Asset Protection for the Real Estate Investor

Clearly the world is more litigious today than it was just 10 years ago. I call this phenomenon ‘wealth through litigation’. It is a sad state of affairs when the average American now believes his path to riches lies not with hard work, but with winning a big lawsuit or the lottery.

The litigation problem real estate investors face is twofold – huge exposure and ease of collection. Later in this newsletter I will provide you with an option to virtually eliminate both of those risks, but for now, let me explain with a hypothetical story.

Mike Smith is an average guy who has worked hard, saved money, and invested in residential rental properties in his hometown. Mike has spent the past 10 years building a sizeable portfolio of rental properties that now totals 25 homes. His average rental is valued at $100,000; therefore he is controlling $2.5M in assets. With $1M in various mortgages, this gives him a net worth of $1.5M.

Mike pays about $7000 per month in mortgage payments, puts aside another $7000 per month for repairs and vacancies and collects $20,000 per month in gross rents. This leaves him with $6000 in net profit.

At his job, he earns about $150,000 per year. This gives Mike a net worth of $1.5M and an annual income of $222,000. Sounds pretty decent, right? The problem is Mike has a huge bull’s-eye on his back now. While he may not be rich in today’s standards of Wall Street bankers and political lobbyists, he does has a sizeable net worth and income level.

With this target painted on Mike, he is now financially susceptible to every potential future creditor. The list of predators is virtually endless.

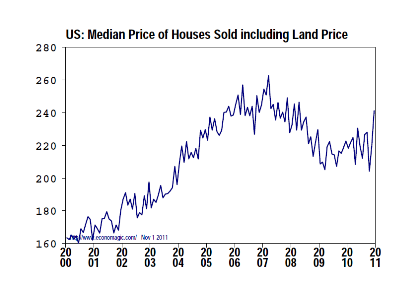

However, right now is quite possibly a once in a lifetime opportunity to become a residential real estate mogul. As you can see from the graph below, housing prices were climbing steadily from 2000 until the crisis began in 2007 where there was a rapid decline and now it appears an uptrend is firmly in place.

There are other demographic issues here that may also provide a tailwind to the rental real estate market. With millions of people having their homes foreclosed on over the past couple of years, there are a lot of people with bad credit scores which place them outside of the realm of bank financing.

We are also seeing an idealogical shift much like the transformation that happened after the great depression in 1929. During this era people began to dramatically cut back their spending habits and focus on self-sustainability. Even the wealthier folks who lived through that time decided that there was no need for their previously opulent lifestyles.

This shift in thought process is happening today as well. I’ve had conversations with several highly successful entrepreneur friends who have made dramatic shifts in their lifestyle even though it wasn’t financially necessary.

In addition to this shift, technological advances over the past few years have provided the ability for workers to be much more transient than before – moving from city to city chasing job opportunities as well as working from a home location more conducive to their lifestyle whilst working remotely.

These various trends have already begun and are creating a shift from home ownership to home rental. I see huge opportunities over the upcoming years for those real estate entrepreneurs willing to work hard and take advantage of this economic transformation.

Of course, herein also lies the problem. Once you begin to develop this portfolio of assets, like Mike Smith, you also increase the size of your bull’s-eye. Do not lose sight of the pitfalls while pursuing the opportunity.

I work with many real estate investors today and one of the biggest problems they face with a properly structured asset protection plan is cost. Asset protection planning can get expensive and it rarely offers any immediate benefit. It’s like buying disability insurance for an Olympic athelete, it’s just hard to justify.

I always advocate getting your personal assets out of your own name as well as segretation of the assets themselves. However, when you are talking about a house that may only cost $50,000, spending $2,000 on a properly stuctured LLC can get cost prohibitive. Especially if you own 25 rental houses.

Using LLC’s is a great way to go as long as they are properly structured, but this requires cafeful planning, registration in the right state and a bulletproof operating agreement. This really isn’t a DIY task.

Another option that is rarely discussed and used almost exclusively by the uber-rich is to have a land trust hold title to your property and use this same properly structured LLC as the trustee.

A land trust can be created for significantly less money than an LLC and because a land trust is not recorded in any public record, it offers you complete anonymity for your real estate holdings.

In the above example with Mike Smith, you could implement a structure using 25 separate land trusts and one or two LLC’s as opposed to 25 LLC’s. This would be significantly more cost effective and equally (if not moreso) as beneficial.

You would create a separate land trust for each property owned and then use the same LLC as the trustee for each of them.

A land trust is a legal entity that exists solely for the purpose of holding assets. A trust has three main elements:

- Beneficiary – the individual(s) who control the trust and its assets. As a beneficiary, you have control of the property held in trust just as if you were the owner and are entitled to profits from the rental or sale of the asset.

- Trustee – The individual (or other entity like an LLC) who actually owns the property in trust. The trustee has the management responsibility of the assets distributing profits according to the terms of the agreement.

- Trust agreement – This contract outlines the terms of how the trust is managed and administered. It spells out the responsibilities of the beneficiaries and the trustee.

The benefits of using a land trust are;

- Privacy of ownership – The property owner of record is only disclosed in the trust agreement. The trust agreement which lists the beneficiaries is not a matter of public record allowing you to retain full control of the asset without creating a public record of your beneficial ownership. This is an ideal asset protection planning tool for real estate holdings because it makes it very difficult for potential creditors to track down your holdings. Frequently attorneys take cases on a contingency basis. If the attorney cannot find any asset of value in your name, he is much less likely to want to pursue a lawsuit against you on this basis. By establishing a veil of privacy around your assets, this frequently is enough of a deterrent to keep the wolves at bay.

- Ease of transfer – Transferring a property held in trust is much easier than transferring a property you own in your own name. The beneficial interest in a trust is considered personal property, not real property therfore you can assign your beneficial interest to another party without a formal closing.

- Ease of control by multiple owners – If there are mulitple partners in a real estate investment, the owners can place the asset in the trust and assign themselves as beneficiaries. Then only the trustee’s signature is required to execute documents as opposed to each and every beneficiary.

- Comined with an LLC as trustee – If you use a properly structured LLC as the trustee, you have created an additional layer of privacy between you and the real estate asset. The LLC, as trustee, effectively serves as property manager keeping all banking records in the name of the LLC as it relates to the property. Additionally, you can also create a 2nd LLC to use as beneficiary as an additional layer of asset protection if so desired.

With a properly developed asset protection plan using land trusts and an LLC, you remedy the investors two biggest dilemmas – huge exposure and ease of collection.

The land trust creates the veil of privacy around the assets making it virtually impossible for creditors to determine the beneficial owners of the real estate. When backed up with the legal asset protection benefits of the properly structured LLC, you create a very cost effective, easily scalable, and bulletproof proof plan that is ideal for residential real estate investors.

If you are a real estate investor and would like to schedule a free 30 minute consultation to learn how we can help you properly structure your bulletproof asset protection plan, contact us today.

Pingback: What Exactly is Asset Protection? | Expat Overseas Radio Network

Pingback: What is Asset Protection? | Offshore and Domestic Asset Protection Planning for Entrepreneurs and Investors

Pingback: Protect Your Assets Like the Uber-Rich