March 7, 2016

By: Bobby Casey, Managing Director GWP

Welcome to the North American Edition of… Insolvency Issues!

Welcome to the North American Edition of… Insolvency Issues!

First up, Canada!

She sold off ALL her gold reserves! One economist, Ian Lee, thinks if the US can abandon the gold standard, so can Canada! It’s CAN-ada, after all… not CAN’T-ada. This just happened in the past month, and the claim is there are other “better assets” to pursue. What they are, or what makes them “better” has yet to be addressed by any Canadian officials. If they are truly following in the US footsteps, then I assume they will be looking to China for some economic favors? If not buying up treasuries then buying up real estate.

How can Canada see gold as so dispensable, while the Chinese and Russians sucking it up like a vacuum? Even the US touts its holdings as being still the highest in the world. What does this mean for Canada? I honestly don’t know. Like every other crazy event in the world, we must just wait and see how it unfolds. I don’t expect anything good to come from this move.

The one thing that’s for sure, ever since the US left the gold standard, she has been struggling. Unbacked currency is debased and struggling to find worth and value, especially as others seek to back their currencies again. Hedging your entire future or retirement on the “full faith and trust of the government” seems highly irresponsible.

Another interesting phenomenon is that Canada is also following in the footsteps of the US on the mortgage and housing front. While their salaries have largely kept in line with the rate of inflation, the cost of real estate has not. It has instead skyrocketed. This isn’t shocking, except that the average household debt levels in Canada have gone from 89% of their annual disposable income to nearly 165%.

They are walking the same precarious line as the US, and I supposed soon, some Canadian blogger will be pointing out the warning signs of doing so, just as we do with the US and other countries.

Next up, the United States.

Well, let me just put all the allegations of fear-mongering to rest right now. When I say we are heading toward an economic disaster, people call me some fear-mongering conspiracy theorist. So I’m just going to let the numbers speak for me. I don’t care who’s word you take for it, this is at best terrifying.

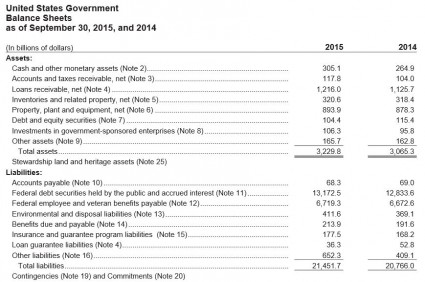

The US government just released its financial statement, and it ain’t pretty. See the assets and liabilities cart below:

Assets, as defined in the statements are: “loans receivable, net; property, plant, and equipment (PP&E), net; inventories and related property, net; and cash and other monetary assets.”

Also included as an “asset”: “Stewardship Land and Heritage Assets in addition to the Government’s sovereign powers to tax and set monetary policy.”

(Side note: should I be concerned about the fact that among the assets of the US government is its ability to steal on a political whim? Is that listed as an asset of other organized crime syndicates as well? La Cosa Nostra has the ability to extort private citizens too. Can they list that among their assets?)

Easy to see where the nearly $18.2 trillion in national debt comes from now, right? Assets minus liabilities equals how deep in the hole you are.

It’s important to mention that $8.5 Trillion of Department of Defense spending is lost. That’s right, it’s totally unaccounted for. It was spent… but then just kinda fell off the books. Granted this happened over the course of the past 20 years, but so did a good amount of this debt in general.

I find it fascinating to see what all constitutes “national defense”. Very similar to the read of what all constitutes “education”. You tell me how planes that don’t fly defend our country, and I’ll show you a bureaucrat in the Department of Education that has revolutionized children’s lives across the country.

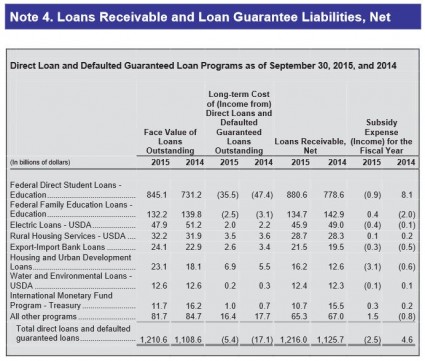

But what’s particularly interesting is that 37.7% of the US government’s “assets” are loans. 69.8% of those loans are student loans. 22.6% of total government assets – i.e. over one fifth of the US governments listed “assets” – are student loans, per the Notes.

Let’s not forget about this: “[A]bout 17% of all borrowers with federal loans being severely delinquent, a share that would be even higher if borrowers currently in school who aren’t yet required to repay were excluded. Millions of other borrowers are months behind but haven’t hit the 360-day threshold that the government defines as a default.” (Source: WSJ)

Imagine if you were having your own net worth assessed. And imagine if 37.7% of your assets are in loans that still need to be paid back. Of those loans nearly 70% of them were from kids with no jobs, and little to no prospect of getting a job that will pay you back. 17% of that 70% is over a year delinquent in paying you back. They have defaulted. Another measure of them are between one month and a year delinquent. Now, imagine if your spouse was seeking to forgive all of those loans. They would no longer be assets, but losses. Not many individuals feel comfortable operating on a fractional reserve basis, and for good reason! They’d end up bankrupt.

