Asset protection is about safeguarding your wealth from lawsuits, creditors, and financial risks. But many people make costly mistakes that weaken their efforts. Here are the most common pitfalls and how to avoid them:

- Timing Issues: Asset protection must be set up before liabilities arise. Waiting until a lawsuit or claim is imminent can lead to legal challenges.

- Wrong Jurisdictions: Choosing weak or non-compliant offshore jurisdictions can expose assets and create tax problems.

- Unqualified Trustees: Trustees without the right expertise can mismanage assets, leading to financial losses and legal risks.

- Ignoring Tax Obligations: Failing to meet U.S. reporting requirements for foreign trusts or accounts can result in severe penalties.

- Poor Trust Structuring: Overly complex or improperly designed trusts can be invalidated by courts, leaving assets unprotected.

- Overcomplication: Multi-jurisdictional setups increase costs, risks, and compliance burdens without adding meaningful protection.

- Skipping Updates: Neglecting to review and maintain your plan can render it ineffective or outdated, especially after life changes or legal updates.

Key Takeaway: Start early, keep your plan simple, and ensure compliance with legal and tax rules. Regular reviews are essential to maintaining effective protection. Below, we’ll dive deeper into these mistakes and how to avoid them.

Mistake 1: Choosing the Wrong Offshore Jurisdiction

Picking the right offshore jurisdiction is critical for ensuring both solid offshore asset protection and tax compliance. A poor choice can leave your assets exposed or create legal headaches that derail your strategy.

Different jurisdictions offer varying levels of asset protection. Some have weak trust laws, automatically enforce foreign court judgments, or appear on international blacklists, leading to banking restrictions. Others offer stronger protections but come with complex reporting requirements. Missing these can lead to hefty penalties – for instance, the IRS can impose a 35% penalty on the trust corpus for failing to report the creation of a foreign trust or asset transfers to it.

