If you’re looking to maximize your dividend returns without worrying about taxes, certain countries offer tax-free or highly favorable conditions for dividend income. Here’s a quick breakdown:

- United Arab Emirates (UAE): No personal income tax on dividends. Residency options include the Golden Visa and Virtual Working Program. Corporate tax applies only to business profits exceeding AED 375,000 (~$102,000).

- Cayman Islands: No income, capital gains, or withholding taxes. Residency requires a $2 million real estate investment.

- Bahamas: No tax on dividends, but a 5% stamp duty applies to large outbound remittances. Residency starts with a $750,000 real estate investment.

- Saint Kitts and Nevis: 0% tax on foreign dividends for residents. Citizenship by Investment starts at $250,000.

- British Virgin Islands (BVI): No taxes on personal or corporate income, including dividends. Residency is optional.

- Monaco: No personal income tax since 1869. Residency requires a €500,000 (~$525,000) bank deposit and meeting physical presence requirements.

- Qatar: No personal income tax on dividends. Residency can be obtained through real estate investments starting at $200,000.

- Panama: Foreign-sourced dividends are tax-free. Residency options include the Qualified Investor Program, starting at $300,000.

- Malaysia: Foreign-sourced dividends are exempt until 2036. A 2% tax applies to local dividends exceeding RM 100,000 (~$23,700).

- Portugal (IFICI Regime): Tax-free foreign dividends if taxed in the source country. Domestic dividends are taxed at 28%.

These countries offer a mix of zero-tax and territorial tax systems, with varying residency requirements and investment thresholds.

