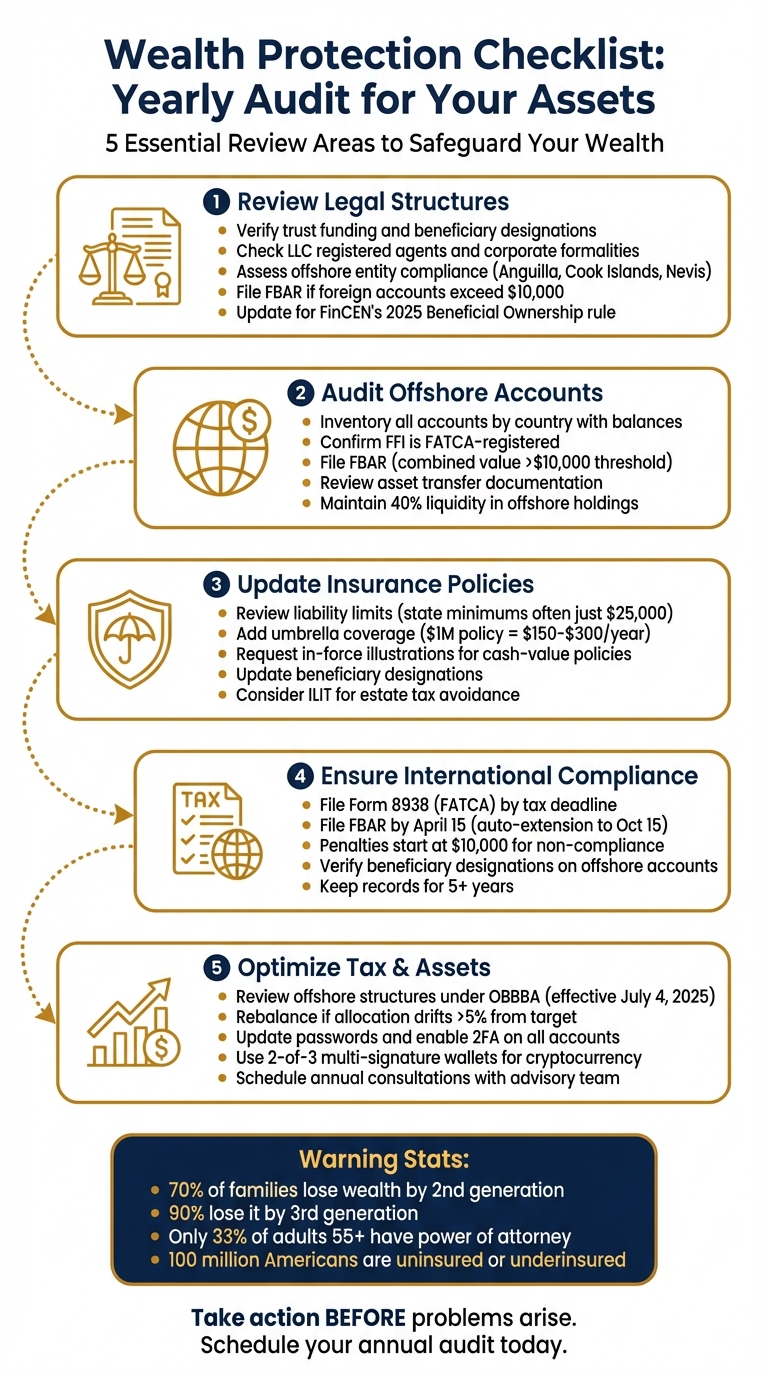

Protecting your wealth requires regular check-ins, especially with changing laws and personal circumstances. The Bill Act of 2025 significantly lowered the federal estate tax exemption, making annual reviews more important than ever. Here’s what you need to focus on:

- Legal Structures: Ensure trusts, LLCs, and offshore entities comply with current laws. Verify trust funding, update beneficiary designations, and maintain proper documentation for LLCs.

- Offshore Accounts: File required forms like FBAR and FATCA, confirm compliance with global reporting standards, and maintain liquidity for unforeseen costs.

- Insurance Policies: Check liability limits, umbrella coverage, and life insurance policies. Consider updating for life changes or adding specialized coverage.

- Tax Efficiency: Review offshore structures, avoid penalties, and ensure compliance with new tax rules like the OBBBA.

- Portfolio & Digital Assets: Rebalance investments, secure cryptocurrency with multi-signature wallets, and update passwords.

