Controlled Foreign Corporation (CFC) laws are designed to stop businesses from avoiding taxes by shifting income to low-tax countries. These laws apply to foreign companies controlled by domestic shareholders and focus on taxing certain types of income, like interest, dividends, and royalties.

Here’s a quick breakdown:

- U.S. CFC Rules: A foreign company is a CFC if U.S. shareholders own over 50% of its voting power or value. Key provisions like Subpart F and GILTI tax foreign earnings immediately, even if not distributed. Compliance involves detailed filings and strict penalties for non-compliance.

- U.K. CFC Rules: The U.K. uses an accounting-based test for CFC classification. Profits are exempt from U.K. taxes if local taxes are at least 75% of what would be owed in the U.K. Exemptions also exist for low profits or specific business operations.

Key Differences:

- The U.S. system focuses on immediate taxation with complex compliance requirements.

- The U.K. system allows more flexibility, with exemptions based on local tax rates and business activities.

Understanding these rules is critical for remote entrepreneurs managing foreign businesses. Each system has unique compliance and tax planning opportunities, so professional guidance is often necessary.

1. United States CFC Rules

In the U.S., the taxation of Controlled Foreign Corporations (CFCs) hinges on specific ownership thresholds. A foreign corporation is classified as a CFC if U.S. shareholders collectively own more than 50% of its voting power or value. However, not every U.S. person counts as a "United States shareholder" for this purpose. Only those who own at least 10% of the voting power qualify.

This 10% ownership rule leads to some interesting outcomes. For example, if six unrelated U.S. individuals each own 9% of a foreign corporation (totaling 54%), or if 11 unrelated U.S. persons evenly split 100% of the voting stock, the corporation is not considered a CFC. Why? Because no single shareholder meets the 10% threshold. This precise definition plays a critical role in determining tax obligations for passive income.

Beyond ownership rules, the U.S. tax code introduces additional layers through provisions like Subpart F and high-tax exceptions. Subpart F requires U.S. shareholders to immediately report certain types of passive income – such as interest, rents, royalties, and dividends – on their tax returns in the year the CFC earns it, even if those earnings are not distributed.

To prevent double taxation, Section 954(b) excludes income already taxed at high rates. Additionally, starting with tax years beginning after December 31, 2025, domestic corporations can claim a 40% deduction on net CFC tested income under Section 951A, effectively reducing the U.S. tax burden on this income. Certain income types are also excluded from CFC tested income calculations, like U.S.-source effectively connected income, income already treated as Subpart F income, dividends from related entities, and foreign oil and gas extraction income. These exclusions help narrow the scope of taxable income under the CFC rules.

Grasping these U.S. CFC rules is essential when comparing them to other international frameworks. They highlight the intricate balance between defining taxable income and minimizing overlap with existing tax systems.

2. United Kingdom CFC Rules

The U.K. takes a different route when it comes to identifying Controlled Foreign Companies (CFCs). Instead of relying solely on percentage-based ownership or control, the U.K. uses an accounting standards test based on FRS 102. Under this framework, a non-U.K. company qualifies as a CFC if its results are consolidated into the financial statements of a U.K. entity and at least 50% of its chargeable profits are linked to the U.K. parent. This method places a strong emphasis on economic substance, setting it apart from more straightforward percentage-based models used in other jurisdictions.

The accounting-based approach determines control through parent-subsidiary relationships as outlined in FRS 102. Notably, this test applies even if the parent company isn’t required to prepare consolidated financial statements, such as in the case of small or medium-sized groups. For example, HMRC highlighted a scenario where a non-U.K. company (Company A) was acquired by a U.K. group (Group C) on March 31, 2015. From that date onward, Company A’s results were included in Group C’s consolidated financials, automatically triggering its CFC status under the accounting standard test. To refine this process, the U.K. distinguishes taxable CFC profits through targeted exemptions.

Once a foreign entity is classified as a CFC, the U.K. applies The Tax Exemption to determine whether its profits are subject to U.K. taxation. This exemption excludes profits from taxation if the CFC pays sufficiently high local taxes. Specifically, if the local tax amounts to 75% or more of what the U.K. corporation tax would have been, the profits are exempt from U.K. tax. However, the exemption doesn’t apply if the CFC benefits from a "designer rate regime" or isn’t taxed in its jurisdiction due to factors like domicile, residence, or management location.

The U.K. also provides several entity-level exemptions aimed at recognizing legitimate commercial operations and simplifying compliance. For instance:

- The Low Profit Margin Exemption applies to CFCs with substantial operations but modest returns, such as back-office functions or call centers, where profits are less than 10% of operating expenses.

- The Low Profits Exemption covers cases where trading profits are under £50,000 or non-trading profits stay below £500,000.

- Newly acquired foreign subsidiaries enjoy a 12-month exemption after coming under U.K. control, giving businesses time to restructure without immediate tax implications.