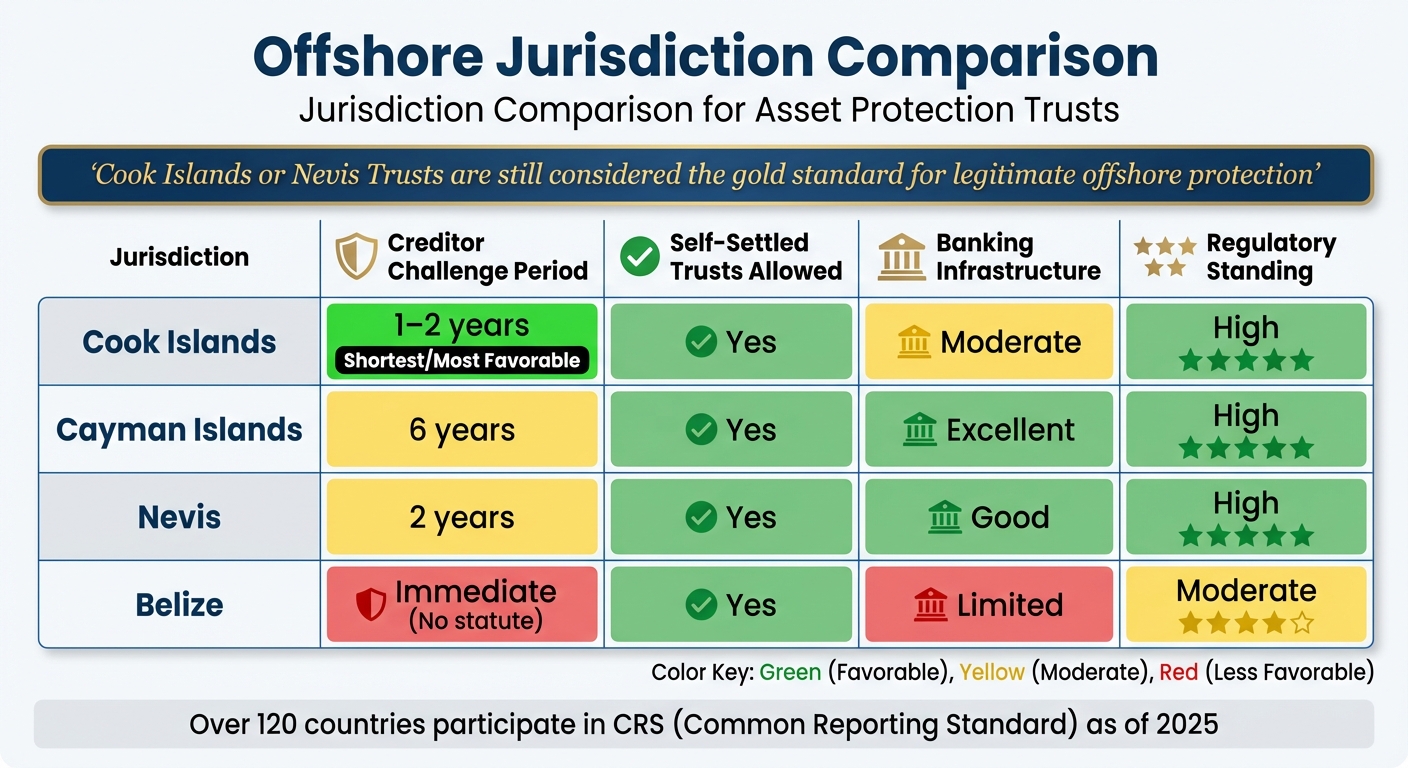

When choosing a jurisdiction, focus on key factors that ensure robust asset protection. Common law jurisdictions like the Cook Islands and Nevis often provide better creditor protection compared to civil law systems. These jurisdictions don’t automatically recognize U.S. court judgments, forcing creditors to re-litigate locally under stricter rules.

"Cook Islands or Nevis Trusts… are still considered the ‘gold standard’ for legitimate offshore protection. Courts in these jurisdictions don’t recognize U.S. judgments, forcing creditors to re-litigate locally – an expensive and difficult process."

- James G. Bohm, Attorney, Bohm Wildish & Matsen, LLP

The time creditors have to challenge your trust varies widely. For example, the Cook Islands offers one of the shortest windows – just 1–2 years. In contrast, the Cayman Islands allows challenges for up to 6 years. A shorter challenge period means creditors have less time to act, strengthening your asset protection strategy. Below, we’ll explore how to assess a jurisdiction’s legal framework before tackling tax considerations.

How to Evaluate Legal Protections and Stability

Start by reviewing the jurisdiction’s legal system. Common law systems often provide stronger frameworks for asset protection trusts, particularly self-settled spendthrift trusts, which allow you to be both the settlor and beneficiary. Many U.S. states don’t recognize these structures, making offshore options an essential tool for comprehensive protection.

In strong jurisdictions, creditors must prove "intent to defraud" beyond a reasonable doubt, creating a significant hurdle that discourages frivolous lawsuits. For instance, the Cook Islands requires creditors to post substantial bonds after proving fraud, making legal challenges prohibitively expensive.

Also, check the jurisdiction’s track record and governmental stability to ensure reliable protection. Avoid jurisdictions flagged by international bodies like the Financial Action Task Force (FATF), as these face severe banking restrictions. Additionally, over 120 countries now participate in the Common Reporting Standard (CRS) for automatic financial information exchange as of 2025. This means modern asset protection depends on legal barriers, not secrecy.

| Jurisdiction | Creditor Challenge Period | Self-Settled Trusts Allowed | Banking Infrastructure | Regulatory Standing |

|---|---|---|---|---|

| Cook Islands | 1–2 years | Yes | Moderate | High |

| Cayman Islands | 6 years | Yes | Excellent | High |

| Nevis | 2 years | Yes | Good | High |

| Belize | Immediate (No statute) | Yes | Limited | Moderate |

Ensure the jurisdiction enforces strict licensing and oversight for trustees. This ensures that trustees operate under high standards and maintain proper insurance coverage. Additionally, seek dual legal opinions – from U.S. counsel and local experts – to confirm compliance with both domestic and offshore laws. This step is crucial to avoid missteps that could make your structure appear as a tax evasion tool.

Lastly, consider economic substance rules. Many jurisdictions now require entities to demonstrate physical presence or actual business activity to maintain their tax status and legal standing, ensuring your structure serves a legitimate purpose beyond tax minimization.

Understanding Tax Implications and Reporting Requirements

Once you’ve assessed legal protections, it’s time to address tax implications tied to your jurisdiction choice.

