Living as a digital nomad offers freedom, but taxes can quickly complicate things. If you’re not careful, you could face double taxation, penalties for unreported foreign accounts, or even unexpected state taxes. Here’s what you need to know:

- Double Taxation: U.S. citizens are taxed on worldwide income, even abroad. Use tools like the Foreign Earned Income Exclusion (FEIE) or Foreign Tax Credit (FTC) to reduce your tax burden.

- Tax Residency Triggers: Spending time in multiple countries or maintaining financial ties (like owning property) can make you a tax resident in more than one place.

- State Tax Obligations: Some U.S. states, like California or New York, may still tax you unless you fully sever ties.

- Foreign Asset Reporting: Laws like FBAR and FATCA require reporting foreign accounts and assets. Missing these filings can result in hefty penalties.

- Social Security Contributions: Totalization Agreements can prevent paying into two systems, but you’ll need proper documentation.

- Self-Employment Taxes: If you’re self-employed, you’re responsible for additional Social Security and Medicare taxes.

To avoid tax headaches, track your travel dates, understand residency rules, and consult a tax professional if needed. Staying compliant ensures you can enjoy your nomadic lifestyle without financial stress.

Tax Residency Rules Explained

Tax residency, which determines where you’re taxed on your worldwide income, is separate from your passport or visa. This often surprises digital nomads, who might assume that a tourist visa or temporary stay exempts them from local tax responsibilities.

Each country has its own rules for determining tax residency, and these can sometimes overlap. It’s possible to end up as a tax resident in more than one country at the same time, which can lead to conflicting obligations that require careful handling.

Physical presence is the most common factor, but how it’s measured varies widely. Some countries count any part of a day, while others only consider overnight stays. Economic connections, like owning property, having a local bank account, or running a business, can also establish tax residency – even if you spend little time in the country. Let’s break down the key triggers and how to figure out your tax residency status.

What Triggers Tax Residency

The 183-day rule is one of the most common benchmarks, but it’s not universal. Countries using this rule generally consider you a tax resident if you spend 183 days or more within their borders during a 12-month period. However, the fine print matters.

For example, Germany counts any part of a day as a full day. If you arrive in Berlin at 11:59 PM on January 1st and leave at 12:01 AM on January 2nd, it counts as two full days toward the 183-day total. The UK, however, uses more complex criteria that factor in not just days spent but also your ties to the country.

Owning property can also make you a tax resident, even with minimal time spent in the country. In Portugal, owning a property that serves as your habitual residence could establish tax residency, regardless of how many days you’re physically there. Spain has similar rules, where your homeownership combined with other factors may classify it as your main residence.

Business activities are another trigger. If you’re taking client calls from a co-working space in Mexico City or managing operations while in Lisbon, you could be considered a tax resident based on where your income is generated. This is a common issue for digital nomads who work regular hours in their temporary locations.

Financial ties like opening a local bank account, getting a local phone number, or registering with local authorities can also signal tax residency. These actions may be used as evidence of your intent to make a country your tax home.

The center of vital interests test looks at where your most significant personal and economic relationships lie. This includes family, social connections, professional activities, and financial interests. Even if you don’t meet a country’s day-count threshold, strong ties like having your primary business or family there could establish tax residency.

For digital nomads, even short stays or minor connections can trigger unexpected tax residency in some jurisdictions.

How to Check Your Tax Residency Status

Keeping track of your travel dates is essential. Save flight confirmations, passport stamps, and other travel records for every country where you spend significant time. Many nomads use apps or spreadsheets to log their daily locations, but the key is having documentation that tax authorities will accept.

Understand each country’s residency rules instead of assuming they all follow the 183-day standard. For example, the IRS in the U.S. uses a “substantial presence test,” which calculates a weighted average of days over three years. European countries often have more intricate criteria that consider multiple factors like ties and intent.

Your financial and personal connections also play a big role. Review your economic ties – such as property ownership, local bank accounts, or business operations – as these can establish residency, even if you don’t meet the physical presence requirements. Knowing how these factors influence your status is key for tax planning.

