A second passport isn’t just a travel document – it’s a safeguard for your wealth, mobility, and personal freedom in an unpredictable world. By securing citizenship in another country, you gain access to benefits like expanded travel options, tax advantages, and stronger asset protection. Here’s why it matters:

- Wealth Protection: Dual citizenship allows you to diversify assets across legal systems, avoid capital controls, and shield wealth through favorable laws.

- Travel Freedom: Countries like St. Kitts and Nevis or Portugal offer passports with visa-free travel to over 150 destinations, providing flexibility during crises.

- Tax Benefits: Many nations with Citizenship-by-Investment programs offer zero or low-tax regimes, helping reduce your tax burden.

- Family Legacy: Second citizenship can be passed to future generations, offering them mobility and economic opportunities.

Programs like St. Kitts and Nevis or Portugal’s Golden Visa cater to different priorities, whether you need fast processing, EU access, or long-term investment options. With political and economic uncertainties on the rise, acting early ensures you secure a reliable “Plan B” for your family and finances.

Benefits of Holding Dual Citizenship

Greater Travel Freedom

Holding a second passport can dramatically expand your global mobility. For instance, while a U.S. passport grants visa-free access to numerous countries, a European Union passport allows unrestricted travel, residence, and work across all 27 Schengen Area nations. Similarly, Caribbean passports from countries like St. Kitts and Nevis or Antigua and Barbuda provide visa-free entry to over 150 destinations, covering approximately 72% of the world.

This added freedom isn’t just about convenience – it can also enhance personal safety and flexibility. Business professionals traveling to politically sensitive regions might choose to use a passport from a neutral country, reducing risks such as hostility, kidnapping, or terrorism. In times of political unrest or travel restrictions, a second citizenship can serve as a critical safety net, allowing you to bypass exit controls or other limitations imposed by your home country.

Moreover, a second citizenship grants indefinite settlement rights in your new country. This means you can relocate permanently, start businesses, and access local banking systems without the usual red tape.

This expanded mobility often aligns with other perks, like financial benefits and increased privacy.

Tax Reduction and Financial Privacy

Dual citizenship can also open doors to significant financial advantages. By establishing residency in countries with favorable tax policies, you may reduce your tax burden. For example, Caribbean nations like St. Kitts and Nevis, Antigua and Barbuda, and Dominica operate zero-tax regimes on income, capital gains, inheritance, gifts, and wealth. Other countries, such as Malta and Malaysia, use territorial taxation systems, taxing only income earned within their borders while leaving foreign-earned income untouched for non-domiciled residents.

A second passport can also enhance your financial privacy. With accounts in financial hubs like Switzerland, Singapore, or the UAE under a different nationality, you may avoid some of the restrictions or scrutiny tied to your primary passport. Additionally, the U.S. does not participate in the OECD‘s Common Reporting Standard (CRS), which can further bolster privacy for non-U.S. citizens banking under a second nationality.

"Privacy is not merely a preference but a necessity for economic citizens." – Official Statement, Antigua & Barbuda Government

While dual citizenship offers these advantages, it’s important to remember that U.S. citizens are subject to worldwide taxation unless they formally renounce their citizenship. However, double taxation treaties can help prevent income from being taxed twice.

Long-Term Family Benefits and Asset Security

The benefits of dual citizenship often extend beyond the individual to future generations. Many of the simplest citizenship programs in the world allow citizenship to be passed down, offering your descendants the same mobility and lifestyle benefits without requiring additional investment. For example, St. Kitts and Nevis citizenship can be inherited seamlessly.

Your family may also gain access to better educational opportunities. With a Maltese or Portuguese passport, for instance, your children can attend top universities across the European Union at domestic tuition rates, often with access to scholarships and work opportunities. Furthermore, many programs allow you to include family members – spouses, children (usually up to age 25), and parents (often over age 55) – in a single application, making it a cost-effective way to secure benefits for the entire family.

