The class divide, corruption, fraud, cronyism, waste, and bottomless spending is made possible by the three-legged stool of the US economy.

March 24, 2025

By: Bobby Casey, Managing Director GWP

Governments have become so convoluted, the average person doesn’t have the bandwidth to keep up with it. They have jobs, responsibilities, children, and heaven forbid a hobby or two. Keeping up with government nonsense is multiple full-time jobs.

At this point, I just assume it’s a mess, and now it’s just a matter of to what degree that’s true. It’s a pretty safe bet.

Getting a glimpse into the inner workings of the US government from some of what DOGE has done is wild. Whether any of the recommendations or cuts will be codified is a separate issue, but the amount of money funneling to innocuous bureaucracies and the amount of money being unquestioningly paid out by the Treasury is just the tip of the iceberg.

All the class divide, corruption, fraud, cronyism, waste, and endless warfare and welfare is made possible by the three-legged stool of the US economy. It consists of: Fiscal Policy, Monetary Policy, and Regulatory Policy. Think of the first two as parallel paths, and the third is the booby traps that crop up to make the journey a little more spicy.

Fiscal Policy

This first leg has to do revenue (i.e. taxes) and spending. This is the purse that Congress holds, so everything within this scope is very political in nature. This has a direct effect on budgets and borrowing.

This is the playground in which you see a lot of left-right bickering and dispute. The allocations made by congress are deliberately vague to provide the flexibility to spend it where “needed”. By law, once the funds are allocated it must be spent as instructed.

It’s also where a lot of money tends to disappear:

The federal government reported an estimated $236 billion in “improper payments” during the most recently completed fiscal year (FY 2023). Such payments are essentially payment errors that can be the result of many things—including overpayments, inaccurate record keeping, or even fraud.

DOGE has been assigned to find inefficiency, waste, and fraud in all federal departments. This is squarely on the fiscal side of things. While heads of each department can redistribute their funding to more efficient areas, they cannot cut spending. That is ultimately up to congress to codify.

What is identified as “waste” or “fraud” could easily be cronyism and a bunch of laundered gifting to get favors too.

We hear a lot about the wasteful spending. There’s also spending we don’t hear about much, like the recent cuts to USAID. This is responsible for the deficits and debts the US government has, to be sure. This first leg of the three-legged stool of the US economy will affect how much money you keep in dollars.

Monetary Policy

This second leg is where interest rates and money supply are regulated. The central bank, or the Federal Reserve as is the case for the US, handles all of this. There are no votes. There are no bills. There’s just levers being pulled and pushed by a chairman. Monetary policy affects exchange rates (i.e. the strength and buying power of the USD) and any lending that is tied to the US Treasury (e.g. housing, automobiles, and student loans).

Fiscal policy decided how much money you get to keep, while monetary policy decides how much value your money gets to keep. This is the brutal reality of what many Americans are seeing now. A household income of $100,000 doesn’t go as far as it used to, and people are feeling it.

When fiscal policy is not reined in and runs at a deficit, monetary policy becomes the credit card. Money is borrowed, and monetized. That is to say, the money supply is inflated.

This third leg of the three-legged stool of the US economy scarcely sees political disagreement in this space, which means there’s been very little criticism, and the only political pressure it gets from politicians is to make the money worth less through lower interest rates and more money supply.

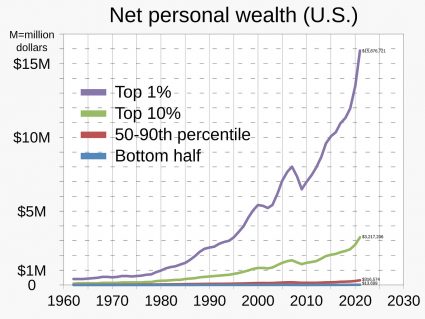

It’s crazy because all the inflation only grows the class divide between rich and poor:

The cronyism is alive and well here too because those proximate to the money printing get the greatest beneift from it. They get the value of the money when it was printed, not the lagged depreciated value later.

Regulatory Policy

If taxes are high, and inflation is high, and interest rates are high, economic growth is very slow, stunted, or shrinking. It would be impossible to do business in such an economic environment. Now throw in the third leg: regulations.

This initiates in the legislature, but they are ultimately managed by the agencies they are assigned to. While the Chevron Deference ruling reined in some of the “creative license” the bureaucrats took in their enforcement, we still see a lot of creativity in how lawyers interpret these laws as well.

I called these spicy booby traps because it’s a moving target subject to a lot of interpretation, and in the end, the imposition of regulations is no small amount when you factor in the hours and fines and legal fees and just the general cost of actual compliance:

Scholars and politicians continue to debate the exact extent of the cost of regulation on companies. Some scholars estimate that American businesses spend an additional $700 billion annually to comply with regulations. The Office of Information and Regulatory Affairs, however, estimates that regulation costs firms closer to $300 billion annually.

Either this is done by the owner of the company, or employees are hired specifically to keep the business in compliance. This is why you see this revolving door between federal regulatory agencies and the private sector. The regulator comes in with a fluent understanding of how the rules work, and how they don’t. They make millions keeping corporations compliant.

We see this in the financial and pharmaceutical industries a lot.

The way in which the three-legged stool of the US economy is being managed is untenable. Small businesses routinely get crushed by these three things. And those who survive do so inevitably by raising their prices which means, the poor and middle class routinely gets crushed by this too. Meanwhile the political elites and their cronies are bankrolling the whole thing.

Click here to get a copy of our offshore banking report, or here to become a member of our Insider program, where you are eligible for free consultations, deep discounts on corporate and trust services, plus a host of information about internationalizing your business, wealth and life.