Review and Update Legal Structures

Legal structures like trusts, LLCs, and offshore entities aren’t static – they need regular reviews to stay effective. Laws and tax regulations evolve, meaning strategies that worked in the past could now be outdated. A yearly audit ensures your structures still meet your goals and comply with current rules. Here’s how to keep everything aligned.

Verify Trusts and Foundations

Start by reviewing your trust documents. Are the beneficiary designations and funding still accurate? A common oversight is setting up a trust but failing to transfer assets into it, which essentially renders it useless.

Next, consider the tax implications, especially if you have foreign trusts. Determine whether they’re classified as grantor trusts (income reported on your tax return) or non-grantor trusts. If you have a foreign trust, you’ll need to file specific forms: Form 3520 for distributions or gifts, Form 3520-A as an annual information return, and Form 8938 for specified foreign financial assets.

If your trust is more than five years old, check whether your successor trustee is still willing and able to serve. Circumstances change, and it’s crucial to ensure this key role is covered.

Check LLCs and Registered Agents

Every LLC must have a registered agent with a physical address in the state where it was formed. This agent is responsible for receiving legal and tax documents, so confirm that your registered agent service is active and that their contact information is up to date. Missing key notices because of outdated info can lead to serious issues.

Also, make sure your LLC is tied to the correct jurisdiction. For example, if you own real estate, the LLC should be formed in the state where the property is located. This avoids potential conflicts in court rulings.

"Privacy ≠ protection. Real defense comes from jurisdiction-matched LLCs." – Bradley Legal Corp

Lastly, maintain corporate formalities to protect yourself from personal liability. This includes keeping annual minutes, ensuring ownership certificates are aligned, and using separate bank accounts for business transactions. Courts can "pierce the corporate veil" if these formalities aren’t observed, leaving you personally liable for business debts.

Assess Offshore Entity Compliance

If you own offshore companies in places like Anguilla, the Cook Islands, or Nevis, ensure they meet the latest regulatory standards. These jurisdictions are often chosen for their high burden of proof for claimants and shorter statutes of limitations on fraudulent transfers.

Don’t forget to file your FBAR (FinCEN Form 114) if the total value of your foreign financial accounts exceeds $10,000 at any point during the year. Also, keep in mind FinCEN‘s 2025 Beneficial Ownership rule, which requires true-owner disclosure. This rule significantly limits anonymity through layered or nominee ownership.

Lastly, confirm that your offshore structure remains tax-neutral. Hybrid setups like Bridge Trusts are designed to simplify IRS reporting (as grantor trusts under IRC §§ 671–677) while still offering flexibility to shift assets offshore if legal threats arise.

Once your legal structures are verified, the next step is to audit your offshore accounts and holdings to wrap up your review.

sbb-itb-39d39a6

Audit Offshore Accounts and Holdings

Once your legal structures are verified, the next step is to carefully audit your offshore accounts and holdings. This process ensures accuracy and compliance while helping you spot potential issues early.

Examine Offshore Bank Accounts

Start by compiling a detailed inventory of all offshore accounts, organized by country. Include critical details such as the legal owner, account numbers, bank contacts, and current balances. For accurate reporting, convert foreign balances into U.S. dollars using the Treasury Bureau of the Fiscal Service‘s year-end exchange rate.

It’s also essential to confirm that your Foreign Financial Institution (FFI) is registered under FATCA. Many banks now report account information directly to the IRS to avoid a 30% withholding tax on U.S.-source payments. Beyond standard bank accounts, make sure to review brokerage accounts, foreign pensions, life insurance policies with cash value, and any ownership stakes in foreign entities.

Keep in mind that the $10,000 FBAR threshold applies to the combined value of all foreign accounts. For example, if you have three accounts with $4,000 each, the total of $12,000 triggers a filing requirement. Penalties for failing to file start at $10,000, with more severe violations potentially resulting in fines and up to five years in prison.

Review Asset Transfers

Ensure that all asset transfers are properly documented. One common mistake is neglecting to update ownership records after transferring funds, which can weaken your asset protection plans.

Additionally, verify that beneficiary designations comply with local laws. For transfers exceeding reporting thresholds, don’t forget to update Form 3520 filings.

Monitor Liquidity and Cash Reserves

Evaluate the liquidity of your offshore holdings. A good guideline is to keep at least 40% of these assets in liquid form. This helps you manage financial risks and cover unexpected costs, such as foreign probate fees, local taxes, or administrative expenses.

