Protecting your wealth is just as important as building it. High-net-worth individuals face risks like lawsuits, market downturns, and tax law changes that can quickly erode financial stability. Here’s what you need to know:

- Lawsuits: Legal claims, divorce, or negligence can target personal assets. Use tools like umbrella insurance, LLCs, and irrevocable trusts to shield wealth.

- Economic Risks: Concentration in a single asset or lack of liquidity can amplify losses during downturns. Diversify investments, maintain cash reserves, and rebalance portfolios.

- Tax Changes: Shifting tax laws can impact estates and capital gains. Strategies like Roth conversions, GRATs, and compliance with FATCA/CRS can mitigate risks.

- Offshore Trusts: Jurisdictions like Nevis or the Cook Islands offer robust legal protection, making it harder for creditors to access assets.

- International Business Structures: Offshore LLCs and companies provide privacy and legal separation, enhancing asset security through offshore protection.

Taking action early is crucial. Establish structures like offshore trusts or LLCs before legal issues arise, and ensure full compliance with reporting requirements to maintain protection. Start planning now to safeguard your financial legacy.

Main Risks That Threaten Your Wealth

Safeguarding your wealth begins with identifying the risks that could jeopardize it. For high-net-worth individuals, these risks generally fall into three categories: legal threats, economic instability, and regulatory changes. Each poses unique challenges and demands specific strategies to mitigate potential damage.

Lawsuits and Legal Threats

In the U.S., where lawsuits are common, wealthy individuals often find themselves in the legal crosshairs. Professional liability is a significant concern for professionals like doctors, lawyers, and accountants, who may face malpractice claims that exceed their insurance limits. Business owners are vulnerable to "piercing the corporate veil", where personal assets can be seized to settle business debts or damages, including claims related to employment disputes like wrongful termination or harassment.

Personal negligence claims also pose a substantial risk. For instance, car accidents or injuries on your property can lead to lawsuits targeting your assets. Marital risks, such as divorce, alimony, and child support, can further threaten your financial stability, potentially forcing the sale of valuable assets like family heirlooms or real estate.

The financial consequences of legal judgments can be severe. Bank accounts may be garnished, tangible assets like gold or jewelry liquidated, and equity in properties lost. While Traditional and Roth IRAs provide some protection, their coverage is capped – $1 million for bankruptcy cases, with SEP IRAs limited to $1,512,350, adjusted every three years.

A multi-layered approach offers the best defense. Umbrella insurance provides a cost-effective first line of protection, with $1 million in coverage typically costing $150 to $300 annually. Beyond insurance, legal structures like LLCs for business assets and irrevocable trusts for personal wealth add an extra layer of security. However, these measures must be established proactively, as transfers made after a legal threat arises could be deemed fraudulent.

While legal risks are one piece of the puzzle, economic downturns can equally undermine your financial stability.

Economic Downturns and Market Volatility

Economic recessions, which average about 10 months, can have long-term effects on your portfolio. Declining markets reduce the value of investments and business assets, while inflation chips away at purchasing power, even when markets seem stable.

One major risk is concentration risk – holding too much of your wealth in a single stock or industry. This leaves you vulnerable to sudden technological shifts or unforeseen events that can wipe out value. Alarmingly, 70% of affluent families lose their wealth by the second generation, and 90% by the third, often due to poor diversification and the need to sell assets during downturns.

Liquidity issues can exacerbate these challenges. Without sufficient cash reserves, you might have to sell investments at depressed prices to cover expenses. Insurance limits, such as $250,000 per depositor per bank for FDIC coverage and $500,000 per brokerage for SIPC protection, may offer little reassurance during economic crises.

"Diversification is the antidote to putting too much into one investment vehicle." – Brian G. Bissell, Senior Vice President, Whittier Trust

To prepare, ensure you have at least six months of household or business expenses in liquid cash or short-term Treasuries. Use strategies like options collars to limit downside risk on concentrated equity positions and bond laddering to spread maturities and manage interest rate exposure. Tax-loss harvesting during market downturns can offset capital gains, while regular portfolio rebalancing helps maintain a disciplined approach to risk management.

