August 17, 2015

By: Kelly Diamond, Publisher

It would seem I gave far too much credit to China on a few things: 1. That they had any faith in fundamental market forces, much less understood them; 2. That their actions were more long sighted, with their own self-interests at the helm.

I do believe they have an excellent work ethic, and they have done some very smart things over the past 10 years, no question. But, they are finding out the hard way that the market isn’t run by fiat. It’s its own body of water, with its own current, and you either take that current to where you’re going, or you get slapped.

China got slapped because economics doesn’t work on “Cuz I said so”.

China’s credibility in the stock market has never been very stable. The fact that they are so secretive and controlling probably has a lot to do with that. So they have oddly seen economic prosperity with a stagnant stock market. About a decade ago, they had a boom and bust in their equity markets, which was largely fueled by greed and a lot of poor speculation. Their index went from 1,000 to 6,000 to 2,000 in under a year and stayed there until last June where the same pattern took hold. Their market once again shot up and crashed.

The over confidence in their equities market was more politically charged than market driven. That’s how the US housing market boom cycle started. The, no doubt well-intended, Community Reinvestment Act of 1977 dug its heals in good and strong, government guarantees everything, people feel entitled to the “American Dream”, all things tied to the housing market get incredibly bullish.

I’ll give these political actors responsible for these boom/bust cycles the benefit of the doubt and assume they were well intended tactics. But well-intended as they might have been, they were very irresponsibly executed and even more recklessly perpetuated.

Yukon Huang of the Carnegie Asia Program says the bubble’s causes are two-fold:

- Policy makers rightly felt that savers needed a broader array of investment options beyond just parking their money with banks or buying property.

- Their second objective was to use the equity market to moderate the country’s debt burden by encouraging companies to raise financing through equities rather than borrowing from banks.

This all took off because basically the political powers that be urged businesses and people to buy-buy-buy. There are the green investors which lead to the surge, and there were the more seasoned investors that knew this was not a market driven phenomenon. Their GDP was not emulating the same trajectory, for one thing. But, as Dr. Huang rightly points out, when China’s bid to be included in MSCI global index was shelved, that might very well have been the straw that broke the camel’s back.

If China is going to centrally plan everything from soup to nuts, then the time to pull in the reins was overlooked, be it intentional or otherwise. The smart investors already could see that their indices had no foothold in reality or market fundamentals, and started backing off.

This very large mistake on the part of Chinese leadership does not detract from the myriad of very smart economic choices and investments they have made. Focusing on the stain detracts from the entire table cloth. To be sure, China will need to focus on effective ways of removing said stain rather than covering it up or staining the rest of the cloth; but it doesn’t have to be a Chinese version of the American Great Depression.

Who is affected by all this? In economics, the butterfly effect is quite real. We are far more interconnected economically than ever before, and governments are horrible at diversifying anything. So when a weak link breaks, it’s felt through the entire chain.

China’s ailing economy and equity market lead them to devalue their yuan by 2% this past week. It used to be that China was propping UP the USD to make its own currency look weak. But now, it is resorting to weakening its own currency to make the USD look strong. This has had profound effects on the world markets:

“Carmakers and luxury goods stocks were among the worst performers in European markets. China is an important export market for European luxury goods companies and carmakers, and shares in those two sectors were among the hardest hit by the yuan devaluation. Miners were also affected.

“The US dollar gained against a basket of currencies, moving up 0.2% but the Australian dollar, often used as a liquid proxy for the Chinese currency, slid more than 1% to as low as US$0.73.

“Share prices across the region were down, with the Nikkei index in Tokyo falling 0.36% and the ASX200 in Sydney down more than 0.5%. The Hang Seng, however, was up 0.72% in Hong Kong.”

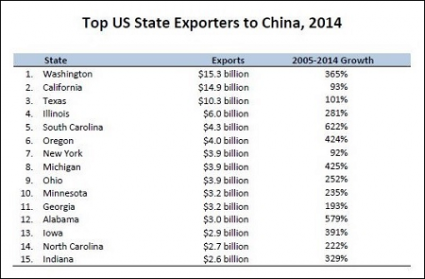

The US will absolutely be affected by China’s devaluation. With over $120 billion in exports to China from the US in 2014, and over 11 million jobs tied to those exports, the US is in a precarious situation. Below is a chart outlining all the states that have reaped astounding economic benefits from their exports to China:

What will happen to these states while China tries to get its economic act together? What will happen while the world starts to engage in a price war on their currencies? It depends a lot on whether central planners will intervene and try to fix what they have broken (whereby likely prolonging the problems or kicking the can down the road) or whether China and the others will allow market forces to regulate them.