"Failure to secure liquidity to pay foreign probate fees is one of the most common causes of delayed estate settlement." – FinHelp

Make sure you also maintain adequate domestic operating capital to handle immediate needs like legal fees or settlements. Review your liquidity annually or after major life changes to ensure your reserves align with current residency and tax regulations.

Update Insurance Policies and Coverage

Keeping your insurance policies aligned with your growing assets is essential. Right now, around 100 million Americans are either uninsured or underinsured, often because they haven’t updated their coverage to match their financial situation. As your net worth increases, standard policies may no longer provide adequate protection. Start by reviewing your liability and umbrella insurance to ensure you’re covered where it matters most.

Evaluate Liability and Umbrella Insurance

Basic home and auto insurance policies often come with low liability limits. For example, in many states, the minimum auto insurance coverage for bodily injury is just $25,000 or less. If you have a high net worth, this could leave your assets vulnerable in the event of a lawsuit.

This is where umbrella insurance steps in. It adds an extra layer of protection beyond your home and auto policies. A $1 million umbrella policy typically costs between $150 and $300 annually, with each additional $1 million adding about $50 to $75 per year. It’s a relatively inexpensive way to safeguard your assets.

If you serve on boards or work in fields like medicine, accounting, or engineering, consider specialized coverage like Directors and Officers (D&O) or professional liability insurance. These policies help protect your personal assets from risks tied to your profession.

Assess Long-Term Care and Disability Policies

Life changes often mean your insurance needs to change too. If you have a cash-value life insurance policy, request an in-force illustration from your provider to check if it’s performing as expected, especially in fluctuating interest rate environments. For instance, low interest rates can impact the policy’s growth.

Make sure your beneficiary designations are current. These designations take precedence over wills or trusts, so events like divorce, remarriage, or the birth of a child require immediate updates to avoid unintended outcomes.

"If you don’t update your insurance alongside [a significant life event], you may have coverage you don’t need or new gaps that aren’t insured." – Miguel Rosas, AVP, Senior Wealth Planner, Comerica Wealth Management

For estate planning, think about whether your life insurance policy should be held in an Irrevocable Life Insurance Trust (ILIT). Policies owned individually are included in your taxable estate, but those held in an ILIT may avoid estate taxes altogether.

Stress-Test Insurance Coverage

Once you’ve ensured your basic coverage is in place, it’s time to stress-test your policies to confirm they can handle extreme situations. For cash-value life insurance, evaluate how it holds up during market fluctuations. For homeowners insurance, ensure your coverage is based on per-square-foot replacement cost rather than the appraised market value. This ensures you can rebuild your home entirely after a loss.

Check whether your policy provides "true replacement value" or "actual cash value." The latter might not cover the full cost of replacing items at today’s prices. Also, update your policies to reflect any recent renovations or high-value purchases.

Lastly, keep in mind that the FDIC insures bank deposits up to $250,000 per depositor, per bank, per ownership category, while the SIPC covers up to $500,000 for cash and securities in brokerage accounts. If your assets exceed these limits, you’ll need additional coverage strategies to protect your holdings effectively.

Ensure Compliance with International Laws

Keeping up with international tax laws is a critical part of protecting your wealth. With updated legal frameworks and increased audits of offshore accounts, it’s essential to meet all reporting requirements to avoid costly penalties. For instance, Foreign Financial Institutions (FFIs) now report U.S. account holder information directly to the IRS. This allows the IRS to cross-check your filings against institutional data, making compliance even more important. Failing to file required forms can lead to penalties starting at $10,000 and climbing to $50,000 for continued non-compliance. Once reporting is squared away, take time to review and update your beneficiary designations.

Review FATCA and CRS Reporting

If you hold offshore accounts, two key forms come into play: Form 8938 (FATCA) and FinCEN Form 114 (FBAR). The FBAR filing requirement kicks in if the total value of your foreign accounts exceeds $10,000 at any point during the year. Meanwhile, Form 8938 has different thresholds depending on your residency and filing status. For unmarried U.S. residents, the thresholds are $50,000 at year-end or $75,000 at any time during the year. For those living abroad, the limits rise to $200,000 and $300,000, respectively.

Reportable assets include foreign bank accounts, stocks, interests in foreign entities, and even foreign-issued life insurance policies with cash value. When converting foreign currency, use the Treasury’s official year-end exchange rate. Form 8938 should be submitted with your annual tax return (Form 1040) by the tax deadline, while the FBAR must be filed separately through the BSA E-Filing System by April 15, with an automatic extension to October 15.

