Relying solely on U.S. investments for retirement can leave you vulnerable. Global diversification spreads your risk, protects against inflation, and opens up opportunities in foreign markets.

Key takeaways:

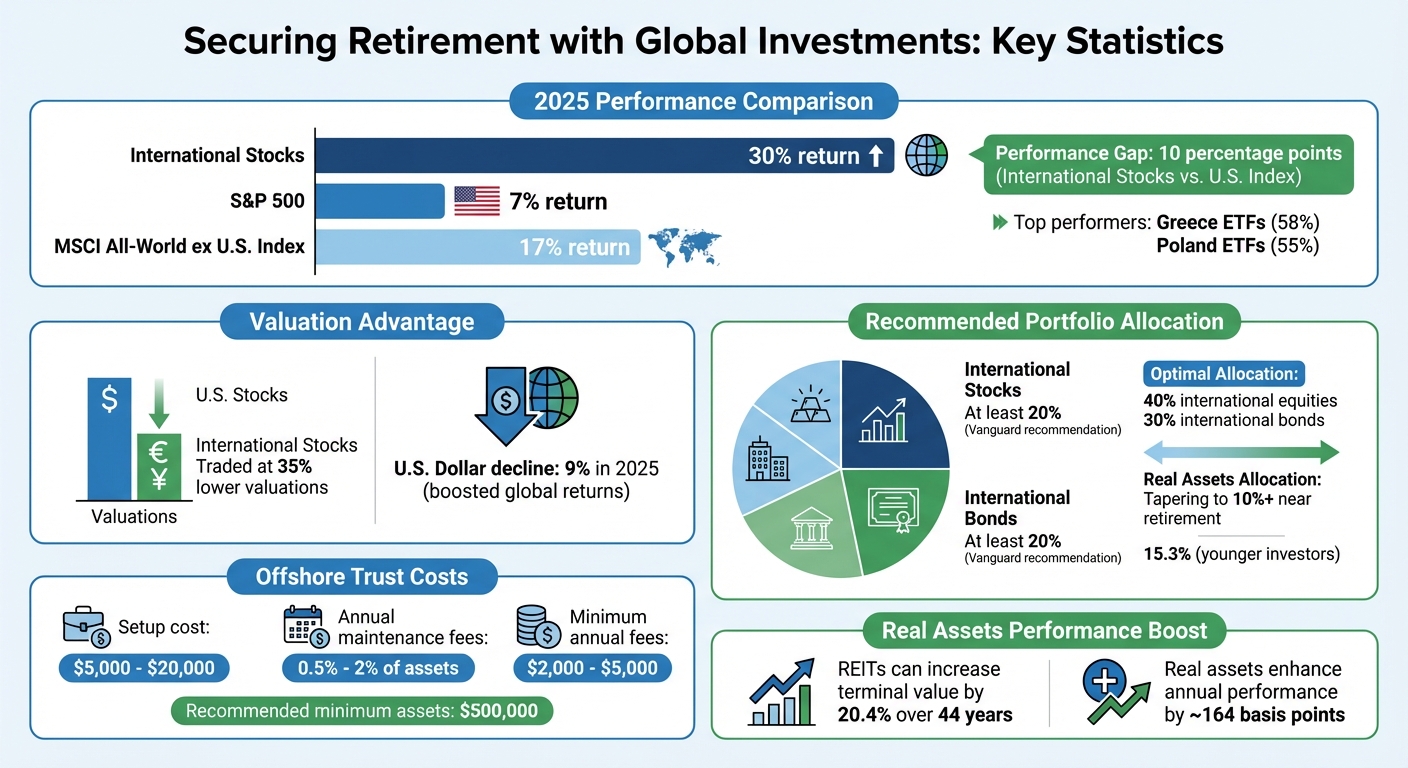

- International stocks outperformed U.S. markets in 2025, delivering a 30% return compared to the S&P 500’s 7%.

- Lower valuations abroad: International stocks traded at 35% lower valuations than U.S. stocks.

- Currency impact: A 9% drop in the U.S. dollar in 2025 boosted returns for global investors.

- Experts recommend allocating at least 20% of your portfolio to international stocks and bonds for better stability and growth.

Diversifying globally reduces your reliance on one economy, helps hedge against market volatility, and provides access to unique opportunities like foreign real estate, government bonds, and private markets. Whether through mutual funds, ETFs, or offshore strategies, building a global investment strategy strengthens your retirement plan.