Economic risks are compounded by the ever-changing landscape of tax laws and regulations, which demand constant vigilance.

Tax Law and Regulatory Changes

Tax laws are in a constant state of flux, and even small changes can have a big impact on your financial plans. For example, the One Big Beautiful Bill Act (OBBBA), enacted on July 4, 2025, made the limitation on excess business losses under Section 461(l) permanent. Federal estate taxes can claim up to 40% of an estate’s value as of 2025, while capital gains taxes on appreciated assets can reach 20%.

The potential expiration of provisions from the Tax Cuts and Jobs Act (TCJA) adds uncertainty, while the SECURE 2.0 Act has pushed Required Minimum Distribution (RMD) ages to 73, with possible increases to 75. For 2024, the total contribution limit for 401(k) plans, including employer matches and after-tax contributions, is $69,000.

Meanwhile, global transparency requirements have tightened significantly. The OECD Common Reporting Standard (CRS) and FATCA require U.S. taxpayers with foreign financial interests to meet strict reporting standards. Many jurisdictions that once offered financial secrecy now participate in automatic information exchanges and maintain registries of beneficial ownership. U.S. taxpayers remain subject to worldwide taxation, and failing to comply with FBAR or FATCA can result in severe penalties.

Proactive planning is key to navigating these changes. Tools like Grantor Retained Annuity Trusts (GRATs) and Charitable Lead Trusts (CLTs) help transfer asset growth to future generations. Roth conversions during years of lower income allow you to lock in current tax rates before potential hikes. Compliance with FinCEN Form 114 (FBAR) and IRS Form 8938 (FATCA) is essential for foreign financial interests. Additionally, Private Placement Life Insurance (PPLI) can shelter investments, allowing them to grow tax-deferred and potentially be accessed tax-free.

Using Offshore Trusts to Protect Assets

Offshore trusts create a legal shield that separates your assets from potential creditors by transferring control to a trustee in another country. This separation means that even if a U.S. court rules against you, the foreign trustee is not bound by that decision. This setup introduces a unique layer of protection, making it worth diving deeper into how offshore trusts operate.

How Offshore Trusts Function

Here’s the basic idea: a foreign entity owns your assets, an independent trustee manages them, and foreign laws govern everything. If a creditor secures a judgment against you in the U.S., they can’t enforce it offshore without starting a new legal battle in the foreign jurisdiction. This process involves hiring local attorneys, paying steep fees, and navigating a completely different legal system.

"An offshore asset protection trust prevents a judge in your jurisdiction from ordering that the trustee release funds within the trust to a creditor." – White and Bright, LLP

The barriers are substantial. Many offshore jurisdictions require creditors to prove fraudulent transfers to a much higher standard, like "beyond a reasonable doubt", and impose short statutes of limitation – often just a year or two. For example, in St. Kitts and Nevis, a plaintiff must pay a $100,000 bond to the Ministry of Finance before filing a claim against a trust. These hurdles make pursuing offshore assets a costly and time-consuming gamble for creditors.

To be effective, the trust must be irrevocable, meaning you can’t easily change it after funding. The trustee must have full control over the assets, which means you give up direct access in exchange for protection. Distributions are made at the trustee’s discretion, based on the trust’s established terms. These legal safeguards are a critical part of a broader asset protection strategy for family offices.

Why Anguilla Works Well for Offshore Trusts

Anguilla stands out as a strong option for offshore trusts, thanks to its International Trust Act of 2007. This British Overseas Territory, governed by Common Law, offers tax neutrality – no local income or capital gains taxes – and a politically stable environment with a solid reputation. Licensed agents regulated by the Anguilla Financial Services Commission (AFSC) ensure proper oversight and compliance.

Anguilla’s privacy laws are another advantage, with closed shareholder registers that make it difficult for creditors to trace trust assets or identify beneficiaries. The jurisdiction also refuses to recognize U.S. civil judgments, forcing creditors to start fresh under Anguillan law. Add to this the need for local legal representation and in-person appearances at hearings, and the obstacles for creditors become even more daunting.