In addition, a second citizenship can serve as a powerful tool for protecting family wealth. When paired with offshore structures, it can shield assets from foreign judgments and simplify cross-border inheritance, ensuring your legacy is preserved for generations. This holistic approach to asset security is an invaluable component of long-term financial planning.

sbb-itb-39d39a6

Leading Citizenship by Investment Programs

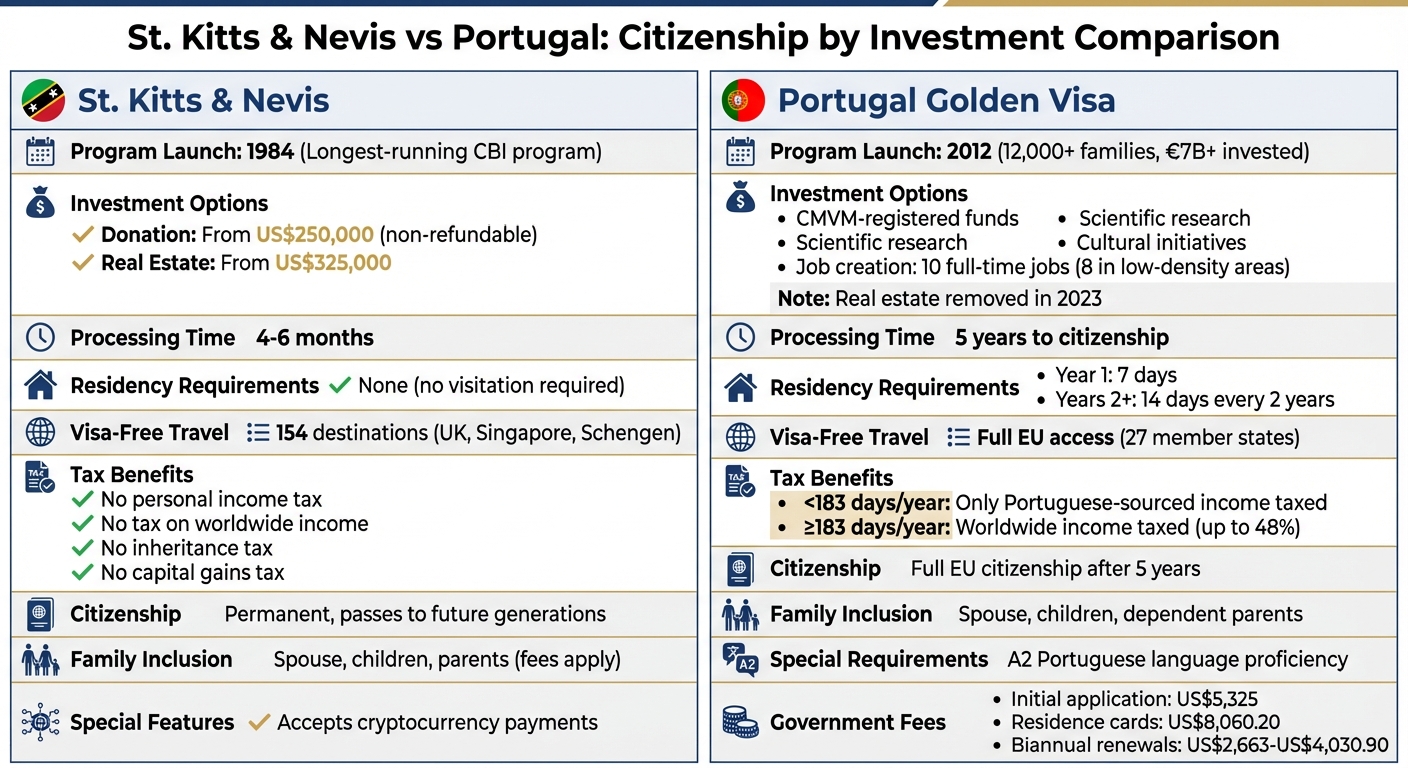

Two standout options – St. Kitts and Nevis and Portugal – provide proven ways to protect wealth and expand personal freedom. These programs demonstrate how well-placed investments can improve global mobility, reduce tax burdens, and enhance asset protection.

St. Kitts and Nevis Citizenship by Investment

Launched in 1984, the St. Kitts and Nevis Citizenship by Investment Program is the longest-running program of its kind, known for its dependability . It offers multiple investment paths, including a non-refundable donation starting at US$250,000 or real estate investments beginning at US$325,000, with lower-cost options for certain economic projects .