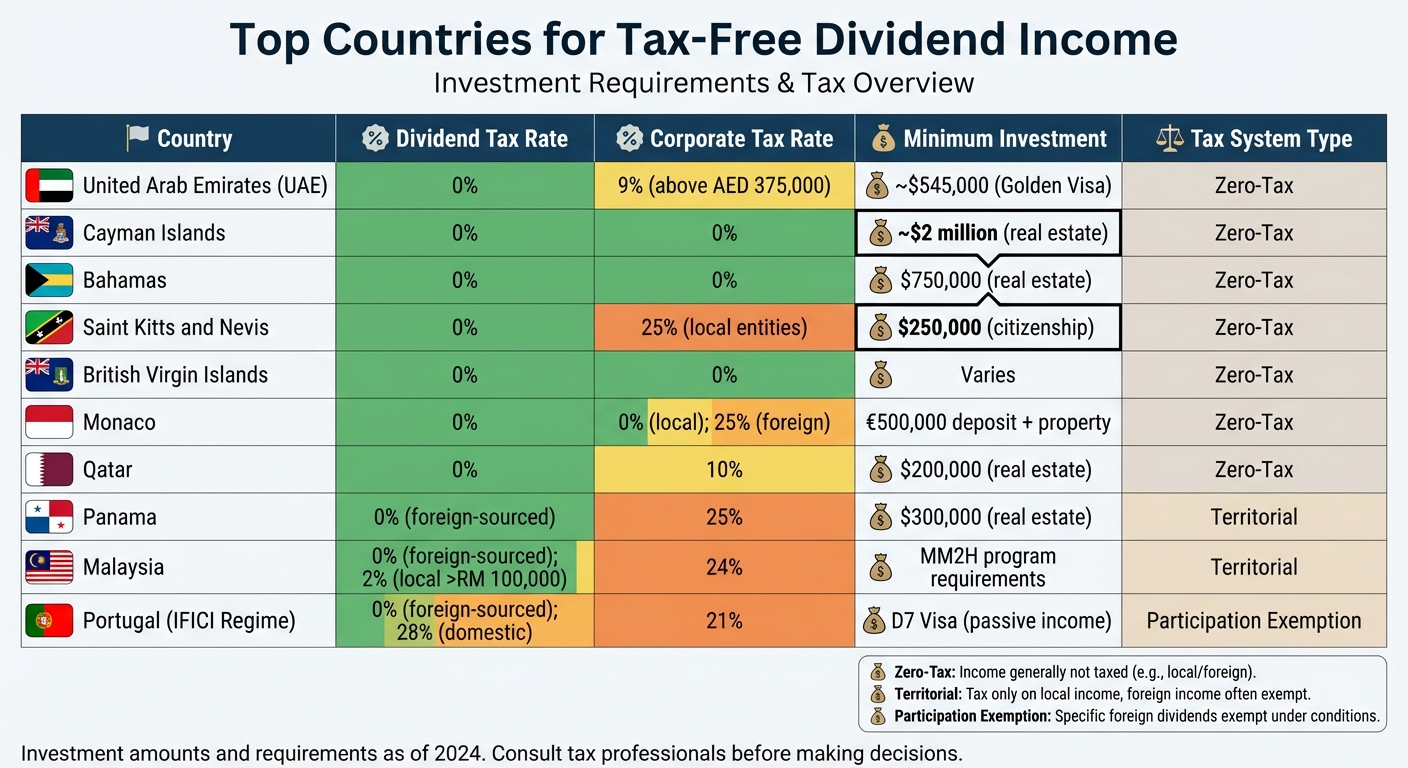

Quick Comparison

| Country | Dividend Tax Rate | Corporate Tax Rate | Residency Investment | Tax System |

|---|---|---|---|---|

| UAE | 0% | 9% (above AED 375,000) | ~$545,000 (Golden Visa) | Zero-Tax |

| Cayman Islands | 0% | 0% | ~$2 million (real estate) | Zero-Tax |

| Bahamas | 0% | 0% | $750,000 (real estate) | Zero-Tax |

| Saint Kitts and Nevis | 0% | 25% (local entities) | $250,000 (citizenship) | Zero-Tax |

| British Virgin Islands | 0% | 0% | Varies | Zero-Tax |

| Monaco | 0% | 0% (local); 25% (foreign) | €500,000 deposit + property | Zero-Tax |

| Qatar | 0% | 10% | $200,000 (real estate) | Zero-Tax |

| Panama | 0% (foreign-sourced) | 25% | $300,000 (real estate) | Territorial |

| Malaysia | 0% (foreign-sourced) | 24% | MM2H program requirements | Territorial |

| Portugal (IFICI) | 0% (foreign-sourced) | 21% | D7 Visa (passive income) | Participation Exemption |

Choosing the right country depends on factors like residency requirements, upfront costs, and lifestyle preferences. Always consult a tax professional to align your financial goals with local regulations.

1. United Arab Emirates

Personal Tax Treatment of Dividend Income

The United Arab Emirates (UAE) stands out as a top choice for dividend investors thanks to its zero personal income tax policy for individuals. Dividends earned from both UAE-based and foreign companies are entirely tax-free when held as personal investments. However, for individuals involved in business activities that surpass certain thresholds, a 9% corporate tax is applied to profits exceeding AED 375,000 (approximately $102,000). On the corporate side, UAE entities can enjoy a tax exemption on foreign dividends if they own at least 5% of the shares (or if the acquisition cost exceeds AED 4 million, roughly $1.09 million) and maintain ownership for at least 12 months.

Residency Requirements and Physical Presence Tests

The UAE offers multiple pathways for individuals to establish residency. Programs like the Golden Visa provide renewable residency for 5 to 10 years, while the Virtual Working Program allows remote professionals to live and work in the UAE without traditional sponsorship. For those seeking a renewable residence visa, a minimum investment of AED 750,000 (around $205,000) is required. To secure a Tax Residency Certificate – which grants access to the UAE’s extensive network of over 100 double taxation treaties – investors must spend at least 180 days per year physically in the country. These straightforward residency options, combined with the UAE’s favorable tax policies, make it an appealing destination for investors.

Withholding Tax on Outbound Dividends

The UAE imposes a 0% withholding tax on outbound dividends, interest, and royalties. This means that when UAE companies distribute dividends to foreign shareholders, no tax is withheld at the source – whether the recipient is an individual or a company.

Regulatory Stability and Investor-Friendly Environment

The UAE is recognized for its political stability and its successful efforts to diversify its economy beyond oil revenues. Its regulatory framework aligns with international standards, including those set by the OECD, solidifying its reputation as a global financial hub. The introduction of a 9% corporate tax on business profits above AED 375,000 in June 2023 highlights the country’s evolving regulations while maintaining tax advantages for personal investments. This balance between regulatory updates and investor-friendly policies continues to attract individuals and businesses alike.

sbb-itb-39d39a6

2. Cayman Islands

Personal Tax Treatment of Dividend Income

The Cayman Islands offers a 0% tax rate on personal income, capital gains, corporate profits, and VAT, making dividend income completely tax-free. This applies to dividends from both local and foreign companies. Instead of relying on income taxes, the government generates revenue through other means like stamp duties on real estate transactions, import duties, and work permit fees.