These exemptions highlight the U.K.’s focus on economic substance. A 2023 case involving Finland’s tax authority provides a clear example. A Luxembourg SARL, primarily owned by a Finnish company, avoided CFC classification because it had an office, employees, and an investment director engaged in genuine activities. The tax authority recognized it as an active business with sufficient substance. This approach ensures that only profits artificially diverted to low-tax jurisdictions are taxed, while income from legitimate overseas operations is left untouched.

sbb-itb-39d39a6

Advantages and Disadvantages

The U.S. and U.K. Controlled Foreign Corporation (CFC) frameworks both aim to address tax deferral, but they take very different approaches. In the U.S., anti-deferral rules like Subpart F income and GILTI (Global Intangible Low-Taxed Income) ensure that foreign earnings are taxed immediately, even if those earnings aren’t distributed. This approach significantly limits opportunities for deferral through tax planning. On the other hand, the U.K. uses an exemption-based system. If a foreign entity pays local taxes that are at least 75% of what the U.K. corporation tax would have been, the CFC charge can be entirely avoided.

"The purpose of CFC rules is to prevent US taxpayers from shifting income to low‑tax jurisdictions and delaying US taxation",

- Josh Katz, CPA at Universal Tax Professionals.

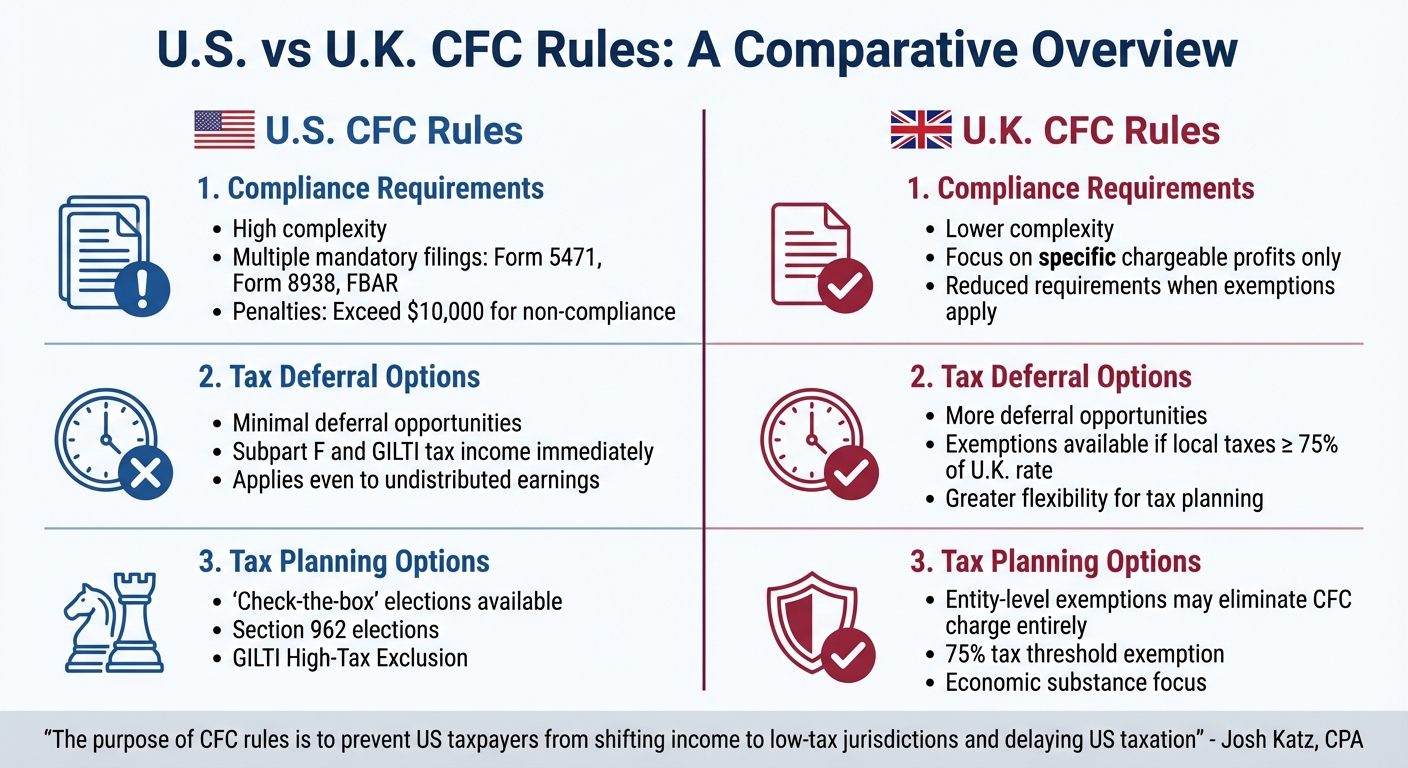

Compliance requirements also vary widely between the two countries. U.S. shareholders must navigate a maze of detailed filings, including Form 5471, Form 8938, and FBAR, with penalties exceeding $10,000 for non-compliance. In contrast, the U.K.’s system focuses only on specific taxable profits, and exemptions can significantly reduce compliance demands. These differences set the stage for exploring compliance, deferral opportunities, and tax planning strategies.