The application process typically takes 4 to 6 months, and there are no residency or visitation requirements to maintain citizenship. With a St. Kitts and Nevis passport, you gain visa-free or visa-on-arrival access to 154 destinations, including the UK, Singapore, and the Schengen Area. Additionally, the country has no personal income tax, nor taxes on worldwide income, inheritance, or capital gains. This makes it an excellent tool for diversifying jurisdictional risk while securing a valuable travel document.

Applicants must pass a thorough, multi-stage due diligence process, including a mandatory interview for the main applicant and dependents aged 16 or older. Interestingly, the program also accepts cryptocurrency as part of the investment, though this comes with additional due diligence fees: US$10,000 for the main applicant and US$7,500 for dependents aged 16 or older.

"While it is trendy nowadays to be a ‘citizen of the world,’ if thousands of our new citizens can identify with Nevis as a place they choose to call home, if they can relate to the culture and feel proud of its people, nothing short of a miracle can happen." – Hon. Mark Brantley, Premier of Nevis

Citizenship is permanent and can be passed on to future generations. Additional family members can also be added later for specific fees, such as US$30,000 for a spouse or US$7,500 for a newborn under 3.

Portugal Golden Visa to Citizenship

Portugal’s Golden Visa is another highly regarded option, offering a route to full European Union citizenship after five years of legal residency . Since its inception in 2012, the program has welcomed over 12,000 families and attracted more than €7 billion in investments. Its minimal physical presence requirement – just 7 days in the first year and 14 days every two years after – makes it a top choice for those seeking access to the EU.

A major update in late 2023 removed real estate as a qualifying investment under the "Mais Habitação" law. Eligible investments now include contributions to CMVM-registered funds, scientific research, or cultural initiatives, with reduced thresholds in low-density regions . Alternatively, investors can qualify by creating 10 full-time jobs (or 8 in low-density areas).

The five-year residency period begins on the date of your initial application. To apply for citizenship, you must maintain your investment for the full term and demonstrate basic Portuguese language skills (A2 level). To meet this requirement, it’s wise to start a language course 6 to 9 months before reaching the five-year mark.

Golden Visa holders who spend fewer than 183 days annually in Portugal are only taxed on Portuguese-sourced income. However, staying longer makes you a full tax resident, with worldwide income taxed at rates up to 48%. Government fees include US$5,325 per applicant for the initial application, US$8,060.20 for residence cards, and US$2,663–US$4,030.90 for biannual renewals.

The program allows you to include a spouse, minor or dependent children, and dependent parents in your application. Once citizenship is granted, your family gains full EU rights, including the ability to live, work, and travel freely across all 27 member states. Understanding these details can help integrate a second passport into broader wealth protection strategies.

Combining Second Passports with Asset Protection

Pairing a second passport with offshore trusts and companies creates formidable legal protections, shielding your wealth from creditors, lawsuits, and even government interference.

Using Passports with Offshore Companies and Trusts

Dual citizenship offers more than just travel freedom – it can significantly strengthen your asset protection strategy when combined with offshore structures. For instance, securing Nevis citizenship and establishing a Nevis International Exempt Trust creates a nearly impenetrable defense against creditors. Nevis law requires creditors to post a $100,000 bond before filing a claim, and it doesn’t recognize foreign judgments.

This approach – spreading your wealth across jurisdictions – limits the control any single government has over your assets. A Caribbean passport, for example, can help you open accounts in financial hubs like Switzerland or Singapore without the intense scrutiny tied to your original nationality. Essentially, you’re banking as a citizen of that neutral country, not as someone from a potentially high-risk jurisdiction.

Additionally, a second passport from a jurisdiction outside the Common Reporting Standard (CRS) framework can enhance privacy when accessing U.S. banking systems. Accounts opened this way stay outside automatic international reporting agreements, offering an extra layer of confidentiality.

"A second passport provides what wealth advisors often call a ‘Plan B’: an escape route to a stable country if conditions deteriorate at home, and a practical way to hedge against sovereign risk", says Sofia Meier, Head of Private Clients at CitizenX.

This combination of legal tools not only protects your assets but also highlights the stark contrast between relying on a single citizenship versus holding dual citizenship.