Non-compliance can have serious consequences. FBAR violations may result in fines and even prison sentences of up to five years. Additionally, failing to report a foreign asset – or omitting more than $5,000 in related income – can extend the IRS statute of limitations to six years, giving the agency more time to audit your filings. A 40% penalty may also apply to any tax understatement tied to undisclosed foreign assets.

Audit Beneficiary Designations

Once you’ve ensured compliance with reporting rules, take a moment to verify and update your beneficiary records. This includes checking all offshore accounts, trusts, and digital assets to confirm the listed information is accurate. For trusts, a domestic trust counts as a "specified domestic entity" if it names one or more U.S. citizens or resident aliens as beneficiaries. If you have a beneficial interest in a foreign trust or estate – such as receiving distributions – you are required to report it.

To further safeguard compliance, use the IRS FFI List search tool to confirm that any foreign institutions holding your assets have a valid Global Intermediary Identification Number (GIIN). Keep detailed records for at least five years, including account names, numbers, bank addresses, and maximum annual values. If you’ve recently discovered unfulfilled filing obligations, the IRS offers streamlined filing compliance procedures, which can help you catch up without incurring standard penalties.

Optimize Tax Structures

Take a close look at your offshore structures to ensure they align with the tax guidelines introduced under the OBBBA, effective July 4, 2025. This legislation provides a stable framework for long-term planning, making tax efficiency just as critical as legal and compliance reviews when it comes to safeguarding your wealth.

Start by reviewing your asset classifications. Offshore assets classified as PFICs or CFCs can lead to unfavorable tax treatment and significant reporting obligations. Make sure your offshore trusts and companies comply with "substance over form" requirements, and keep detailed records proving their legitimate business purposes.

As Eric L. Johnson from Deloitte Tax LLP puts it:

"In uncertain times, clarity is more than a comfort – it’s your most powerful advantage."

Use multi-year financial models and maintain a detailed inventory of offshore assets. This should include legal ownership details, title documents, and contact information for local banks and trustees. Annual coordination with estate and tax lawyers in each jurisdiction is crucial since strategies that work in one country might not be effective – or even legal – in another.

Evaluate Tax Efficiency of Offshore Entities

Understand how the OBBBA impacts your offshore entities. Check whether they are optimized under provisions like the permanent excess business loss limitation and immediate expensing for domestic research and experimental costs.

Ensure private annuities and loans to family members or trusts adhere to the current IRS Applicable Federal Rate (AFR) for proper tax treatment. Stay updated on your jurisdiction’s Tax Information Exchange Agreements (TIEAs) and beneficial ownership registries, as global transparency standards are constantly evolving. Firms like PwC, which operate in over 150 jurisdictions, can help navigate these complexities for families with international assets.

Plan ahead for liquidity needs. Set aside cash reserves or consider life insurance to cover local taxes and administrative costs, avoiding the need to sell location-specific assets under pressure. Additionally, document the business purpose for all offshore structures and retain these records for at least five years.

Assess Relocation and Residency Plans

If relocation is on your radar, it’s essential to understand the distinction between domicile and residence. Domicile refers to the place you consider your permanent home, which often determines succession and inheritance tax rules. Residence, on the other hand, is where you physically live.

For U.S. citizens and resident aliens, worldwide income is taxable regardless of where you reside. Full expatriation comes with its own set of challenges, including an exit tax if your net worth exceeds $2 million or your average annual income tax over the last five years surpasses $206,000. The exit tax applies to gains over $890,000 and eliminates access to the $13.9 million lifetime gift and estate tax exclusion.

Review tax treaties between your current and intended jurisdictions to identify options for double-taxation relief. These considerations play a key role in shaping your relocation strategy, ensuring it supports your broader asset protection goals. Additionally, evaluate how your life and health insurance policies will function internationally, and consider the quality of medical care in your target location. Collaborate with local attorneys in the destination country and U.S. advisors experienced in international tax and compliance.

As Suzanne L. Shier, Partner at Levenfeld Pearlstein, LLC, explains:

"Full expatriation represents the most extreme option – relinquishing U.S. citizenship entirely, typically accompanied by permanent relocation and no intention of returning to live in the United States."

Morgan Stanley‘s 2023 report projects a 40% rise in high-net-worth individuals with cross-border assets by 2025. If you’re part of this growing group, formally determine your domicile status, especially if you maintain connections to multiple countries. This decision directly affects your tax residence and inheritance laws. Aligning your residency plans with your tax strategy is just as important as reviewing your legal and compliance structures to secure your wealth effectively.