If you qualify as a resident in multiple countries, tax treaties can help resolve conflicts. These treaties often use a hierarchy of tests, starting with your permanent home, followed by the center of your vital interests, habitual abode, and finally, nationality. Applying these rules to your situation can clarify your primary tax residency.

Document your intentions and plans – like lease agreements or business registrations – to show where you intend to reside. A clear paper trail of your activities can support your case if your residency status is questioned.

Check official tax authority resources for each country where you might have exposure. Many countries provide tools or questionnaires to help determine residency. For instance, the Australian Taxation Office offers detailed guidance on their residency tests, complete with practical examples.

In more complex cases – like managing multiple residencies, significant assets, or running a business – consulting a tax professional is a smart move. Experts in international tax law can guide you through conflicting rules and help you structure your lifestyle to avoid unintended tax liabilities.

The bottom line? Be proactive. Understanding your tax residency status before it becomes an issue gives you more control over your financial and lifestyle choices.

How to Prevent Double Taxation

Double taxation occurs when you’re taxed on the same income by both the U.S. government and a foreign country. This is especially relevant for American digital nomads because U.S. citizens and Green Card holders must pay taxes on their worldwide income, no matter where they live or earn it. That means you’re required to file a U.S. tax return every year, even if you’ve been living abroad.

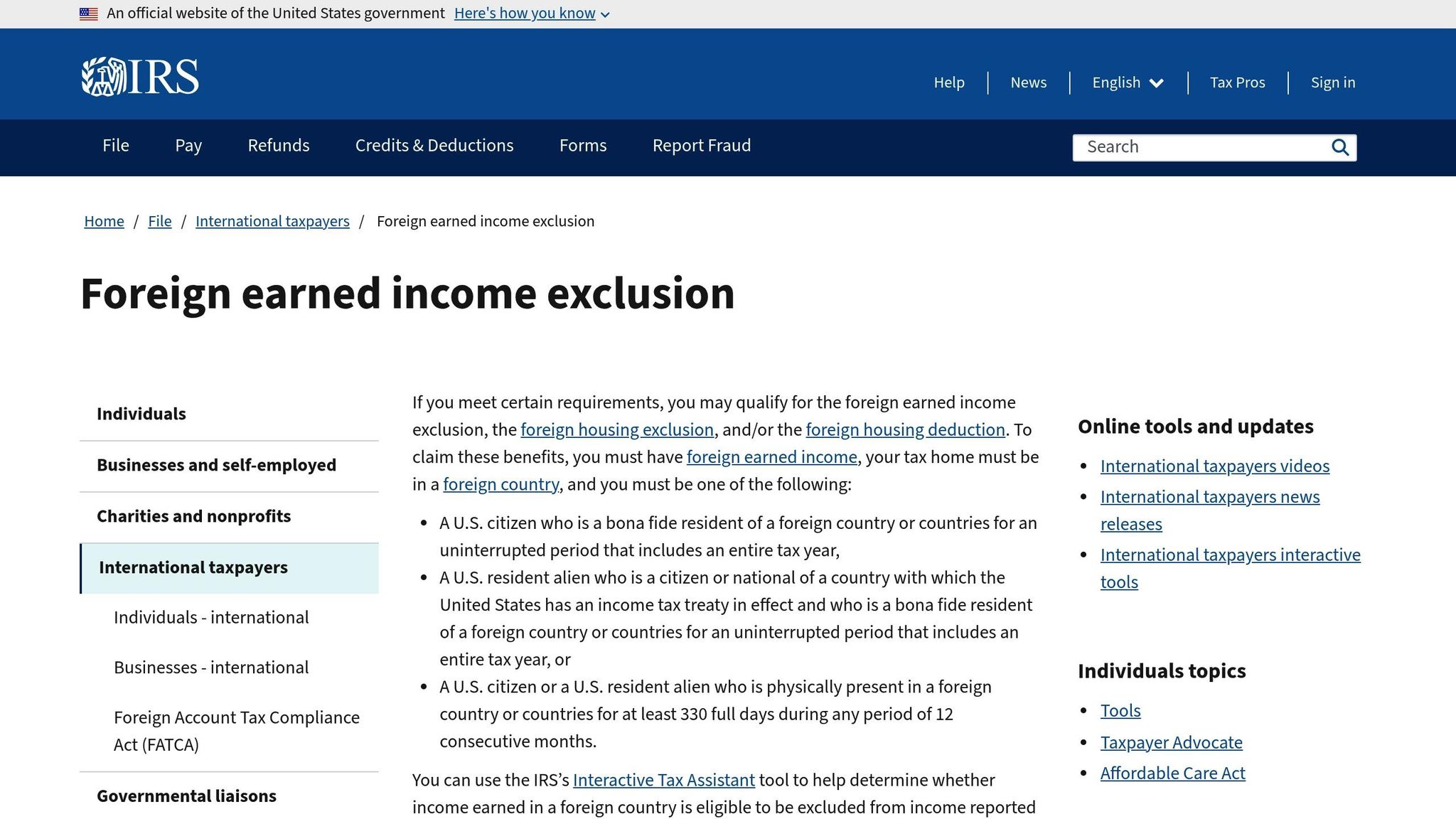

Fortunately, the IRS offers two key tools to help you avoid double taxation: the Foreign Earned Income Exclusion (FEIE) and the Foreign Tax Credit (FTC). Knowing how these work and when to use them can save you thousands of dollars.

Using the Foreign Earned Income Exclusion (FEIE)

The Foreign Earned Income Exclusion allows you to exclude a portion of your foreign-earned income from U.S. taxes. For the 2024 tax year, this exclusion is capped at $120,000, with adjustments made annually for inflation.

To qualify for the FEIE, you need to meet one of two tests:

- Physical Presence Test: You must spend at least 330 full days outside the U.S. in any 12-month period.