The Risks of U.S.-Only Retirement Savings

Putting all your retirement savings into U.S. assets can expose you to unnecessary risks. Depending entirely on one economy leaves your portfolio vulnerable when domestic markets falter. The 2007–08 subprime mortgage crisis is a stark reminder of this danger. It highlighted how concentrating investments in a single market can have devastating consequences. Let’s dive deeper into how inflation and market volatility make a U.S.-only retirement strategy even riskier.

Inflation and Loss of Purchasing Power

Inflation acts like a slow leak, quietly reducing the value of your money over time. When inflation rises, traditional assets like stocks and bonds often lose value. A U.S.-only portfolio misses out on key protections, like gains from foreign currencies when the dollar weakens. For instance, physical assets such as gold tend to perform well during inflationary periods, often moving in the opposite direction of paper assets. Without exposure to these alternatives, a portfolio limited to U.S. stocks and bonds lacks this natural hedge. International investments, on the other hand, bring diversification through foreign currencies and alternative assets, offering a buffer against inflation’s impact. But inflation isn’t the only challenge – market volatility can also wreak havoc on an undiversified portfolio.

Market Volatility and Economic Instability

Market swings add another layer of risk to U.S.-only portfolios. The reality is, U.S. markets are rarely stable, and sharp fluctuations can hit portfolios hard if they lack geographic diversification. Consider this: in 2025, while the S&P 500 posted a modest 7% gain, the MSCI All-World ex U.S. Index surged by 17%, outperforming by 10 percentage points. Even more striking, ETFs tied to Greece and Poland soared 58% and 55%, respectively, during the same period.

The U.S. Securities and Exchange Commission emphasizes the importance of diversification:

"Including exposure to both domestic and foreign securities in your portfolio may reduce the risk that you will lose money if there is a drop in U.S. investment returns and your portfolio’s overall investment returns over time may have less volatility".

This issue becomes even more pronounced when U.S. monetary policies diverge from global trends. For example, in 2025, the Federal Reserve’s decision to maintain higher interest rates for an extended period created challenges for domestic companies. These headwinds didn’t affect foreign markets in the same way. A U.S.-only portfolio fully absorbs such policy shifts, while a globally diversified portfolio can benefit from different economic cycles around the world. Geographic diversification provides the balance needed to navigate these unpredictable market conditions.

sbb-itb-39d39a6

Benefits of Global Investment Diversification

Spreading investments across international markets helps reduce dependence on the performance of any single economy. International markets often behave differently from U.S. markets, creating opportunities for smoother returns. The U.S. Securities and Exchange Commission sums it up well:

"By including exposure to both domestic and foreign stocks in your portfolio, you’ll reduce the risk that you’ll lose money and your portfolio’s overall investment returns will have a smoother ride".

A historical analysis from 1927 to 2005 revealed that retirement savers in nearly all studied countries could have achieved higher average pensions by allocating entirely to foreign investments rather than sticking to domestic options alone. Let’s explore how various asset classes contribute to these diversification benefits.

International Stocks and Bonds

Investing in international stocks and bonds opens doors to opportunities unavailable within the U.S. market. Developed markets like the UK, Japan, and Canada offer access to stable, mature industries, while emerging markets such as India, China, and Mexico provide exposure to faster-growing economies. Vanguard suggests allocating at least 20% of both stocks and bonds to international investments.

Currency diversification also plays a role, as it can add value when the U.S. dollar weakens. For individual investors, international mutual funds and ETFs are often the easiest way to access foreign markets. These funds provide broad exposure without requiring investors to manage individual trades. Another simple option is American Depositary Receipts (ADRs), which allow investors to trade foreign stocks on U.S. exchanges in U.S. dollars.

Real Assets for Inflation Protection

Assets like international real estate, infrastructure, and commodities offer a safeguard against inflation. Their cash flows often rise alongside prices, providing direct protection. For example, including REITs in a retirement portfolio can lead to a terminal value that’s 20.4% higher over a 44-year period.

Real assets have also been shown to enhance annual performance by roughly 164 basis points. As Vince Childers, CFA, Head of Real Assets Multi-Strategy at Cohen & Steers, explains:

"Real assets’ ability to counter inflation offers potential benefits to portfolios in the short term, as prices climb, and in the longer term, should inflation rates continue to surprise to the upside".

