Balancing wealth preservation and growth is essential for long-term financial security. While preservation protects your assets from risks like market downturns and inflation, growth focuses on increasing wealth through investments. Striking the right balance depends on your financial goals, risk tolerance, and time horizon.

Key Takeaways:

- Wealth Preservation: Focuses on safeguarding assets using tools like insurance, structuring offshore trusts, and diversified portfolios. It minimizes risks but may limit growth potential.

- Growth Strategies: Aims to expand wealth through investments in stocks, alternative assets, and international opportunities. Offers higher returns but comes with increased risk and complexity.

- Challenges: Cross-border tax obligations, legal compliance, and market volatility require careful planning, especially for expats and high-net-worth individuals.

- Actionable Steps: Regularly review your portfolio, ensure compliance with tax laws, and rebalance investments to maintain the right mix.

Finding the right approach involves aligning strategies with your unique needs, whether you’re protecting wealth, growing it, or both.

1. Wealth Preservation Strategies

Protecting your wealth involves building multiple layers of defense around your assets. A solid starting point is insurance. Umbrella policies provide additional coverage beyond standard home and auto insurance limits, while disability insurance ensures a steady income for high-net-worth individuals. Long-term care (LTC) insurance is another key tool, safeguarding your portfolio against steep medical expenses. This is particularly important since around 60% to 70% of people will need some form of long-term care during their lifetime.

Risk Mitigation

Legal structures offer an added layer of security. For instance, setting up LLCs or LPs for high-risk assets like rental properties can help separate personal wealth from business risks . Irrevocable trusts can also protect inheritances from future creditors or divorce settlements, but timing is everything. As Derek Thain, Vice President at Fidelity‘s Advanced Planning team, advises:

"If you initiate this planning after you think liability is coming your way, it’s likely too late".

Diversification is another powerful risk management strategy. Spreading investments across uncorrelated assets – like stocks, bonds, real estate, and precious metals – reduces exposure to market volatility. To stay disciplined, consider creating a formal Investment Policy Statement (IPS). This document outlines your risk tolerance and establishes rebalancing rules, helping you avoid emotional decisions during turbulent markets. Throughout all these efforts, adhering to legal and tax requirements is critical.

Compliance Requirements

Regular legal and tax reviews are essential to ensure your strategies remain effective. Offshore tools, like foreign trusts, come with strict reporting obligations. For example, U.S. persons must file an FBAR (FinCEN Form 114) if their foreign accounts exceed $10,000 at any point in the year. Additionally, FATCA (Form 8938) applies to specified foreign assets above certain thresholds . Owners of foreign trusts must also submit Forms 3520 and 3520-A, with penalties for noncompliance sometimes exceeding the value of the accounts themselves . Given the complexity of these rules, working with specialized legal and tax professionals who understand both U.S. and offshore regulations is crucial .

Return Potential

Wealth preservation doesn’t mean sacrificing growth. In fact, combining preservation strategies with tax-efficient planning can protect and grow your assets. Tax-advantaged accounts like 401(k)s, IRAs, and HSAs help minimize tax erosion while still generating returns . Strategic Roth IRA conversions during low-income years can also pave the way for tax-free growth over time. Maintaining about 10% liquidity ensures you’re prepared for emergencies without needing to dip into your core investments. This balanced approach safeguards your wealth while still allowing room for growth.

sbb-itb-39d39a6

2. Growth Strategies

Building wealth involves more than just safeguarding what you have – growth strategies are equally important. While preservation focuses on protecting your assets, growth strategies aim to expand them. Over the last decade, alternative investments have surged in popularity. In fact, assets under management in this space nearly tripled, climbing from $7.2 trillion in 2014 to over $20 trillion by late 2024. Today, institutional investors typically allocate 20% to 30% of their portfolios to alternatives, a sharp increase from the single-digit percentages seen in the early 2000s.