U.S. taxpayers are taxed on worldwide income, meaning offshore structures won’t eliminate your tax obligations. Instead, these structures provide legal protection while requiring strict compliance with reporting rules.

Check if the jurisdiction has signed U.S. Tax Information Exchange Agreements (TIEAs). You can find this information on the U.S. Treasury website. Many jurisdictions and financial institutions now report U.S. account holder information directly to the IRS under the Foreign Account Tax Compliance Act (FATCA).

Understanding grantor trust rules is also essential. Under IRC Sections 671-679, if a U.S. person transfers assets to a foreign trust with a U.S. beneficiary, they are typically treated as the owner for tax purposes. This means you’ll be taxed on the trust’s income, even if you don’t receive distributions.

| Requirement | Form Number | Purpose | Filing Deadline |

|---|---|---|---|

| Foreign Trust Transactions | Form 3520 | Reports the creation of, transfers to, or distributions from a foreign trust | April 15 |

| Foreign Trust Annual Return | Form 3520-A | Provides annual information about a foreign trust with a U.S. owner | 15th day of the 3rd month after the trust’s tax year |

| Foreign Bank Accounts | FinCEN Form 114 (FBAR) | Required for financial interest in foreign accounts exceeding $10,000 | April 15 |

| Specified Financial Assets | Form 8938 | Reports specified foreign financial assets if they exceed certain thresholds | April 15 (with tax return) |

"Compliance with appropriate reporting standards is crucial if you plan to use an offshore trust."

- Karen L. Goldberg, Partner-in-Charge of National Tax Trusts and Estates, EisnerAmper

Finally, be cautious about holding assets through foreign corporations, as this could trigger tax regimes like Passive Foreign Investment Company (PFIC) or Controlled Foreign Corporation (CFC). These come with heavy reporting requirements and potentially unfavorable tax treatment.

sbb-itb-39d39a6

Mistake 2: Selecting an Unqualified Trustee

The trustee plays a key role in safeguarding your assets. Choosing the wrong person or entity for this responsibility can jeopardize everything you’ve worked to protect.

An unqualified trustee, especially one who lacks independence, can make your trust vulnerable to creditor claims by appearing too closely tied to you. Poor decision-making regarding distributions or administrative missteps – like missing required filings or failing to maintain separate records – can lead to hefty financial penalties. It’s essential that your trustee is well-versed in these responsibilities to avoid costly IRS fines.

"Trustees carry substantial fiduciary duties extending far beyond basic asset custody."

- Offshore Protection

Corporate trust companies often outperform individual trustees. They bring specialized departments focused on tax law and regulatory compliance, ensuring continuity through their corporate structure. These companies also maintain a professional distance from beneficiaries, reducing the emotional conflicts and poor judgment that can sometimes arise when family or friends are appointed. To avoid these risks, it’s important to fully understand what a trustee’s role entails.

What a Trustee Does

A trustee is tasked with managing, administering, and distributing the assets in your trust according to the instructions laid out in your trust document. This role requires a high level of expertise, as trustees must maintain detailed records, file tax documents, and handle complex assets like intellectual property or business interests.

In the case of asset protection trusts, the trustee’s role becomes even more critical. Distributions are made at the discretion of an independent trustee, creating a legal barrier that prevents creditors from forcing payouts. This discretion requires a delicate balance between meeting the needs of beneficiaries and protecting the trust’s assets from claims.

The trustee also acts as the main liaison with regulatory authorities. For foreign trusts owned by U.S. citizens, trustees must file annual information returns and work closely with tax advisors to ensure compliance. Keeping the trust structure at "arm’s length" from you is vital – greater independence makes it harder for creditors to access the trust’s assets.

For offshore trusts, trustees must navigate the legal and regulatory landscape of their jurisdiction while also adhering to U.S. reporting requirements. This dual skill set is crucial to maintaining both asset protection and tax compliance. When executed properly, the trustee’s role strengthens the overall security of your trust.

How to Evaluate Trustee Qualifications

The qualifications of your trustee are just as important as the jurisdiction of your trust. Start by confirming that the trustee is licensed to operate in the chosen jurisdiction. For domestic asset protection trusts, at least one trustee must reside or be a corporate entity based in the state where the trust was established.

