February 16, 2015

By: Kelly Diamond, Publisher

There are nearly 74,000 pages in that code. And code it is, because you need attorneys, CPAs, and computer algorithms to decipher it. Ever hear the old adage, “Ignorance of the law is no excuse for breaking it”? Well, if you need a special degree or certification to know it, then perhaps it is a rather viable excuse!

That’s just the federal tax code. We aren’t talking about the state and local levels yet!

While there is a lot of clamoring for tax reform, the reality is, it isn’t likely to come, or at least not in any form that doesn’t make your skin crawl. Many “conservatives” and “libertarian leaning” think tanks advocate for what is called a “Fair Tax” or a “Flat Tax”. Both are certainly an improvement from what we have now, but stand no chance of being passed to replace the codes we have now.

There was a point in time where taxation crossed over from necessary to provide common needs to inconvenient, to oppressive thievery, to downright pathological madness. Very recently, Tom Brady was awarded a truck as MVP after winning the Super Bowl.

“The truck is considered a taxable prize under the Internal Revenue Code, section 74, meaning it is taxed at Brady’s 39.6 federal income tax rate. With the value of a 2015 Chevy Colorado around $34,000, that means a tax bill of $13,500 alone.

“Brady’s also going to have to pay a gift tax of $8,000 to hand the keys to Butler, since the tax code only allows one $14,000 from any one person to another.

“Again, we think Brady can scratch up the $21,500 to make this happen, but it is getting close to the point where rolling into a New England Chevy dealer and just buying Butler a new one might be easier.”

How maddening is that? Tom Brady doesn’t believe he deserve this prize as much as Malcom Butler, so he wants to give it over to him instead for his performance during that game. But the mere fact that it would make more sense for him to buy him his own car than to simply transfer ownership to Butler due strictly to our ridiculous tax code is outrageous, to say the least!

All this news about taxes, however, sounds very desperate. Last week, I discussed how Obama had this “brilliant” idea to impose a one-time tax on offshore earnings at about 14%. Liberals are squawking that’s not enough while conservatives are trying to mitigate the penalties and incentivize bringing the money back to the states.

In addition to that, Obama plans to – brace yourself for the huge shocker – tax the rich some more. The current target is inheritance, estate, and death taxes.

“Raising the capital gains rate, ending the break on inheritances and imposing a fee on financial firms would generate $320 billion in revenue over a decade, according to the administration’s estimates.”

To distract from the obvious money-grab, he wants to extend more tax credits to the middle class for 2nd incomes and childcare.

But the U.S. is broke. It’s not just broke, it’s eyeballs deep in debt. Debt is to the US what depleted uranium is to Fallujah: debilitating for generations to come.

Having sufficiently illustrated my point, then, the time for patience and friendly incentives is over. One of the major differences between the US and many other openly socialist countries is not the laws or even their tax regimes. It’s their bandwidth to actually enforce their laws and regimes. The time for batons and chains is now upon us.

Representative John Katko of New York is a former prosecutor on a mission. He introduced a couple bills that will inject the TSA with steroids in the name of counter terrorism and safety. As Martin Armstrong puts it:

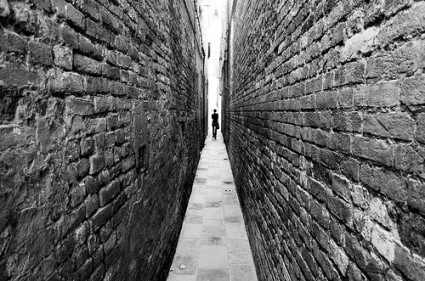

“Katko’s bill will … now result in the arrest of anyone for any alleged crime whatsoever and that will apply to taxes. Katko is constructing a highly dangerous version of the Berlin Wall around all American citizens. He is converting the TSA into a police force less concerned about air safety and focused more on catching anyone the government can argue violates some law federal or state. It is so broad, this would apply to domestic disputes as well.”

Also:

“H.R. 719, the TSA Office of Inspection Accountability Act, ensures that funding is used wisely by TSA. It would require that TSA Criminal Investigators spend at least 50 percent of their time investigating, apprehending, or detaining individuals suspected of committing a crime. Currently, TSA does not necessitate that its Criminal Investigators meet this requirement, despite being considered law enforcement officers and receiving premium pay.”

This is isolation is just more police state enhancements. But it’s not in isolation. Instead it is in conjunction with a lot of other existing laws such as the Patriot Act and NDAA. You take what’s in italics above and combine that with indefinite detention or “all I need to do is SAY terrorism” and you have nothing more than a junta.

It makes sense to think that this is all part of a greater effort to keep not just people OUT of the US… but keep people IN the US. No one gets on or off the plantation. But more importantly, the wealth stays here in the States.

You’re welcome to call me a fear monger. You are also welcome to compliment me on my fine foil hat. But I’m not alone in this take.

A record number of people expatriated last year: 3,415 individuals to be exact. They didn’t just leave, they got a divorce from the US and renounced their citizenship! Anyone who’s ever done taxes for an expat knows their clients’ frustration with the ever metastasizing American tax code. It hardly seems worth it for anyone who doesn’t spend enough time in the US to benefit from what their tax dollars pay for to fork out thousands in time and treasure just to maintain their place on the right side of compliance.

The US is becoming more insular, due in part to policies that isolate us from the rest of the world and vilify us to the rest of the world. We are North Korea with electricity!

Assets aren’t always about wealth. You are your greatest asset, everything else is an extension of that. Your privacy is your second greatest asset, as it affords you the space you need to succeed and gives you an edge over circumstances and competition.

As these little stories come trickling out from dark moldy corners of the ethers, understand they are pieces to a far larger puzzle. Once the puzzle is complete, it’s too late. The sooner you see the picture that’s forming before you and act, the better off you will be.

To schedule a consultation and learn about what your options are for protecting yourself from getting walled in, click here.