Review Portfolio and Digital Assets

Think of portfolio and digital asset reviews as the financial equivalent of routine check-ups – they help shield your investments from market shifts and operational hiccups. Once you’ve wrapped up legal and financial audits, it’s time to ensure your investments are balanced and secure.

Start by checking if your asset allocation has drifted more than 5% from its target mix. Pay attention to where your money is parked. For instance, while U.S. equities held steady in 2025, institutional investors are eyeing a shift for 2026, leaning toward non-U.S. developed and emerging markets instead of large-cap U.S. equities. Also, watch out for overloading on tech giants like Nvidia, Apple, Microsoft, Alphabet, and others. Even with their recent gains, high valuations could pose risks. To diversify, consider alternative investments like hedge funds, private credit, or CLO equity, which might help balance out lower returns from traditional portfolios.

Analyze Asset Allocation

Take a close look at your risk tolerance to ensure your portfolio matches both your financial goals and your comfort with potential losses, especially after recent market swings. If you have excess cash beyond six months of expenses, think about investing it gradually using dollar-cost averaging. As State Street Global Advisors points out:

"Too much cash can actually erode your wealth thanks to inflation. Plus, you could miss out on the long-term benefits of compounding".

Use the fall months – October or November – to review your portfolio for underperforming positions that could be sold to offset capital gains. Just keep the 30-day Wash-Sale Rule in mind. Business owners should also account for the permanent limitation on excess business losses under Section 461(l) when crafting their 2026 strategy. If your account balances are lower, it might be a good time to convert traditional IRAs to Roth IRAs, potentially reducing the tax burden of conversion.

Secure Digital Assets

Once your physical investments are in order, turn your attention to safeguarding your digital assets. These require extra care since operational mistakes are often the root cause of losses.

Start by updating all financial passwords and enabling app-based two-factor authentication (2FA) or using hardware security keys for all accounts. Assign a digital executor to manage your accounts in case you’re unable to.

For cryptocurrency, consider a 2-of-3 multi-signature wallet setup. This splits keys between you, an independent trustee, and a technical custodian, ensuring no single party can move assets independently. Store seed phrases on metal cards instead of paper and keep them in secure, fireproof locations. As asset protection attorney Gideon Alper explains:

"If you personally hold the keys or can move coins with your own authority, a judge can compel a transfer or hold you in contempt".

Use exchanges strictly for trading and move your crypto to cold storage for long-term security. Add another layer of safety by enabling address whitelisting to restrict withdrawals to pre-approved wallets. Test-restore your wallets quarterly on a clean, offline device to make sure your backups work as intended. Document clear instructions for your executor on accessing these assets. For an added layer of protection, consider placing digital assets in an offshore trust. This creates a jurisdictional hurdle, making it harder for domestic courts to compel asset surrender.

Finalize and Document Changes

After reviewing your legal structures, offshore accounts, and insurance policies, the next step is to document everything. Proper documentation is key to securing your asset protection strategy for the coming year. It helps you avoid compliance issues and ensures your team has a clear roadmap to follow.

Cross-Check Documentation

Start by organizing and verifying all relevant documents. This includes updated title deeds, bank statements, insurance policies, business registrations, LLC agreements, trust documents, and jurisdiction-specific registration numbers. Double-check that asset titles have been transferred to trusts to prevent probate complications.

If your Durable Power of Attorney is more than five years old, renew it – many financial institutions prefer more recent versions. For those with assets in multiple countries, work with local counsel to ensure your primary will doesn’t accidentally revoke foreign "situs" wills. Additionally, make sure international filings, such as FBAR or Form 3520-A, are up to date.

Store digital copies of documents, passwords, and legal instructions in a secure digital vault. This ensures your executor can access everything easily when the time comes. Once all documents are reviewed and organized, you’ll be better prepared for consultations with your advisory team.

Schedule Consultations

Set up meetings with your estate attorney, local counsel in key jurisdictions, and a tax advisor. Aim to schedule these consultations annually or after major life events like moving, marriage, divorce, or acquiring new properties.

It’s important to remember that asset protection strategies must be in place before any creditor claims or lawsuits arise. As Lenox Advisors explains:

"Asset protection strategies only protect you against unanticipated creditor claims that arise in the future. You can’t use them to avoid liability for existing or reasonably foreseeable claims".

These sessions are an opportunity to stress-test your asset protection structures. Discuss whether revocable trusts should be converted to irrevocable ones for enhanced creditor protection, and confirm your legal domicile status if you’ve lived in multiple countries. Also, plan for liquidity needs – set aside cash reserves or life insurance to cover foreign probate fees and inheritance taxes so you won’t need to sell assets unexpectedly.