Conduct thorough due diligence. Review their business registrations, financial statements, and regulatory compliance history across all jurisdictions where they operate. It’s also wise to investigate their litigation history – specifically, how they’ve defended trusts under legal challenges and whether they’ve faced regulatory penalties or client complaints.

"A reputation for integrity and confidentiality is a must-have in a trustee."

Make sure the trustee has adequate insurance to cover administrative errors or omissions. Professional trustees are typically subject to strict regulatory oversight, providing additional layers of protection that often surpass domestic standards.

If your trust includes specialized assets like business holdings, real estate, or cryptocurrency, confirm that the trustee has experience managing these types of assets successfully. Be cautious of trustees who focus exclusively on one jurisdiction; instead, seek professionals who can offer comparative analysis tailored to your unique needs.

Finally, assess their communication and transparency. Pay attention to how responsive they are and whether they clearly outline their fee structures upfront. Setup costs can range from a few thousand to tens of thousands of dollars, with ongoing annual fees covering administration, compliance, and other professional services. Understanding these costs ahead of time helps you avoid surprises and ensures you’re getting value for your investment. Choosing a trustee with these qualifications is a critical step in building a solid asset protection plan.

Mistake 3: Ignoring Tax Reporting Obligations

Some believe that setting up offshore trusts or holding foreign accounts completes their asset protection strategy. However, U.S. taxpayers are required to meet strict foreign asset reporting rules. Ignoring these obligations can lead to severe penalties.

For example, if you fail to report over $5,000 in gross income, the statute of limitations for an IRS audit extends to six years. On top of that, you could face a 40% penalty on any tax understatement tied to unreported foreign assets.

"Failure to satisfy the information reporting requirements can result in significant penalties, as well as an extended time to assess any tax imposed with respect to the period to which the information relates."

The Foreign Account Tax Compliance Act (FATCA) requires foreign institutions to report U.S. account information directly to the IRS. This means any discrepancies in your filings are likely to be uncovered quickly.

International Reporting Standards You Need to Know

U.S. taxpayers must navigate several reporting frameworks, each with its own thresholds and deadlines. Under FATCA, you must file Form 8938 with your annual tax return if your foreign financial assets exceed specific limits. For unmarried individuals living in the U.S., the thresholds are $50,000 at year-end or $75,000 at any point during the year. For married couples filing jointly, the limits increase to $100,000 and $150,000, respectively.

FBAR (FinCEN Form 114) has separate requirements. You need to report financial accounts – such as bank accounts, brokerage accounts, and mutual funds – if their total balance exceeds $10,000 at any time during the year. This form is filed electronically through the FinCEN BSA E-filing System and is due by April 15, with an automatic extension to October 15.

| Form | Threshold (U.S. Residents) | Where to File | Deadline |

|---|---|---|---|

| Form 8938 (FATCA) | $50,000 (year-end) / $75,000 (anytime) | Attached to tax return (IRS) | April 15 (with extensions) |

| FBAR (FinCEN 114) | $10,000 (any time) | FinCEN BSA E-filing System | April 15 (auto extension to Oct 15) |

If you’re involved with foreign trusts, additional forms are required. For instance, creating a foreign trust, transferring property to one, or receiving distributions means you must file Form 3520. The trust itself must file Form 3520-A annually by March 15 for calendar-year trusts. If the trust does not file, you must submit a substitute Form 3520-A to avoid penalties.

To ensure accuracy, all foreign currency values must be converted using the U.S. Treasury Bureau of the Fiscal Service exchange rate as of the last day of the tax year.

Staying compliant with these reporting standards is critical to avoiding the financial and legal consequences described below.

What Happens When You Don’t Comply

Failing to file Form 8938 comes with an initial penalty of $10,000. If you ignore the requirement after being notified by the IRS, you could face an additional $10,000 penalty for every 30 days of non-compliance, up to a maximum of $50,000.

FBAR violations are handled separately. Non-willful violations can result in fines up to $10,000. For willful violations, the penalties are much harsher – the greater of $100,000 or 50% of the account’s total balance at the time of the violation.

The consequences don’t stop at civil penalties. Willful non-compliance can lead to criminal prosecution. The IRS and Department of Justice actively pursue cases involving undisclosed foreign assets, which can result in steep fines and even imprisonment.