- Bona Fide Residence Test: This is more subjective and requires you to demonstrate that you’ve established a genuine residence in a foreign country for a full tax year. Factors like your intent to stay, the nature of your living arrangements, and your ties to the foreign country versus the U.S. are considered.

It’s important to note that the FEIE applies only to earned income – this includes wages, salaries, and self-employment income for services performed abroad. It doesn’t cover passive income like dividends, interest, rental income, or capital gains. For instance, if you earn $150,000 annually as a digital nomad, you can exclude $120,000, but you’ll still owe U.S. taxes on the remaining $30,000.

To claim the FEIE, you must file Form 2555 with your tax return. This form requires detailed information about your foreign residence, travel dates, and income. If you miss filing this form, you lose the exclusion – regardless of whether you qualify.

Also, if you’re relying on the Physical Presence Test, you have 35 days within a 12-month period to visit the U.S. without losing the exclusion. Keeping precise records of your travel days is essential to make the most of this allowance.

Claiming the Foreign Tax Credit (FTC)

The Foreign Tax Credit takes a different approach. Instead of excluding income, it provides a direct credit against your U.S. tax liability for income taxes you’ve paid to foreign governments. For example, if you paid $5,000 in taxes to Germany, you can claim a $5,000 credit to offset your U.S. taxes.

The FTC is especially useful if you’re working in high-tax countries like Germany, France, or the Netherlands, where foreign tax rates often exceed those in the U.S. In such cases, the taxes you’ve paid abroad may fully eliminate your U.S. tax liability.

Unlike the FEIE, the FTC applies to all types of income, including earned income, dividends, interest, and capital gains. It also doesn’t require you to meet physical presence or residence tests – you just need to have paid or accrued foreign income taxes.

To claim the FTC, you’ll need to file Form 1116 with your tax return. This form can be complicated, especially if you’re dealing with income from multiple countries or different income types. You’ll need to provide documentation of all foreign taxes paid, such as foreign tax returns and proof of payment.

One limitation is that the credit is capped at the amount of U.S. tax you would owe on the foreign income. If the foreign tax rate is lower than the U.S. rate, you may still owe some U.S. taxes. On the other hand, if the foreign rate is higher, you can’t get a refund for the excess, but you can carry unused credits forward for up to 10 years.