Here’s a quick comparison of the two systems:

| Feature | U.S. CFC Rules | U.K. CFC Rules |

|---|---|---|

| Compliance Requirements | High complexity with multiple filings (e.g., Form 5471, 8938, FBAR); penalties exceeding $10,000 for non-compliance. | Lower complexity; focuses on specific chargeable profits, with reduced requirements when exemptions apply. |

| Tax Deferral Options | Minimal deferral due to Subpart F and GILTI, which tax income immediately – even if undistributed. | More deferral opportunities through exemptions, especially if local taxes meet the 75% threshold. |

| Tax Planning Options | Options like "check-the-box" elections and Section 962 elections can help optimize tax treatment. | Entity-level exemptions may eliminate the CFC charge entirely. |

For business owners, these frameworks offer distinct planning opportunities. U.S. taxpayers can leverage tools like the "check-the-box" election or Section 962 to manage CFC classification and tax treatment. Meanwhile, U.K.-based businesses can focus on jurisdictions where the foreign company meets the 75% tax threshold to avoid the CFC charge altogether. Additionally, both systems allow for tax treaty benefits, which can further reduce exposure to CFC-related taxation.

Conclusion

The U.S. and U.K. Controlled Foreign Corporation (CFC) frameworks share the goal of preventing tax deferral but take very different approaches to achieve it. In the United States, provisions like Subpart F and Global Intangible Low-Taxed Income (GILTI) impose immediate taxation, which can create significant compliance hurdles. However, elections such as Section 962 and the GILTI High-Tax Exclusion can help reduce these burdens. On the other hand, the United Kingdom offers more flexibility, granting a full exemption from CFC charges if at least 75% of the equivalent U.K. tax rate has been paid abroad.

For U.S.-based remote entrepreneurs, strategic elections provide options to manage the impact of CFC classification. For example, the GILTI High-Tax Exclusion can be particularly beneficial for qualifying entities. As Andrew Coleman, CPA, explains:

"Running a business in another country can feel exciting and confusing. Tax rules from the US still apply, even when the company is formed overseas, and some of those companies fall under a special label called a controlled foreign corporation (CFC)".

Meanwhile, U.K. entrepreneurs benefit from a different set of advantages. By meeting specific exemption criteria, they can structure their operations to avoid immediate taxation.

For all remote business owners, staying ahead on compliance is critical. U.S. shareholders face penalties exceeding $10,000 for failing to file required forms. Professional guidance is invaluable in navigating these complex rules and avoiding costly mistakes. Attempting a do-it-yourself approach can lead to errors that are both time-consuming and expensive.

If you’re looking for expert advice to structure your offshore business and minimize tax risks, consider reaching out to Global Wealth Protection (https://globalwealthprotection.com).

FAQs

How do U.S. and U.K. CFC rules differ for offshore businesses?

The U.S. and U.K. Controlled Foreign Corporation (CFC) rules share a common goal: to curb tax avoidance by taxing certain foreign income. However, their methods and criteria differ significantly.

In the U.S., a foreign corporation qualifies as a CFC if U.S. persons own more than 50% of its voting power or stock value. U.S. shareholders must report specific types of income, including Subpart F income (generally passive or easily movable income) and GILTI (global intangible low-taxed income), on their tax returns – even if the income hasn’t been distributed. This system involves extensive reporting requirements, and failing to comply can result in steep penalties.

The U.K. takes a broader approach, defining a CFC as any foreign company under “control” by U.K. residents. However, only profits taxed below the U.K. corporate tax rate are subject to CFC charges. Furthermore, multiple exemptions, such as the low-tax exemption or other specific reliefs, can completely eliminate these charges.

To sum up, the U.S. approach emphasizes ownership thresholds and specified income types, while the U.K. focuses on low-taxed profits with wider exemptions, creating distinct compliance and planning challenges for those managing offshore businesses.

How do exemptions under UK CFC rules impact tax responsibilities?

Under the UK’s Controlled Foreign Corporation (CFC) rules, specific exemptions can completely shield a CFC’s profits from additional UK taxes. For instance, exemptions like the temporary exemption for newly controlled companies, the excluded territories exemption, or the low-profits exemption (applicable if profits are $625,000 or less, with non-trading income capped at $62,500) may apply. When a CFC meets the criteria for any of these exemptions, its profits are not subject to the UK CFC charge, ensuring UK shareholders don’t face extra tax liabilities on those earnings.

These exemptions aim to minimize unnecessary tax burdens while maintaining compliance with UK tax laws. Carefully evaluating each exemption is essential to confirm eligibility and properly align with your offshore business setup.

What are the key compliance challenges for U.S. shareholders of Controlled Foreign Corporations (CFCs)?

U.S. shareholders of Controlled Foreign Corporations (CFCs) have to navigate a maze of compliance requirements. One key obligation is filing Form 5471 each year, which demands detailed reporting on ownership and financial activities. On top of that, shareholders need to calculate and report Subpart F income and Global Intangible Low-Taxed Income (GILTI) – both of which can lead to a heavier tax bill.

The rules around ownership attribution for CFCs add another layer of complexity. Determining control thresholds often requires a deep dive into the regulations. Missing deadlines or submitting inaccurate filings can trigger hefty penalties, so staying on top of these rules and consulting a tax professional is often essential.