The MSM says the economy is fine, but three key trends are spiraling into much worse: taxes, inflation and interest rates.

But it isn’t…

In fact, there are three key trends that are likely to get much worse in the U.S. as time goes on: Taxes, inflation, and interest rates.

This trifecta of bad trends will make living in the U.S. more costly than it’s been in the last 30 years… while making certain countries more popular than ever for expatriates looking for lower cost of living and better investment opportunities.

You might even call it the “highway robbery of the American people.”

Let’s take a fast look at each of these three trends, and then I’ll reveal how you can create an exit plan to get away from it all.

Starting with inflation…

The Worst “Inflation Nation” in Decades

If you look at the final reported inflation rate, you might think inflation is easing back towards normal. See for yourself on the graph below:

But there are three big problems with the official numbers:

First, U.S. inflation is still higher than it has been in decades.

Second, this inflation permanently robs you of your wealth every month your income doesn’t increase to account for inflation.

Finally, there is a kind of “shell game” being played by the Government here. Jeffrey Tucker explains it well:

“So on it goes, and each month we get a report, and the intensity shifts from one sector to another. The perception that this is cooling is based mostly on the weighting scheme that yields the final number. This is no world in which we are watching the problem gradually disappear.”

For example, the inflation intensity that Jeffrey mentioned has currently shifted away from gas prices and toward food prices again, which have increased 10.6%. That increase is much higher than the final reported inflation number of 7.1%.

Gas prices are also likely to start rising again soon because President Biden can’t keep tapping into the U.S. emergency reserves to artificially ease them. That’s because U.S. gas reserves are currently sitting at the lowest level they’ve been since the 1980s.

I could go on and on about inflation, but you get the point. Inflation is bad inside the U.S., and could take a decade or longer before it eases back below 2%.

In short, “Inflation Nation” is likely to get worse before it starts getting better.

Since I already addressed how the IRS would be raising taxes and widening its dragnet even further in a previous message, let’s take a quick look at mortgage rates before moving on to your “exit plan”…

Mortgage Rates Make Living in the U.S. Expensive

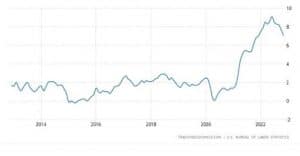

Federal Reserve Chairman Powell just raised the federal funding rate again. In turn, U.S. mortgage rates are the highest they’ve been since the last recession in 2008. You can see just how high they are (and how quickly they’ve risen) on the chart below:

Bottom line: This signals the end of “cheap money” in the U.S. for a while.

Of course, there’s the possibility that the housing market will crash, and mortgage rates might come back down. But if Powell stops raising the funding rate (which affects credit cards and personal loans), then inflation could heat up again.

To sum it all up, living in the U.S. is already quite expensive and it appears taxes, inflation, and interest rates will all continue to rise. But GWP Insiders have an advantage…

Your “Exit Plan” Starts With One Phone Call

Look, I hate taxes and I hate inflation. And I want to help you avoid as much of this as possible.

Become a GWP Insider, and you can schedule unlimited 1-hour consultations with me to help you reduce your tax burden, lower your costs, and implement any other business and wealth internationalization strategies that make sense for you.

In just one call, we could put together an exit plan to help you escape higher taxes, inflation, or expensive housing in the U.S. or any other country.

People from all walks of life become GWP Insiders, like:

- A Canadian ecomm entrepreneur living in Portugal making 6-7 figures net. He needs to know where to register his company and how to get out of the Canadian tax system without owing much (or anything) in Portugal.

- A German SaaS company owner living in Thailand.

- A Brit who is nomadic with a digital marketing agency.

- An American with a digital products business living in Mexico.

Even though my clientele is diverse, they’re all facing similar challenges.

They all want to create the right business structure and optimize it for a low-tax multi-jurisdictional approach in different parts of the world (to stay free).

And I’m the one guy they come to for help!

So if you’d like to exploit every possible tax loophole, while avoiding the #1 most common business structure mistake (plus others unique to your situation)…

Then you should join us inside GWP Insiders.

Once you join, you’ll immediately get to schedule your first 1-hour consultation with me. This can be used to discuss your business structure, residency, tax planning, or to make professional introductions for your specific needs.

One consultation would normally cost $445 to $4,000 depending on your situation, but GWP Insiders get unlimited consultations at no charge.

You’ll also gain access to the private membership area, which includes a variety of business, life, and wealth internationalization strategies that give you shortcuts to success with the following:

- Offshore companies,

- Trust planning,

- Tax planning,

- Real estate,

- 2nd passports,

- Discounts on offshore structures

- And so much more.

As a bonus, the insiders-only content includes the 2022 edition of my Offshore Banking Report where you’ll discover:

- The 9 best licensed offshore banks for 2022, plus my commentary on each.

- How to start banking in the US without visiting a single branch.

- How to leverage “Fintech” institutions like the wealthy elite do.

- How FATCA could “trap” you even if you aren’t a U.S. Citizen.

- The Top 5 Traditional U.S. Banks that accept non-residents.

Look, I’ve made joining GWP Insiders and scheduling your first 1-hour consultation with me as easy as taking a walk in the park.

But for a limited time, I have one more surprise for you…

If you go to this special page and sign up you’ll also receive an 80% discount.

To live freely is divine,

Bobby Casey

Location Independent Entrepreneur

P.S. For the next decade, living inside the U.S. could get really expensive with higher taxes, red-hot inflation, and rising interest rates. That’s why I strongly encourage you to become a GWP Insider right now.

When you do, bring me your toughest questions about setting up your digital nomad “exit plan” to get away from it all.

I bet I can answer all of them during our first call. Massive financial and personal security for the right person. Hurry, and go to this link to save 80% right now.