If you’ve missed reporting foreign assets in previous years, you might consider using the IRS Criminal Investigation Voluntary Disclosure Practice or Streamlined Filing Compliance Procedures. These programs offer a way to come into compliance and may reduce penalties, but they require full transparency and cooperation. Taking action before the IRS identifies any non-compliance is crucial.

While choosing the right legal jurisdiction and trustee is essential, staying on top of tax reporting obligations is just as critical for safeguarding your assets.

Mistake 4: Poor Trust Structuring and Asset Transfers

A poorly designed trust can completely undermine your asset protection efforts. Courts often reverse transfers that seem rushed, lack proper documentation, or leave the person setting up the trust without enough funds to cover their debts. The way a trust is structured is just as crucial as the timing of its creation.

If a trust gives you too much control, courts might label it a "sham" and treat the assets as if they still belong to you. Additionally, transferring assets when you’re already facing legal trouble can lead to fraudulent transfer claims, which can invalidate your entire arrangement.

How to Avoid Fraudulent Transfer Claims

Fraudulent transfers happen when assets are moved to block, delay, or deceive creditors. Courts don’t need to prove bad intentions – if you transfer assets while insolvent or for less than their fair market value, it could be considered "constructive fraud".

"A plan that is set up long before any legal action occurs is more likely to be viewed as legitimate in the eyes of a court."

Courts often look for red flags, known as "badges of fraud", such as transferring assets to family members, keeping control over the transferred assets, hiding transactions, or making transfers right before or after a lawsuit is filed. In most U.S. states, creditors can challenge such transfers for up to four years after they occur or within one year of discovering them. Offshore jurisdictions like the Cook Islands and Nevis typically reduce this window to around two years.

To steer clear of fraudulent transfer claims, set up your trust well before any potential legal issues arise. Keep enough assets outside the trust to cover your financial obligations, and ensure you receive "reasonably equivalent value" for any assets you transfer. Document legitimate reasons for the transfer, such as estate planning or tax efficiency, to demonstrate it wasn’t solely to avoid creditors. Avoid appointing family members or close associates as trustees, as courts may view them as "insiders" under your influence.

Next, let’s look at how to structure your trust to create a clear separation between personal and trust assets.

How to Structure Trusts for Maximum Protection

To protect your assets effectively, choose a trust structure that limits your control and creates a clear divide between you and the assets. Revocable trusts won’t help here – they offer no protection from creditors because you retain full control, making the assets legally yours. Instead, consider an irrevocable trust, which transfers ownership of the assets out of your hands permanently.

Among irrevocable trusts, discretionary trusts provide stronger protection than fixed trusts. Fixed trusts require specific payments to beneficiaries, which creditors could claim. Discretionary trusts, on the other hand, give trustees full control over when and how much to distribute, making it harder for creditors to access the assets.

Including a spendthrift clause can further shield beneficiary interests from creditors. It’s also wise to appoint an independent trustee – ideally, an institutional trustee located in a favorable jurisdiction – rather than serving as the trustee yourself. This helps maintain an arm’s-length relationship and strengthens the trust against claims that it’s merely an extension of your personal assets.

"The more you respect the entity as being separate from your personal assets, the more likely the entity’s assets will be protected from your creditors."

- Adam Frank, Managing Director, Head of Wealth Planning and Advice, J.P. Morgan Wealth Management

As of 2024, 17 U.S. states, including Nevada, South Dakota, Delaware, and Wyoming, allow self-settled domestic asset protection trusts (DAPTs). Offshore trusts and private interest foundations, while offering even greater security by operating outside U.S. legal jurisdiction, come with added complexity and higher compliance costs.

For the strongest protection, consider layering your approach: transfer assets into a Limited Liability Company (LLC) and then place the LLC interests into an irrevocable trust. Treat the trust as a completely separate legal entity, maintaining its own records, books, and tax filings. Never mix trust funds with personal accounts or use them for personal expenses – this could cause courts to dismantle the trust structure.

Keep in mind that even the best-structured trusts have limits. They cannot shield assets from obligations like child support, alimony, or federal taxes. Avoid trying to set up trusts on your own. These arrangements are complex, and they must meet specific state laws to hold up in court.