"There are no income or withholding taxes imposed on individuals in the Cayman Islands." – PwC

As one of the world’s leading offshore finance hubs, the Cayman Islands attracts dividend investors from around the globe. With over 99,000 active companies and more than 10,000 mutual funds operating within its borders, the jurisdiction provides a highly favorable environment for tax-efficient investing. These benefits also tie into flexible residency options for those looking to establish a base in the islands.

Residency Requirements and Physical Presence Tests

One standout advantage is that the Cayman Islands’ 0% tax rate applies to everyone, regardless of residency status. For those seeking formal residency, the "Certificate of Permanent Residence for Persons of Independent Means" is available, requiring a minimum investment of $2 million in local real estate. Alternatively, remote workers can take advantage of the Global Citizen Concierge Program, which permits a legal stay without incurring local income tax obligations, provided specific salary and health insurance criteria are met.

For businesses, the Economic Substance (ES) law may apply, but companies can avoid being classified as a "relevant entity" by proving tax residency elsewhere. U.S. citizens and green card holders, however, should note that the IRS requires reporting of worldwide income, including dividends earned from Cayman-based entities. Combined with a stable legal framework, these residency and tax policies make the Cayman Islands especially appealing for investors focused on dividends.

Withholding Tax on Outbound Dividends

The Cayman Islands’ no-tax policy extends to outbound dividend payments as well. There is no withholding tax on dividend distributions, and the lack of exchange-control restrictions ensures that capital can be repatriated without complications.

Regulatory Stability and Investor-Friendly Environment

As a British Overseas Territory, the Cayman Islands enjoys a stable political and legal framework rooted in English common law. This stability is bolstered by the presence of around 300 banks, 750 insurers, and the Cayman Islands Stock Exchange, which has been operational since 1997. Another major draw for investors is the absence of tax filing requirements for individuals and corporations, which eliminates much of the administrative hassle and compliance costs. Professional service firms like PwC, which has been operating in the Cayman Islands for over 30 years, provide expert advisory services to support even the most complex dividend strategies.

3. Bahamas

Personal Tax Treatment of Dividend Income

The Bahamas boasts a tax-friendly system where dividends, interest, and royalties – whether from domestic or foreign sources – are not taxed. However, there is a catch: if outbound dividend remittances exceed BSD 500,000, a 5% stamp duty applies when funds are converted and transferred to a related party. For offshore holdings, International Business Companies (IBCs) are a popular choice, as they enjoy a 0% corporate tax rate on income sourced from abroad. These structures are often utilized for offshore asset protection to safeguard wealth from legal liabilities.

Residency Requirements and Physical Presence Tests

One of the Bahamas’ standout features is that its tax-free dividend policy applies universally, regardless of residency status. However, for those seeking formal residency, the country requires a minimum real estate investment of $750,000. Permanent residents must also spend at least 90 days annually in the Bahamas. Adding to its appeal, the Bahamian dollar is pegged 1:1 with the US dollar, offering currency stability for American investors.

Withholding Tax on Outbound Dividends

The Bahamas further strengthens its appeal with its withholding tax policies. Non-residents receiving dividend payments enjoy a 0% withholding tax, and non-resident companies can move capital freely without restrictions. The only exception is a 5% stamp duty on related-party transfers exceeding BSD 500,000.

Regulatory Stability and Investor-Friendly Environment

The Bahamas combines over 80 years of stable parliamentary democracy with a legal framework based on English Common Law. It complies with OECD standards and introduced the Economic Substance Act in 2018 to align with global regulations. Pure equity holding companies have minimal annual filing obligations. Meanwhile, the Central Bank’s oversight of dividend repatriation and the Banks and Trust Companies (Payment of Dividends) Regulations, 2025, which require adequate Common Equity Tier 1 capital, underscore the Bahamas’ reputation as a premier offshore financial hub.