Steps to Establish an Offshore Trust

Start by choosing a jurisdiction with strong asset protection laws, political stability, and a trustworthy legal framework. If Anguilla fits your needs, appoint a professional offshore trust company as the trustee. Work with experienced estate planning attorneys to draft a trust deed that defines the trustee’s powers, beneficiary rights, and distribution terms.

Timing is crucial – set up and fund the trust before legal issues arise. Transferring assets to avoid known creditors is illegal and can be challenged as fraudulent. Focus on movable assets like cash, securities, and business interests, as U.S. real estate remains vulnerable.

Costs to establish an offshore trust typically range from $10,000 to $50,000, with annual maintenance fees of $3,000 to $6,000. These trusts are generally most practical for estates valued at $250,000 or more. Compliance with IRS requirements is non-negotiable – this includes filing Form 3520, Form 3520-A, and FBAR (FinCEN Form 114).

"Offshore asset protection is not a tax strategy. It requires full compliance with all U.S. tax and reporting obligations." – Jon Alper, Attorney

For added security, consider layering protections. For instance, the offshore trust can own an offshore LLC, which then holds the assets, creating additional complexity for creditors. Regularly update the trust to account for major life changes, such as marriage or the birth of a child, ensuring it aligns with your evolving financial goals.

International Business Structures for Diversification

International business structures go beyond offshore trusts, offering another layer of protection and diversification for your assets. By using offshore companies, you create jurisdictional separation, meaning your assets are owned and governed by foreign entities under foreign laws. This makes it harder for domestic courts to directly access your property, forcing creditors to restart their efforts in another legal system.

The real strength lies in integrated structures. A common approach involves an offshore trust owning an offshore LLC, which in turn holds your investments or businesses. This setup ensures that creditors must deal with a foreign trustee and not you directly, adding layers of complexity and expense to their efforts.

Advantages of Offshore Companies

Offshore companies bring more than just asset protection to the table. Privacy is a key benefit, as many jurisdictions keep ownership details private, making it harder for creditors to track your assets. They also ensure operational continuity. For instance, Nevis LLCs prevent asset freezing orders, allowing trustees to keep funds moving or pay legal bills even during litigation.

Another advantage is reducing legal and political risk. By spreading assets across jurisdictions with stable governments and favorable laws, you minimize exposure to sudden regulatory changes in any one country. However, these strategies are typically recommended for individuals with at least $1 million in liquid assets, given the costs of setup and maintenance.

"The fundamental principle is jurisdictional separation: assets are owned by foreign entities, administered by independent foreign trustees, and governed by foreign law." – Jon Alper, Attorney

Top Jurisdictions for Offshore Companies

Some jurisdictions stand out for their robust asset protection laws:

- Nevis: Known for its LLC laws, where creditors are limited to a charging order as their only remedy. Creditors must also post a $100,000 cash deposit to sue a trust.

- The Cook Islands: Famous for strong asset protection laws, short statutes of limitations on fraudulent transfers (1-2 years), and requiring proof of fraudulent intent beyond a reasonable doubt. Setting up a trust here costs about $25,000.

- The Cayman Islands: Ideal for institutional wealth and private funds. Offers STAR Trusts and flexible LLCs with no local taxes. However, assets must remain in a trust for six years to be fully protected from fraudulent transfer challenges.

- The British Virgin Islands (BVI): A global hub for holding companies and VISTA trusts, which allow the settlor to retain management control while holding shares.

- Singapore: Offers a stable banking system, AA-rated economy, and company structures with no capital gains tax.

- Belize: Known for its quick setup process and immediate asset protection upon trust creation.

| Jurisdiction | Strength | Burden | Tax on Passive Income |

|---|---|---|---|

| Cook Islands | Strong case law history | Proof of fraud beyond reasonable doubt | 0% |

| Nevis | Top LLC protection (charging order only) | $100,000 bond required to sue | 0% |

| Cayman Islands | Ideal for funds and STAR trusts | Six-year protection window | 0% |

| BVI | High-volume holding companies, VISTA trusts | Standard civil burden | 0% |

| Singapore | Stable banking, AA-rated economy | Standard civil burden | 0% (capital gains) |

| Belize | Low-cost and fast setup | Proof of fraud required | 0% |

"The Cook Islands has the strongest of asset protection case law history." – Offshore Corporation

Once you’ve chosen the right jurisdiction, the next step is establishing your offshore company.

