September 11, 2015

By: Claudio Grass

This is an article from Global Gold’s Outlook Report (subscribe on www.globalgold.ch)

It has been nearly three years since we published our first Outlook Report in December 2012. Since the beginning of our publication, we have focused on different aspects of the gold market and have analyzed what moves the gold market. In this article, we would like to re-examine some of the topics that we had previously discussed and analyze whether any of our assumptions have changed.

It has been nearly three years since we published our first Outlook Report in December 2012. Since the beginning of our publication, we have focused on different aspects of the gold market and have analyzed what moves the gold market. In this article, we would like to re-examine some of the topics that we had previously discussed and analyze whether any of our assumptions have changed.

Financial Repression

Financial repression has been a frequently discussed topic since our first publication. During that period, many of the measures we had warned about are now in place or events have already taken place. A good example is capital controls. In 2012, a discussion about the possibility of capital controls in a Western country seemed like a conspiracy theory. In the meantime, they became a reality in both Cyprus and Greece. Could a major Western country be next?

We also warned about negative interest rates. At that time, they were observable in some short dated government bonds. The ECB and Swiss National Bank have both now lowered deposit rates into negative territory. The results: Swiss government yields are negative for terms up to 10 years. Imagine! As an investor you have to actually pay the Swiss government so that you can lend them money for 10 years. It is absurd, if you think about it. The same is true for several other European government bonds.

One thing that we had predicted didn’t become reality yet: Consumer Price Inflation. Although asset price inflation is very prevalent and real estate and equity prices have increased rapidly, we did expect consumer prices to pick up more quickly. However, this can always change … very quickly.

Endless debt

Another topic that we have been discussing for years is the debt level. Debt and interest are not bad by themselves. The principal problem is when we have a currency system that is based on debt. Why? Since debt has to be repaid with interest, if the money supply does not constantly increase debtors will default. It is inherent to the system that the money supply has to constantly increase to avoid a collapse, and this in turn reduces the purchasing power of money.

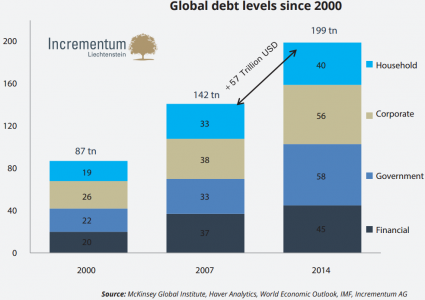

So, do we still have a debt problem? Yes, we still have a debt problem, but it has gotten worse. My good friend Ronald Stöferle, the author of the publication “In Gold we Trust”, developed the chart below. The result is striking! Between 2007 and 2014, the total global debt increased by over 40%. Governments, financials, corporations and households have all increased their absolute debt levels in the last few years. The chart shows that total global debt has reached 200 trillion USD. World global output measured by the gross world product was around 76 trillion USD in 2013. This means that on a global scale we have a debt ratio of approximately 270% of the total yearly world output.

In summary: The debt situation has become worse in the past few years. It has reached an unsustainable level. However, unsustainable situations can continue to persist for some time. The question is not if, but rather when this debt bubble will pop.

Where is the gold price heading?

When clients ask me where the gold price is heading, some of them are surprised to hear that I don’t actually have a target price for gold. The reason why I personally hold gold is because I see it as an insurance against our current monetary system. It is one of the only assets I know that has no sort of counterparty risk and has been considered to be of value for thousands of years. Do I follow the gold price constantly? No! Do I regret owning precious metals when the price stays stable or declines in USD? No, not really, the same way that I don’t regret owning health insurance, when I stay healthy.

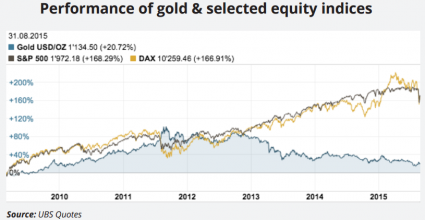

I would like, however, to make one observation in regard to the gold price. It becomes clear when we look at the chart below. Since the 2008 financial crisis, central banks worldwide have pumped a massive amount of liquidity into the markets. Much of this liquidity has ended up in “bankable assets” i.e. equities and bonds. Since their lows in March 2009, both the S&P 500 and the German DAX have had triple digit gains of almost +170%. At the same time, the real economies have more or less stagnated. In the meantime, the price of gold has increased by 21% during the same period. Which asset do you think is more at risk of being in bubble territory? Which one do you think has a bigger upside? I leave you to draw your own conclusions.

Central banks are still buying gold

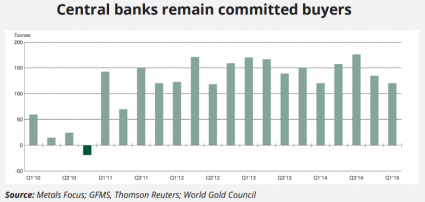

The demand for gold from central banks has remained stable over the last few years as shown in the chart below. Interestingly, the Russian central bank had the largest gold purchases during the first half of 2015. It purchased a total of approximately 70 metric tons. This is interesting since during this period Russia has been under increased scrutiny and has even had sanctions placed on the country. It appears that the Russians want to stock up on the one currency that can’t be “frozen” and will always be accepted.

Our conclusion

Overall, our outlook remains unchanged! The reasons why we believe it is crucial for seasoned investors to hold gold have not only remained unchanged, but have become even more urgent. We would also like to go one step further. As governments worldwide become increasingly desperate due to their dire financial circumstances, I believe that they will resort to increasingly tyrannical means to access the wealth of their citizens. It is essential to keep at least a part of your assets far away from the banking system, which I consider to be an “extended arm” of the government. I recommend that if you are looking for a real way to secure your assets, they should be kept physically outside the banking system. It would be ideal if they were in a jurisdiction that has never confiscated precious metals in the past.

This is an article from Global Gold’s Outlook Report (subscribe on www.globalgold.ch)