4. Saint Kitts and Nevis

Personal Tax Treatment of Dividend Income

Saint Kitts and Nevis is a tax haven for residents receiving dividend income. Dividend income, whether domestic or foreign-sourced, is taxed at 0% for tax residents. On top of that, there’s no personal income tax, wealth tax, or inheritance tax. Legal and Compliance Officer Albert Ioffe highlights the advantage:

"If an investor moves to the islands, obtains tax resident status and registers a company, his dividends are not taxed."

For non-residents, foreign-sourced dividends are also tax-free, but dividends originating within Saint Kitts and Nevis are subject to a 15% withholding tax. This makes obtaining tax residency a crucial step for those looking to eliminate taxes on their dividend income entirely.

Residency Requirements and Physical Presence Tests

To qualify as a tax resident, you must spend more than 183 days in Saint Kitts and Nevis within a calendar year. Even if you participate in the Citizenship by Investment program, meeting this residency requirement is essential to unlock the full tax benefits.

The Citizenship by Investment program, which dates back to 1984, requires a minimum investment of $250,000. This can be done through the Sustainable Island State Contribution, public benefit projects, or purchasing approved real estate (minimum $325,000 with a seven-year holding period). However, it’s important to note that obtaining citizenship alone does not grant tax residency or exempt you from the domestic dividend withholding tax.

Withholding Tax on Outbound Dividends

Non-residents are subject to a 15% withholding tax on dividends, interest, and royalties. In contrast, tax residents are exempt from this tax. However, Double Tax Agreements with countries like the UK, USA, Switzerland, Canada, Denmark, Norway, and CARICOM nations can help reduce these tax obligations for non-residents. Withholding taxes are payable quarterly, with due dates on March 15, June 15, September 15, and December 15.

Regulatory Stability and Investor-Friendly Environment

Saint Kitts and Nevis offers a stable legal environment rooted in English Common Law, which provides clarity and predictability for investors. The country imposes no exchange controls, making it easy to repatriate profits. It also aligns with international standards through participation in the Common Reporting Standard (CRS) and FATCA reporting.

As of January 6, 2026, new physical residency requirements were introduced for the Citizenship by Investment program, showcasing the country’s commitment to adapting to global regulations. For American investors, the East Caribbean Dollar is pegged to the US dollar at a fixed rate (1 EC$ equals 37 US cents), ensuring currency stability.

5. British Virgin Islands

Personal Tax Treatment of Dividend Income

The British Virgin Islands (BVI) offers a zero-income tax policy for individuals, covering all types of personal income, including dividends. Whether the dividend income is domestic or foreign-sourced, it is taxed at 0%, regardless of residency status. As noted by Legal 500:

"More accurately, there is an Income Tax Act on the statute books but it imposes a 0% income tax regime for individuals."

Additionally, the BVI does not impose capital gains tax, wealth tax, gift tax, or inheritance tax. Residency and domicile status are irrelevant when it comes to taxation on income or capital gains.

Residency Requirements and Physical Presence Tests

You don’t need to establish residency in the BVI to benefit from its tax-free dividend rules – the 0% tax rate applies universally. However, for those interested in formal residency, an Investor Residence Certificate is available. This requires a minimum investment of $500,000 in BVI real estate.

If property ownership is part of your plan, obtaining "belonger" status could be advantageous. This status, granted through ancestry, marriage, or long-term residence, significantly reduces the stamp duty on property purchases from 12% (for non-belongers) to just 4%.

Withholding Tax on Outbound Dividends

The BVI imposes no withholding tax on outbound dividends paid to foreign investors. This means dividends can move across borders without any deductions at the source. The same zero-tax policy applies to interest and royalty payments.

Despite its tax-neutral approach, the BVI is committed to global tax transparency. It participates in initiatives like the OECD’s Automatic Exchange of Information (AEOI). However, investors should be mindful of their tax responsibilities in their home countries, as the BVI has limited double tax treaties with other jurisdictions. These tax benefits are supported by a strong legal and regulatory framework, which is detailed below.

Regulatory Stability and Investor-Friendly Environment

As a British Overseas Territory, the BVI operates under the English common-law system, providing legal clarity and reliable asset protection. The Beneficial Ownership Secure Search System (BOSS) ensures that ownership information is accessible to designated authorities while maintaining privacy for the general public.