Return Potential

Alternative investments, such as private equity, private debt, and venture capital, often benefit from something called the "illiquidity premium." With traditional banks stepping back from leveraged lending, these options can offer higher yields for those willing to commit long-term capital. Additionally, international real estate in countries like Portugal, Panama, and Mexico not only provides a hedge against inflation but also has the potential for appreciation. However, keep in mind that these investments may come with added complexities, such as transfer taxes and reporting requirements.

For high-net-worth individuals – those with portfolios exceeding $2 million – Private Placement Life Insurance (PPLI) can be an attractive option. It combines flexible investment opportunities, tax-deferred growth, and creditor protection, making it a versatile tool for wealth management. Currency diversification is another key strategy. Holding assets in Swiss Francs or gold can act as a safeguard against potential dollar depreciation.

That said, achieving strong returns requires a careful balance of risk and diversification.

Risk Mitigation

With growth strategies, managing risk is just as important as seeking returns. Diversifying across jurisdictions can be an effective way to protect your assets. Regions like Switzerland, the Cook Islands, and Nevis offer legal frameworks that make it harder for creditors to make claims against your wealth. Meanwhile, targeting specific sectors – such as artificial intelligence, decarbonization, and secondary markets – allows investors to tap into niche opportunities without becoming overly exposed to broader market volatility.

Compliance Requirements

Growth strategies often come with a layer of regulatory complexity. Offshore investments, in particular, require strict adherence to U.S. reporting standards. For instance, investors must comply with PFIC rules and file Form 5471 for foreign corporations. Banking minimums also vary by country – Swiss banks typically require at least $1 million, while Austrian private banking starts at $250,000 to $300,000. Because the penalties for noncompliance can be significant, working with a specialist is essential to navigate these requirements effectively.