Many democrats are stumping for the absolution of student loans. What is a little peculiar is how the federal government took over student loans entirely, giving the banks the boot, just recently. It was part of the Affordable Care Act! So at this point, why is the government lending money for overpriced universities rather than price fixing it just like a Medicare program?

As if that were not uncomfortable enough, this financial statement was then audited by the Government Accountability Office (GAO).

Let’s again put this in private sector terms. If a private company was audited and received failing marks, the SEC would descend upon them like locusts, as from a scene out of the Old Testament. They would likely face charges for some white collar impropriety.

Never mind the market scrutiny they would face! Falling stock prices? Angry shareholders and investors? Losses galore!

No need to imagine what a bad report looks like. The GAO has been issuing one year over year to the US government, without reprisal.

Here are a few choice excerpts from their audit:

“About 34 percent of the federal government’s reported total assets as of September 30, 2015, and approximately 19 percent of the federal government’s reported net cost for fiscal year 2015 relate to three Chief Financial Officers Act agencies—the Department of Defense (DOD), the Department of Housing and Urban Development, and the U.S. Department of Agriculture—that received disclaimers of opinion on their fiscal year 2015 financial statements.”

Disclaimers of opinions in the private sector are when auditors don’t have enough information to formulate an opinion on the matter one way or another. Sometimes not having enough information has to do with the scope of what is being audited: too small, not enough time, too soon to tell. Other times they just couldn’t get access to that information and therefore were unable to perform the audit. Care to hazard a guess as to which one is true for the Department of Defense, HUD, and USDA?

Here it is in the GAO’s own words:

“Three major impediments continued to prevent GAO from rendering an opinion on the federal government’s accrual-based consolidated financial statements: (1) serious financial management problems at DOD that prevented its financial statements from being auditable, (2) the federal government’s inability to adequately account for and reconcile intragovernmental activity and balances between federal entities, and (3) the federal government’s ineffective process for preparing the consolidated financial statements.”

Ouch! But wait. There’s more.

“Significant uncertainties, primarily related to the achievement of projected reductions in Medicare cost growth, and a material weakness in internal control over financial reporting, prevented GAO from expressing an opinion on the sustainability financial statements, which consist of the 2015 Statement of Long-Term Fiscal Projections.”

Can you quantify that for us? What would possibly qualify as a “significant uncertainty”?

“About $27.9 trillion, or 67.0 percent, of the reported total present value of future expenditures in excess of future revenue presented in the 2015 Statement of Social Insurance relates to Medicare programs reported in the Department of Health and Human Services’ 2015 Statement of Social Insurance, which received a disclaimer of opinion.”

Yup. I think that qualifies as a significant uncertainty. $10 trillion OVER our current national debt is very much a significant number. And it has to do specifically with Social Security and Medicare.

The notes on this just get better though:

“The extent to which actual future Part A and Part B costs exceed the projected amounts due to changes to the productivity adjustments and specified physician updates depends on what specific changes might be legislated and whether Congress would pass further provisions to help offset such costs.

However, absent an unprecedented change in health care delivery systems and payment mechanisms, the prices paid by Medicare for health services will fall increasingly short of the cost of providing such services. If this issue is not addressed by subsequent legislation, it is likely that access to, and quality of, physicians’ services would deteriorate over time for beneficiaries. By the end of the long-range projection period, Medicare prices for many services would be less than half of their level without consideration of the productivity price reductions and physician payments would be 30 percent lower than they would have been under the SGR.

Before such an outcome would occur, lawmakers would likely intervene to prevent the withdrawal of providers from the Medicare market and the severe problems with beneficiary access to care that would result. Overriding the productivity adjustments and specified physician updates, as lawmakers have done repeatedly in the case of physician payment rates, would lead to substantially higher costs for Medicare in the long range than those projected in this report.”

This took a very scary turn, didn’t it? This was the GAO’s response to socialized health insurance in the United States. Worse still, the fact that this represents an UNCERTAINTY means that things are likely WORSE than what we are being told.

I’ve linked all the information here. You are more than welcome to – in fact, if you get a chance, I wish you would – read the statements and audits. People typically don’t. When you do a search for this stuff, you will find independent bloggers mainly addressing it, some linking back to the statements and audits themselves, but not a whole lot of mainstream coverage. It’s all there, though. This isn’t a conspiracy theory any longer. It’s a conspiracy fact. The US is broke as a joke, and even when they cook their books, it’s still painfully obvious.

Canada seems to think the US got something right in all this! They could stand to read over those statements and audits as well before taking another step down the US path. If you read this information along with what is linked here, and still think things are great, you’re in for a rude awakening. Clearly government and your representatives aren’t looking out for your best interests, and are doing nothing to protect you, so it’s up to you to take those matters into your own hands. Let’s talk about your options! Click here to set up a consultation.