The BVI’s Trustee Act includes robust "firewall" provisions that shield BVI trusts from foreign forced heirship claims and matrimonial orders. For those who want to retain control over their investments, the Virgin Islands Special Trust Act (VISTA) allows trusts to hold shares in BVI companies while enabling settlors to maintain management control.

This combination of tax advantages, legal stability, and regulatory support makes the BVI a prime location for maximizing dividend returns. For personalized advice on structuring your offshore holdings, consider private consultations. For American investors, currency stability is an added bonus, as the US dollar is widely accepted throughout the territory.

6. Monaco

Personal Tax Treatment of Dividend Income

Monaco has maintained a 0% personal income tax policy since 1869, making it a long-standing haven for tax-free income. Residents are not taxed on any personal income, whether it’s domestic or foreign dividends, interest, or capital gains. As international tax expert Marc Cantavella puts it:

"An individual resident in Monaco will not pay taxes on any personal income, which includes capital gains, dividends and interests."

However, there is one notable exception: French nationals living in Monaco are still required to pay French income tax under a bilateral agreement. While Monaco itself does not tax foreign-sourced dividends, these may still be subject to withholding taxes in the country where the dividends originate. This is partly because Monaco has only established eight double taxation treaties as of 2026.

Residency Requirements and Physical Presence Tests

To enjoy Monaco’s tax-free benefits, individuals must first secure administrative residency by obtaining a residence permit (known as a "carte de séjour") and then apply for a tax residence certificate. This process involves demonstrating financial stability, often by maintaining a bank deposit of at least €500,000 (around $525,000) in a Monaco-based bank. Additionally, individuals need to meet a physical presence requirement of at least 183 days per year. Alternatively, one can qualify by proving Monaco is their "center of interests", meaning it is the primary location of their economic and personal ties. As Marc Cantavella explains:

"Administrative residency alone does not guarantee a tax residency certificate."

This structured residency process highlights Monaco’s dedication to preserving its tax-free reputation for dividend income.

Withholding Tax on Outbound Dividends

Monaco does not impose any withholding tax on dividend distributions or interest payments made by Monaco-based companies to their shareholders. This zero-tax policy applies to both residents and non-residents, ensuring that dividends can move across borders without any tax deductions.

Regulatory Stability and Investor-Friendly Environment

Monaco is no longer labeled a tax haven by the OECD or EU, thanks to its adoption of international transparency standards and participation in automatic financial information exchanges. The country boasts a strong financial services sector and high levels of personal security. However, living costs are steep – real estate prices often exceed €50,000 per square meter, and monthly rent for a two-bedroom apartment starts at approximately €8,000. Financial oversight is managed by the Commission for the Control of Financial Activities (CCAF), ensuring a stable and compliant banking system. These regulatory measures, combined with the absence of dividend taxes, make Monaco an attractive destination for investors looking to maximize their income without tax burdens.

7. Qatar

Personal Tax Treatment of Dividend Income

Qatar stands out as one of the few nations with zero personal income tax. This means individuals receiving dividends aren’t taxed on them, as long as the dividends stem from profits already taxed at the corporate level in Qatar or from companies officially exempt from tax. According to the Qatar Financial Centre (QFC):

"No personal income tax, wealth tax or Zakat."

Beyond dividend income, Qatar also exempts other forms of personal income from taxation. However, non-residents should be aware that capital gains from Qatar-sourced assets are subject to a 10% tax, with returns required to be filed within 30 days of the sale. These tax policies, combined with Qatar’s residency options, create an appealing environment for investors.

Residency Requirements and Physical Presence Tests

Unlike many other countries, Qatar does not enforce physical presence tests to qualify for its tax-free dividend policy – the 0% personal income tax applies universally to individuals. For foreigners interested in obtaining residency, Qatar offers a Golden Visa program tied to real estate investments. A property purchase of $200,000 grants a renewable residence permit, while a $1,000,000 investment qualifies for permanent residency.

Withholding Tax on Outbound Dividends

Qatar applies a 0% withholding tax on all outbound dividend payments, enabling companies operating in the Qatar Financial Centre to repatriate profits in full without deductions. This zero-tax policy on outbound dividends ensures that investors can transfer their income across borders without encountering additional tax burdens.

