Remote work has opened the door for Americans to combine their careers with long-term international travel. Digital nomad visas make this possible by legally allowing remote workers, freelancers, and self-employed professionals to live and work abroad for extended periods – often far beyond the limits of standard tourist visas. These visas typically last from six months to two years, with options to renew, and are designed to attract skilled professionals while boosting local economies.

Here’s a quick look at nine standout options:

- Spain: One-year visa, renewable up to five years. Pathways to permanent residency and citizenship.

- Thailand: Five-year Destination Thailand Visa. Flexible entry and stay options with a focus on remote workers and freelancers.

- Portugal: One-year Digital Nomad Visa (D8), renewable. Offers a path to permanent residency and tax benefits.

- Philippines: One-year visa, renewable for another year. Affordable living and English-speaking environment.

- Taiwan: Three-year Employment Gold Card. Combines residence and work authorization.

- Japan: Six-month visa, non-renewable. A short-term option for experiencing Japan while working remotely.

- Italy: One-year visa, renewable. Path to permanent residency after five years.

- Estonia: One-year Digital Nomad Visa. Strong digital infrastructure and EU access.

- Costa Rica: Rentista Visa for temporary residency. Territorial tax system and relaxed lifestyle.

These visas vary in duration, costs, and benefits, so choosing the right one depends on your income, lifestyle, and long-term plans. Whether you’re drawn to Europe’s interconnected travel perks, Southeast Asia’s affordability, or Costa Rica’s tax advantages, there’s likely a program that fits your remote work goals.

1. Spain – Digital Nomad Visa

Spain’s Digital Nomad Visa offers an enticing option for those seeking long-term residency, with pathways to both permanent residency and citizenship.

Visa Duration and Renewability

Here’s how it works: The visa is valid for 12 months initially and can be renewed for up to a total of five years. To maintain eligibility, renewals must be submitted between 60 days before and 90 days after the permit’s expiration. Visa holders are required to spend at least six months per year residing in Spain.

After five years of continuous legal residence – defined as living in Spain for at least 183 days per year – holders can apply for permanent residency. Beyond that, Spanish citizenship becomes an option after 10 years of continuous residence. However, individuals from certain regions or those with Sephardic Jewish heritage may qualify for citizenship in just two years.

2. Thailand – Destination Thailand Visa (DTV)

Thailand introduced the Destination Thailand Visa (DTV) in July 2024, catering to digital nomads, freelancers, and remote workers seeking a base in the country.

Eligibility Requirements

The DTV is open to applicants under three main categories:

- Workcation: This category is tailored for digital nomads and remote workers. To qualify, applicants need to provide proof of employment or freelance status. Unlike some other visas, there are no minimum income requirements or social media follower thresholds.

- Thai Soft Power Activities: This option is for those planning to immerse themselves in long-term activities like learning Muay Thai, taking Thai cooking classes, or attending local festivals and seminars. While there’s no strict rule, staying for at least six months can improve approval odds.

- Family Members: Spouses and unmarried dependent children under 20 years old can join the primary applicant. However, each dependent must apply for their own visa and pay a separate fee.

Applicants must meet a few additional conditions: they need to be at least 20 years old, have no significant visa overstay history with Thai Immigration, and prove access to liquid assets of about $15,000–$16,000 USD (500,000 THB) through official six-month bank statements. Some embassies may request higher amounts.

Visa Duration and Renewability

The DTV is valid for five years and includes multiple-entry privileges. Each stay allows up to 180 days, with the option to extend for another 180 days, giving nearly a year before re-entry is required. Once the extended period ends, applicants must exit and re-enter Thailand to reset the stay period. Extensions are processed in person at Thai Immigration in Chaeng Wattana.

Application Fees

The fee for the initial visa is 10,000 THB, which is approximately $300–$500 USD. If you choose to extend your stay for an additional 180 days, the extension fee is 1,900 THB. With its five-year validity and multiple-entry allowance, the DTV offers excellent value for those planning extended stays in Thailand.

Tax Implications

DTV holders are not eligible for Thai work permits and cannot earn income from Thai-based companies. All income must come from foreign sources, as working for a local employer would breach the visa’s terms.

Strategic Benefits

The DTV is ideal for digital nomads due to its flexibility. Its multiple-entry feature allows for regional travel and deeper engagement with Thailand’s culture without the hassle of additional re-entry permits. However, since requirements can vary by embassy and approval depends on immigration officers, working with a visa specialist can help streamline the application process.