Risk Comparison: Single vs. Dual Citizenship

The risks tied to holding just one passport become more apparent when compared to the advantages of dual citizenship, especially in specific scenarios:

| Risk Type | Single Passport Exposure | Dual Passport Mitigation |

|---|---|---|

| Asset Seizure | A single court order can freeze all domestic and linked international accounts. | Assets held in a second jurisdiction (where you are a citizen) are shielded from foreign judgments. |

| Financial Privacy | Automatic reporting (CRS/FATCA) links all wealth to one nationality. | Ability to bank as a citizen of a neutral or non-CRS jurisdiction (e.g., using a Caribbean passport in the U.S.). |

| Creditor Claims | Creditors can easily target assets in the debtor’s home country. | Creditors must re-litigate in debtor-friendly courts (e.g., Nevis) with high bonds and proof standards. |

| Sovereign Risk | Total vulnerability to domestic political upheaval or currency collapse. | Provides a "Plan B" escape route and legal right of abode in a stable jurisdiction. |

| Capital Controls | Vulnerable to domestic freezes or limits on international transfers. | Access to foreign banking systems and multi-currency accounts in stable hubs. |

Timing is crucial when setting up these structures. They must be established during stable financial conditions – any transfers made after a creditor threat arises could be reversed as "fraudulent transfers." For example, following a major political event in late 2024, interest in Citizenship by Investment (CBI) programs surged by 392%, underscoring the growing recognition of dual citizenship as a safeguard against instability.

How to Get a Second Passport

This section dives into the steps to secure a second passport, building on the advantages of dual citizenship.

Choosing the Right Program

When selecting a program, it’s important to focus on three key factors: global mobility, processing times, and tax advantages. These elements play a crucial role in protecting your assets and improving your international access. For instance, a passport from St. Kitts and Nevis offers visa-free travel to over 150 countries and comes with a tax-friendly environment, making it appealing for those looking to preserve wealth. If speed is your priority, Vanuatu stands out with application approvals often completed in just 6 to 8 weeks. On the other hand, most Caribbean programs take between 3 to 6 months to process applications. European options, such as Portugal, require a longer commitment – 5 years of residency before you can apply for citizenship. However, they come with the added perk of EU work rights.

Before diving in, confirm that your home country allows dual citizenship and that the program you’re considering accepts applicants from your nationality. For example, St. Kitts and Nevis does not accept applications from citizens of Iran, Afghanistan, North Korea, or Cuba.

Investment requirements also vary widely. Some countries, like Dominica, offer a straightforward donation option starting at US$100,000, though these contributions are non-refundable. In St. Kitts and Nevis, real estate investments begin at US$325,000, with a mandatory holding period of 5 to 7 years. This option provides a chance to recoup your investment over time. Choose the path that aligns best with your financial goals and priorities.

Application and Investment Requirements

Most Citizenship by Investment programs, including those in St. Kitts and Nevis, require applicants to work through government-authorized agents rather than submitting applications directly. To avoid scams, ensure your agent is listed on the official government website.

The application process involves gathering extensive documentation. This typically includes valid passports, birth certificates, police clearance certificates from all countries you’ve lived in over the past decade, medical certificates (including HIV test results), and detailed proof of the legal source of your funds. Expect to provide 12 months of bank statements and business or employment records to meet anti-money laundering standards.

Governments conduct thorough background checks before issuing an approval-in-principle letter. Only after receiving this approval should you transfer your investment funds, whether it’s a US$250,000 donation or a real estate purchase. Standard processing times range from 3 to 6 months, but you can expedite the process to about 60 days for an additional fee. Be prepared for extra costs like due diligence fees, which typically amount to US$10,000 for the main applicant and US$7,500 for dependents aged 16 or older. Once the investment is verified, the government will issue a Certificate of Naturalization, which you’ll need to apply for your second passport.

Working with Professionals for Compliance

Navigating the application process can be complex, which is why working with professionals can make all the difference. Authorized agents help ensure your submission meets stringent government standards, from proof of identity to verifying the legal source of your wealth. Their expertise minimizes risks, such as making investments before receiving approval-in-principle, and ensures that unconventional income sources, like cryptocurrency, are presented in a way that satisfies government requirements.