Mistake 5: Creating Overly Complex Multi-Jurisdictional Structures

Adding too many jurisdictions to your asset protection plan can create unnecessary complications. Just like choosing the right jurisdiction and trustee, keeping things simple is critical for maintaining a strong and manageable structure. Every additional country, trust, or entity creates more reporting requirements, coordination challenges, and compliance costs that can quickly spiral out of control.

"When setting up multi-jurisdiction protection, simplicity is often better. If you overcomplicate your structure, you must deal with even more reporting and compliance requirements."

- Blake Harris, Attorney, Blake Harris Law

This added complexity doesn’t just make operations more cumbersome – it also increases management risks. Coordinating trustees, LLC managers, and trust protectors across different time zones and legal systems can become a logistical nightmare. On top of that, political or regulatory changes in one jurisdiction can freeze your accounts when you need liquidity the most. For physicians, who face a 31.2% chance of being sued during their careers, losing access to funds could be catastrophic.

Managing multiple jurisdictions also means higher administrative costs and a greater chance of attracting tax scrutiny. The IRS closely monitors offshore arrangements, and even a minor filing error in one jurisdiction can lead to penalties, even if no taxes are owed. Trustee fees, registered agent costs, annual filings, and legal reviews can drain your resources faster than the protection they provide.

"Oftentimes, the simpler solution will give you the protection that you need."

- Adam Frank, Managing Director, Head of Wealth Planning and Advice, J.P. Morgan Wealth Management

Finding the Right Balance Between Complexity and Simplicity

Start with domestic protections before considering offshore options. Tools like umbrella liability insurance, homestead exemptions, and ERISA-qualified retirement plans provide strong safeguards without the complications of international structures. For example, Traditional and Roth IRAs protect up to $1,000,000 in bankruptcy cases, and employer-sponsored retirement plans enjoy unlimited federal protection.

If domestic options aren’t enough, focus on a single offshore jurisdiction with proven legal protections rather than spreading assets across several countries. Jurisdictions like the Cook Islands, Nevis, and Belize offer strong creditor protection and short statutes of limitations on fraudulent transfer claims – typically one to two years. A straightforward structure, such as an LLC held within a Cook Islands trust, allows you to maintain operational control through the LLC while the trust adds a protective legal layer.

For a middle ground, consider Domestic Asset Protection Trusts (DAPTs). Around one-third of U.S. states now allow DAPTs, which combine domestic convenience with some of the strength of offshore trusts.

It’s also essential to keep enough liquidity in the U.S. Don’t lock all your cash in offshore accounts, where political changes or banking restrictions could leave it stranded. Retain enough accessible funds domestically to cover legal defense costs or settlement negotiations. And remember, every entity in your structure must serve a valid business purpose beyond asset protection – courts can easily dismantle arrangements designed solely to block creditors.

When choosing jurisdictions, practical considerations like language barriers, time zones, and the quality of local professionals matter more than you might think. These details directly affect how effectively you can manage your structure. To avoid being trapped in a single jurisdiction, include "flight clauses" in your trust documents. These allow your trust to automatically relocate to a more favorable jurisdiction if circumstances change.

| Strategy | Complexity Level | Primary Benefit |

|---|---|---|

| Umbrella Insurance | Low | Broad liability coverage for major claims |

| ERISA Retirement Plans | Low | Unlimited federal bankruptcy protection |

| Domestic LLC | Medium | Limits personal liability for business debts |

| Single Offshore Trust | High | Maximum protection outside U.S. jurisdiction |

The goal is to create a structure that offers real protection without becoming a financial or administrative burden. Simpler plans are easier to maintain and less likely to fail under pressure. Every additional layer in your structure should justify its cost by providing measurable benefits. By streamlining your asset protection strategy, you can safeguard your wealth effectively while avoiding unnecessary headaches and expenses.

Mistake 6: Skipping Succession Planning and Regular Maintenance

Keeping your asset protection plan up-to-date isn’t just a good idea – it’s a must. Without regular updates and proper succession planning, you risk leaving your heirs with unnecessary headaches or even losing assets entirely. For instance, offshore bank accounts can become inaccessible if heirs aren’t informed, and many foreign banks aren’t obligated to report unclaimed accounts to U.S. authorities. To put it into perspective, New York State alone returns about $1.5 million in unclaimed funds daily, largely because these assets were never included in estate plans.