Conclusion

Safeguarding your wealth requires setting up strong structures and conducting annual maintenance audits. These yearly reviews help ensure your trusts are funded correctly, your insurance policies provide the right level of protection, and your offshore accounts comply with FBAR and FATCA regulations. Skipping these reviews can leave assets vulnerable to probate, creditor claims, or hefty penalties.

The numbers are eye-opening: 70% of families lose their wealth by the second generation, and 90% by the third. The primary culprits? Poor planning and lack of communication. Additionally, only 33% of adults aged 55 and older have a power of attorney in place. These figures highlight the importance of a consistent, repeatable audit process – not just to preserve wealth but to ensure it’s passed on securely.

As discussed earlier, it’s crucial to review and update asset titles and key documents regularly. This keeps your asset protection strategy aligned with your current situation and ensures all critical assets remain well-structured.

Proactive action is essential in asset protection. As Offshore Pro emphasizes:

"The key to protecting your assets is taking action before a problem arises. If you delay asset protection planning, you can become vulnerable to lawsuits, creditors, and financial instability".

Waiting too long can leave you exposed to unnecessary risks.

To strengthen your protection, bring together a reliable advisory team. This should include an estate attorney, local counsel for jurisdictions where you hold assets, and a tax advisor with expertise in cross-border treaties. Schedule annual consultations to test your structures, address regulatory updates, and adjust for changes in your life. Taking these steps now ensures your wealth remains secure, private, and ready for the future.

FAQs

How will the Bill Act of 2025 affect my estate planning?

The Bill Act of 2025 brings some noteworthy changes that may reshape your estate planning approach. One of the most impactful updates is the permanent increase in the federal estate, gift, and generation-skipping transfer (GST) tax exemptions. Starting in 2026, individuals will benefit from an exemption of $15 million per person, significantly reducing federal transfer tax liabilities for many families. However, it’s worth noting that state-level estate taxes could still apply, so those should remain part of your planning considerations.

The Act also addresses other important areas:

- SALT deduction cap revisions: These adjustments could affect how much state and local tax you can deduct.

- Expanded benefits for Qualified Small Business Stock (QSBS): This could be a game-changer for those investing in small businesses.

- Stricter reporting requirements for offshore accounts and foreign assets: Compliance with laws such as FATCA and FBAR becomes even more critical under these new rules.

Given these updates, it’s a good time to revisit your trusts, legal structures, and overall compliance with U.S. regulations. Ensuring your strategies align with the new rules will help maintain their effectiveness and protect your assets.

The Bill Act of 2025 introduces both opportunities and challenges for estate planning. Adjusting your approach to fit these changes can help you stay ahead and optimize your financial strategies.

How can I make sure my offshore accounts comply with U.S. regulations?

To keep your offshore accounts in line with U.S. regulations, it’s essential to understand and fulfill critical reporting obligations like the Foreign Bank and Financial Accounts Report (FBAR) and the Foreign Account Tax Compliance Act (FATCA). This means filing required forms, such as the FBAR and Form 8938, to report foreign financial assets. Staying informed about updates to tax laws is key to avoiding costly penalties.

Consider working with experienced legal and tax professionals to establish compliant structures, such as offshore trusts or LLCs, while ensuring proper documentation is maintained. Regularly reviewing your accounts can help confirm that all transactions are transparent and accurately recorded. Keeping detailed records is especially important if you face audits or investigations.

Finally, make sure your offshore banking activities align with both U.S. laws and international standards, including FATCA and the Common Reporting Standard (CRS). Consulting with experts in international compliance can offer valuable insights, helping you protect your assets while staying within legal limits.

What steps can I take to ensure my insurance coverage protects my assets effectively?

To make sure your insurance coverage offers the protection your assets need, it’s a good idea to review your policies every year. This helps ensure they align with your current financial situation and goals. If you’re a high-net-worth individual, focusing on life insurance, long-term care policies, and liability coverage is especially important. These types of coverage can provide a safety net against unexpected events. Adding an umbrella policy is another smart move, as it gives you extra liability protection beyond the limits of your standard policies.

You might also want to integrate your insurance plan with legal structures like trusts or LLCs, which can act as a shield for your assets against lawsuits or creditors. Keeping estate planning documents, such as wills and trusts, up to date is equally important to ensure your strategies stay relevant. Working with seasoned financial or legal professionals can help you spot any gaps in your coverage and recommend personalized adjustments to better protect your wealth.