How to Set Up an Offshore Company

Start by consulting tax and legal experts to clarify your goals and pick the best jurisdiction. Timing is critical – set up your offshore structure during "peacetime", before any legal disputes arise. Transfers made after litigation begins are more likely to face scrutiny or be challenged as fraudulent.

Prepare the necessary documents, such as trust deeds or LLC articles, and include protective clauses like anti-duress provisions (to block distributions under legal pressure) and flight clauses (allowing trustees to relocate the entity in response to legal threats). Once the paperwork is ready, register the entity and fund it promptly.

Ensure that foreign trustees or managers maintain real control over the assets. Avoid overly complicated setups – fewer, well-organized entities across strong jurisdictions often provide better protection than a web of complex arrangements.

Finally, compliance is non-negotiable. File required IRS disclosures, such as FBAR and FATCA forms, to stay within U.S. regulations. Choose banking partners wisely, avoiding institutions with branches in your home country, as they could be subject to domestic court orders. Proper maintenance and adherence to compliance rules are essential to keep your offshore structure effective.

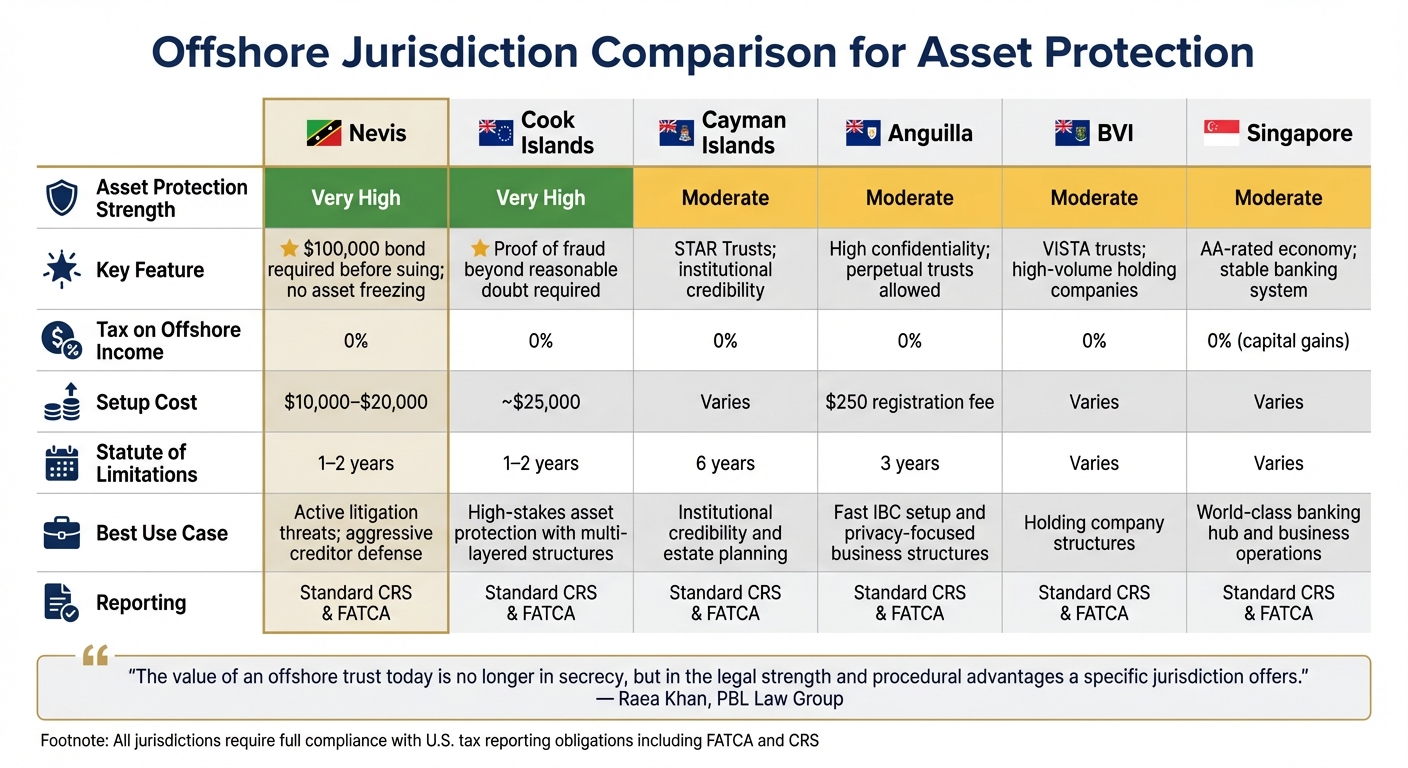

Jurisdiction Comparison Table

When considering asset protection strategies, it’s essential to weigh the strengths and weaknesses of different jurisdictions. Here’s a comparison of key factors like legal protections, tax policies, costs, and practical applications to help guide your decision-making.

| Jurisdiction | Asset Protection Strength | Tax Treatment | Setup Cost | Statute of Limitations | Reporting Requirements | Best Use Case |

|---|---|---|---|---|---|---|

| Nevis | Very High (requires a $100,000 bond before suing; no asset freezing) | 0% on offshore income | $10,000–$20,000 | 1–2 years | Standard CRS & FATCA reporting | Active litigation threats; aggressive creditor defense |

| Cook Islands | Very High (requires proof of fraud beyond a reasonable doubt) | 0% on offshore income | Not specified | 1–2 years | Standard CRS & FATCA reporting | High-stakes asset protection with multi-layered structures |

