February 1, 2016

By: Bobby Casey, Managing Director GWP

If the US continues the same failed fiscal and monetary practices of other socialist “paradises”, it will soon face the same fate.

Just as the voting public holds their nose and casts their vote for the lesser evil every election cycle for all levels of government, so too do legislators hold their noses and cast votes – yea or nay – for the lesser evil. Hidden inside each bill that is supposed to be predominantly about one thing, are several hidden clauses regarding other things. They agree with the solutions for the former, but disagree with the measures in the latter… or vice versa. What to do?

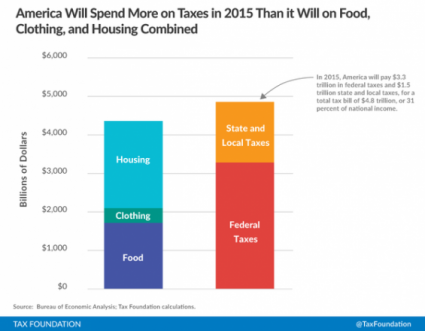

Do that for a few decades and it’s no wonder we are marching toward $20 Trillion in debt with approximately 75,000 of tax code. So would it surprise you that Americans overall are now spending more in taxes than on their basic needs?

This doesn’t include the ancillary taxes along the way, like the tax on their cell phones, or the tax on their utilities, any traffic tickets, any fees for such things as a driver license or registration, filing something with the state or local government (such as a marriage license or a fishing license), or the cost of processing their taxes.

The article doesn’t specify whether that includes property taxes, sales taxes, or fuel taxes either. If that is ONLY the different tiers of income taxes, then indeed we are being fleeced.

What happens when people are spending more on government than in the private sector? What happens when job growth is seen on the government level, and in some cases to a greater extent than in the private sector?

The short answer is: that formula is unsustainable. The math simply doesn’t work. Government jobs are no different than any other government expense. Whether we cut a check for food stamps, or cut a check to the VA, or cut a check for the congressional aids… it matters not. Not a single function of government turns a profit. It’s all a cost. The spending at the Pentagon is as much a burden as the spending at the Department of Education, the EPA, NSA, DHS, Department of Treasury, and Department of Transportation. It’s all a cost with no return. You might feel better about throwing your money away on veteran affairs or the poor than you do setting it on fire with the Pentagon or politician paychecks, but that is a distinction without a difference. Economics doesn’t care about subjective feelings toward a cause, any more than gravity cares about your self-esteem or desires to fly.

In fact, why was it, when we approached a government shutdown or even during the most recent snow storm, the federal government had several thousand “nonessential” workers to send home? If they aren’t essential, what are they doing on the taxpayer payroll? If I were in the same economic situation as the US government, I’d not have a gardener, a pool maintenance fellow, or a maid.

“[T]he shutdown provides the country with a perfect moment to ask why a federal government whose spending habits are an insult to drunken sailors everywhere is paying above-market compensation to hundreds of thousands of ‘non-essential’ workers.” (Nick Gillespie, Time)

I thought Greece was going to be the global example of a dying economy, but they were resuscitated once more by the EU defibrillators. Funny how socialists say there should be no corporation that is too big to fail… unless that corporation is the country and government itself? Gotta love those double standards, huh?

Alas, it was not Greece, but rather Venezuela that would show the world how to truly fail. And the fastest route to failure is socialism sprinkled with just the right amount of crony corruption. Venezuela’s 2016 is so sad and tragic, the only thing missing is Sarah McLaughlin singing in the background.

They are on course for 720% inflation! I can’t even wrap my head around what that means other than no one can afford anything, and that’s assuming there is anything left to buy.

Turns out when you put your friends in charge of industry rather than experts, you lose productivity (about 25% of it to be exact). And when productivity falls, you lose GDP and income. When you lose income, but still want $0.02 gas and free housing, you operate at a deficit. But when you’re a socialist, your go-to solution is printing money.

No one in the top brass of the Venezuela government BELIEVES in inflation! That’s right. Inflation is faith-based, not a verifiable reality. All you gotta do is fix the prices and control the currency exchange.

“The idea was that it could stop inflation without having to stop printing money by telling businesses what they were allowed to charge, and then giving them dollars on cheap enough terms that they could actually afford to sell at those prices. The problem with that idea is that it’s not profitable for unsubsidized companies to stock their shelves, and not profitable enough for subsidized ones to do so either when they can just sell their dollars in the black market instead of using them to import things.” (Source: Washington Post)

Which leads to the economic reality of Venezuela:

“[I]n reality the Venezuela economy no longer exists, with all transactions now taking place in the gray or black markets, and the government apparatus effectively operating in a vacuum.” (Source: Zerohedge)

Interesting to note that all transactions are taking place in the grey and black markets. Citizens are in fact turning to capitalism, like prodigal children, to save themselves from the socialist disaster, and capitalism remains the loyal solution. These black marketeers are of course being depicted by the government as greedy and savage capitalists. The reality is, they are poor and broke and looking for a way for them and their families to survive.

Unless you’re an oil investor, this is horrible news.

Does any of this sound familiar? If not, you have some serious catching up to do. If so, then you are watching as Chinese investors circle like vultures to snatch up American real estate. I don’t say this pejoratively either!

I no more care that China buys up US real estate than I do that Mexicans take US jobs at lower wages. THIS. IS. CAPITALISM. And this capitalism is probably one of the few things keeping the US economy afloat! We here at GWP absolutely advocate buying up undervalued real estate at home and abroad among other diverse investments. I’m constantly scouring the world for investment opportunities to share with you guys.

Vultures are nature’s clean-up crew. They are essential to life. They are scavengers who pick at the bones of what is already dying. What benefit is that to the natural world? It prevents the spread of disease and deadly bacteria.

Economic vultures are not much different. They are scavengers looking for a fire sale on various hard assets. And they cast their lots and scoop up the viable assets from the dead industries. They are cleaning up the mess of failure, salvaging what they can for their own benefit, but subsequently benefiting the whole economy in the process.

Detroit has seen quite a bit of Chinese investor activity. China is the third largest export country for Detroit… and Detroit is now a hot destination point for Chinese real estate investors. Not just the dilapidated homes, but the abandoned corporate buildings. The governor is touting how Detroit is rebounding and coming back, and thanks to foreign investors it is. But if this is true for Detroit, why wasn’t this also true for General Motors? Why didn’t they sell off their assets to other investors who could save it?

The US economy is exhibiting signs of collapse mainly because the US government insists upon employing the same economic tactics as failed socialist countries. This shouldn’t be a surprise. The most fatal mindset one can take is to think things like this will never happen to them; that this sort of economic disaster will never come to their shores. It is time to think about how to protect your interests, your investments, and your assets. Let’s talk. Click here to schedule an appointment.