3. Portugal – Digital Nomad Visa (D8)

Portugal’s Digital Nomad Visa (D8) is designed for remote workers, freelancers, and digital entrepreneurs seeking a mix of professional flexibility and a great lifestyle. With its welcoming environment and attractive tax benefits, Portugal has become a top choice for those looking to balance work and leisure.

Eligibility Requirements

To qualify, applicants need to demonstrate a stable income from foreign sources. Additional requirements include:

- Recent bank statements

- A clean criminal record

- Valid comprehensive health insurance

- Proof of accommodation, either through a rental agreement or property ownership

These straightforward criteria make the process approachable for many digital professionals.

Visa Duration and Renewal

The D8 visa is initially valid for one year, but it’s designed with long-term residents in mind. After the first year, it can be renewed for multi-year periods. Over time, this path can lead to permanent residency. Another perk? Visa holders enjoy the freedom to travel throughout the Schengen Area.

Application Fees

There are a few costs to consider, including a visa processing fee and a separate fee for the residence permit. Additional expenses, like document translation or certification, may also come into play during the application process.

Tax Implications

Portugal’s Non-Habitual Resident (NHR) tax regime is a big draw. It offers potential tax reductions or exemptions on certain types of foreign-sourced income. To make the most of these benefits, applicants should carefully review the program’s requirements and timing.

Lifestyle and Strategic Benefits

Portugal combines a high quality of life with relatively low living costs. Cities like Lisbon and Porto are hotspots for digital nomads, offering dynamic communities and excellent coworking spaces. For those who prefer a slower pace, smaller towns provide charm and tranquility. Plus, Portugal’s reliable internet and time zone are ideal for working with both European and U.S. clients.

While Portugal’s real estate-based Golden Visa remains an option, the D8 visa is tailored for remote workers, emphasizing lifestyle perks and tax incentives over property investment.

4. Philippines – Digital Nomad Visa

The Philippines offers a Digital Nomad Visa that’s valid for 12 months, with the option to renew for another 12 months, allowing remote workers to stay in the country for up to 2 years.

Eligibility Requirements

To apply, you’ll need to show proof that you can work remotely. This could be through employment contracts, freelance agreements, or business registration documents. Other essential requirements include:

- Proof of monthly income

- Comprehensive health insurance

- A clean criminal background check

- A passport with at least 18 months of validity remaining

Application Process and Fees

The Bureau of Immigration handles the application process, and fees generally range between $200 and $500 USD. The exact cost depends on the processing speed and any additional services you choose. The application system is user-friendly, allowing most documents to be submitted online. However, some paperwork may need to be notarized or certified with an apostille.

Benefits and Strategic Advantages

This visa provides legal work authorization while letting you enjoy the Philippines’ affordable cost of living and its English-speaking population. The country’s 7,000+ islands offer a mix of vibrant city life in places like Manila and Cebu, alongside serene beach destinations ideal for remote work. Major cities also boast reliable internet infrastructure, ensuring you stay connected with clients and colleagues worldwide.

For remote workers looking for long-term options in Southeast Asia, the Philippines stands out. It combines legal clarity, a welcoming environment, and the flexibility digital nomads need, making it a great alternative to programs in countries like Spain and Thailand.

5. Taiwan – Digital Nomad Visa

Taiwan’s Employment Gold Card is a standout option for remote workers, offering work authorization, residence rights, and multiple-entry privileges – all rolled into one permit. While not officially branded as a digital nomad visa, it serves the same purpose by combining these benefits into a single, streamlined solution.

Eligibility Requirements

To qualify, applicants must demonstrate expertise in areas like technology, finance, or digital services. This can be done by meeting income thresholds or providing proof of relevant professional qualifications. Additional requirements include a clean criminal background check, valid health insurance, and a passport with sufficient validity.

Once approved, the Gold Card grants a fixed period of residence, with the option to renew.

Visa Duration and Renewability

The Gold Card provides a three-year residence permit that includes work authorization. After the initial term, cardholders can renew their permits, and those who stay long-term may eventually become eligible to apply for permanent residency.

Application Process

Applications are submitted online through Taiwan’s official Gold Card portal. Fees vary depending on nationality and the chosen processing level, so it’s essential to check the most up-to-date information on the official website.

Additional Considerations

The Gold Card may offer tax benefits, but it’s a good idea to consult official resources or a tax advisor for specific details.

