Digital Nomad Visas by Cost: Europe vs. Asia

Explore the key differences in digital nomad visas between Europe and Asia, focusing on costs, benefits, and tax implications for remote workers.

Explore the key differences in digital nomad visas between Europe and Asia, focusing on costs, benefits, and tax implications for remote workers.

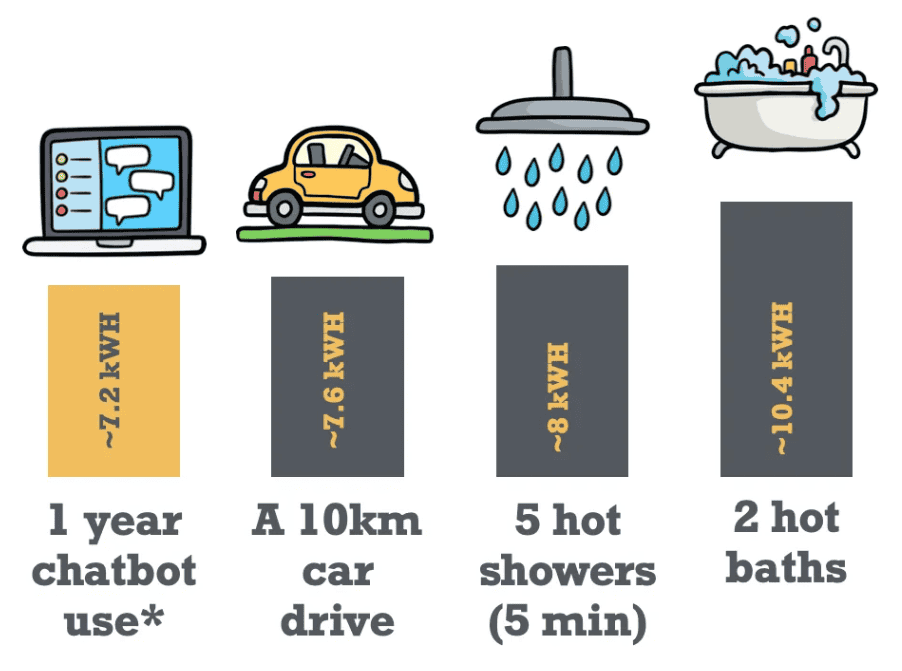

AI is driving up energy bills, so can what digital entrepreneurs do to curb soaring costs, optimize power usage, and boost profits? In the race

Aligning OFAC and AML frameworks enhances compliance, reduces risks, and simplifies financial operations for organizations with international exposure.

Explore the best countries for angel investment in 2025, focusing on tax benefits, investor networks, and growth opportunities for startups.

Explore how arbitration clauses can streamline dispute resolution for offshore companies, offering privacy, speed, and international enforceability.

Explore how Double Tax Treaties significantly reduce U.S. withholding tax rates on dividends, interest, and royalties for cross-border transactions.

ALMOST THERE! PLEASE COMPLETE THIS FORM TO GAIN INSTANT ACCESS

Privacy Policy: We hate SPAM and promise to keep your email address safe.