August 10, 2015

By: Kelly Diamond, Publisher

“Puerto Rico,

My heart’s devotion,

Let it sink back in the ocean.

Always the hurricanes blowing,

Always the population growing,

And the money owing.”

~West Side Story

To put that into perspective, that’s four times what Detroit’s debt was when it filed for bankruptcy in 2012. “With a population of 3.6 million, Puerto Rico carries more debt per capita than any state in the country,” according to the Washington Post; however, Puerto Rico, like the states in the US, cannot file bankruptcy the way a city can.

I imagine there are a handful of folks in Washington who are reconsidering whether any part of Puerto Rico’s debt can fall under Chapter 9, but then again, such legislation hasn’t even made the news much less the House or Senate floors.

Moody’s has gone on record saying they regard this unfulfilled obligation as defaulting on their debts:

“Moody’s views this event as a default,” Emily Raimes, vice president at Moody’s Investors Service, said in a statement, adding that payment of “debt service on these bonds is subject to appropriation, and the lack of appropriation means there is not a legal requirement to pay the debt, nor any legal recourse for bondholders.

“This event is consistent with our belief that Puerto Rico does not have the resources to make all of its forthcoming debt payments. This is a first in what we believe will be broad defaults on commonwealth debt,” she added.

Standard and Poor concurred, classifying the lack of payment as a default which resulted in another slip in their rating from “CC” to “D”. (Source: CNBC)

What does this mean for Puerto Rico?

Aside from going down in history as the first American commonwealth to default on a payment, it means folks will need to check on their bonds. Year over year, Puerto Rico’s bond prices have dropped; and it might surprise you to know that nearly one third of all US muni mutual funds have holdings in the commonwealth. That assessment is rather conservative in contrast to the Washington Post which claims “at one point in 2013 nearly 75% of municipal bond mutual funds held Puerto Rican bonds, which were attractive because of their high yields and exemption from federal, state and local taxes”.

According to Marketwatch, “The S&P Municipal Bond Puerto Rico Index had dropped 10.8% year-to-date on July 31 and its total market value had lost $6.9 billion”.

To be clear, not all bonds are the same. It depends what backs them and whether they are insured. The two major differences are the G.O. (or General Obligation) bonds and PFC (Public Finance Corporation) bonds. The former is guaranteed and backed by the full faith and credit of the commonwealth, the other is contingent upon appropriations… and that was the debt that came due.

Those who hold PFC bonds can petition the Puerto Rico’s Government Development Bank to make them whole. According to the bond covenants, the GDB must respond ‘in a timely manner’ or bondholders may bring a suit in San Juan court. If you have any bonds in Puerto Rico, it would certainly be wise to see if they are insured as well as find out how they are backed.

There are some who want to blame the half-assed colonization of Puerto Rico, others who want to blame the low tax regime of Puerto Rico, and others still who want to blame creditors for lending to them at all knowing full well their dire straits. (Source: Fortune)

The first point is valid in that it abridges the island’s ability to trade their rich resources of sugar, tobacco, and whiskey. It’s difficult to manage a GDP when the US has just enough of a stranglehold on your international trade to keep you from making any money or even – heaven forbid – competing with the mainland US! The US absolutely needs to fish or cut bait with Puerto Rico, no doubt about it.

Certainly if they don’t have the same considerations as a state, then they shouldn’t be paying into the US federal coffers! The country pays about 25% of its annual budget to the federal government… and for what? They have no vote in Congress. They have no assistance from them. They have no constitutional protections. Basically they get a little leniency on taxes for the privilege of having some access to the mainland.

Low taxes aren’t the issue. It’s the spending. Nearly 1/3 of the annual budget is on government funded corporations. Get the government the hell out of their businesses altogether. Just stop it! Sell it off entirely to private investors. Another 1/3 is spent on the “general fund”. For every problem that island has, it creates a committee and they don’t work for free. That nonsense needs to stop. They are spending too much and it can’t be that every single government job is essential!

As for blaming the creditors, well, that was inevitable. If they didn’t lend, they would be cold and heartless jerks who wouldn’t help a people in need. But since they DID lend the money, they are cold and heartless jerks who are taking advantage of an island in need. They never win. They are always the bad guy. But at the end of the day, they didn’t cause the problem. They were supposed to bridge the gap. It’s like blaming your employer for enabling your gambling problem by giving you your paycheck. I mean get real!

This crisis has many components, as well as symptoms flaring up, including declining investment in the island, falling housing prices, high labor costs, low labor participation rates and declining population. Capital flight coupled with a dependent vestige population means some hard times are ahead. Amongst its debt obligations is about $37 Billion in pensions.

The other culprit in this disaster is their woefully inefficient energy subsidiary, PREPA. The island currently imports crude oil to provide energy. It hasn’t diversified at all on this front, contrary to its neighboring islands in the Caribbean. It owes $9 billion and is Moody’s places it in an abysmal category.

There is general talk of restructuring. It’s done everything the EU would have it do were it a member of its union. Puerto Rico has cut pensions, government jobs and spending, and raised taxes. Sadly, it’s that last piece, coupled with its perpetual debt cycle used to compensate for the dwindling tax base that is making all other efforts futile. They need wealth to return to the island, not run from it. Wealth will stay where it is welcomed, not punished.

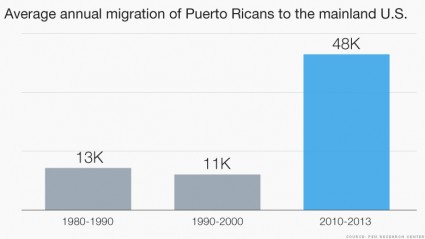

People are leaving the island in greater numbers than ever before:

(Source: CNN)

The mainland US would do well to consider the implications of soaring emigration by economic refugees. Losing your wealthy and/or productive tax base means all that’s left are the poor and entitled voting base. It will be interesting to watch Puerto Rico’s approach to solving this problem, or if we are in store for a lot of rhetoric and posturing. It will also be interesting to see what, if anything, the mainland US does to help.