President Biden is ready to drop the hammer on the producers, earners, and side-hustlers by amplifying IRS enforcement funding by 150%.

May 3, 2021

By: Bobby Casey, Managing Director GWP

It’s weird that when I say this, nearly everyone in the room agrees. Even politicians agree! But only when it comes to individuals. Businesses should not lay off a single employee, still pay them arbitrarily high wages, and keep up with expensive inconsequential regulations.

And when the economy is hurting, government should do what? Borrow and spend more money. Of course! Why would the government cut a single cent from its budget?

In fact, when the government is struggling to pay for its wish list, it does what any other organized criminal organization does: goes harder after people that “owe” them money.

Just under two years ago, I wrote a blog “Is the IRS Shrinking?“. It talked about the reduction in budget and bandwidth the IRS has experienced over the past several years:

Between 2010 and 2017, the IRS has lost $2 BILLION in funding. Not lost like the Pentagon loses money, and can’t account for where it went. Lost, as in Congress cut their budget, so they had to reduce their employees, departments, and enforcement.

The IRS’s budget dropped $2 billion in seven years. Remember this number, because we are coming back to it in a minute.

Also in this article, despite the reduced budget and resources at the IRS, they still brought in more revenue under the Trump administration because prior to 2020, the economy was expanding.

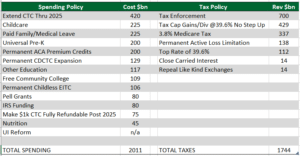

Under the Biden administration, there is what’s called the “American Families Plan”. It’s a $1.8 trillion welfare expansion plan. Simply raising taxes back to 39.6% won’t cut it. However, spending $80 billion to recover $700 billion would offset the costs of the bill by nearly half. Below is a grid that shows the spending proposals on the left, and the “fundraising” measures on the right. Notice how the biggest revenue generator is tax enforcement:

Now, look back at the $2 billion haircut the IRS saw over seven years and compare that to the $80 billion windfall this bill intends to give it. It’s expected to grow the IRS enforcement staff by nearly 15%.

The current annual funding for the IRS is $12 billion, with $5.2 billion allotted toward enforcement. $80 billion over ten years is $8 billion per year more toward just enforcement. That’s over two and half times what they are spending now.

The claim is that they are now going to hunker down and really go after the rich, the corporations, and offshore. And I believe it to some degree. I do NOT believe that’s all they are going to do, however.

Any time you give the IRS — or any enforcement arm of the state for that matter — more money, they find ways to use it. The ways in which they use it often translates into a huge headache for financial institutions, banks, third-party payment providers, and anyone who uses any of those three things.

…Lest we forget FATCA…

Do you use Venmo? Cashapp? Zelle? PayPal? Then you’re automatically entered into the IRS audit lottery:

Among other things, that means banks and third-party apps will be required to give the IRS data about account holders’ “aggregate account outflows and inflows,” the Treasury Department said in a statement on Wednesday.

“This reform aims to provide the IRS information on account flows so that it has a lens into investment and business activity,” according to the Treasury’s statement. “Providing the IRS this information will help improve audit selection so it can better target its enforcement activity.”

I don’t even want to know what “other things” they were referring to when they said “among other things”. In case you thought that might not directly affect the middle class or the poor, think again. In a separate initiative called Biden’s “Rescue Plan”.

You remember that one right? That was the $1.9 trillion bill that was supposed to help the recovery efforts from the pandemic. 5% of it actually is allocated toward anything to do with the pandemic. The rest is a series of gratuitous state bailouts and cronyism.

Within the bill was this little nugget:

Buried inside the 600-page bill that’s ostensibly meant to provide pandemic relief is a provision requiring gig economy platforms to report information to the IRS about all users who earn at least $600 in a year. Previously, platforms were only required to provide the IRS with information on users who made at least 200 transactions or earned at least $20,000.

Reporting someone for earning $600 in a YEAR, is asinine. And with $8 billion per year more in tax enforcement, you can bet there’s bandwidth to investigate.

Think of all the people affected though. It wouldn’t take much to get to $600 in one year doing any of these things:

-

Uber drivers

-

Dash deliverers

-

Furniture flippers

-

Artisans selling their crafts on eBay

-

Airbnb occasional renters

The headaches just doubled. Now these platforms have to enhance their reporting and that’s as much of a pain as it will be for those who use them.

Remember, the IRS is getting $8 billion dollars a year… not all these businesses and individuals. In the US, it cost $197.3 billion in tax compliance in 2019. Expect that number to go through the roof! And who will be left to pay the cost of that along with the sick amount of spending coming through congress?

For a president, and his followers, who insisted this is all about coming after the rich and the corporations, it certainly doesn’t look that way.

Basically no one is safe: rich, poor, or anywhere between. Orange Man was bad, but Biden was not the solution to the problem. Economically, every American person is in for it. With the IRS emboldened, and the financial institutions, banks, third-party payment providers, and gig platforms scrambling to comply, it’s time to make plans to get as much out of the US and your name as possible.

Click here to schedule a consultation on how you can protect your assets from overreaching governments, or here to become a member of our Insider program where you are eligible for free consultations, deep discounts on corporate and trust services, plus a wealth of information on internationalizing your business, wealth and life.