The recommended allocation to real assets varies, starting at 15.3% for younger investors and tapering to over 10% as retirement nears. These investments – whether in European data centers, Asian toll roads, or South American farmland – derive their value from tangible utility rather than market sentiment. This inflation resistance helps create a more stable foundation, as we’ll see in the discussion on private markets.

Private Markets for Long-Term Stability

Private markets build on the stability provided by real assets by focusing on long-term business fundamentals. Investments such as private equity and private credit tend to have low correlation with daily market volatility because their value is tied to the performance of private companies rather than short-term market fluctuations. While these assets are less liquid than public investments, they help smooth portfolio performance over time by aligning with long-term growth trends.

To account for their illiquidity, it’s essential to maintain a liquid buffer for near-term needs, allowing private investments the time they need to grow. Publicly traded large-cap stocks lose money about 33% of the time, so incorporating less volatile private investments can help reduce overall portfolio swings.

Offshore Strategies to Protect and Grow Retirement Wealth

Expanding on the benefits of global diversification, offshore legal structures offer a way to both protect and grow retirement wealth. These setups – primarily trusts and companies – serve as a strong barrier against creditor claims and lengthy legal battles. They also provide opportunities for tax deferral and, in some cases, the elimination of state-level income taxes.

Offshore Companies and Trusts

Offshore asset protection trusts are designed to operate in jurisdictions that do not recognize U.S. court orders. This means creditors must initiate legal proceedings in the offshore jurisdiction, a process that is often expensive and time-consuming. Certain jurisdictions also impose stricter standards of proof, requiring creditors to meet a "beyond a reasonable doubt" threshold instead of the usual "preponderance of the evidence" standard.

Popular jurisdictions for these trusts include the Cook Islands, Nevis, the Cayman Islands, and the Bahamas. These locations are known for their political stability, strong confidentiality laws, and short statutes of limitations – typically one to two years – for challenging asset transfers. Many of these jurisdictions also include "flight provisions", which allow trustees to move assets to another jurisdiction if a legal threat arises.

Jaclyn Ford-Grella, a Business Development and Trust Officer at Nevada Trust Company, emphasizes the benefits of these trusts:

"An offshore asset protection trust is a powerful tool for securing your wealth and ensuring your financial future remains stable. These trusts offer more protection than domestic options, particularly when it comes to safeguarding your assets from creditors and legal claims".

According to the U.S. Treasury Department, offshore asset protection trusts currently hold assets worth "tens of billions of dollars".

Setting up one of these trusts typically costs between $5,000 and $20,000, with annual maintenance and trustee fees ranging from 0.5% to 2% of the trust’s assets, with minimum fees of $2,000 to $5,000. These structures are generally recommended for individuals with at least $500,000 in assets. It’s important to establish these trusts well ahead of any legal issues to avoid accusations of fraudulent conveyance. Beyond asset protection, these trusts also offer tax-related advantages, which are covered in the next section.

Tax Efficiency Through Global Structures

While offshore trusts are not tax shelters for U.S. citizens, they do offer certain tax advantages. Attorney Robert J. Mintz, an expert in asset protection, clarifies:

"All of the income of the trust is included on the tax return of the U.S. settlor of the trust. The trust is treated in the same manner as a revocable living trust".

The primary tax benefit lies in deferring U.S. taxes on interest income or capital gains until distributions are made. Additionally, if the trust is set up in a jurisdiction without state income taxes, it can eliminate state-level tax liabilities. Offshore structures also open doors to international investment opportunities, such as access to certain bank accounts and mutual funds that are typically unavailable to U.S. residents.

To ensure compliance, these trusts must adhere to FATCA requirements and Tax Information Exchange Agreements, which require reporting all foreign financial assets to the IRS. To maintain the trust’s protective features, it’s wise to appoint an independent foreign trustee with no U.S. presence and include a "trust protector" – an independent party who ensures the trust operates as intended.

A common strategy involves using a domestic LLC to hold property, with the offshore trust owning the LLC membership interest. This approach allows individuals to avoid moving all assets at once while still benefiting from the trust’s protections.