| Cayman Islands | Moderate (6-year fraudulent conveyance window) | 0% on offshore income | Not specified | 6 years | Standard CRS & FATCA reporting | Institutional credibility and estate planning |

| Anguilla | Moderate (high confidentiality; standard common law) | 0% on offshore income | Not specified | Varies | Standard CRS & FATCA reporting | Fast IBC setup and privacy-focused business structures |

| BVI | Moderate (standard civil burden) | 0% on offshore income | Not specified | Varies | Standard CRS & FATCA reporting | Holding company structures |

| Singapore | Moderate (standard civil burden) | 0% on foreign income and capital gains | Not specified | Varies | Standard CRS & FATCA reporting | World-class banking hub and business operations |

This table underscores the unique benefits offered by each jurisdiction, making it easier to align your asset protection strategy with your specific needs.

For those seeking the strongest safeguards, Nevis and the Cook Islands stand out. Nevis imposes a $100,000 bond requirement for lawsuits and eliminates Mareva Injunctions, while the Cook Islands demands proof of fraudulent intent beyond a reasonable doubt. These measures create formidable barriers for creditors.

"The value of an offshore trust today is no longer in secrecy, but in the legal strength and procedural advantages a specific jurisdiction offers."

– Raea Khan, PBL Law Group

If maintaining institutional credibility is a priority, the Cayman Islands is a top contender. Its stable regulatory framework and extensive professional network make it ideal for estate planning and high-level financial management. However, it’s worth noting the longer six-year statute of limitations for fraudulent conveyance challenges compared to the 1–2 years in Nevis or the Cook Islands. Ultimately, the choice hinges on how aggressively you need your assets protected when facing potential creditor claims.

sbb-itb-39d39a6

Meeting CRS and FATCA Requirements

Strong asset protection relies on adhering to international compliance standards. These standards are vital for maintaining the legal standing of your offshore trusts and companies.

What CRS and FATCA Mean for You

FATCA requires U.S. taxpayers to report foreign-held assets, while CRS establishes similar reporting obligations across more than 120 countries.

"CRS is essentially FATCA with a global reach." – Guilherme B. Reis, Vice-President, Citco (Canada) Inc.