The numbers paint a concerning picture: only 24% of Americans had a will in 2025, a drop from 33% in 2022. Meanwhile, the federal estate tax exclusion for 2025 sits at $13,990,000 ($27,980,000 for married couples), but this is temporary – it’s set to shrink significantly in 2026. Without regular reviews, your plan could quickly become ineffective, leaving your assets unprotected or subject to higher taxes.

"The offshore bank accounts that provided safety and privacy during your lifetime can be lost forever if your family members have no clue about their existence."

- Jiah Kim, Attorney, Jiah Kim & Associates

Another challenge is that U.S. executors have no authority over foreign assets. This means heirs often have to navigate complex local legal systems to recover them. In Singapore, for example, recovering deposits over $5,000 requires hiring a local attorney and obtaining a court-issued letter of administration. These hurdles can delay asset recovery for years. To avoid such issues, it’s vital to implement clear, proactive succession plans.

How to Create Effective Succession Plans

Start by keeping a detailed and updated inventory of all your assets. This should include everything from international property deeds and bank accounts to insurance policies and digital assets like cryptocurrency private keys.

Your trust documents should also address incapacity. Define what incapacity means and include provisions for medical assessments to trigger the automatic succession of trustees or protectors. Align these documents with your estate plan to prevent conflicts. For example, if your LLC operating agreement names different beneficiaries than your will, you’re setting the stage for family disputes. This is especially important as age-related conditions like dementia become more common – one in 11 people over 65 in the UK is affected.

"Trustees are well advised to be mindful of incapacity issues and endeavour to be ‘ahead of the curb’ to minimise their impact on the administration of trust structures."

- Ashley Fife and Michael Giraud, Trust Professionals, Standard Bank

Don’t overlook beneficiary designations on retirement accounts and life insurance policies. These should align with your trust structure. Keep in mind that beneficiaries often need to empty inherited retirement accounts within 10 years, which can lead to significant tax implications if not planned for.

For offshore assets, research specific tools available in each jurisdiction. Some countries offer options like "Transfer on Death" (TOD) or "Payable on Death" (POD) designations, while civil law countries may use "usufruct" rights to bypass probate.

Modern succession plans should also cover email accounts, social media, and cryptocurrency. Privacy laws often block family access unless prior authorization is included. A letter of instruction stored with your legal documents can help ensure these assets are handled properly.

Why You Need to Monitor and Update Your Asset Protection Structures

Regular reviews are just as important as creating the plan itself. Aim to revisit your asset protection and estate plans every 3–5 years. Tax laws change frequently, and what works today might cause problems in the future. For example, the federal estate tax exclusion is set to drop in 2026, which could significantly alter your tax liability.

Life events are another trigger for updates. Events like births, marriages, divorces, or deaths require immediate adjustments. Similarly, children who were minors when you set up your trust may now be ready to serve as trustees or executors. Don’t forget to remove former spouses as beneficiaries or add new children to your distribution plans.

| Review Trigger | Key Considerations |

|---|---|

| Life Events | Birth, marriage, divorce, death, or children reaching adulthood |

| Financial Changes | Significant wealth increase, inheritance, or acquisition of risky assets |

| Legal Changes | Federal/state tax law shifts, new state residency, or digital asset law changes |

| Fiduciary Status | Death, retirement, or diminished capacity of a named trustee or executor |

Properly titling your assets is another common oversight. It’s not enough to create a trust – you need to transfer assets into it. This includes new bank accounts, properties, and insurance policies. If you move to a different state, update your plan to reflect changes in estate tax thresholds, inheritance taxes, and property laws.

"Many estate plans no longer meet their original intent due to inattention and a lack of routine updating."

Also, review incapacity documents if they’re more than four years old. Healthcare powers of attorney and living wills should include HIPAA waivers to ensure your representatives can access necessary medical information. Submit signed HIPAA forms directly to your healthcare providers to avoid delays.

If you have offshore structures, stay on top of compliance requirements like filing Form 3520-A for foreign trusts. The penalties for noncompliance are steep, even if no taxes are owed. Filing errors in one jurisdiction can create a ripple effect, complicating your entire structure.

