by Steven Hilgart, Director of Conference Operations and Marketing

Over the past week, we have received several responses from my article, Philosophy on Wealth.

I went ahead and paraphrased some of the responses in easy-to-answer sentences and I’d like to take a minute today to respond to some of these thoughts.

“Education isn’t enough, you need luck!”

First off – how about we stop using out-dated definitions of words like “luck”? Luck is simply when preparation meets opportunity. So “luck” is manufactured – not bestowed upon us by some goddess, or leprechaun, or Easter bunny.

One of my mentors taught me that we should always start with education first. Why? If you start with something like strategy first, it wouldn’t be understood. If you start with motivation first – well sure, you can motivate an idiot, but then all you have is a motivated idiot!

The hardest part is knowing whether or not you are educating yourself in the right stuff.

The trick is to begin with the end in mind. What are your financial goals? How do you intend to reach them? Simply – what do you need to educate yourself in – to achieve them?

I’m excited to be a part of the Global Wealth Protection team because they are experts in educating people in what’s important. Some simple examples include transferring a percentage of your wealth into precious metals, diversifying your assets geo-politically so you are not beholden to any one person, country, or government, or creating a veil of privacy for your business to protect yourself from the ever increasing vultures!

These newsletters are filled with ideas to grow and protect your wealth, but it is ultimately up to you to choose your path and educate yourself on it.

“My partner/wife/brother-in-law took my money!”

This, of course, is a sensitive topic – for everyone.

“I can’t wait to deal with the financial and emotional pain that divorce brings.” – said no one, ever. I personally have been involved in bad family business deals, and it sucks!

The one thing you can count on in life is set-backs. They are going to happen, and usually when we least expect it.

The question is, will you REACT to the set back or RESPOND to it?

I know I’m preaching to the choir here but we could all hear it just one more time: The major difference in our life is not what happens to us but how we respond to what happens.

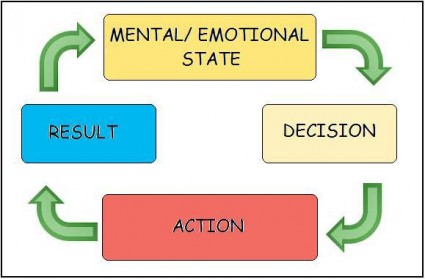

This diagram illustrates the spiral.

Simply put – If we are in a crappy mental or emotional state, we tend to make negative decisions, which lead to negative actions, which lead to negative results, and inevitably lead to a worse mental or emotional state – the downward spiral.

But if you cut it off at the head and create a positive mental or emotional state, you set yourself on an upward spiral.

When you’re “in the zone” all decisions (including financial ones) seem to come easy, set-backs no longer feel like brick walls but little speed bumps on the road to victory.

State management is an art and science unto itself – but it is one of the major keys in creating and protecting wealth that we rarely address (maybe we should address it more!).

“My 401k/retirement fund is worth LESS than what I originally invested!”

This one really hits home for me. My parents are perfect examples of this. Both of them are young, but my mother has been completely wiped out. Literally she has zero dollars left in her 401k. My father lost over 60% of his retirement fund when the markets crashed.

Someone somewhere sold them the wrong plan.

“Markets go up and down,” they said, “what you need to do is buy, hold, and diversify,” and “the markets always come back!”

When the markets began to crash, they realized very quickly that they, like many Americans, were trapped.

They couldn’t take any money out because the penalties and taxes would have made it pointless. They didn’t dare put more money in because it’d be gone in five minutes! So they were forced to sit idly by as they watched their entire life savings disappear.

Every now and then I speak to my father about what he would do differently if he could go back. The number one thing he always says? “I would have started my business twenty years earlier.”

It’s relatively easy to create a high ROI with your own business. And while many people see the stock market as a money maker, it is actually a tool for wealth preservation, not creation.

A Final Thought…

Many people I speak to seem cynical and afraid of the future.

Understandable – The world seems to be going to hell in a hand basket. We are in the midst of a global economic meltdown, wars that never seem to end, and little hope for future generations. But, what’s new about that?

As hopeless and crazy as it might seem, though, it’s up to you and I to save this world. One of the biggest contributions you can make is to take care of yourself first. For every person that becomes independently wealthy, that’s one less person the world has to take care of.