. Asset protection is only effective if implemented before any potential claims or liabilities arise. Waiting too long can leave you vulnerable to accusations of fraudulent conveyance, which could undermine your efforts. By planning ahead, you can establish protections that are much harder to challenge legally.

Begin by conducting a thorough risk audit to identify your legal, financial, and professional vulnerabilities. Clearly define your objectives – whether you’re preparing for lawsuits, guarding against currency devaluation, or navigating political instability. From there, construct your defense using tools like domestic and offshore legal entities, multi-jurisdictional banking, diversified currency portfolios, and secondary residencies. Keep in mind that modern offshore strategies require strict adherence to reporting standards, such as FBAR and FATCA, to avoid hefty penalties.

Remember, wealth protection isn’t a one-and-done task. Regularly review your strategies – at least once a year – while keeping an eye on your banking relationships and currency exposure as market conditions shift. Collaborate with experienced cross-border CPAs, attorneys, and financial advisors who are well-versed in international law and tax compliance to ensure your plan remains effective.

Given the current economic climate, the need for proactive wealth protection has never been more pressing. Take these steps now to strengthen your financial defenses and prepare for whatever challenges may lie ahead.

FAQs

What are the advantages of diversifying my investments across different countries?

Diversifying your investments across various countries can act as a shield for your wealth, minimizing risks tied to any single economy, currency, or political system. For instance, if one nation faces a financial crisis or sudden policy shifts, assets in other regions can help offset the fallout.

This approach also unlocks access to international markets – think foreign real estate or stocks – that might offer growth opportunities or advantages you won’t find at home. Plus, holding assets in multiple currencies can help protect your purchasing power if the U.S. dollar weakens.

Another benefit? It can strengthen your legal protections. Assets spread across borders are harder for creditors or legal claims in one country to reach. All these factors combined provide a stronger financial foundation, more flexibility, and room for growth, even in unpredictable economic climates.

How can an offshore trust help protect my assets from creditors?

An offshore trust can be a highly effective way to shield your assets from creditors. When you transfer ownership of your assets to a trust governed by the laws of foreign jurisdictions like the Cook Islands, Nevis, or Belize, you create a legal barrier between yourself and your property. These jurisdictions are known for their robust asset protection laws, which make it extremely challenging for U.S. creditors to reach the trust’s holdings.

Offshore trusts often include features like a trust protector, who monitors the trustee and ensures your interests are safeguarded. Additional provisions, such as an “event of distress” clause or a “flight clause,” provide further security by allowing assets to be relocated or managed differently if external threats arise. With proper setup and management, an offshore trust can act as a dependable layer of protection, keeping your wealth safe from lawsuits, judgments, or other creditor actions, all while enabling you to benefit from the assets under the trust’s terms.

What are the reporting requirements for U.S. taxpayers with offshore accounts?

As a U.S. taxpayer, holding offshore accounts comes with specific reporting responsibilities. You’re required to disclose these accounts on Schedule B of your federal income tax return. This includes providing details like the foreign country where the account is held and the account’s highest balance during the year. If the total value of your foreign financial assets exceeds $50,000 on the last day of the tax year (or $75,000 at any time during the year for single filers – higher thresholds apply for joint filers or those living abroad), you’ll also need to file Form 8938, Statement of Foreign Financial Assets.

In addition, if your offshore accounts collectively exceed $10,000 at any point during the year, you must file the Report of Foreign Bank and Financial Accounts (FBAR). This report is submitted electronically through the BSA E-Filing System and is due by June 30 of the following year, separate from your tax return.

Noncompliance can lead to steep penalties, including fines of up to $10,000 per violation or a percentage of the account balance. To steer clear of these issues, make sure to report all worldwide income tied to these accounts, maintain thorough records, and meet all filing deadlines.