Advantages and Disadvantages

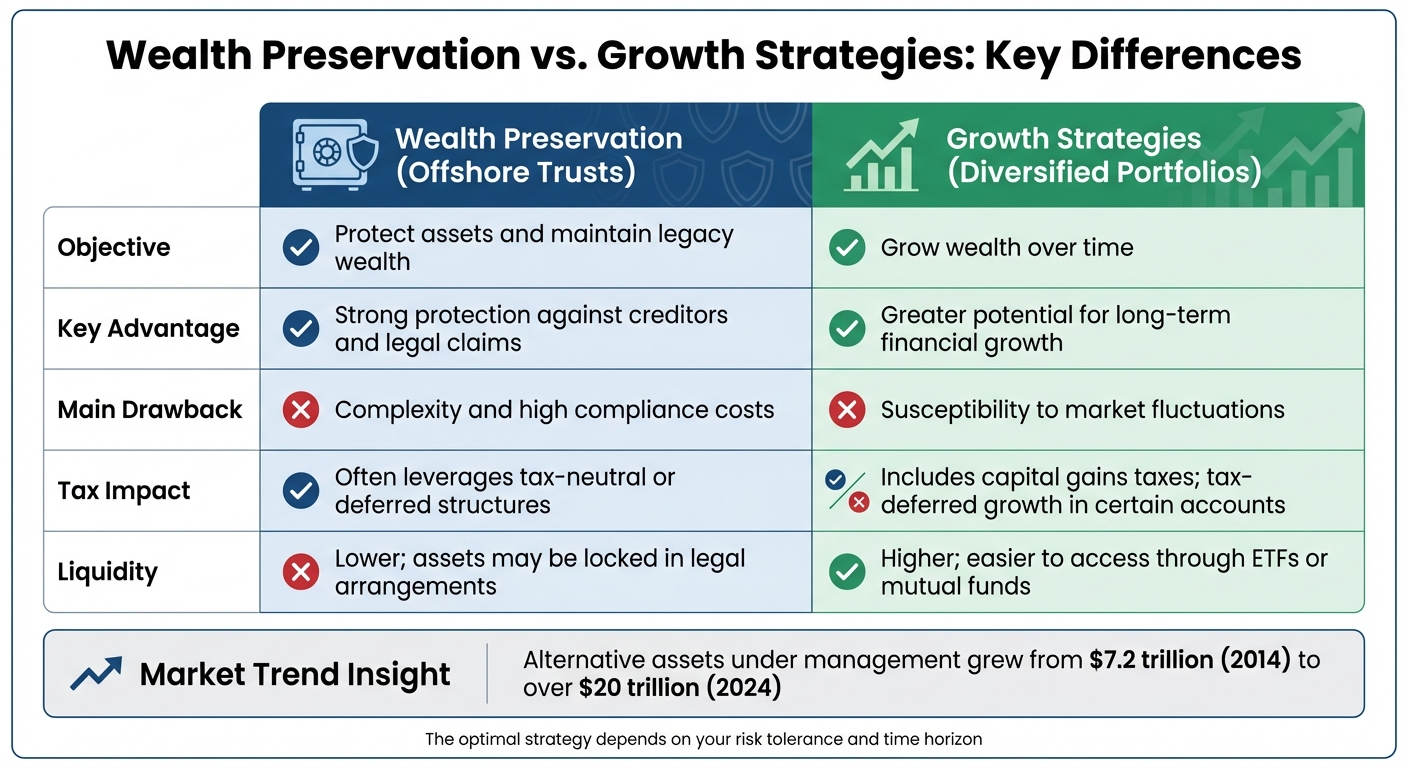

Balancing the decision between protecting existing assets and pursuing wealth growth requires careful consideration of the trade-offs.

Wealth preservation focuses on safeguarding what you already have. Offshore trusts, for instance, offer robust protection against creditors by leveraging international legal frameworks. They also typically provide tax neutrality in jurisdictions like the Cayman Islands or Bermuda, where you’re usually taxed only in your home country. However, these structures are not without challenges. They demand strict compliance with reporting regulations, such as FATCA and CFC rules. Additionally, assets held in these trusts often have limited liquidity, and inflation can gradually diminish their purchasing power.

Growth strategies, on the other hand, aim to increase wealth through capital appreciation. A globally diversified portfolio spreads investments across various asset classes and regions, minimizing the risk of a "single point of failure". For example, alternative assets under management have surged from $7.2 trillion in 2014 to over $20 trillion by 2024. These portfolios generally offer higher liquidity, especially when using ETFs and mutual funds, which are easier to trade. However, they come with their own challenges, such as exposure to market volatility and the potential for capital gains taxes when rebalancing portfolios.

To better understand the distinctions, here’s a comparison of the key features of these two strategies:

| Feature | Wealth Preservation (e.g., Offshore Trusts) | Growth Strategies (e.g., Diversified Portfolios) |

|---|---|---|

| Objective | Protect assets and maintain legacy wealth | Grow wealth over time |

| Key Advantage | Strong protection against creditors and legal claims | Greater potential for long-term financial growth |

| Main Drawback | Complexity and high compliance costs | Susceptibility to market fluctuations |

| Tax Impact | Often leverages tax-neutral or deferred structures | Includes capital gains taxes; tax-deferred growth in certain accounts |

| Liquidity | Lower; assets may be locked in legal arrangements | Higher; easier to access through ETFs or mutual funds |

Ultimately, the choice depends on your financial priorities. If protecting your wealth and reducing legal risks is paramount, tools like offshore trusts can be effective. On the other hand, if you’re focused on growing your assets over the long term, diversified portfolios provide opportunities for higher returns, albeit with some exposure to market ups and downs.

Conclusion

Wealth preservation is about safeguarding what you’ve earned, while growth focuses on increasing your assets. Preservation shields your wealth from market downturns, taxes, and legal risks, whereas growth relies on investments and capital appreciation to expand your portfolio. Striking the right balance between these strategies depends on your unique circumstances, particularly your risk tolerance and time horizon.