How to Build a Global Retirement Investment Strategy

Expanding your retirement portfolio internationally adds a layer of protection against domestic market swings. To begin, take it step by step. Start by deciding how much of your portfolio to allocate to stocks, bonds, and cash based on your personal risk tolerance and how far you are from retirement. Vanguard suggests that at least 20% of your stocks and bonds should be invested internationally. This approach puts the idea of diversification into action, making it a practical part of your strategy.

Next, choose investment options that match your goals. For most investors, international mutual funds or ETFs are the easiest way to gain global exposure without needing to trade directly on foreign exchanges. These funds spread your investments across a variety of markets, from developed economies like the UK and Japan to emerging markets such as India and China, and even frontier markets in Africa and the Middle East. Another option is American Depositary Receipts (ADRs), which allow you to invest in foreign companies through U.S. exchanges, using U.S. dollars, making the process more straightforward.

Portfolio Rebalancing for Global Exposure

Once your global portfolio is in place, rebalancing becomes essential. This process ensures your portfolio stays aligned with your target allocations, especially since international and U.S. investments often grow at different rates. Rebalancing takes advantage of these differences to keep your investments on track.

"By sell assets that outperform and buy those that underperform, rebalancing forces you to buy low and sell high." – Investor.gov

You can rebalance in several ways: by selling assets that have grown too much and reinvesting in those that lag, by using new investment funds to boost underweighted areas, or by adjusting your regular contributions to focus on underperforming categories. Decide on a schedule – every six or twelve months works well for most people – or set a threshold where you rebalance if an asset class drifts too far from its target. It’s also a good idea to consult a tax adviser before selling assets to avoid unnecessary fees or tax burdens. If you prefer a hands-off method, consider lifecycle (or target-date) funds. These automatically adjust to a more conservative global mix as you approach retirement.

Working with Experts for Offshore Setup

After building and rebalancing your portfolio, managing offshore investments often requires professional help. U.S. reporting requirements for offshore accounts can be complicated, so expert advice is invaluable.

"It is generally against the law for a broker, foreign or domestic, to contact a U.S. investor and solicit an investment unless the broker is registered with the SEC." – U.S. Securities and Exchange Commission

Before hiring an expert, check their credentials through the SEC’s Investment Adviser Public Disclosure (IAPD) website or FINRA’s BrokerCheck. Working with a registered professional ensures you’re protected under U.S. law, which isn’t the case with unregistered brokers. If you decide to open offshore accounts, be prepared to provide notarized documents proving your identity, residence, and funds. Many banks will also require an "apostille stamp", a special international certification, to confirm the authenticity of your documents.

For most U.S. investors, sticking with U.S.-domiciled investment options simplifies tax reporting and reduces administrative headaches. Professionals can help you align your investments with your future plans, especially since where you retire can affect how your dividends, capital gains, and pension withdrawals are taxed.

Case Studies: Real Examples of Global Investments

After diving into the concept of global diversification, let’s take a closer look at how international investments can help secure retirement wealth through some real-world examples.

International Real Estate for Income and Growth

Investing in international real estate can provide a steady stream of income through avenues like residential rentals, commercial leases, or dividends from REITs. These income sources often remain reliable even when U.S. markets hit a rough patch, thanks to differing economic cycles abroad.

In many emerging markets, property values tend to rise faster than in the U.S., which can lead to higher long-term returns. On top of that, if the local currency gains value against the U.S. dollar, rental income and profits from property sales can grow even more when converted back to dollars. UBS highlights the importance of preparation:

"Smart international real estate investing begins with careful research".

Before diving in, it’s crucial to evaluate factors like regional stability, local property laws, and economic indicators. Be aware that earning rental income overseas could lead to tax obligations in both the foreign country and the U.S., although certain expenses – like mortgage interest and depreciation – might be deductible. This example shows how real estate investments can act as a stabilizing force in a portfolio, especially during volatile times.

Government Bonds for Stability

Adding international government bonds to a portfolio can provide stability by spreading out economic and interest rate risks. These fixed-income investments offer regular interest payments and help smooth out volatility, as foreign markets often move independently of U.S. trends. For example, Japan accounts for 11% of the global investment-grade bond market. Vanguard even suggests allocating 20–30% of your bond investments to international bonds for better diversification.

That said, currency fluctuations can eat into returns when converting back to U.S. dollars. To counter this, Vanguard recommends:

"Since international bonds may be more affected by currency risk than international stocks, consider hedging international bond investments in U.S. dollars".