The classification of your offshore entities – whether as Financial Institutions (FIs) or Non-Financial Entities (NFEs) – determines their reporting responsibilities. For trusts managed by professional trustees, classification as an FI is common. This means reporting details about all "Controlling Persons", including the settlor, trustees, protectors, and beneficiaries. Financial accounts under these rules include bank accounts, equity interests, and trust benefits.

Failing to comply can lead to severe penalties. For U.S. taxpayers, failing to file Form 8938 (Statement of Specified Foreign Financial Assets) can result in an initial $10,000 fine, escalating to $50,000 for prolonged non-compliance. There’s also a 40% penalty for underreported income or up to 50% of the undisclosed asset value (minimum $100,000) for willful violations. Foreign financial institutions face a 30% withholding tax on certain U.S.-source income if they fail to meet FATCA requirements.

Understanding these obligations is just the beginning. The real challenge lies in applying them to your offshore trusts and foundations.

How to Stay Compliant

The first step is ensuring your entity is correctly classified. Use the "Gross Income Test" (checking if 50% or more of income comes from financial assets) and the "Managed By Test" (determining if another financial institution manages the entity) to decide if your structure qualifies as an FI or a Passive NFE. Misclassification can lead to reporting mistakes and penalties.

Self-certification forms are also essential. Offshore banks require these forms to confirm your tax residency. Providing inaccurate information can result in legal consequences. U.S. taxpayers must also track reporting thresholds. If your foreign assets exceed $50,000 at year’s end (or $75,000 at any point during the year) as a single filer, Form 8938 must be filed. These thresholds are higher for those living abroad.

Keep your records updated. Any changes in tax residency or controlling persons must be reported within 30 days to avoid compliance issues. Failing to notify financial institutions of a "Change in Circumstances" could lead to account closures or non-compliance flags.

Here’s a quick comparison of FATCA and CRS to clarify their differences:

| Feature | FATCA | CRS |

|---|---|---|

| Primary Target | U.S. taxpayers (citizens and residents) | Non-residents of participating jurisdictions |

| Framework | U.S.-specific law | OECD multilateral standard |

| Reporting Path | Directly to the IRS (or via local authority under IGA) | To local tax authority, then shared globally |

| Enforcement | 30% withholding on non-compliance | Local penalties and possible criminal charges |

| Account Thresholds | $50,000 or $250,000 for individuals | Generally no thresholds (some exceptions apply) |

Transparency is now mandatory. Tax authorities exchange information confidentially through encrypted government channels. This makes hiding assets nearly impossible. To safeguard your offshore structures, work with legal experts to ensure proper classification, thorough documentation, and timely reporting of any changes. Staying compliant is the cornerstone of maintaining the protection of your offshore assets.

Real Examples of Offshore Structures That Work

Offshore structures aren’t just theoretical – they’ve been successfully used to protect wealth and assets in real-world situations. Below are two examples that highlight how these strategies can be applied effectively.

Example: Anguilla Trust for Estate Planning

A high-net-worth family used an Anguilla Asset Protection Trust to safeguard their estate from forced heirship laws and probate issues. They transferred investment portfolios and real estate into the trust, which was registered with the Anguilla government for a one-time fee of $250. The entire process took just 24 hours. Thanks to Anguilla’s abolishment of the "Rule against Perpetuities", the trust can exist indefinitely, allowing assets to grow for future generations. The settlor retained oversight by appointing a Protector and managing the trust indirectly through a subsidiary LLC.

"Anguilla trusts can be perpetual and can accumulate assets and income for as long as it chooses to remain in existence."

– OffshoreCompany.com

Later, when a distant relative contested the estate plan, Anguilla’s creditor protections proved invaluable. The court required evidence that the settlor was insolvent when transferring assets and imposed a strict three-year window for filing claims. The challenge failed, and the trust avoided probate, ensuring the family’s assets were distributed privately and efficiently.

Example: Nevis LLC for Business Protection

A high-risk surgeon took a proactive step to protect her assets by transferring an investment portfolio and real estate into a Nevis LLC. The formation of the LLC cost around $2,500, with annual fees of $1,000. When a malpractice verdict exceeded her insurance coverage, the plaintiff’s attorneys targeted the LLC. However, they quickly abandoned their efforts after encountering Nevis’ tough legal barriers.