Choosing Between FEIE and FTC: You generally can’t apply both to the same income, so it’s crucial to pick the option that best suits your situation. The FEIE is often better for those in low-tax countries or earning under the exclusion limit, while the FTC is more advantageous in high-tax countries or for those with significant passive income.

Tax Planning Methods That Work

Strategic tax planning can help you make the most of these tools and further reduce your tax burden.

- Pick your tax home wisely: If you’re location-independent, consider spending more time in countries that have favorable tax treaties with the U.S. or lower tax rates. For instance, Portugal’s Non-Habitual Resident program or certain jurisdictions in the UAE can offer notable tax benefits.

- Time your income: If you’re relying on the FEIE, plan your high-earning periods to align with your qualifying foreign residence. Many digital nomads schedule consulting or project work to maximize the income that qualifies for exclusion.

- Separate your income streams: Keep earned income, which qualifies for the FEIE, distinct from passive income, which doesn’t. This separation simplifies tax filing and ensures you’re applying the right strategies to each type of income.

- Use the foreign housing exclusion: The FEIE also allows you to exclude or deduct certain foreign housing costs if they exceed a base amount. For 2024, this base amount is $19,200 (16% of the FEIE maximum). Expenses like rent, utilities, and parking that exceed this threshold may be excludable up to certain limits. Keep detailed records of these expenses to support your claim.

- Plan for state taxes: Even if you eliminate your federal tax liability through the FEIE or FTC, some U.S. states may still consider you a resident and tax your worldwide income. Breaking state tax ties (discussed in the next section) is essential for a comprehensive tax strategy.

Ultimately, tax planning for digital nomads isn’t just about reducing this year’s taxes – it’s about building a sustainable, compliant system that adapts as your income grows and your travel patterns change. By understanding your options and planning ahead, you can avoid unnecessary tax headaches while keeping more of your hard-earned money.

Getting Benefits from Tax Treaties and Agreements

Tax treaties and agreements can make life much easier for digital nomads, especially when it comes to avoiding double taxation and sorting out Social Security contributions. These agreements are key tools to help reduce your tax burden and protect your income while working across borders.

The U.S. has established tax treaties and Totalization Agreements that are designed to prevent double taxation and eliminate dual Social Security payments. Let’s dive into how you can identify relevant tax treaties and make the most of Totalization Agreements.

Finding Tax Treaties That Apply to You

Tax treaties are agreements between two countries that aim to prevent double taxation and clarify which nation has the primary right to tax different types of income. The U.S. has such treaties with over 60 countries, including popular destinations like the United Kingdom, Germany, Portugal, and Singapore.

These treaties often go beyond the benefits offered by the Foreign Earned Income Exclusion or the Foreign Tax Credit. For example, they may reduce withholding tax rates on dividends, interest, and royalties. If you’re earning passive income from U.S. sources while living in a treaty country, you could qualify for lower withholding rates.

Key provisions, like tie-breaker rules, help determine your primary tax residence if both the U.S. and another country consider you a tax resident. These rules look at factors such as where your permanent home is, where your vital interests lie, your habitual abode, and even your nationality.

Some treaties also offer exemptions or special treatment for specific types of work, but these often come with time and income thresholds. To take advantage of these benefits, you may need to prove strong local ties – like having housing, a local bank account, or utility bills in your name – rather than just relying on the length of time you’ve spent abroad.

It’s worth noting that many modern tax treaties include limitation of benefits clauses. These clauses require you to have substantial local ties to claim treaty benefits, so it’s essential to ensure your residency is well-documented and genuine.

Totalization Agreements for Social Security

Totalization Agreements are a lifesaver for digital nomads when it comes to Social Security contributions. These agreements ensure you don’t have to pay into both the U.S. and your host country’s Social Security systems. The U.S. has Totalization Agreements with 30 countries, including Germany, the United Kingdom, Canada, and Australia. These agreements assign Social Security coverage to just one country, eliminating double contributions.

