February 29, 2016

By: Bobby Casey, Managing Director GWP

The second is to push the Negative Interest Rate Policy. While Switzerland and Iceland are doing away with fractional reserve banking and printing unbacked money out of thin air, the rest of the West is running head long into it.

There have been grumblings that the US should consider banning or abandoning the $100 bill while Germany is getting backlash for trying to abandon the 500 Euro note. (Source: Zerohedge)

“The ECB has begun contemplating the death of the €500 EURO note, a fate which is now virtually assured for the one banknote which not only makes up 30% of the total European paper currency in circulation by value, but provides the best, most cost-efficient alternative (in terms of sheer bulk and storage costs) to Europe’s tax on money known as NIRP.”

“[A]ll this modest proposal will do is make it that much easier to unleash NIRP, because recall that of the $1.4 trillion in total U.S. currency in circulation, $1.1 trillion is in the form of $100 bills. Eliminate those, and suddenly there is nowhere to hide from those trillions in negative interest rate “yielding” bank deposits.”

While China is still the title holder for Greatest Amount of US Treasury Holdings Overseas ($1.4 Trillion), they are also the title holder for Greatest Amount of US Debt Dumped ($200 Billion as of October 2015). They have been releasing billions in US Treasuries to support their own currency and domestic programs. However, Americans have resorted to buying up a significant amount of US Treasuries of late, which somewhat neutralizes the problem… for now. (Source: Bloomberg)

“American funds have purchased 42 percent of the $1.6 trillion of notes and bonds sold at auctions this year, the highest since the Treasury department began breaking out the data five years ago. As recently as 2011, they bought as little as 18 percent.”

“The fact that Americans are pouring into Treasuries may point to a deeper concern: the world’s largest economy, plagued by lackluster wage growth and almost no inflation, just isn’t strong enough for the Federal Reserve to raise interest rates.”

So maybe we hold off on raising the interest rates. Or maybe we look into negative interest rates.

It all comes back to that, doesn’t it? Mike Gleason had a very insightful interview with Austrian School Economist Marc Faber not too long ago, and Faber had this to say about China:

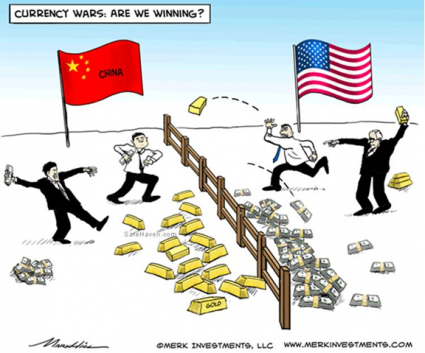

“The Chinese, for some reason, believe in gold. My sense is that the Chinese would like to eventually have the world’s dominant currency, in other words, replace the dollar as the reserve currency of the world. Whether they manage it this time, I’m not sure, because right now, China has also some of its own problems. But I’d like to tell you, if I have to choose between the problems of Western Europe and the U.S. and China, I’d take the problems of China any time.”

What a profoundly strong statement coming from a staunch Austrian Economist. The EU and US have to be two of the biggest blundering superpowers in recent history. If the system is rigged and producing undesirable results, the solution isn’t to rig it more. It’s to unrig it or abandon it altogether. We keep adding laws, regulations, and guidance which compound the problems rather than solve them.

China might be undergoing some hardships right now, but it is also one of the biggest consumers of gold. They get it, or at least more so than the West.

Let’s recap on the strides China has made to overtake the USD as the premier reserve currency:

- Recently added to the IMF reserve basket

- It’s selling off US Treasuries, and buying up gold.

- It has several economic friends, including Russia, who are also eager to buy up gold, and abandon the USD.

- It has surpassed the US already on so many other levels

Between the zero and negative interest rate policies, the transition toward cashlessness, and the quantitative easing, it’s fair to say that the USD is volatile at best. That the US is on the phone trying to synchronize its policies with Japan, England, and the EU to prevent any economic discrepancies that could globally bring down world economies, it’s also fair to say that the apparatus that is holding all this together is too delicately codependent on everyone doing exactly as they are told. Like a trapeze artist who not only has no safety net below, but rather a bed of rusty nails.

If you buy gold, you are obviously aware and fearful of the current situation. When they inevitably come for your gold, you will know you were right to be fearful as they will give you plenty of reason to be. Have you ever seen those movies where someone doesn’t want their call traced so they bounce the call off several towers and satellites all over the world and universe? Yes, it is eventually traceable, but the idea is that they will get off the phone with you before you can find them, or that you will give up the search before you find them.

Think of offshore accounts and corporate structures in a similar way. You are creating an apparatus that makes it really tedious to find your assets, and while there is still plenty of low-hanging fruit, you’re not worth the effort. Criminals like easy targets. It’s a proven fact. Be a big enough pain in the ass, it won’t be worth it for them to pursue you.

It’s happened before. If you buy gold, don’t just shove it under your mattress or worse in a safe deposit box (lest the DHS confiscate it in the name of national security). Bury it. Offshore. As anonymously as you can. You might not win every fight with the school yard bully, but you won’t make it easy for him to steal your lunch money either. Let’s talk about some strategies that might work for you. Click here to make an appointment.