Regulatory Stability and Investor-Friendly Environment

The Qatar Financial Centre uses an English common law framework, offering international investors a familiar and reliable legal system supported by independent courts. The QFC also provides an advance ruling service, delivering binding tax decisions within 30 days, which offers clarity on dividend taxation and other matters. Further bolstering investor confidence, Qatar has signed double taxation agreements with over 80 countries to safeguard investor rights.

Qatar’s corporate tax rate is set at 10%, though entities that are at least 90% Qatari-owned may qualify for a 0% concessionary rate. Additionally, foreign investors can fully own businesses within the QFC and Free Zones, with regulations supporting complete profit repatriation. This combination of legal stability and investor-friendly policies makes Qatar an attractive destination for global investors.

8. Panama

Panama stands out as a tax-efficient jurisdiction with its unique territorial tax system.

Personal Tax Treatment of Dividend Income

Panama’s territorial tax approach means only income generated within the country is subject to taxation. For residents, dividends from foreign sources are entirely exempt from local taxes. Simply put, income earned outside Panama is not taxable under this system.

When it comes to dividends from Panamanian companies, the tax rate varies based on the source of income. Dividends from local income are taxed at 10%, while those tied to foreign-source income, export revenue, or exempt income (such as government securities or bank interest) are taxed at a reduced 5%. However, bearer shares face a higher penalty rate of 20%. Companies operating in special economic zones, like the Colón Free Trade Zone, often benefit from the lower 5% rate regardless of the income source.

Residency Requirements and Physical Presence Tests

To qualify as a tax resident in Panama, individuals must spend more than 183 days in the country or establish a permanent economic presence through housing or economic ties. However, legal permanent residency is more flexible, requiring only a visit once every two years.

Panama’s Qualified Investor Program (VIP) offers an expedited path to permanent residency. Applicants can qualify with a minimum investment of $300,000 in real estate, $500,000 in the stock market, or $750,000 in a bank deposit. While the program technically requires applicants to be physically present for five days every two years, enforcement of this rule is generally lenient. The use of the U.S. dollar as legal tender adds further stability for international investors, making Panama an attractive option for efficient dividend repatriation.

Withholding Tax on Outbound Dividends

Panamanian companies are required to withhold and remit dividend taxes within 10 days of distribution. Jose Agustin Preciado, Senior Partner at FABREGA MOLINO, explains:

"Pursuant to Panamanian tax regulations, any legal entity that requires a notice of operation to carry out its commercial or industrial activities within the national territory or that generates taxable income within the Republic of Panama, must withhold from each shareholder and pay in his name and on his account, the tax levied on the dividend."

If a company distributes less than 40% of its net profits from local sources (or 20% for certain types of income), it must pay a 10% "complementary tax" as an advance on dividend taxes. To avoid double taxation, dividends derived from income already subject to dividend tax are not taxed again.

Regulatory Stability and Investor-Friendly Environment

Panama’s territorial tax system has been a reliable framework for long-term financial planning. The country has signed bilateral investment protection agreements with nations like the U.S., UK, Netherlands, and Spain, ensuring foreign investments are safeguarded and disputes can be resolved through international arbitration in cases of nationalization or expropriation.

In efforts to bolster its global standing, Panama adopted the OECD’s Common Reporting Standard (CRS) and FATCA for automatic exchange of financial information. Additionally, the country was removed from the Financial Action Task Force (FATF) grey list in 2023. Panama also offers specialized regimes, such as SEM (Multinational Headquarters) and EMMA (Manufacturing Services), which provide tax, immigration, and labor incentives for multinational companies. Furthermore, the country has established double taxation treaties with several nations, ensuring these agreements take precedence over local tax laws when applicable. These measures collectively enhance Panama’s appeal for global investors seeking a stable and tax-efficient environment.

9. Malaysia

Malaysia offers a favorable tax environment for dividend investors, thanks to its single-tier tax system. Under this system, companies pay corporate tax on their profits, and dividends distributed to shareholders are generally free from additional taxation. However, starting January 1, 2025, a 2% tax will be applied to annual dividend income exceeding RM 100,000 (around $23,700). This threshold applies per taxpayer annually, based on the total dividend income rather than individual sources.