Taiwan also boasts urban conveniences, affordable living costs, and a prime location for accessing regional business hubs. With its reliable internet infrastructure, Taipei is a great base for remote work. Plus, Taiwan’s central position in Asia makes it easy to travel to other major business centers nearby. The Gold Card provides digital nomads with a secure and well-defined framework to live and work abroad.

6. Japan – Digital Nomad Visa

Japan offers a Digital Nomad Visa that allows remote workers to live and work in the country for up to 6 months. However, this visa does not provide a pathway to permanent residency or citizenship.

Visa Duration and Conditions

The visa is valid for a 6-month period and cannot be renewed. Once the visa expires, applicants must leave Japan and stay abroad for at least 6 months before they can apply again.

Up next, we’ll take a look at Italy’s digital nomad program and how it’s shaping up.

sbb-itb-39d39a6

7. Italy – Digital Nomad Visa

Italy provides digital nomads with a one-year residency permit, which can be renewed annually as long as you continue to meet the eligibility requirements. After living in Italy for five years, you may qualify for permanent residency, and after ten years of legal residence, you can apply for Italian citizenship.

Up next, let’s take a closer look at Estonia’s Digital Nomad Visa.

8. Estonia – Digital Nomad Visa

Estonia offers a Digital Nomad Visa that provides remote workers the opportunity to live and work in the country temporarily. Here’s a breakdown of its duration and renewal rules.

Visa Duration and Renewability

The Digital Nomad Visa allows eligible individuals to stay in Estonia for up to 1 year (365 days). Depending on the intended length of stay, the visa is issued as either a long-stay D-visa or a short-stay C-visa.

While the visa cannot be renewed directly, applicants can reapply for a new Digital Nomad Visa once the initial one expires. However, it’s important to note that long-stay visas in Estonia – and the broader EU – have a limit of 548 days within any 730-day period.