For everyday investors, U.S.-registered mutual funds or ETFs simplify the process of investing internationally. These funds handle currency conversions and provide professional management. A great example is the Vanguard Total International Bond Index Fund, which gives investors access to roughly 6,000 non-U.S. bonds.

These case studies highlight how international real estate and government bonds can both play key roles in building a resilient and diversified portfolio.

Conclusion: Securing Your Financial Future Through Global Investments

Relying solely on U.S. investments for your retirement portfolio can leave you exposed to domestic economic challenges, inflation, and market ups and downs. Expanding your investments to include international markets helps create a safety net, shielding your purchasing power and opening the door to growth opportunities beyond a single economy. This reinforces the importance of global diversification highlighted earlier.

Historical data backs this up. A study covering 1927–2005 revealed that retirement savers in almost all analyzed countries could have achieved higher average pensions by including foreign investments. For a well-rounded portfolio, experts recommend allocating about 40% of your stock investments to international equities and 30% of your bond holdings to international bonds. To achieve this, consider a strategic mix of global assets like stocks, bonds, real estate, and offshore structures. U.S.-registered mutual funds and ETFs, such as the Vanguard Total International Stock Index Fund, offer an easy way to access over 7,500 non-U.S. stocks in one investment vehicle.

Professional guidance is essential to navigate complexities like currency risks, foreign tax laws, and compliance requirements. A resilient retirement portfolio isn’t about keeping all your investments in one place – it’s about diversifying across borders to safeguard and grow your wealth effectively.

FAQs

What are the benefits of adding international investments to my retirement portfolio?

Including investments from outside the U.S. in your retirement portfolio can add a layer of diversification that helps smooth out market ups and downs. Global markets don’t always follow the same patterns as U.S. markets since they’re influenced by different factors like currency shifts and political events. This lack of synchronization can help reduce the overall volatility of your portfolio and lower the chances of a major loss tied to an economic downturn in a single country.

Beyond reducing risk, international investments open the door to growth opportunities that you won’t find domestically. Emerging markets, for instance, often experience faster growth compared to developed economies, which could translate into higher returns. Incorporating assets like foreign government bonds, international mutual funds, or even offshore real estate can expand your portfolio while introducing new income streams. Together, these choices can support long-term growth and help safeguard your retirement savings against inflation and economic uncertainty.

How do currency fluctuations affect the returns on global investments?

Currency fluctuations can play a big role in shaping the returns of global investments, especially when those investments are in foreign currencies. Let’s say you invest in a European equity fund that gains 5% in euros. The actual return you see in U.S. dollars will hinge on the exchange rate. If the euro loses 3% of its value against the dollar, your return shrinks to about 2%. On the flip side, if the euro gains 3%, your return could climb to roughly 8%.

These shifts in exchange rates can inject extra volatility into your portfolio, particularly when dealing with emerging markets, where currency movements are often more unpredictable. To navigate this risk, you might consider tools like currency-hedged exchange-traded funds (ETFs) or forward contracts. Another option is diversifying with assets that naturally counterbalance currency fluctuations. Taking steps to address currency risk is crucial for safeguarding your retirement savings while still tapping into the potential of global investments.

How can I include real assets in my retirement savings plan?

Adding assets like international real estate, infrastructure-related investments, or commodity-linked funds to your retirement portfolio can help guard against inflation and market ups and downs. A good starting point is to allocate a modest portion of your portfolio – around 5% to 15% – to international real estate or real estate investment trusts (REITs) that focus on properties in stable economies. Before diving in, take the time to research the local market, tax rules, and the political environment. Partnering with local professionals can also help you navigate risks and manage logistics effectively.

If you’re looking for a more hands-off approach, globally diversified mutual funds or ETFs that include real assets might be a better fit. These options give you exposure to a broad range of international investments, often at a lower cost and with more liquidity than directly owning property. Plus, they’re easier to adjust within your retirement account to keep your portfolio balanced over time.

When investing internationally, it’s crucial to consider factors like currency fluctuations, tax laws, and political stability. Working with a U.S.-based financial advisor can help you stay compliant with IRS regulations and manage risks such as exchange rate volatility. With the right planning, these investments can play an important role in strengthening your long-term financial strategy.