If you’re self-employed, these agreements can exempt you from U.S. self-employment tax, meaning you’d only contribute to the host country’s Social Security system instead. Considering that U.S. self-employment tax is 15.3% on earnings up to $160,200 in 2023, earning $100,000 annually could result in $15,300 in savings under a Totalization Agreement. However, you’d still be responsible for contributions to the local system.

To benefit from these agreements, you’ll need a Certificate of Coverage from the relevant Social Security agency. This document confirms which country’s system you’re covered under and exempts you from duplicate contributions.

The process to obtain a Certificate of Coverage depends on the country. Generally, you’ll need to provide documentation of your work location, residency status, and employment details. If you want to remain in the U.S. Social Security system, you’d request the certificate from the U.S. Social Security Administration. Alternatively, if you prefer the host country’s coverage, you’d apply through their social security agency.

Planning ahead is essential when using Totalization Agreements. While they prevent you from paying double Social Security taxes, they can also impact your future benefits. Some agreements allow coverage periods from both countries to be combined for benefit calculations. However, each country will calculate benefits based on its own rules and contributions.

To stay organized, keep detailed records of your work locations, residency status, and any Certificates of Coverage you obtain. If your situation changes – like moving to a new country or switching employment – you’ll need to update your coverage and get new documentation. This level of clarity is an important part of managing your overall financial strategy while working abroad.

sbb-itb-39d39a6

Cutting State Tax Ties in the US

Dealing with state tax obligations can be tricky, even after tackling international tax issues. Simply leaving the United States doesn’t automatically free you from state tax responsibilities. In states like California and New York, tax authorities might still consider you a resident for tax purposes unless you meet their specific requirements for establishing non-residency.

It’s important to note that federal and state tax residency rules operate independently. You might qualify for federal benefits like the Foreign Earned Income Exclusion, but your former state could still impose taxes on your worldwide income. Without a clear shift in residency status, this can leave you with unexpected tax bills.

What Makes You a State Tax Resident

Each state has its own rules for determining tax residency, and they often look at a mix of factors. For instance, California might still consider you a resident if you maintain strong ties there, such as family connections, property ownership, or professional licenses – even if you spend most of your time living abroad.

New York uses the concept of "domicile" to assess residency. If your move is seen as temporary or you show signs of planning to return, you could remain liable for state taxes on all your income. Common indicators of continued residency include:

- Holding a driver’s license or voter registration in the state.

- Owning property, even if it’s rented out.

- Having close family members, like a spouse or children, living in the state.

- Keeping local banking accounts or forwarding mail to a state address.

- Maintaining memberships or affiliations that suggest ongoing ties to the state.

Other states have their own criteria, often blending time-based tests with evidence of personal and financial connections. To avoid these issues, you’ll need to take clear steps to sever ties with your former state.

How to Break State Tax Residency

To avoid being taxed twice – once internationally and again by your former state – you need to actively address lingering state tax obligations. Moving away isn’t enough; you’ll need to take deliberate actions to show you’ve established a new domicile. Here are some strategies to consider:

- Update Your Legal Records: Change your driver’s license, voter registration, and bank accounts to reflect your new location. If possible, establish domicile in a state with no income tax.

- Manage Real Estate Wisely: If you own property in your previous state, think about selling it or converting it to an investment property. Avoid using it as a personal residence, as this could weaken your claim of non-residency.

- Cut Local Ties: Cancel memberships, subscriptions, and affiliations linked to your old state. If you hold professional licenses or business accounts there, transfer or close them.

- Build New Connections: Establish a clear presence in your new location by opening local bank accounts, securing local identification, renting or purchasing a home, and joining community organizations.

- Keep Detailed Records: Document your move with travel records, lease agreements, and receipts. These records can be critical if your former state challenges your residency status.

- File a Final State Tax Return: Submit a final return that marks your departure. Some states may require a part-year resident return for the year you leave, along with an explanation of your change in domicile and the date it became effective.