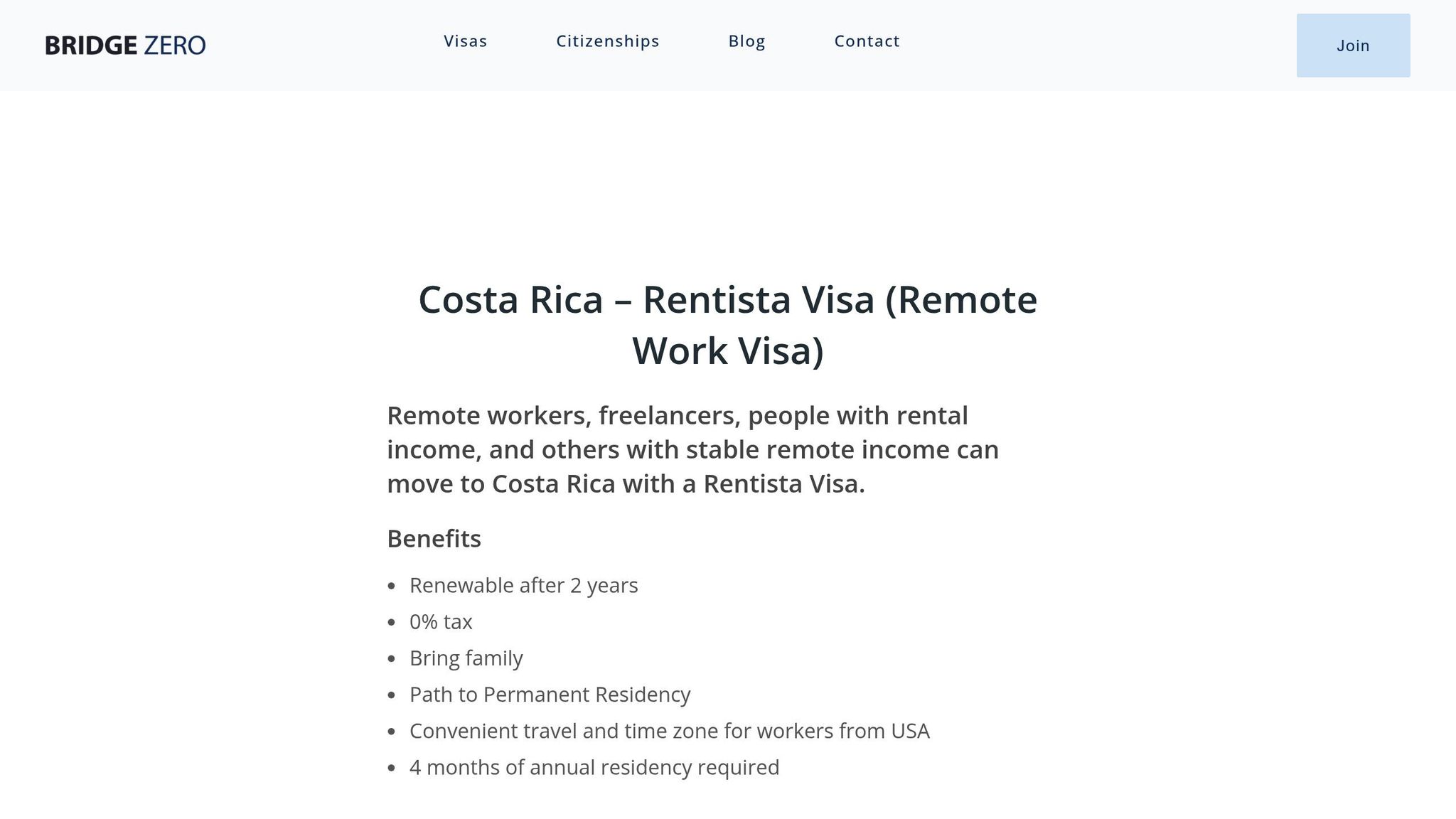

9. Costa Rica – Rentista Visa

Costa Rica’s Rentista Visa is a popular choice for digital nomads looking for temporary residency in Central America. This visa is tailored for individuals with a steady income from foreign sources, making it an attractive option for remote workers.

Eligibility Requirements

To qualify, applicants need to demonstrate consistent income through documents like bank statements, pension records, annuities, or investment dividends. Additional requirements include a clean criminal background check (authenticated and translated if necessary), a medical exam, and proof of valid health insurance.

Visa Duration and Renewability

The Rentista Visa is issued as a temporary residency permit and can be renewed. After maintaining temporary residency for a specified period, applicants may qualify for permanent residency. The visa also allows flexibility for travel, though residents must comply with the country’s residency rules.

Application Fees

Application costs vary depending on individual circumstances and typically cover government processing fees, document authentication, translations, legal assistance, medical exams, and health insurance.

Tax Considerations

Costa Rica uses a territorial tax system, meaning residents are taxed only on income earned within the country. Since Rentista visa holders cannot work for Costa Rican employers, foreign-sourced income is generally not taxed in Costa Rica. However, it’s essential to consider tax obligations in your home country. For example, U.S. citizens must report worldwide income. Consulting a tax expert is highly recommended to ensure compliance with all regulations.

Lifestyle and Practical Advantages

Costa Rica offers more than just a visa – it provides an exceptional quality of life. Known for its political stability, excellent healthcare, and reliable internet, the country is ideal for remote work. The "Pura Vida" lifestyle promotes a balanced, stress-free way of living, while the stunning natural surroundings, from pristine beaches to lush cloud forests, create an inspiring environment. Additionally, its proximity to the United States ensures convenient time zone alignment for those working with North American clients.

Comparison of Digital Nomad Visas

Choosing the right digital nomad visa depends on several factors, including income requirements, lifestyle preferences, and the unique perks each program brings to the table. Here’s a closer look at what to consider when comparing your options.

Income requirements vary significantly across programs. Some visas are designed to be more inclusive, catering to a wide range of remote workers, while others set higher income thresholds that reflect the local cost of living or economic conditions.

Visa durations also differ. Some countries offer shorter initial periods with the option to renew, while others provide longer-term stays, which can save you from frequent reapplications. Think about how long you plan to stay in one place when evaluating this aspect.

Application fees are another key factor. While some countries keep fees low to make the process more accessible, others may charge higher fees that come with added benefits, such as extended visa validity or better access to healthcare. Balancing these costs against the overall advantages is essential.

Geographic advantages play a big role, too. For instance, visas from European Union countries often come with the added benefit of regional mobility, while non-EU destinations might offer unique experiences, such as favorable tax policies or cultural richness. Speaking of taxes, some countries only tax income earned locally (territorial taxation), while others may tax worldwide income. It’s crucial to understand these policies to ensure they align with your financial goals.

Processing and renewal times can also impact your decision. Some countries have streamlined applications, while others may require more documentation and time. Additionally, the quality of digital infrastructure and healthcare systems can significantly influence your day-to-day experience. Some destinations offer fast, reliable internet and universal healthcare, while others might require private health insurance or have inconsistent connectivity outside major cities.

