Medellin for Digital Nomads: Lifestyle Perks, Legal Risks, and Tax Pitfalls

Explore Medellin’s advantages for digital nomads, including cost of living, legal considerations, and tax responsibilities for U.S. citizens.

Is Barcelona a Smart Base for Digital Nomads Concerned About Taxes?

Explore the tax implications of living in Barcelona and compare it with other digital nomad hotspots like Lisbon, Dubai, and Tbilisi.

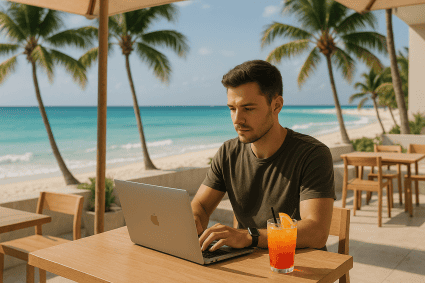

Playa del Carmen for Digital Nomads: Sun, Safety, and Tax Considerations

Explore Playa del Carmen, a digital nomad paradise offering affordable living, reliable internet, vibrant culture, and important tax considerations.

How Digital Nomads Can Benefit from Puerto Rico’s Act 60 (If at All)

Explore how Puerto Rico’s Act 60 can offer tax benefits for digital nomads, along with the challenges and requirements of compliance.

The 5 Best Countries for Territorial Tax Systems (Ideal for Digital Nomads)

Explore the top 5 countries with territorial tax systems that benefit digital nomads, offering low taxes and affordable living.

Ultimate Guide to Family-Friendly Digital Nomad Visas

Explore family-friendly digital nomad visas in 66 countries, covering key application tips, healthcare, schooling, and financial planning for a smooth move.

Banking Without Borders: Offshore Bank Accounts for Freelancers & Nomads

Explore how offshore bank accounts can enhance financial management for freelancers and digital nomads seeking multi-currency support and tax efficiency.

Digital Nomad Residency: The Best Second Residency Programs in 2025

Explore the best digital nomad residency programs in 2025, highlighting income requirements, tax benefits, and lifestyle perks across top destinations.

How Digital Nomads Can Legally Pay Zero Taxes: A Practical Guide

Explore legal strategies for digital nomads to minimize or eliminate tax liabilities while ensuring compliance with international tax laws.

Best Banking Jurisdictions for Location-Independent Founders in 2025

Explore the top banking jurisdictions for location-independent entrepreneurs in 2025, focusing on ease of setup, tax benefits, and digital solutions.