Under Nevis law, judgment creditors are limited to a charging order, which requires a $100,000 bond. This restriction prevents creditors from seizing or selling LLC assets or gaining management control. Additionally, creditors must prove fraudulent transfers "beyond a reasonable doubt", a standard typically used in criminal cases. Faced with these obstacles, the legal case was dropped, leaving the surgeon’s assets untouched while she retained full control of the LLC.

"The entry of a charging order shall be the sole and exclusive remedy against a member’s interest in a Nevis LLC."

– Nevis Limited Liability Company Ordinance (Cap. 7.04)

These examples demonstrate how selecting the right jurisdiction and structure can make a significant difference. By proactively establishing offshore entities, individuals can shield their assets from creditor claims while adhering to legal and reporting requirements.

Conclusion

Protecting your wealth requires taking action before any threats arise. As we’ve outlined, setting up strong legal safeguards – such as offshore trusts, international business structures, and maintaining proper compliance – needs to happen well in advance. If you wait until a lawsuit is filed, any asset transfers made afterward could be classified as fraudulent.

The statistics are sobering: around 70% of family wealth disappears by the second generation, often due to poor asset structuring. On top of that, basic insurance coverage is often grossly inadequate. For example, many states only mandate $25,000 in automobile liability coverage, which is far from sufficient for high-net-worth individuals facing significant claims.

"Offshore asset protection is not a tax strategy. It requires full compliance with all U.S. tax and reporting obligations." – Jon Alper, Attorney

To build a solid defense, consider combining umbrella insurance (costing about $150–$300 annually for $1 million in coverage), domestic LLCs, and offshore trusts in jurisdictions like the Cook Islands or Nevis. These strategies don’t just block creditors – they change the financial incentives, often discouraging lawsuits altogether. This approach not only protects your assets but also ensures long-term financial security.

Wealth protection isn’t static; it must adapt to changes in tax laws, family dynamics, and regulations. Partnering with professionals who specialize in international law and offshore structures ensures compliance with FATCA, CRS, and IRS requirements. The investment in strategic planning is minimal compared to the financial damage litigation could cause. Start now to secure your legacy for generations to come.

FAQs

What are the benefits of using offshore trusts to protect wealth?

Offshore trusts are a practical option for high-net-worth individuals looking to shield their assets. Setting up a trust in a foreign jurisdiction with favorable asset protection laws can help guard your wealth against risks like lawsuits or creditor claims. Many of these jurisdictions enforce strict privacy regulations and often disregard U.S. court judgments, making it more difficult for others to access your assets.

Another advantage is the reduced timeframe creditors may have to file claims, along with legal protections that strengthen the security of your wealth. When properly structured, offshore trusts can serve as a dependable way to preserve your financial legacy for generations to come.

What should I know about the tax implications of creating an offshore business structure?

Creating an offshore business structure might offer potential tax advantages, like reduced effective tax rates, but it also comes with strict legal and reporting responsibilities. U.S. citizens and residents are still required to follow U.S. tax laws, including FBAR (Report of Foreign Bank and Financial Accounts) and FATCA (Foreign Account Tax Compliance Act). These regulations demand detailed reporting of foreign accounts and assets.

While offshore structures can improve tax efficiency, they need to be carefully crafted to comply with U.S. and international laws. Ignoring reporting rules can lead to steep penalties. To navigate these complexities, working with a skilled tax professional or attorney is crucial. They can help ensure compliance and align your offshore strategy with your long-term financial goals.

Why is diversification essential for protecting wealth during economic downturns?

Diversification plays a crucial role in safeguarding wealth during economic downturns. It works by spreading investments across various asset classes, industries, and geographic locations. This approach minimizes the impact of underperformance in any single area, offering a more balanced way to manage risk and protect financial stability.

By avoiding the mistake of putting all your eggs in one basket, diversification helps shield your portfolio from market swings, legal challenges, and economic unpredictability. It’s a smart strategy for preserving long-term financial security, especially when faced with uncertain times.