Lastly, communicate your plan to your family. Discuss why you’ve set up certain structures or made unequal distributions while you’re still able. Transparency now can prevent resentment and legal battles later. Remember, even the best asset protection plan only works if those responsible for carrying it out understand it.

Conclusion

Protecting your assets requires careful planning and consistent upkeep. As we’ve explored, common errors – like choosing the wrong jurisdiction or neglecting to update your plan – can jeopardize even the best intentions. The good news? Most of these mistakes can be avoided with a forward-thinking approach.

Timing matters. Asset protection strategies must be in place well before any financial or legal troubles arise. If you wait until creditors or lawsuits are on the horizon, transfers made during that time could be undone under fraudulent transfer laws. Acting early is not just smart – it’s essential.

"Asset protection is not about hiding wealth. It is about anticipating risks and building a structure strong enough to withstand them."

It’s also important to stay compliant with legal and tax obligations. For U.S. citizens, international asset protection strategies don’t eliminate the requirements to report worldwide income or comply with FBAR and FATCA regulations. The strongest plans often blend domestic tools – like insurance and well-structured entities – with offshore components, but only after thorough legal and tax evaluations.

Keep your plan straightforward but effective. A multi-layered defense using tools such as insurance, trusts, and LLCs can shield you from a variety of risks. This underscores the importance of creating a balanced, flexible strategy, as we’ve discussed earlier. To keep your plan relevant, review it every three to five years or after significant life changes. This ensures it stays aligned with current laws and your financial goals.

With early action, regular reviews, and a well-rounded approach, you can create a solid framework to safeguard what you’ve worked so hard to achieve.

FAQs

Why is selecting the right offshore jurisdiction crucial for protecting your assets?

Choosing the right offshore jurisdiction plays a critical role in ensuring your assets are well-protected from creditors, lawsuits, or government actions. Different countries have varying legal frameworks, which directly impact the level of protection you can expect. Take the Cook Islands or the Cayman Islands, for example – these jurisdictions are known for offering strong asset protection through self-settled trusts and imposing short time limits for creditor challenges. On the other hand, some jurisdictions lack these protections, leaving your assets more exposed, even if they’re held offshore.

Beyond legal safeguards, the best jurisdiction can provide practical advantages like confidentiality, political and economic stability, and dependable banking systems. These factors not only help maintain your privacy but also reduce the risk of forced disclosure while ensuring compliance with U.S. reporting requirements. By carefully selecting the right jurisdiction, you can enhance your asset protection strategy and avoid unnecessary legal or financial hurdles.

What are the dangers of choosing an unqualified trustee to manage my assets?

Choosing the wrong trustee can put your entire asset protection plan at risk. Without the right expertise, a trustee may fail to fulfill their fiduciary duties, leading to bad investment choices, administrative mistakes, or even breaches of trust. These missteps can leave your assets exposed to risks like lawsuits, creditor claims, or unnecessarily high taxes.

An inexperienced trustee may also struggle to keep up with changing laws and regulations, potentially causing your trust to be invalidated or labeled a “sham” in court. If that happens, the protections your trust was meant to provide could vanish, leaving both your personal and business finances open to threats.

To protect your assets, select a trustee with a proven track record, relevant legal or financial qualifications, and a clear understanding of your asset protection goals. A capable trustee will ensure your trust functions as intended and shields your assets from unnecessary risks.

What steps should I take to comply with U.S. tax reporting requirements for foreign assets?

To meet U.S. tax reporting requirements for foreign assets, it’s crucial to file the correct forms on time. Here are the key forms to be aware of:

- FinCEN Form 114 (FBAR): Mandatory if the combined value of your foreign accounts exceeds $10,000 at any point during the year.

- IRS Form 8938: Required under FATCA for reporting specified foreign financial assets.

- Form 3520 and Form 3520-A: Necessary for reporting foreign trusts or gifts (with Form 3520-A specifically for foreign trusts).

Maintain thorough records of your foreign accounts and assets, such as account numbers, the names of financial institutions, and account balances. It’s also vital to regularly check reporting thresholds and stay informed about updates to tax laws to avoid costly penalties. For added peace of mind, consider consulting a qualified tax professional to ensure you’re fully compliant with all regulations.