Some states offer rules that might reduce your tax burden if you’re absent for an extended period, but these provisions often come with exceptions. Consulting a tax professional can help you navigate these complexities. Ultimately, your intent matters. If you maintain strong ties to your former state or signal plans to return, you could still face tax obligations. Taking clear, documented steps to demonstrate your relocation is essential for breaking state tax residency effectively.

Following Asset Reporting Laws

Living abroad doesn’t exempt you from meeting IRS requirements for reporting foreign accounts and assets. For digital nomads, ignoring these obligations can lead to penalties so steep they may even surpass the value of the unreported accounts. The U.S. government demands detailed disclosures of overseas financial activities, making compliance a must.

This becomes even more critical when juggling income streams across multiple countries. Whether it’s funds in a European business account, savings in an Asian bank, or investments through global platforms, staying compliant is non-negotiable. Let’s break down the FBAR and FATCA rules that guide these reporting responsibilities.

FBAR and FATCA Reporting Rules

Two key regulations govern foreign account reporting: the Foreign Bank Account Report (FBAR) and the Foreign Account Tax Compliance Act (FATCA). While they share a focus on foreign financial assets, their requirements differ in thresholds, forms, and scope.

- FBAR: If the combined value of your foreign financial accounts exceeds $10,000 at any point during the year, you must file FinCEN Form 114. This threshold applies to the total across all accounts, not just individual balances.

- FATCA: This rule has higher thresholds and uses Form 8938. For single taxpayers living abroad, you must report if your foreign financial assets exceed $200,000 at year-end or $300,000 at any point during the year. Married couples filing jointly have thresholds of $400,000 at year-end or $600,000 during the year.

The distinction lies in what each covers. FBAR focuses exclusively on financial accounts, while FATCA includes a broader range of assets like stocks, bonds, and equity in foreign entities outside traditional bank accounts.

Filing Deadlines and Penalties

The deadlines for these forms are strict, and missing them can lead to harsh penalties:

- FBAR (FinCEN Form 114): Due April 15, with an automatic extension to October 15. Unlike tax returns, no further extensions are available.

- FATCA (Form 8938): This follows your tax return schedule, typically due April 15, with possible extensions to October 15 if you file Form 4868. Any extension for your tax return applies to this form as well.

The penalties for non-compliance can quickly escalate. FBAR violations start at $12,921 per unreported account for non-willful cases, while willful violations can hit $129,210 per account or 50% of the account balance – whichever is greater. These penalties apply to each account and each year of non-compliance.

For FATCA, the initial penalty for failing to file Form 8938 is $10,000. If the form remains unfiled after IRS notification, additional penalties of $10,000 accrue every 30 days, capped at $60,000 per form.

Here’s an example: If you fail to report five foreign accounts worth $50,000 over three years, non-willful FBAR penalties alone could exceed $190,000. This highlights why compliance is essential, no matter your account balances.

Protecting Assets with Offshore Methods

Using offshore structures can provide both asset protection and streamlined compliance. Setting up an offshore company offers a legitimate framework for managing international business activities while adhering to U.S. reporting rules.

For instance, forming an offshore company in jurisdictions like Anguilla can help separate personal and business assets. This simplifies reporting by consolidating income streams and investments under one entity. However, you’ll still need to report your ownership in the company and its accounts.

Offshore trusts add another layer of protection, especially for high-net-worth digital nomads. These trusts can safeguard assets from creditors and offer estate planning benefits, all while staying within U.S. compliance rules. That said, careful planning is crucial to avoid unintended tax consequences.

Private interest foundations are another option, blending elements of trusts and corporations. They provide flexible management, strong privacy measures, and asset protection in certain jurisdictions. Like other offshore structures, they must align with U.S. reporting requirements.

The key to protecting your wealth lies in aligning offshore strategies with compliance. Work with professionals who understand the rules and opportunities. Proper documentation, regular reporting, and open communication with tax authorities ensure your offshore structures protect your assets without triggering unnecessary risks or penalties.