"The St. Kitts and Nevis Citizenship Programme ensures a seamless and transparent application journey for investors and their families." – St. Kitts and Nevis Citizenship by Investment Unit

Conclusion: Protecting Your Wealth and Freedom

A second passport is far more than just a travel document – it’s a crucial tool for reducing dependence on a single government and ensuring your family has permanent options in an unpredictable world. The growing trends highlight how diversifying citizenship is becoming increasingly important.

This isn’t just about you; a second passport creates a lasting legacy for future generations. It opens doors for your children and grandchildren, offering them expanded opportunities through a private family office while complementing broader strategies for protecting your wealth. For example, combining a second passport with offshore trusts or companies in jurisdictions like Nevis – where creditors must post a $100,000 bond to challenge your assets – can form a robust shield for your financial security. As global uncertainties rise, this kind of foresight becomes even more critical.

But the clock is ticking. After a major political event in late 2024, citizenship-by-investment inquiries skyrocketed by 392%. With countries tightening requirements and raising investment thresholds, waiting could mean losing access. Some programs have already closed their doors. As Professor Peter Spiro of Temple University explains:

"There’s an understanding that even if you’re eligible today, you may not be tomorrow. Eligibility is not set in stone. Grab what you can."

Whether you opt for a $100,000 donation to Dominica or pursue a European residency, the key is to act now. The world is becoming increasingly uncertain, and having a Plan B isn’t overreacting – it’s smart financial planning. A second passport serves as your freedom insurance, safeguarding your assets and securing your family’s future against whatever challenges lie ahead.

FAQs

What are the key advantages of having a second passport?

A second passport comes with a variety of perks, starting with visa-free travel to numerous countries. This can make international trips quicker and far more convenient. Plus, it grants the ability to live and work in another country, unlocking fresh opportunities for both personal and career development.

But it’s not just about travel. A second passport can act as a financial safety net, offering potential tax benefits, better asset protection, and a buffer against political or economic uncertainty back home. On top of that, it lets you pass citizenship down to future generations, ensuring lasting advantages for your family.

How does having dual citizenship impact your tax responsibilities?

When it comes to taxes, having dual citizenship doesn’t give U.S. citizens or green-card holders a free pass. The U.S. taxes its citizens on worldwide income, meaning you’re required to file a federal tax return every year – no matter where you live or earn money. If your second country also taxes residents, you might need to file taxes there too. The good news? Tools like the Foreign Earned Income Exclusion, Foreign Tax Credit, and certain tax treaties can help ensure you’re not taxed twice on the same income.

Dual citizens may also face extra reporting requirements. For example, if you hold foreign financial accounts that exceed specific thresholds, you might need to file an FBAR (Foreign Bank Account Report) or comply with FATCA (Foreign Account Tax Compliance Act). While tax treaties can ease or even eliminate double taxation in some cases, U.S. citizens are still required to file taxes unless they formally renounce their citizenship. Keep in mind, renouncing citizenship could result in an "exit tax", so it’s not a decision to take lightly.

What are the main differences between the St. Kitts and Nevis and Portugal citizenship programs?

The St. Kitts and Nevis program provides a Citizenship-by-Investment (CBI) option, allowing individuals to secure a passport by contributing $250,000 or more or purchasing eligible real estate. This process is relatively quick, typically taking just a few months, and does not require applicants to reside in or visit the country. With this passport, holders gain visa-free access to over 150 countries, the possibility of a 10-year U.S. visa, and the benefits of the island’s tax-friendly policies – a compelling choice for those focused on wealth preservation and global mobility.

Portugal takes a different approach with its Golden Visa residency-by-investment program. Investors are required to make a real estate investment ranging from €280,000 to €500,000 and maintain legal residence for five years before becoming eligible for citizenship. Successful applicants receive an EU passport, which allows them to live, work, and study throughout the EU, along with Schengen-area travel privileges. However, this path is slower, involves a residency requirement, and comes with EU tax and regulatory responsibilities.

In essence, St. Kitts and Nevis offers a quicker and less demanding option with tax advantages, while Portugal provides a pathway to EU citizenship and its broader set of rights, albeit with more time and commitment required.