To help you compare, here’s a table summarizing key details for popular digital nomad visa programs:

| Country | Income Requirement | Visa Duration | Application Fee | Key Benefits |

|---|---|---|---|---|

| Thailand | Accessible | Extended long-term | Moderate | Long validity and affordable cost of living |

| Estonia | Higher | One-year term | Low | EU access and strong digital infrastructure |

| Spain | Moderate | One-year term | Low | EU access and high-quality healthcare |

| Portugal | Higher | One-year term | Low | Clear path to residency and EU access |

| Philippines | Moderate | One-year term | Moderate | English-speaking environment and affordability |

| Taiwan | Moderate | One-year term | Low | Excellent digital connectivity and strong safety |

| Japan | Moderate | Short initial period | Minimal | Rich cultural experiences and efficient systems |

| Italy | Elevated | One-year term | Higher | Appealing lifestyle with EU benefits |

| Costa Rica | Variable | Temporary residency | Variable | Favorable tax policies and overall stability |

This table highlights the most important aspects of each program, helping you weigh the options based on your priorities and needs.

Conclusion

Digital nomad visas have created exciting possibilities for remote workers to combine their careers with the adventure of exploring the world.

These programs vary widely, catering to different needs and priorities. For those on a tighter budget, options like Thailand or the Philippines stand out. Both offer affordable living costs and long visa durations, with the Philippines being especially appealing for English-speaking professionals who want to avoid language barriers.

If living in the European Union is your goal, countries such as Spain, Portugal, Estonia, and Italy offer compelling choices. Portugal’s D8 visa, for instance, could lead to permanent residency for long-term stays, while Estonia is a favorite for its tech-friendly infrastructure and streamlined online processes.

For higher earners, programs in Italy and Portugal provide access to premium healthcare and lifestyle perks. Japan, on the other hand, offers a unique cultural experience and exceptional safety, though its visas may require more frequent renewals.

Tax planning is another key factor. Costa Rica, with its territorial tax system, might be ideal for those with income from multiple sources.

Since visa requirements can change, it’s essential to stay informed. Regularly check official government websites for the latest updates and details.

Ultimately, the right visa is the one that fits your practical needs while aligning with your lifestyle goals.

FAQs

What should I consider when selecting a digital nomad visa that fits my lifestyle and work needs?

When picking a digital nomad visa, it’s crucial to weigh factors like how long you can stay, income criteria, and tax responsibilities. Some visas are short-term, lasting just a few months, while others let you settle in for a year or more, often with renewal options. Many countries also require you to prove a certain monthly or yearly income to show you can financially sustain yourself while living abroad.

If you’re bringing your family along, check whether the visa extends to dependents, such as your spouse or children. It’s also important to see how the visa fits with your work situation – some are tailored for freelancers or remote workers, but they might restrict employment with local companies. Lastly, dive into the tax rules for both your home country and your destination to avoid any financial surprises later.

What should I know about taxes when applying for a digital nomad visa and working remotely abroad?

Tax laws for digital nomads can differ significantly based on the country issuing the visa, your home country, and the duration of your stay abroad. Typically, spending more than 183 days in a single country may classify you as a tax resident there. That said, some countries offer specific tax exemptions tailored for digital nomads.

To prevent being taxed twice on the same income, many nations have established tax treaties. For U.S. citizens, options like the Foreign Earned Income Exclusion (FEIE) or the Foreign Tax Credit (FTC) can help minimize tax obligations. However, if you’re self-employed, you might still be responsible for self-employment taxes. It’s wise to consult a tax professional to fully understand your responsibilities and identify any potential benefits you can claim.

Can a digital nomad visa help you gain permanent residency or citizenship, and which countries make it easiest?

Yes, some digital nomad visas can lead to permanent residency or even citizenship, but the specifics depend on the country. Places like Portugal, Spain, Greece, Italy, Mexico, Latvia, and Norway are often mentioned for offering relatively straightforward pathways. Typically, these programs require you to maintain legal residence for a set period – usually around five years – before you’re eligible to apply for permanent residency.

The rules and timelines differ from one country to another, so it’s crucial to carefully review the details of each visa program to ensure they fit your long-term plans. For instance, Portugal’s D7 Visa is a favorite among remote workers, offering a well-defined path to residency and, eventually, citizenship.