It’s important to remember that offshore structures are meant for lawful tax planning and asset protection, not tax evasion. Every structure must be reported to the IRS, and all income must be declared on your U.S. tax returns. The goal is to reduce your tax burden legally while staying fully compliant.

Conclusion: Smart Tax Planning for Digital Nomads

Managing taxes as a digital nomad requires navigating the intricate web of international tax systems. The combination of tax residency rules, international treaties, and asset reporting obligations can easily lead to unexpected challenges. These complexities make it essential to develop a strategy that carefully addresses residency requirements, treaty advantages, and compliance tools.

Given the harsh penalties for misreporting and the ever-changing nature of global tax regulations, seeking expert advice becomes crucial. Handling taxes as a digital nomad often spans multiple jurisdictions, each with its own stringent reporting rules. As discussed earlier, professional guidance ensures you can navigate tax treaties and exclusions, make the most of deductions and credits, and remain compliant with both U.S. and international tax laws.

Your tax situation will likely evolve alongside your nomadic lifestyle. For instance, the strategies that work when earning $50,000 annually while hopping between countries may no longer apply if you scale up to running a six-figure business with employees across multiple regions. Tax professionals who specialize in digital nomad scenarios understand these complexities and can help you avoid the severe consequences of non-disclosure or filing errors.

Proactive tax planning is a powerful tool for avoiding costly mistakes. This involves securing proper residency documentation, structuring your business in a compliant manner, keeping detailed records of your income and travel, and ensuring all necessary forms are filed on time.

As highlighted throughout this discussion, your nomadic lifestyle comes with unique tax responsibilities tied to the countries you visit, the income you generate, and the assets you own. By understanding and addressing these obligations, you can safeguard both your financial well-being and the freedom that comes with your chosen way of life.

FAQs

How can digital nomads figure out which country’s tax residency rules apply to them if they live in multiple countries?

Determining your tax residency as a digital nomad can be tricky and depends on a few key factors:

- The 183-day rule: Many countries will classify you as a tax resident if you spend more than 183 days within their borders in a calendar year. This is one of the most commonly used criteria worldwide.

- Center of vital interests: Even if you don’t meet the 183-day threshold, tax authorities might assess where your strongest personal and economic ties are. This could include factors like where your family lives, where you own property, or where your main business activities take place.

Because tax regulations differ greatly from one country to another, it’s crucial to understand the specific rules in the places you stay. Consulting a tax professional can help you navigate these complexities and ensure you’re meeting your obligations while avoiding potential issues like double taxation.

What’s the difference between the Foreign Earned Income Exclusion and the Foreign Tax Credit, and how can digital nomads decide which is best?

The Foreign Earned Income Exclusion (FEIE) and the Foreign Tax Credit (FTC) are two key options that can help digital nomads lower their U.S. tax obligations, but they operate differently. For the 2024 tax year, the FEIE allows you to exclude up to $126,500 of foreign-earned income from U.S. taxation. Meanwhile, the FTC offers a dollar-for-dollar credit for taxes you’ve already paid to a foreign government.

Which option works best for you depends largely on your specific financial situation. If you’re earning a substantial income abroad but paying little to no foreign taxes, the FEIE might be the better choice. On the flip side, if you’re subject to high taxes in another country, the FTC could provide more relief by offsetting your U.S. tax bill. In some instances, you can combine both strategies, but you can’t apply both to the same income.

Navigating these options can get complex, so consulting a tax professional is a smart move to figure out the best strategy for your individual needs.

How can digital nomads avoid state tax obligations in the U.S. while living abroad?

Digital nomads looking to sidestep unexpected state tax bills while living abroad should take deliberate steps to cut ties with their previous state of residence. One of the first moves? Establishing domicile in a state that’s more tax-friendly – often one without income tax or where your connections are minimal.

To solidify this change, it’s crucial to have clear documentation showing your intent to leave your former state behind. This might mean updating essentials like your voter registration, driver’s license, and bank accounts to reflect your new state. Lastly, working with a knowledgeable tax professional can help you navigate the maze of state-specific tax rules and ensure you stay compliant with both state and federal laws.