Your risk tolerance plays a major role in shaping your asset allocation. Studies reveal that up to 90% of a fund’s return variability comes from how you divide your assets, rather than the specific stocks or bonds you choose. If you’re comfortable with market fluctuations and have many years before retirement, leaning heavily toward growth assets can make sense. For instance, missing just the five best market days over a 35-year period (1988–2023) could reduce a portfolio’s value by 37%.

Your time horizon is perhaps the most critical factor in determining your strategy. If you’ll need funds within the next few years – say, for a down payment or a business venture – preservation-focused tools like bonds and cash reserves are key. However, for long-term goals, such as retirement 20 or 30 years away, growth assets are essential to outpace inflation and address longevity risks. Consider this: about one in three 65-year-olds today will live to at least age 90. Even retirees benefit from equity exposure, with the average IRA maintaining around 46% in stocks for this reason.

To put these strategies into action, annual rebalancing is crucial to ensure your portfolio doesn’t drift too far in either direction. Tax-advantaged accounts, like Roth IRAs, can help shield your gains, while tools like umbrella liability and long-term care insurance protect against non-investment risks. For high-net-worth individuals, estate planning becomes especially urgent as the Tax Cuts and Jobs Act provisions are set to expire in 2026, reducing lifetime gift tax exemptions from $13.99 million to about $7 million. This makes 2025 a pivotal year for taking action.

Ultimately, your portfolio should reflect both your current needs and your long-term goals, with adjustments made as circumstances evolve.

FAQs

How can I find the right balance between protecting my wealth and growing it?

Finding the right mix between preserving your wealth and achieving growth starts by clearly defining your financial goals, understanding how much risk you’re comfortable with, and considering your investment timeline. Crafting an asset allocation strategy that reflects these factors is key. For example, investments like bonds or cash equivalents can add stability to your portfolio, while stocks or alternative options might bring greater growth opportunities.

To keep this balance intact, it’s important to revisit and adjust your portfolio regularly, especially as market trends shift or your personal circumstances change. Spreading your investments across different asset types, regions, and vehicles – such as offshore trusts or global portfolios – can help manage risk while aiming for steady growth. Working with a financial expert can also offer personalized advice tailored to your specific needs.

What are the advantages and risks of using alternative investments to grow your wealth?

Alternative investments like private equity, real estate, and cryptocurrencies can bring stronger returns and add diversity to your portfolio beyond traditional stocks and bonds. These types of assets often open doors to global markets and can serve as a buffer against inflation, making them attractive for those aiming for long-term wealth growth.

That said, they aren’t without challenges. Many alternative investments are less liquid, meaning converting them to cash quickly can be tough. They also tend to carry higher volatility, come with complex tax and legal implications, and present a greater risk of losing capital. To make the most of these opportunities while managing the risks, it’s important to ensure they align with your personal risk tolerance and long-term financial objectives.

How can I stay compliant with U.S. tax and legal requirements when using offshore strategies?

To stay within U.S. tax and legal boundaries while using offshore strategies, it’s essential to understand and adhere to the rules surrounding foreign assets and reporting. If you’re a U.S. citizen or resident, you’re required to disclose foreign accounts and assets by filing forms like the Foreign Bank and Financial Accounts Report (FBAR) and complying with the Foreign Account Tax Compliance Act (FATCA). Failing to meet these requirements could result in hefty penalties or even legal trouble.

When setting up offshore tools such as foreign trusts, LLCs, or bank accounts, transparency and proper documentation are non-negotiable. These measures help prevent accusations of tax evasion or fraudulent activity. Partnering with experienced legal and tax professionals is a smart move – they can guide you through the intricate regulations and ensure your strategies align with both U.S. and international laws.

Ultimately, compliance comes down to accurate reporting, detailed legal reviews, and collaborating with experts to build a plan that safeguards your wealth while meeting all legal requirements.