Personal Tax Treatment of Dividend Income

The 2% dividend tax applies to both resident and non-resident individuals, including those holding shares through nominees, for dividends received from resident companies. Additionally, foreign-sourced dividend income brought into Malaysia by resident individuals remains exempt from tax until December 31, 2036. This policy primarily targets high-income earners, such as those in the T20 (top 20%) and upper M40 (middle 40%) income brackets, while smaller portfolios remain unaffected. Understanding residency status is essential for navigating these tax implications effectively.

Residency Requirements and Physical Presence Tests

To be considered a tax resident in Malaysia, an individual must spend at least 182 days in the country during the tax year or meet specific cumulative presence criteria.

Withholding Tax on Outbound Dividends

Malaysia’s single-tier tax system does not require companies to withhold tax on dividends paid to non-resident shareholders. This approach simplifies cross-border dividend payments, making it attractive for international investors.

Regulatory Stability and Investor-Friendly Environment

Malaysia has an extensive network of double tax treaties designed to minimize or eliminate double taxation on cross-border dividend income. Additionally, the Inland Revenue Board provides clear formulas and updated guidelines to ensure compliance and transparency when calculating taxable dividend income. This framework reflects a broader trend in Southeast Asia, where countries aim to balance fiscal policies with competitiveness to attract global investment.

10. Portugal Non-Habitual Resident Regime

As of January 1, 2024, Portugal replaced its original Non-Habitual Resident (NHR) regime with the IFICI regime. This new framework narrows eligibility to professionals in innovation-related fields while maintaining a 10-year exemption for foreign-sourced income. Under the previous NHR program, foreign-sourced dividends were generally exempt from Portuguese taxation for a decade, provided they could be taxed in the source country under a Double Taxation Agreement (DTA) or the OECD Model Tax Convention. However, domestic dividends faced a flat tax rate of 28%, and dividends from blacklisted jurisdictions were taxed at a higher rate of 35%. These updates represent a notable shift in Portugal’s tax policies, impacting how investors plan for dividend taxation.

Personal Tax Treatment of Dividend Income

The new IFICI regime continues to offer tax exemptions for foreign-sourced dividends, provided they are taxed in the source country, a benefit carried over from the previous NHR system for those who qualify.

Residency Requirements and Physical Presence Tests

To qualify for NHR status, individuals must establish Portuguese tax residency by either spending more than 183 days in the country or maintaining a habitual residence there. Additionally, applicants must not have been Portuguese tax residents in the preceding five years. Applications for NHR status must be submitted through the Portal das Finanças by March 31 of the year following the establishment of tax residency.

Withholding Tax on Outbound Dividends

Portugal applies a 28% withholding tax on dividends paid by Portuguese companies to non-residents. However, reductions may be available under applicable DTAs, depending on the terms of the agreement between Portugal and the recipient’s country of residence.

Regulatory Stability and Investor-Friendly Environment

The former NHR regime provided benefits for a fixed 10-year period. In response to EU concerns about double non-taxation, Portugal introduced a 10% flat tax on foreign pensions. Regardless of tax exemptions, all foreign dividend income must be reported to Portuguese tax authorities. Despite these changes, Portugal remains a prominent destination in Europe for tax-efficient dividend investments, offering a favorable environment for investors seeking long-term opportunities.

Country Comparison Table

Countries often fall into three main tax categories: zero-tax, territorial, and participation exemption regimes. Knowing these distinctions is crucial for aligning your investment goals with your residency plans.

Zero-tax jurisdictions, like the UAE, Cayman Islands, Bahamas, Monaco, and British Virgin Islands, do not impose personal income tax on dividends. For example, the UAE introduced a 9% federal corporate tax in June 2023 on business profits exceeding AED 375,000 (about $102,000), but personal dividend income remains untaxed. Monaco has maintained its 0% personal income tax policy since 1869. Meanwhile, territorial systems such as Panama and Malaysia only tax income generated within their borders, leaving foreign-sourced dividends untouched. Entry costs for residency or citizenship vary widely, ranging from $250,000 for Saint Kitts and Nevis citizenship to $1.2 million in real estate for a Cayman Islands residency certificate. Physical presence requirements also differ, with programs like Monaco’s typically requiring around 183 days annually, while the UAE’s Golden Visa has minimal stay conditions.

Here’s a summary table that outlines key metrics like dividend tax rates, corporate tax rates, minimum investment thresholds, and tax system types for these jurisdictions:

| Country | Dividend Tax Rate | Corporate Tax Rate | Minimum Investment | Tax System Type |

|---|---|---|---|---|

| United Arab Emirates | 0% | 9% (above AED 375,000); 0% in Free Zones | ~$545,000 (Golden Visa) | Zero-Tax |

| Cayman Islands | 0% | 0% | ~$1.2 million (real estate) | Zero-Tax |

| Bahamas | 0% | 0% | $750,000 (real estate) | Zero-Tax |

| Saint Kitts and Nevis | 0% | 25% (0–1% for offshore entities) | $250,000 (citizenship) | Zero-Tax |

| British Virgin Islands | 0% | 0% | Varies | Zero-Tax |

| Monaco | 0% | 0% (local); 25% (foreign revenue) | €500,000 deposit + property | Zero-Tax |

| Qatar | 0% | 10% (foreign firms) | Varies | Zero-Tax |

| Panama | 0% (foreign-sourced) | 25% | $1,000/month pension | Territorial |

| Malaysia | 0% (foreign-sourced) | 24% | MM2H program requirements | Territorial |

| Portugal (NHR/IFICI) | 0% (foreign-sourced)* | 21% | D7 Visa (passive income) | Participation Exemption |

This table provides a clear comparison to help investors match their dividend strategies with the residency and tax frameworks highlighted earlier.

Conclusion

Choosing the best tax-free jurisdiction for dividend income involves more than just focusing on the appealing 0% personal income tax rates offered by places like the UAE, Cayman Islands, and Monaco. Investors must weigh other factors, such as residency rules, financial obligations tied to securing tax benefits, and hidden costs like VAT or import duties, which can climb to as much as 40% in some areas. Residency requirements often include specific physical presence criteria, which differ depending on the jurisdiction, making them a key part of the decision-making process.

Another critical aspect is the role of double taxation treaties, which help prevent unexpected tax burdens or complications from dual residency situations. For some individuals, particularly those from countries enforcing worldwide taxation, these treaties can be a game-changer. Beyond taxes, lifestyle factors such as access to quality healthcare, reliable internet for remote work, and personal safety should also influence the choice of jurisdiction.

Given the intricate nature of international tax laws, seeking professional guidance is essential. Tax researcher James R. Hines Jr. aptly points out:

"Tax havens are typically small, well-governed states that impose low or zero tax rates on foreign investors".

Services like those provided by Global Wealth Protection offer tailored consultations, assistance with offshore company formation, and strategic planning to simplify compliance with frameworks like FATCA and the Common Reporting Standard.

FAQs

What are the residency requirements to qualify for tax-free dividend income in certain countries?

To enjoy tax-free dividend income in Cyprus, you’ll need to establish tax residency by spending over 183 days in the country within a calendar year. On top of that, you must qualify for non-domiciled (non-dom) status. This status is available if you weren’t born in Cyprus and haven’t lived there for the last 17–20 years. With non-dom status, you can take advantage of a 0% tax rate on dividend income for up to 17 years.

It’s essential to check your eligibility and consult a tax expert to ensure you’re meeting all local regulations while making the most of these tax advantages.

How do double taxation treaties impact dividend income in tax-friendly countries?

Double taxation treaties exist to ensure investors aren’t taxed twice on the same dividend income. These agreements often lower the withholding tax on dividends in the country where the income originates, sometimes reducing it to just 5–15% or even eliminating it altogether. In addition, investors can typically claim a tax credit or exemption in their home country, making dividend income more appealing and financially efficient.

Are there extra costs or requirements for getting tax benefits in these countries?

Yes, there are often extra costs and responsibilities to keep in mind. Many countries offering 0% dividend tax require you to either establish residency or obtain citizenship through programs like citizenship-by-investment. These programs can come with hefty price tags, including application fees and minimum investment requirements – often starting at $100,000 or more – along with ongoing compliance obligations.

Even after meeting these qualifications, you might encounter indirect taxes such as value-added tax (VAT), import duties, or consumption levies, which can drive up your overall cost of living. Additionally, maintaining residency may involve specific commitments, like spending a minimum number of days in the country annually, maintaining a local bank account, or proving economic activity in the region. These requirements can bring about added administrative and legal expenses. It’s crucial to consider all these factors when evaluating the real advantages of tax-free dividend income.